Sino-US Trade Disputes and US Protectionism

Since Donald Trump took office last year,protectionism has gained momentum in the United States. In recent months,Trump has announced plans for a series of trade sanctions against China,calling for tariffs on US$50 billion worth of imports followed by tariffs on another US$100 billion of goods. He also has called for restrictions on investments and acquisitions in the United States by Chinese companies. The potential for a trade war has already become a serious impediment to economic globalization and this could significantly affect the global economic recovery. Developments are being watched closely around the world.

The history of trade barriers can be traced back to the 15th and 16th centuries as mercantilism was promoted. Although mercantilist policies have long been abandoned by major powers,protectionist measures have never really disappeared.

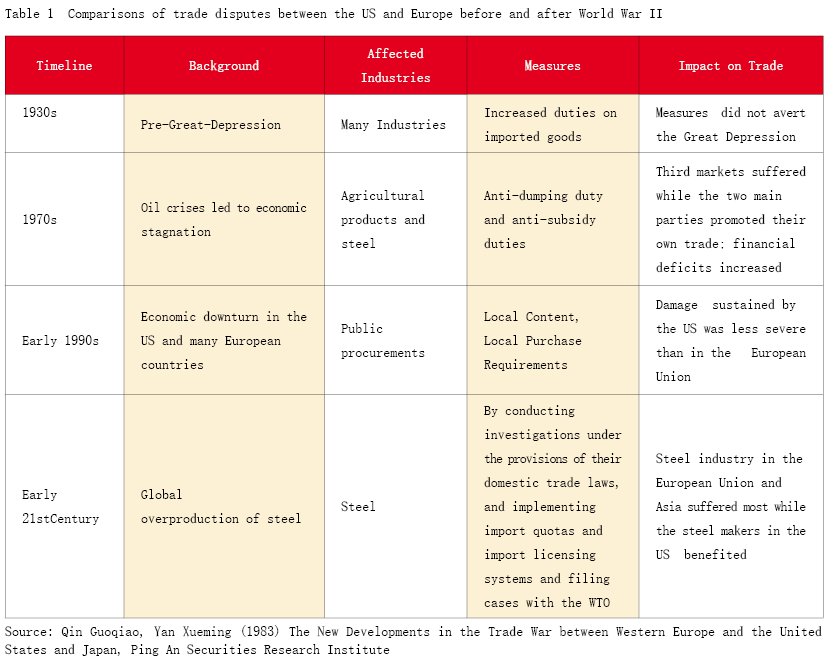

The onset of the Great Depression prompted the United States and European countries to erect trade barriers to protect their own economies,and that in turn amplified the economic damage. In the 1970s,there were bitter trade disputes involving the US and Europe over agricultural products as well as iron and steel. Both sides turned to legal challenges such as anti-dumping and countervailing duties under the framework of General Agreement on Tariffs and Trade (GATT). These were in fact disguised duty increases,which appeared to be more acceptable than the simple measure of raising import duties. In the 1990s,the Americans and the Europeans made use of local content requirements and local procurement priorities,further expanding the arsenal for fighting trade wars. At the beginning of this century,against a global background of excess production capacity in steel,the US and Europe engaged in a trade confrontation over steel. The US conducted investigations into trade practices of the European Union and Japan under the provisions of domestic trade laws,and imposed import quotas and import licensing requirements. The EU reacted with counter-measures of its own ¨C import quotas and increased import tariffs on US-made steel. It also filed trade complaints with the WTO against the US.

It can be seen clearly that the US,the EU and other Western countries have honed their skills in trade disputes. While it was difficult to extend those simple tariff barriers under the framework of the WTO,protectionists have managed to turn to anti-dumping and countervailing duties,along with an array of other measures such as quotas,licenses,local content requirements,special investigations and sanctions under domestic law.

The trade disputes between the US and Japan in the 1980s can be viewed as classic cases in the annals of trade history. After World War Two,the US and the Soviet Union wrestled for global hegemony. Japan,as an American ally in the political rivalry with the Soviet Union,received a great deal of American policy benefits. However,with the collapse of the Soviet economy in the 1980s,Japan’s role was greatly weakened. Japan’s strong economic growth brought unprecedented pressure on the American economy,prompting Washington to train its political might on Japan to push its ally to reduce its trade surplus with the US. Dispute between the two countries was inevitable.

