China's Credit Divergence

China's debt market is once more in the eye of the storm. Rising leverage levels and easier monetary and credit conditions have not been effective in promoting economic growth. Many Chinese companies are struggling with heavy debt burdens,declining profitability and excess capacity amid a fragile world economy. Defaults have occurred with greater frequency and there is growing concern over corporate debt issues and banks’ non-performing loans.

Bond defaults will lead to higher risk premiums and diverging credit pictures -- a reflection of the allocation of resources through price signaling. But a stable and appropriate default rate will help eliminate inferior borrowers and give clarity to the market. This will also demonstrate that the market is maturing. It is important to break the "implicit guarantee" for domestic bonds and release risk in an orderly manner. Currently,China's debt issues,and even the bond market itself,are in a critical period - the third round of credit revaluation. Credit spreads are diverging as default totals rise. Moreover,this period of adjustment could be prolonged.

Three Rounds of Credit Revaluations

Over the past two decades,China's bond market has experienced three rounds of credit revaluations. The first was in 2008 when companies like Jiangxi Copper,Shandong Weiqiao,Aerosun and Linuo all had credit problems,causing credit spreads to increase significantly. Those companies managed to avoid default. The main reason for this initial round of credit revaluation was a chain reaction started by an external event -- the financial crisis in the US.

The second round was in 2011 and it stemmed from an internal shock ¨C potential defaults on bonds of local government financing vehicles (LGFVs). LGFVs often have low profitability,weak cash flows and short-term debt repayment pressure,so they may find it difficult to pay interest and maturing debt on their own. As a result,they rely on more debt to maintain a healthy cash flow. However,cash flow from debt is vulnerable in nature,since tight financing conditions could lead to a deterioration in short-term debt repayment capacities. In the first half of 2011 there were concerns about the debt burden of LGFVs and tight refinancing conditions imposed by regulators. What worried investors most was the poor behavior of some LGFVs. Several LGFVs illegally transferred their core assets or stopped paying interest due to insufficient cash flow. Investors had been attracted to LGFV bonds because of their high yields. But as of May that year,the prices of LGFV bonds declined due to the poor performances of those companies,as well as the overall economic environment and macroeconomic policies at that time. Credit spreads widened by hundreds of basis points. Under pressure,many institutions ¨C including mutual funds and insurance companies -- sold off their holdings of LGFV bonds,amplifying a market slump.

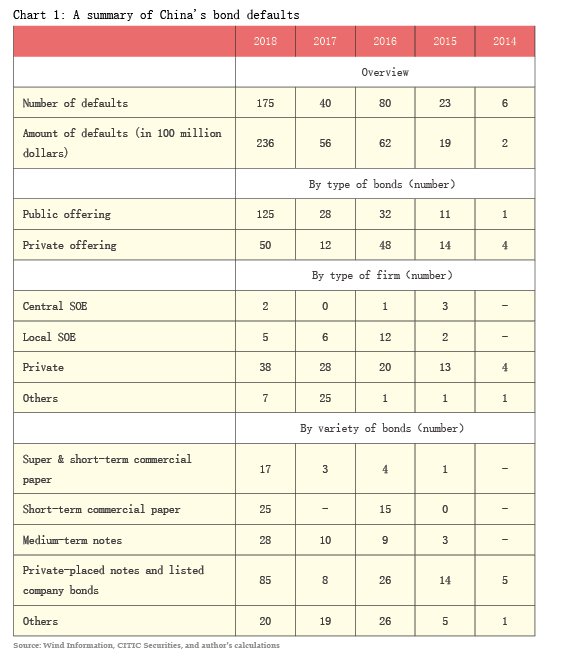

The third round of credit revaluation,which has been focused on corporate bonds,began in 2013 and is still under way. In 2018 there were 175 defaults on bond issues totaling more than 160 billion yuan. These involved private enterprises,local state-owned enterprises (SOEs),and central SOEs. As many as 21 provincial-level administrative regions were affected,and the debt securities included both public and private offerings. The length,depth and breadth of this round of credit revaluation is expected to be much more severe than the previous two.

