Is The Financial Sector Facing Overcapacity?

In the past year or so,the main theme of macro-economic control has been the elimination of excess capacity as well as surplus inventories and elevated leveraging while reducing costs and strengthening disadvantaged parts of the country. When speaking of overcapacity,people tend to think of the manufacturing sector and rarely think of the financial industry. However,no one can ignore the fact that China's financial industry has also been facing challenges from excess leveraging and financial bubbles. So,is there a problem of overcapacity in the financial industry? If so,what does this mean for the development of the financial industry?

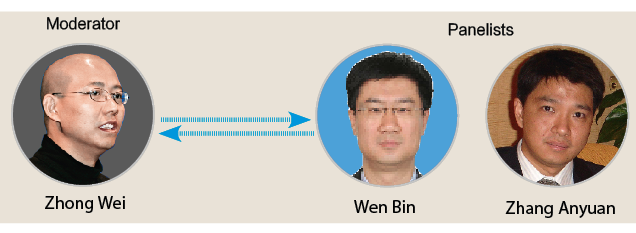

Zhong Wei,deputy director of China Forex,leads the discussion with Wen Bin,Principal Research Fellow of China Minsheng Bank,and Zhang Anyuan,chief economist of Dongxing Securities.

Zhong Wei: Welcome to our latest round table discussion. Since the subprime mortgage crisis,the central banks of the world's major economies have adopted quantitative easing measures. Now,with the Federal Reserve of the US taking the lead,major central banks are ready to bid farewell to quantitative easing,and are preparing to raise interest rates and shrink their balance sheets. Today,financial liberalization is no longer so popular,and the financial sector continues to face challenges. For example,since the subprime mortgage crisis,US commercial banks have reduced their physical networks by about 5%,the shadow banking system has been shrinking and the number of financial practitioners continues to decline. In your view,are there overcapacity problems in the financial sector? If so,where do you see such problems?

Wen Bin: Overcapacity is usually used to describe a situation where the capacity of productive enterprises is greater than market demand. The relationship between output and demand is dynamic but with a relative balance. Whether we can use "overcapacity" to define the state of the financial sector is open to question. In order to adapt to developments in internet finance,the financial sector began to transform itself from the traditional physical network to a combination of online and offline operations. This led to a reduction in the number of physical outlets. In addition,there is not enough evidence to show that the number of financial practitioners is showing an absolute decline if we take into account new finance players.

Credit is the core of finance. The main problem in the financial sector now is the excessive expansion of credit. First,the credit expansion rate far exceeds real economic growth,leading to financial bubbles. Between 2007 and 2016,the average annual growth rate of the Federal Reserve's assets was 18.9%,while total assets of commercial banks expanded by an average of 4.5% a year and the annual growth rate of M2 was 6.7%. Over the same period,the average annual GDP growth was only 1.3%,and even if we take inflation into consideration,it was still far below the rate of credit expansion. It is the same with China. From 2007 to 2016,the central bank's assets grew at an average annual rate of 8%,total commercial bank assets increased by 17%,the annual M2 growth rate was 16% and average annual GDP growth was 9%.

Second,credit expansion pushed up global asset prices,leading to asset bubbles. In stocks,the three major US stock indexes recorded a series of record highs,while in bonds,before major central banks had a chance to begin raising interest rates and shrink their balance sheets,the low interest rate environment promoted a strong bond market with bond prices at historic highs. In real estate,with the inflows of speculative funds,property prices in major countries were buoyant. In many countries prices had returned to pre-crisis levels,and in some economies bubbles were emerging.

Zhang Anyuan: The financial sector should serve the real economy. Those financial activities that do not serve the real economy are where we find excess capacity. At present,China's financial industry has two key problems. First,the value added output of China's financial sector accounts for too high a proportion of GDP. In recent years,the proportion of China's GDP from the financial sector has continued to rise. In 2016,the proportion was 8.35%,up from 4.54% in 2006. In the first quarter of 2017,it increased further to 9.98%. That was only below the 10.9% recorded in the first quarter of 2015 ¨C shortly before the stock market crash. In contrast,the financial sector in the US accounted for 7.3% of GDP in 2016,down 0.3 percentage point from the pre-financial crisis level of 2006. In Japan,it accounted for 4.44% in 2015,down 1.32 percentage points from 5.76% in 2006.

Zhong Wei: In the years since 2015,the expansion of the balance sheet of China's central bank has slowed,but the growth in the balance sheets of financial institutions has generally been faster than that of the central bank. At the same time,the contribution to China's GDP from the nation's financial industry has exceeded that of the key real estate sector,and it has topped the level of the United States. With the diminished importance of shadow banking and the challenges from internet finance,do you expect to see China's main financial institutions continuing to expand,or is it possible they will have to make adjustments to their assets and liabilities,as well as their products,personnel,the number of outlets and even their organizational structure?

Wen Bin: In recent years,China's financial institutions have made use of leverage to promote asset expansion. At the end of March of this year,the total assets of China's banking sector reached US$33 trillion,surpassing those of Europe,the United States and Japan. With a tightening of central bank monetary policy and the strengthening of financial supervision,the first quarter of this year has seen slower growth in the banking sector's total assets.

In the context of financial deleveraging,the banking sector is more focused on structural optimization,using targeted measures in the areas of assets and liabilities,the number of outlets,types and number of products to improve the quality and efficiency of services. For instance,the efforts to assist the disadvantaged segments of the economy,such as financial inclusion,green finance,consumer finance and technology finance,may become the focus of future structural adjustments. In particular,with technological progress,the banking sector will make greater use of the internet,big data,cloud computing and other new technologies and new ideas. It will combine online and offline services to achieve multi-faceted business channels.

Zhang Anyuan: China's financial sector needs to go through a process of rebalancing,much like the real economy. China's real economy may not need such a large financial sector to meet its needs. The steady decline in the growth of the real economy may not be able to meet the needs of the accumulation of huge financial assets in the distribution of incomes. China's financial sector needs to recuperate,slow down its pace of growth to coordinate with the real economy's growth. This process and the elimination of overcapacity in the manufacturing industry have much in common. This does not necessarily lead to a comprehensive shrinking of bank balance sheets or the absolute decline in industrial capacity.

Zhong Wei: Financial liberalization seems to have been gradually replaced by strengthened regulation and increased capital requirements for financial institutions. This has led to reduced regulatory arbitrage. Cross-border financial activities are also diverging and global financial asset prices are facing adjustment. What impacts do you think that these ever-tighter regulations are likely to have on financial capacity?

Wen Bin: As of this year,China's regulatory authorities,as they give more attention to the preven