The most noteworthy area of dispute was the auto sector. At that time,Japan’s inexpensive autos became the new darling of the European and the US markets. However,Japan did not completely open its domestic market,making the US and Japanese shares of each other’s auto markets seriously imbalanced. Although the US imposed import quotas on Japanese autos,parts and components in the early 1980s,forcing Japan to promote the opening of its domestic market in the early 1990s,success was limited. Japanese manufacturers set up factories in the US through direct investment and the Japanese share of the US auto market continued to increase. After Bill Clinton became the American president,he continued to exert pressure on Japan. European countries were similarly troubled by the big market share of Japan’s automakers,so they applied similar restrictions on Japanese cars. Japan could only react by filing complaints at the WTO. In the end,the US and Japan reached an agreement in 1995 under which Japan promised to increase imports of US autos and parts,expanding direct investment in the US and significantly liberalize its own domestic market.

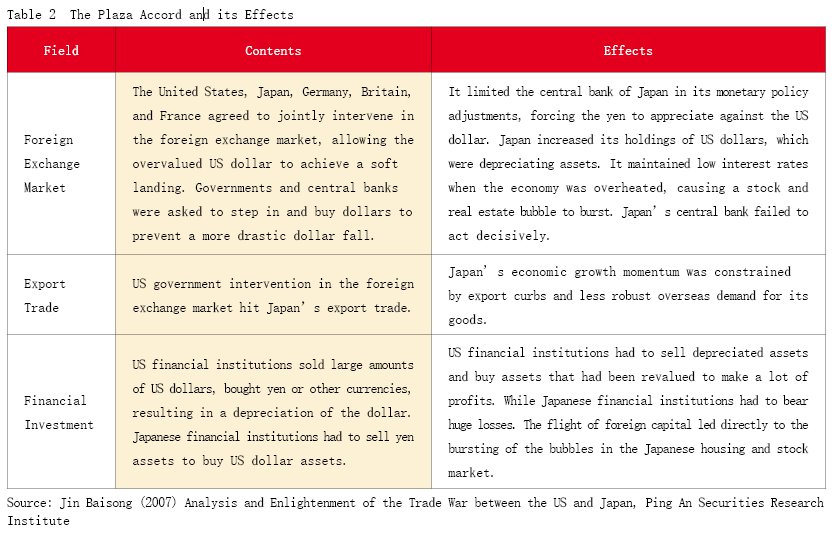

Japan made trade concessions under continuing pressure from the US and coordinated actions by Europe,and in September 1985,it joined the United States,Britain,France and Germany in signing the Plaza Accord. That agreement,which sought to adjust interest rates to guide a depreciation of the dollar,may have played a greater role in facilitating the dramatic reversal of Japan’s policies. The objective of the agreement was to increase the export competitiveness of US products,which had been hit hard by a much stronger dollar. However,Japan was overly dependent on exports and investment,and it saw a significant decline in export growth and its trade surplus after signing the Plaza Accord. Although the economy was stimulated by a loose monetary policy,the continuing appreciation of the yen and the rise in the housing market attracted a large influx of international capital. Japan witnessed an investment and stock market bubble. The Japanese government did not realize the potential risks at that time. Again,under the constraints of the Plaza Accord,there was little room for Japan’s central bank to conduct monetary policy adjustments. When foreign capital withdrew and the financial bubble burst,the Japanese economy fell into a long-term decline,which eventually became known as the two lost decades.

It can be seen that the Plaza Accord brought significant strategic advantages to the US. Under the framework of the agreement,the Japanese government lacked room for policy adjustment which put it in a very disadvantaged position. In its trade disputes,Japan had sufficient economic clout but it had few weapons at its disposal,relying on the relatively mild countermeasures of trade complaints. Eventually it sacrificed economic growth. The US,relying on its national strength,launched a multi-dimensional assault that covered trade,finance and exchange rates,accompanied by diplomatic and political pressure. The outcomes of trade wars are determined by national strength,relevant experience, an ability to make and carry out bold decisions as well as government willpower. Japan was at a disadvantage in these areas.

The US trade conflicts of the past are of great reference value for China. Beijing needs to take them under consideration and avoid falling into three major traps.

Judging from the history of Sino-US trade disputes,the US has mostly been on the offensive side while China has mostly been on the defensive. Before 2010