Rising Tally of Defaults

There has been a growing number of "credit events" over the past several years. In 2016,80 bonds,amounting to over 41.8 billion yuan in principal and issued by 34 companies,defaulted over the year. The number of bonds and the principal amount involved increased by 247% and 231% respectively from a year earlier. Bond defaults saw another dramatic increase,from 37.7 billion yuan in 2017 to 160 billion yuan in 2018,most of them private enterprise bonds. A handful of LGFVs defaulted on their liabilities,though only one of them defaulted on its publicly issued bond. (See Chart 1)

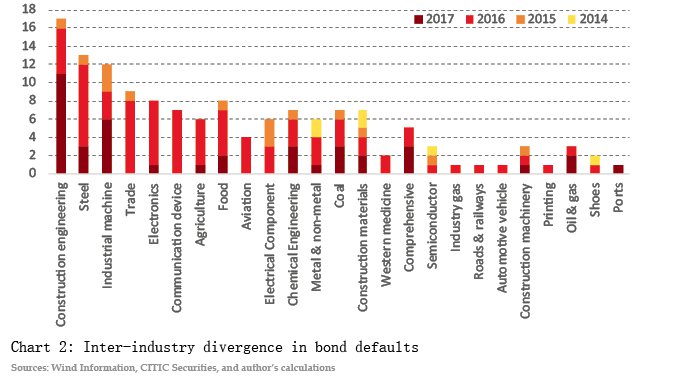

The reasons behind these defaults have varied considerably,differing from industry to industry. Industries that are highly cyclical have had more problems servicing debt. When the economy slows,demand for their products slackens,sales drop and cash flow weakens. Chemicals are an industry is this category. The second type of industries such as iron,steel,and mining,have long had excess production capacity and high inventories. In the past,defaults were concentrated in these industries. (See Chart 2) In the future,these industries are also likely to be at the center of supply-side reforms,and such reforms will make the credit quality of companies in these industries diverge even more from other healthier sectors. The third type includes commodities and trading companies where product prices have fallen dramatically in recent years,leading to a significant drop in revenue and net income. These firms are in difficultly now,and their credit quality is largely dependent on future price dynamics. If product prices continue to fall,these firms will be exposed to even greater credit risk.

Credit risk has gradually expanded from private companies to SOEs. Before 2014,there were no SOE bond defaults. In 2015,there were five defaults of SOEs and the number increased to 13 in 2016. In 2017 and 2018 SOE bond defaults decreased slightly to six and seven,respectively,but the totals were still significant. With the deepening of market-oriented reforms and the increased burden of government debt,there were fewer sources of support for these companies. Local governments were unable to bail out every troubled firm.

Since the first defaults on short-term commercial papers (SCPs) in 2016,defaults have occurred across all types of debt in China. And in 2018,there was a dramatic rise in the number of defaults of medium-term notes (MTNs),SCPs,privately placed notes and listed corporate bonds.

