China's Route to Capital Account Convertibility

As part of its steady progress in foreign exchange regulatory reforms,China has been moving away from a framework of capital controls and towards capital account convertibility. The country maintained strict capital controls up until the mid-1990s,owing to foreign exchange shortages. But economic reforms created a world-beating accumulation of foreign exchange reserves and that eventually undercut the argument for those restrictive policies. As a result,renminbi convertibility on the capital account has been an objective of foreign exchange reform and that has been the case since December 1996 when China formally accepted the obligations of Article VIII of the Articles of Agreement of the International Monetary Fund (IMF) and made the currency convertible under the current account. Great progress has been made in this area over the past two decades or so. This article will examine that progression and look ahead to what it means for the future.

Past Progress

China began to adjust its capital controls policy in the early years of the 21st century,driven by the progress in the opening of its economy after the country entered the World Trade Organization. China's "dual surplus" in trade and the financial account had increased rapidly since the mid-1990s,making looser capital controls possible.

With respect to direct investment,measures were taken to facilitate both inbound foreign direct investment (FDI) and outbound overseas direct investment (ODI). Since 2002,there has been wider access to the domestic market for foreign investors and investment has been made simpler. That included the examination and approval process,as well as foreign exchange settlement related to capital inflows from direct investment. Some restrictions were removed on mergers and acquisitions involving domestic enterprises in certain industries. Additionally,foreign investors were allowed to become strategic partners of domestically listed companies. For outbound investment,Chinese enterprises saw an easing of restrictions on foreign currency purchases and many formalities were simplified.

As far as investments in securities are concerned,China has gradually opened channels for foreigners to participate in the domestic stock market and created avenues for outbound investment by local investors. Foreign investments in Chinese securities have been permitted under the qualified foreign institutional investors (QFII) program while local investors have been able to make investments in insurance,mutual funds and bank products through institutions via the qualified domestic institutional investors program. The relaxation was realized by the qualified domestic institutional investors (QDII) system. More policy innovations were unveiled after the US subprime mortgage crisis.

The domestic bond market was opened to three types of "foreign banks" — renminbi clearing banks from outside of mainland of China,overseas banks participating in renminbi settlement in cross-border trade,and central banks or monetary authorities of other countries. That was followed by the renminbi qualified foreign institutional investors (RQFII) and renminbi qualified domestic institutional investor (RQDII) programs as well as other bond connect programs such as Shanghai-Hongkong Bond Connect,Shenzhen-Hongkong Bond Connect,panda bonds (renminbi-denominated bonds from a non-Chinese issuer and sold in China) and the Bond Connect program (which allows investors from mainland China and offshore to trade in each other's bond markets through a connection between financial infrastructure institutions).

There was progress in other areas of investment. Medium and long-term international commercial borrowings by China's domestic enterprises were no longer limited by the state's plan of utilizing foreign capital. Since 2015,domestic enterprises were only required to report such borrowings. Additionally,SAFE ended its policy of approving short-term (one year or less) international commercial borrowings. Since 2016,a macro-prudential approach has been taken in regulating this area. Quantitative limits on overseas loans with a domestic guarantee was also removed in 2014.

