Preventing Money Laundering Risks in Cross-border Mergers and Acquisitions

With the acceleration of economic and financial globalization,more and more Chinese corporations have acquired overseas companies in order to improve their overall competitiveness in the international market. At the same time this trend has been driven by the government’s drive to transform the economy and upgrade domestic industry. According to statistics from Thomson Reuters,there were 866 cross-border mergers and acquisitions involving Chinese companies in 2017 with the transaction volume reaching US$141.9 billion.

China has become the largest player in cross-border mergers and acquisitions in the global arena. Moreover,private enterprises have taken a more prominent role in these transactions. Listed non-state enterprises have significantly increased their stakes in quality offshore assets as part of a national policy that encourages companies to "go global." At present,China's foreign exchange management for capital account items calls for examination and approval as well as registration. The regulatory system is relatively comprehensive,but in some cases there is money laundering,terrorist financing,or tax evasion,and these activities may be disguised as legitimate cross-border flows of funds. This poses a threat to normal financial transactions and the collection of taxes as well as China's macroeconomic environment. Effectively identifying money-laundering risks in cross-border mergers and acquisitions and conducting comprehensive monitoring and effective supervision are of great importance in maintaining national financial security.

Case Analysis

In general,cross-border mergers and acquisitions are relatively large transactions,and frequently involve cash payments. Some illegal organizations use less supervised channels or engage in money laundering in the name of cross-border mergers and acquisitions. The following case of money laundering in a cross-border acquisitions serves an example. (The the companies involved have not been identified by name).

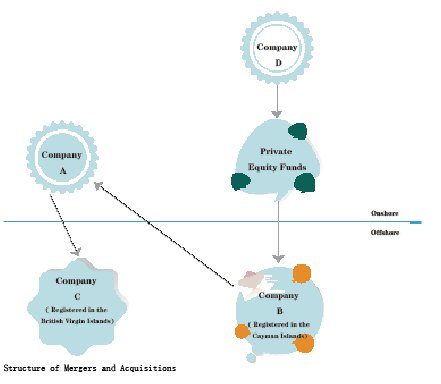

Company A is a domestic manufacturer of new materials. Company B,registered in the Cayman Islands,and Company C,registered in the British Virgin Islands,are wholly-owned subsidiaries of Company A. Company B is an overseas raw materials procurement center that supplies raw materials to Company A. Company C is a downstream company in the industrial chain. 50% of Company A’s products are exported to Company C. There are a few account receivables between Company C and Company A,but most of the business is conducted in cash.

Company A intends to sell its 100% equity stake in Company B due to cash flow needs. However,according to available financial data,Company B’s registered capital is only 30 million yuan,sales were 150 million yuan and it had a net loss. The valuation should not have been high but surprisingly,Company D,a limited partnership that invests in private equity funds,offered US$30 million (equivalent to 189 million yuan when calculated at the exchange rate of 6.3 yuan to US$1). That was five times Company B’s registered capital,a substantial premium for this company. Due diligence uncovered hidden contracts between Company D and Company A. It was suspected that the premium in the acquisition actually included some funds that represented capital flight. At the same time,Company A registered a number of shell companies that had complex interlocking relations with each other in many tax havens,such as the Cayman Islands and the British Virgin Islands. There were related-party transactions that appeared to be merely for the movement of capital and money laundering (See the chart below for the structure of the acquisition).

In the above case,the valuation of the target company is the core of the acquisition. In the bidding process of cross-border mergers and acquisitions,if the seller’s valuation far exceeds a fair market price,and the buyer is still willing to pay in cash with no bank financing,there is often a risk of money laundering. In addition,bypassing overseas direct investment review by designing a complex transaction using tax havens is often a means of laundering money. The tax haven attracted foreign capital through low-tax or zero-tax policies accompanied by loose regulations. These countries and territories often establish strict bank secrecy systems,making it difficult to learn the source of the external funds.

Risk Characteristics

Money laundering channels in cross-border mergers and acquisitions include cash smuggling,alternative remittances,transactions under the current account,investment under the capital account,cash outflows from credit cards,offshore financial centers,direct overseas receipts,and the transfer of funds through specific relationships abroad. Cross-border mergers and acquisitions are an important tool used by unscrupulous institutions to launder money by means of investment under the capital account. If a cross-border M&A transaction displays one or more of the following characteristics,it is necessary for the bank involved in the transaction to conduct a detailed anti-money laundering due diligence investigation.

First,cross-border mergers and acquisitions require a high degree of confidentiality,which often means full cash delivery. Thus it is necessary to conceal the true source of funds and the ultimate controller of a company. At the same time,the transactions must be completed quickly to facilitate the rapid flow of illegal funds. Moreover,there are over-valuations and so-called black-box operations.

Second,the stated value of the acquisition target is problematic. In China,the pricing and evaluation mechanism of equity acquisitions are vague and lacking in reasonable and objective assessment criteria. Cross-border premium mergers and acquisitions have great flexibility. The actual transaction price can be much higher than the target’s net equity value,which can help move capital and facilitate money laundering.

Third,cross-border mergers and acquisitions transactions can be highly complex,often using a multi-tiered structure to avoid taxes. Offshore financial centers are also commonly used to transfer assets abroad. There are generally two steps ¨C the first being to set up a shell company in the offshore center. The second is the domestic company buys raw materials,equipment or other items at high prices from the offshore company. Later the domestic company sells the goods at a low price to the offshore company or a domestic exporter sells the goods to the same company,thus creating a large volume of account receivables. When assets are transferred overseas,another anonymous offshore company is registered to use a small portion of the assets for the acquisition,thereby disguising the laundering of funds.

Fourth,companies with strong cash recovery abilities,such as trading companies,sports clubs,film studios,real estate and hotels are prime targets for money laundering through cross-border mergers and acquisitions. In recent years,some companies have made frequent large-scale acquisitions in these areas. Some of the apparently irrational overseas investment activities may be related to such asset transfers and money laundering.

The aforementioned risk characteristics provide a theoretical basis for effectively identifying money laundering risks in cross-border mergers and acquisitions transactions.

Precautions

When dealing with cross-border renminbi pools,foreign exchange settlements,and the financing of cross-border mergers and acquisitions,banks must strengthen the identification of the risk characteristics of money laundering and adopt measures to prev