International Capital Flows and China's Bond Market

China's domestic bond market saw a surge of international capital inflows in the first half of 2018. What was behind this sharp increase? What was the impact on longer term interest rates and the renminbi's exchange rate? And will the upward trend continue? The following article seeks to examine these questions.

Data from three different organizations show that in the first half of 2018,international investors substantially increased their holdings of Chinese bond assets. The State Administration of Foreign Exchange (SAFE) said in its China's Balance of Payments publication that investments in Chinese bonds from overseas reached a net US$75.7 billion in the first half of 2018,up 741% from a year ago. US$69.8 billion of that total came from overseas institutional investors. In the same period,Chinese domestic renminbi financial assets held by overseas institutions and individuals were valued at 404.1 billion yuan,up 923% year on year,according to the People's Bank of China publication Domestic RMB Financial Assets Held by Overseas Entities. Statistics from the China Central Depository & Clearing Co. Ltd. and Shanghai Clearing House showed that the balance of Chinese domestic bonds held in trust by overseas institutions reached 400.9 billion yuan at the end of the first half of 2018,a year-on-year growth of 969%.

Factors Behind the Investment Upturn

The large increase in international investment reflected cyclical and structural factors.

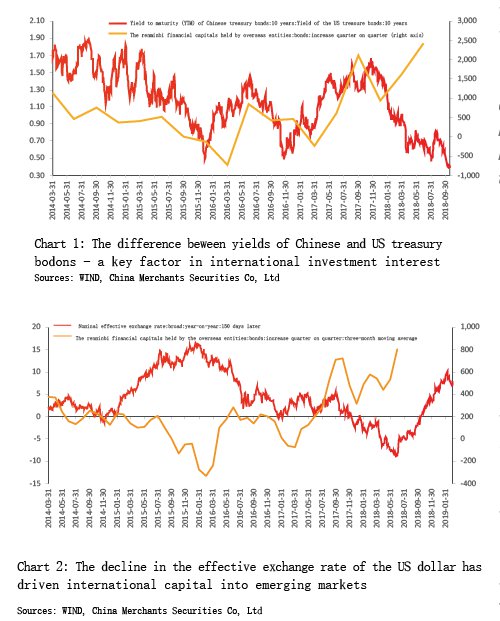

There are two cyclical factors that influence investment enthusiasm for Chinese bond assets. The first is the spread between yields on US treasury bonds and Chinese government debt. Chinese treasury bond yields are matched against US treasury bonds with the difference as the opportunity cost. In this case the difference between the yields serves as a bellwether for overseas investment in the Chinese bond market (See Chart 1). The difference between the 10-year Chinese and US treasury bond yields slipped from as much as 180 basis points in 2014 to as low as about 40 basis points at the beginning of 2016. After the decline in yield spreads,international investment in Chinese bonds declined,reversing the 2014 third quarter's net purchases of 74.8 billion yuan to net sales of 71.7 billion yuan in 2016.

In contrast,purchases by foreign investors rose when the spreads between Chinese and US treasury bond yields recovered from their lows. Spreads widened from about 55 basis points in the fourth quarter of 2016 to 160 basis points by the end of 2017. This reversed net sales of 22.4 billion yuan in the first quarter of 2017 to net purchases of 212 billion yuan in the third quarter and 94.6 billion yuan in the fourth quarter of the same year. Investor enthusiasm has increased in 2018,despite the narrowing of spreads from a high of 160 basis points to about 60 basis points in the second quarter.

The second factor is the effective exchange rate of the US dollar. There is a negative correlation between a strong US dollar and dollar-denominated cross-border bank loans. That is,when the US dollar strengthens against the currency of another economy,capital flows out of that country; when the US dollar is weak,capital flows in. The negative correlation is apparent in international investment in Chinese bonds,but there's a time lag of three to six months. As shown in Chart 2,international investment in Chinese bonds shows up five months after a change in the effective US dollar exchange rate. The fall in the effective rate from the high levels of the third quarter of 2015 has been an important cyclical factor driving purchases of Chinese bond assets by international investors since the second quarter of 2016.

There are two key structural factors affecting international investment in the Chinese bond market. First,it is worth considering how open the domestic market is. China has been proactively expanding the openness of its market to foreign capital and enhancing convenience for bond market investors. Since 2016,a number of measures have been put in place. For example,in February 2016,qualified foreign financial institutions were allowed to invest in China's inter-bank bond market without any limits on the size of their investments,as per the central bank's Circular on Further Improving the Investment in the Interbank Bond Market by Foreign Institutional Investors (PBOC Document No. 3 2016). "Qualified foreign financial institutions" are those identified by the central bank as medium- or long-term investors,including commercial banks,mutual funds,pension funds,insurance companies and charities. In May 2016,the Regulations on Investment in the Interbank Bond Market by Overseas Institutional Investors (SAFE Document No. 12 2016) allowed overseas institutional investors to remit funds related to investments in the interbank bond market in or out of the Chinese mainland as long as these fund movements complied with foreign exchange regulations.

In February 2017,the SAFE Circular on Foreign Exchange Risk Management for Foreign Institutional Investors in the Interbank Bond Market (SAFE document No. 5 2017) provided foreign institutional investors with a way to access the interbank foreign exchange derivatives market on the mainland. Investors have been able to hedge against the risk of exchange rate by selling and buying foreign exchange products such as forwards,swaps and options. Further to these announcements,in May 2017,the PBOC and the Hong Kong Monetary Authority jointly announced a plan to launch the Bond Connect Program. The following month,the PBOC released its Interim Measures for Administration of Mutual Access and Connection between Mainland and Hong Kong Bond Markets. In July of the same year,the Bond Connect program was officially launched. In addition,measures such as tax relief and the introduction of foreign credit rating companies into the bond market have been taken to facilitate foreign investment and enhance China's attractiveness. In March 2018,Bloomberg announced that,starting from April 2019,renminbi-denominated China treasury bonds and policy bank bonds would be included in the Bloomberg Barclays Global Composite Index. This was to be completed over a period of 20 months.

Another factor has been the internationalization of the renminbi. The steady expansion of the renminbi's international role will help attract more foreign investors to the Chinese bond market. Foreign exchange reserves held in renminbi by other countries are a case in point. In the first half of 2018,other economies increased their holdings of renminbi as foreign reserves. The total rose 69.9 billion yuan,up 660% from the 9.2 billion yuan in the same period in 2017,according to statistics from the International Monetary Fund. (The IMF has been disclosing such figures since December 2016 following the inclusion of the Chinese currency in the Special Drawing Rights.) Those national governments holding renminbi generally chose Chinese treasury bonds as a way to ensure the security and liquidity of their reserve assets. Therefore,changes in the foreign exchange reserve assets held by other economies are closely related to changes in the balance of Chinese Treasury bonds.

Although structural factors such as renminbi internationalization can explain some of the increase in purchas