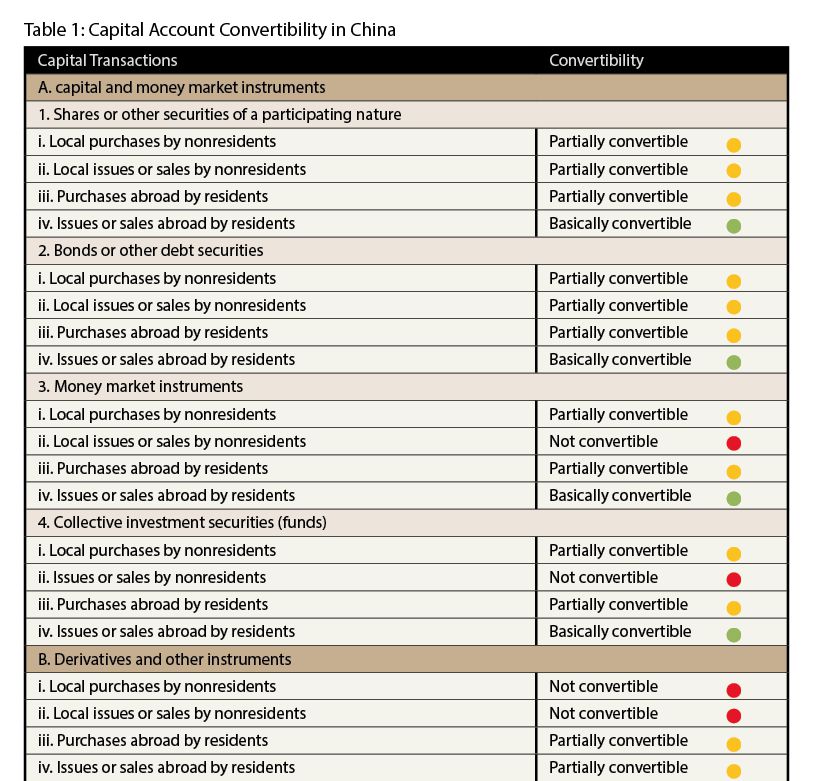

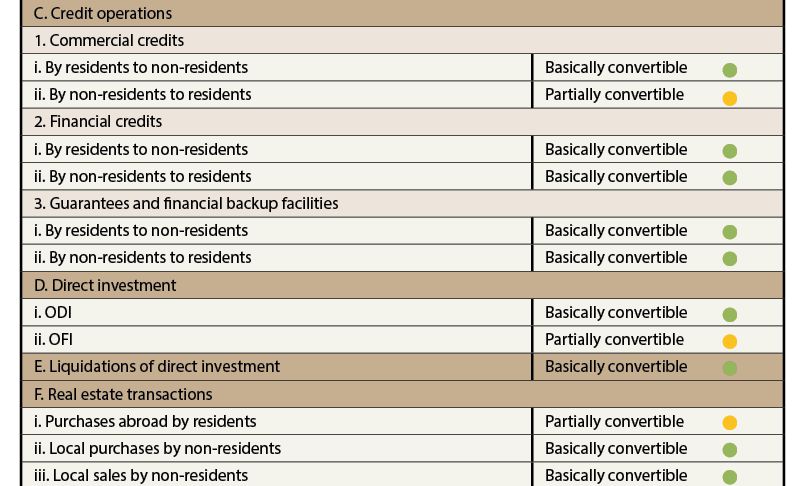

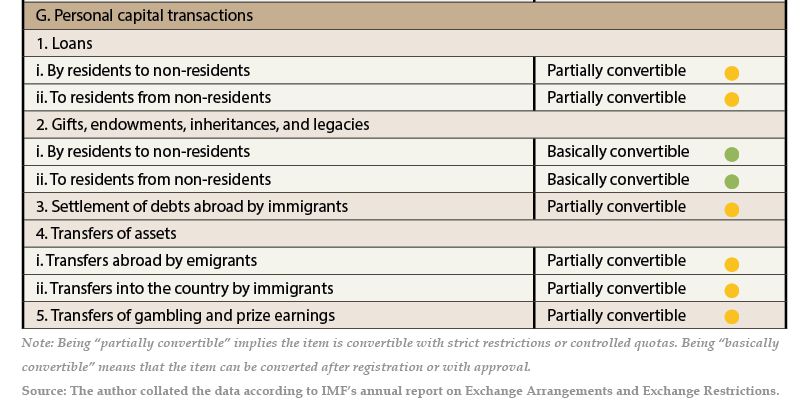

Great progress has been made in China's current account convertibility through the 20 years of market-oriented reform. The IMF's annual report on Exchange Arrangements and Exchange Restrictions highlighted the country's achievements. Of the 40 categories of capital transactions in the report,80% were under strict control in the late 1990s. The figure dropped to 50% or so in 2004. Moreover,only four categories of transactions remained totally unconvertible at the beginning of 2016,just 10% of the 40 categories. There were 22 categories,or 55% of the total,that were partially convertible and 14 categories,or 35%,which were considered to have achieved basic convertibility. In other words,90% of all the categories in the IMF's annual report were basically or partially convertible in China (See Table 1). The achievement was made in spite of a serious bout of capital outflows following the foreign exchange reform of August 11,2015. At that point,authorities tightened regulation of cross-border capital flows,and capital account convertibility decreased for a short period of time.

A Gradual Approach to Reform

China's market-oriented economic reforms gathered pace in the early 1990s,targeting policies governing trade阅读全部文章,请登录数字版阅读账户。 没有账户? 立即购买数字版杂志