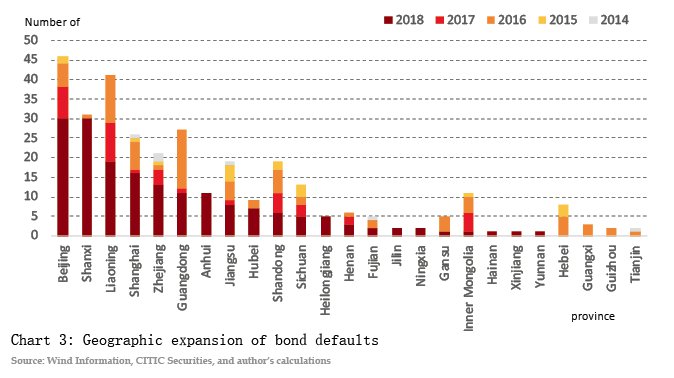

There has also been a geographic expansion of defaulting bond issuers. In 2016,defaults occurred in 18 provincial-level administrative regions,doubling the 2015 total. There were seven provincial-level administrative regions where defaults occurred for the first time,namely Liaoning,Jiangsu,Hubei,Inner Mongolia,Shanxi,Zhejiang and Gansu. Another surge of first-time bond defaults was seen in seven provincial-level administrative regions in 2018,namely Anhui,Heilongjiang,Jilin,Ningxia,Hainan,Xinjiang,and Yunnan. As of the end of 2018,bond defaults had occurred in 25 of China's 32 mainland provincial-level administrative regions. (See Chart 3)

Default Disposals

With the rise in defaults,the default disposal process has received greater attention. Basically,there are two major disposal methods in China: bankruptcy proceedings and suing for breach of contract. Under bankruptcy proceedings,debtors need to be insolvent. Currently,only Chaori Solar,Tianwei,Erzhong,Dongbei Special Steel Group and Guangxi Nonferrous Metal Group have started or completed bankruptcy proceedings. Guangxi Nonferrous Metal Group has declared bankruptcy,and creditors will be paid according to the priority of their claims after the auction of the firm's assets. Claims for compensation for breach of contract are another way of disposing of defaults when the debtor has a better credit rating. In such cases,specific disposal plans may be negotiated with the issuer of the debt.

A study by the author in 2017 shows that private enterprises are generally reluctant to default. Sometimes their inability to pay is a short-term funding issue rather than long-term weakness that would require insolvency. The author's study reviewed all 23 enterprises with publicly issued bonds that defaulted during the 2014-2016 period,and the aim was to see what these issuers did to settle their debts through the first half of 2017. Among these bond issuers,8 were SOEs,13 were private companies,and 2 were other types of enterprises.

Among the SOEs that defaulted,Shanxi Huayu Energy Co.,Ltd.,Sichuan Coal Industry Group Co.,Ltd.,and Hebei Logistics Industry Group Co.,Ltd. have fully repaid their principal and interest. China National Erzhong Group Co. turned its losses to profit after a restructuring and eventually repaid the principal on its publicly held bonds. Sino-steel Corporation used its stock as collateral for its existing bonds and was preparing to register bond repurchases. Sunnsy Group has not made a specific repayment plan while Dongbei Special Steel Group Co.,Ltd.,was still under bankruptcy restructuring. Only 37% of the SOEs involved in default have made full repayment of both principal and interest. Additionally,Dongbei Special Steel Group Co.,Ltd.,Tianwei Group,and China National Erzhong Group Co. all have started or finished bankruptcy restructuring. In comparison,among the private companies that defaulted,Yabang Group,GCL Energy Holdings Ltd.,Cloud Live Tech Group,Bohong Group,Zhuhai Zhongfu,and Hongda Kuangye have paid or agreed to repay their debt. China City Construction Holding Group Company and Nailun Group have agreed to make overdue interest payments,but have not announced a comprehensive repayment proposal. Sunday Floorboard,Evergreen Holding Group,Wuhan Guoyu Logistics Industry Group,Dalian Machine Tools Group,and Neimenggu Boyuan Group have not announced any repayment proposals. Of the privately owned companies in default,46% had made full repayment ¨C a higher percentage than among SOEs. Moreover,there were no private enterprises initiating bankruptcy restructuring during the first half of 2017,and that was a better outcome compared to SOEs.

