Global Economic Momentum: This Time It's Different

China has been an important driver of the global economy for some time. But more recently there have been changes from global recoveries of the past. Since the end of 2015,China's growth in domestic demand has been declining and external demand has taken a more prominent role. So where does the momentum come from in this global recovery? What will it look like in the future? This will have a direct impact on China's economic development.

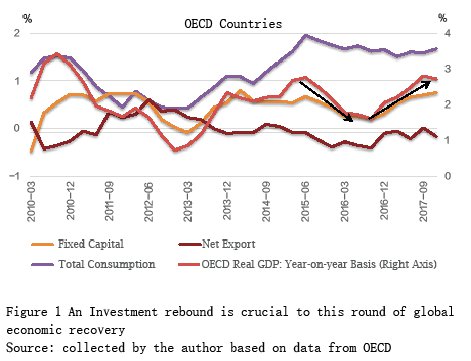

From a global perspective,investment plays a leading role in the current economic recovery. Data from the 35 member states of the Organization for Economic Co-operation and Development (OECD) is used as an approximate indicator of global economic growth,as OECD economic aggregates account for about two-thirds of global volume. The growth rate of world gross domestic product correlates closely with this growth level,having a high coefficient of 0.94. Historically,investment has a greater impact on economic growth than consumption and net exports and this maintains a higher degree of consistency with the overall GDP growth trend (see Figure 1). Over the last 10 quarters,the correlation coefficient between the increase in investment and GDP has been as high as 0.97,which shows that investment has largely led the recovery in this round of global economy.

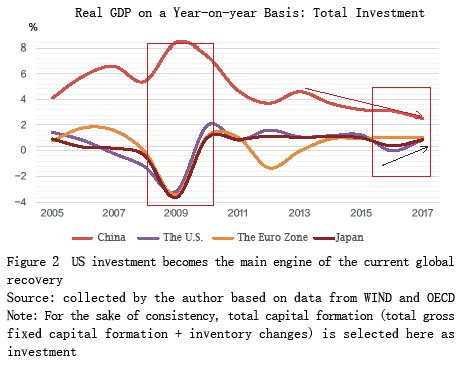

US investment has played a more obvious role in the current global economic recovery,while China's investment growth has shown a weaker trend (see Figure 2). Although the long-term investment growth in China is much higher than in the US,Europe,Japan and other major economies,due to factors such as excess domestic production capacity,real estate regulation and debt problems,China's investment growth has weakened. Therefore,from the perspective of marginal changes,China is no longer the main contributor to the global recovery. Changes in US investment have better demonstrated the trend in the global economy over the past two years. Japan’s economy has apparently rebounded,but its global influence is much less than that of the US in terms of economic volume. It is worth noting that,although rising prices caused by the elimination of excess production capacity in China may have a positive impact on halting deflationary expectations,US investment is still the main engine in the global recovery.

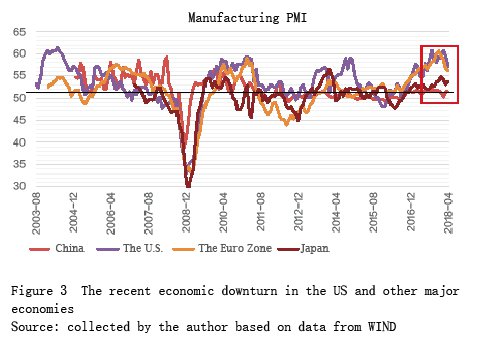

How will global economic momentum evolve in the future? Since the first quarter of this year,the purchasing managers' index (PMI) of major economies such as the US have fallen (see Figure 3),which has raised concerns about the exhaustion of global economic momentum in the future. Based on the above analysis,it is believed that predicting the future trend of global investment is crucial to grasping macroeconomic direction. The future changes in US investment,a key indicator of current global recovery,may be able to reflect the economic development of the US and even the global economy to a large extent.

For clarity,the US investments mentioned here refer to domestic private investment. US investment growth hit bottom in mid-2016 and steadily increased in 2017. Investment in new equipment accounted for about 35% to 40% of total investment,higher than residential and construction investment,and it had the highest correlation with overall investment. Judging from various current leading indicators,US investment is expected to gain more traction in the near term.

The manufacturing PMI sub-index for new orders indicates that US investment growth in the next one or two quart