Interest Rates and Shrinking the Fed Balance Sheet

Since the beginning of 2017,two issues have attracted great attention in financial circles. One is the pace of increases in US interest rates and the other is how soon the Federal Reserve will reduce the size of its balance sheet. Both are likely to have an impact on China's central bank as well as the Fed. The Fed has made clear it has shifted from quantitative easing to gradual increases in interest rates. It has also said it wants to unwind the US$4.5 trillion in bonds on its balance sheet,according to statements by Fed officials,including Chairwoman Janet Yellen. China's economy is showing stable growth. The sound and neutral monetary policy now in effect,combined with regulatory policies that promote financial deleveraging,set the stage for an increase in market interest rates and an adjustment of asset prices. Market players are speculating whether the People's Bank of China will push for what would be a Chinese version of shrinking the domestic balance sheet. Where are US and Chinese interest rates headed and will there be balance sheet reductions in either country? These are among the topics in our latest round table discussion.

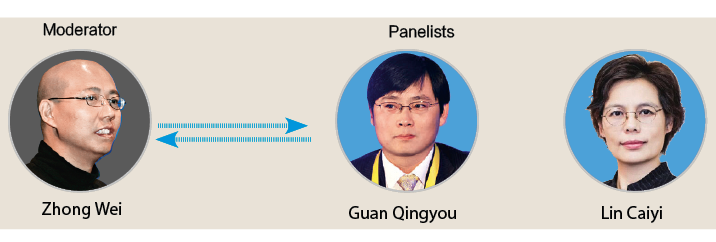

Zhong Wei,deputy director of China Forex,leads the discussion with Guan Qingyou,vice president of Minsheng Securities,and Lin Caiyi,chief economist of Guotai Junan Securities.

Zhong Wei: The US Federal Reserve has moved to push interest rates higher,but when will it shrink its balance sheet? Former Fed chief Ben Bernanke,the initiator of the quantitative easing policy in the United States,insisted that shrinking the balance sheet would not be difficult. However,the Fed has found that this is in fact not so easy to do. It needs to carefully consider the strength of US economic growth,high asset prices and changes in international capital flows among other factors. In your opinion,given the quantitative easing and the vast enlargement of the balance sheet under Bernanke and his successor Janet Yellen,what are the right conditions for the Fed to reduce the size of the balance sheet? When might this actually take place?

Guan Qingyou: We need to examine the nature of the most recent round of interest rate hikes if we want to understand the appropriate conditions for the Federal Reserve to act on its plans to shrink its balance sheet. This round of tightening by the Federal Reserve is different from the previous rounds in 1994 and 2004. During the first two rounds the economy was showing signs of overheating and that applied to durable goods,real estate and other areas. When the Fed raised interest rates in December 2015,major US economic indicators had not recovered to the average levels of the past decade. In this round of interest rate increases the Federal Reserve is trying to normalize monetary policy. On one hand,the US attaches great importance to the global economic environment. On the other hand,it is concerned about the volatility in financial markets. If an interest rate hike is aimed at preventing risk but instead actually accentuates risk,this is something that should be avoided. It is therefore not surprising at all that the pace of interest rate hikes has been extraordinarily slow.

Shrinking the balance sheet is more straightforward as it merely involves the sale of assets. The Federal Reserve could start the process when the fed funds rate returns to an appropriate level,conditions in the global financial environment are stable and American economic indicators are generally favorable. Based on the remarks of former officials of the Fed,it is estimated that the Federal Reserve will shrink the balance sheet by the end of 2017 or at the beginning of 2018.

Lin Caiyi: The Federal Reserve undertook three rounds of quantitative easing,with its assets expanding from US$894.3 billion in 2007 to US$4.5 trillion in 2014. By 2016,the Federal Reserve's balance sheet was still US$4.45 trillion. Some 90% of that total,or about US$4 trillion,was in treasury bonds and mortgage-backed securities. With the steady recovery of the economy,the Federal Reserve must gradually undertake large scale sales of treasury bonds and mortgage-backed securities as it shrinks its balance sheet. At the same time we could have an implementation of Trump's plans for tax cuts and infrastructure spending as well as a policy that favors American industry. Along with this we could see international capital flowing back to the United States. As a result,we are likely to see solid economic growth over the longer term in the US. A shrinking of the Fed's balance sheet under those conditions would not reverse the momentum of the US economy. It is likely that in the second half of this year,the plan to shrink the Fed's balance sheet will enter into the operational phase.

Zhong Wei: China's financial environment has changed significantly this year. Monetary policy is stable and neutral under a macro-prudential framework and regulatory policy continues to pursue deleveraging as a means of reducing risk. There has been a rise in domestic interest rates and a stabilization of the renminbi exchange rate. At the same time,despite volatility in the property,stock and bond markets,there has been fairly strong economic growth. Some financial institutions have managed to shrink the size of their own balance sheets. Some scholars suggest that it is time for a Chinese-style shrinking of the balance sheet,while others believe it is still too early as the central bank has been reluctant to reduce the reserve ratio on bank deposits. In your opinion,is it possible for the Chinese central bank to follow the Federal Reserve by raising benchmark interest rates and shrinking the balance sheet?

Guan Qingyou: As the central bank implements monetary policy,the first factor to be considered is maintaining financial stability and promoting national economic development. The central bank has to strike a balance with its multiple objectives. This is true in the United States and China as well.

The Chinese central bank¡¯s key policy in 2017 is to maintain financial stability while squeezing out asset bubbles and achieving an overall deleveraging. This will make the financial system serve the real economy in a more practical manner. It also means that the central bank will maintain a relatively tight monetary policy and a strict regulatory stance. Specifically,short-term liquidity adjustment tools,such as the short-term liquidity operations (SLOs) and the standing lending facilities (SLFs),will be used to maintain market stability. These are more targeted tools that can be used to achieve the same goals as small increases in interest rates. However,there is no need for increases in benchmark interest rates at this time.

The strategy of tightening monetary policy and achieving a general deleveraging throughout the economy is not the equivalent of shrinking the central bank balance sheet as proposed in the US. In China,it would be an effort to reduce leveraging by shrinking the lending activities of commercial banks and the use of financial derivative products by the banks and the non-bank financial sector.

Lin Caiyi: Based on what we have seen this year in terms of the central bank's monetary policy and its open market operations,it is highly likely that the People's Bank of China will need to make a passive shrinking of the balance sheet. That is,foreign exchange assets decrease and government deposits ¨C or liabilities ¨C also decrease. With the decline in foreign exchange reserves over the past two years,the central bank has not yet been able to make changes in benchmark interest rates. Instead,it has adjusted liquidity through reverse repurchase agreements on the money market as well as the use of the medium-term lending facility (MLF),