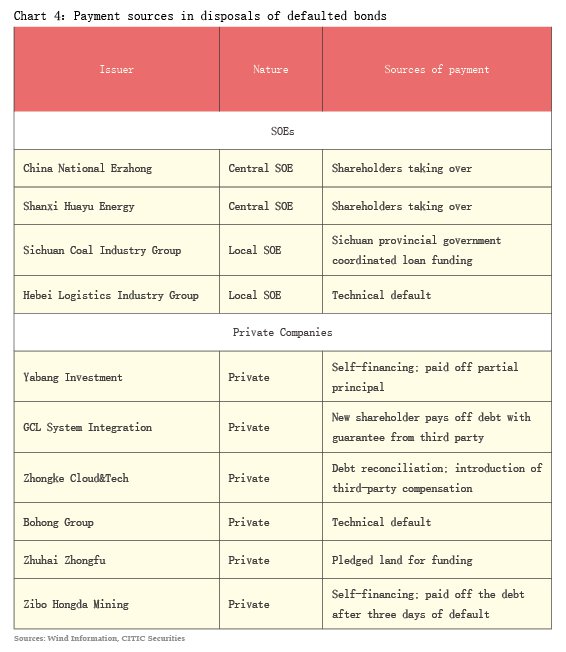

The sources of repayments for defaulted debts is listed in Chart 4. We can see the sources are different between SOEs and private companies. For central SOEs,funds mainly come from the support of key shareholders. The local SOEs relied on reconciliation with the help of local government,and the debts were paid by the companies themselves with bank financing. For private companies,they relied mainly on market-based approaches,including introducing new investors,refinancing by pledging fixed assets (land),and self-financing,among other means.

No matter what process of disposal is employed or the source of funds used in repayments,we can see some clear patterns in debt resolution. SOEs actually depend more on external help when in default. This may be related to the fact that SOEs usually have higher credit qualifications compared to private companies. This means that it is easier for them to obtain bank loans or raise money from the capital markets to avoid a default. Only when the cost of helping these troubled SOEs significantly outweighs the benefits,will shareholders strategically choose default. However,for private companies,the causes of default vary more widely. The founders of private companies that slip into default are often more closely attached to their own firms. Particularly if the companies have sold shares to the public,the CEOs and managers of privately run firms have a strong incentive to protect their company from bankruptcy. In addition,some private companies have relatively strong assets,which can provide good protection during liquidation. As a result,the bonds of private firms are often more valuable than those of SOEs in default.

Impact of Credit Risk Events

In conclusion,debt defaults have become relatively frequent and involve large sums. They have affected all types of firms across a rapidly expanding geographic area. In recent years,credit risk events have made the payment of interest and return of principal less certain. In the meantime,the disposal of defaults is becoming more optional and is diverging between privately-owned enterprises and state-owned enterprises. Once default occurs,it is likely that an SOE has a worse credit quality and a lower liquidation value compared with some private firms. Thus,payments by state-owned firms rely heavily on support from the government or other external institutions. However,disposal for private companies is rather flexible. At a time when the economy is slowing and leverage is increasing,exposure to credit risk is inevitable. The impact on market participants will be more extensive and in extreme situations,there could be spillover risks.

In 2016,there were many credit events,although some companies ultimately did not default on their debts. However,these unusual events caused great uncertainty and significant market turbulence. The "CRMC Incident" was a typical example.

On April 11,2016,China Railway Materials Corp. (CRMC) made a public announcement,stating that the company was discussing... "reform and recovery,and debt repayment arrangement,etc." It proposed an application to suspend trading of 16.8 billion worth of bonds.

CRMC is a subsidiary of China Railway Material Group Co.,Ltd. and its ultimate corporate parent is the State-owned Assets Supervision and Administration Commission of the State Council (SASAC). Affected by a weak steel market in 2014,the company was in financial distress,though its financial reports did not make the extent of its problems that obvious. The company is the only steel rail supplier in China with a large market share. Thus,investors had grounds to expect implicit government backing.

However,the announcement on the "debt arrangements" was completely unanticipated and market panic ensued. Trading of CRMC debt resumed later that month but the impact on the market overall was evident. Five-year "AAA" and "AA" credit spreads increased by 44 basis points (BPs) and