Monetary Policy Making and the Jackson Hole Symposium

The annual US Federal Reserve’s Jackson Hole Economic Symposium concluded recently,and the topic “Challenges for Monetary Policy” seemed particularly appropriate. These are challenging times indeed amid weaker global growth and a spike in trade tensions. One of the key takeaways from the latest gathering of economic and financial heavyweights is that as far as the Fed is concerned the US economy is in fairly good shape – despite an inversion of interest rates – normally a reliable sign of recession ahead. The key task for the Fed,it seems,is sustaining the economic expansion,which has already powered ahead for more than a decade. And in the eyes of the Fed,trade policy – read that mostly as the trade war with China – is the main challenge rather than interest rates.

Once again major central bankers took the stage. Fed Chairman Jerome Powell and Bank of England Governor Mark Carney both used some of their time to address trade policies and trade tailwinds for the economy.

But before we delve more closely into the current challenges and the policy responses,let us first examine this most prestigious gathering of the men and women tasked with keeping the global monetary system running smoothly. Why does this meeting get so much attention from the world’s financial markets? How did Jackson Hole become the premier meeting for policy makers? Just who are these policy insiders,economists,financial market participants,and government representatives who gather in this idyllic retreat to discuss key long-term policy issues?

The Federal Reserve Bank of Kansas City began hosting the conference at the Jackson Lake Lodge in Wyoming more than four decades ago. All 12 of the Fed’s district banks organize research conferences,but only Jackson Hole becomes the Davos for central bankers.

The Symposium began in 1978. In 1982 the conference permanently moved to Jackson Hole and persuaded Paul Volcker,then-chairman of the Fed and a keen fly-fisherman,to attend. At that time,Volcker’s battle against inflation was putting the economy into a recession and left him fighting critics from all sides. He might have seen this meeting as a welcome relief,though it turned out to be no vacation.

Jackson Hole is a valley between the Teton Mountain Range and the Gros Ventre Range in Wyoming. In a book entitled In Late August,which introduces the history of this long-standing central banking symposium,the Federal Reserve Bank of Kansas City depicts Jackson Hole this way: “Jackson Hole’s awe-inspiring and isolated nature provides the ideal environment for symposium attendees to discuss economic policy issues away from daily pressures and distractions. At the symposium,barriers are removed and participants engage with each other in a way that isn’t always possible at other gatherings,perhaps due to Jackson Hole’s remote setting,no-frills location and the small number of participants.”

The ideal outdoorsy location and Volcker’s regular attendance attracted other policymakers and made the event an unequalled gathering for heavy hitters in the economic policy realm. The goal of the symposium was to set up conditions of lively debate in an informal setting. The topic for each annual symposium is chosen by the Federal Reserve Bank of Kansas City,but the focus has always been purely on central banking,and it asks experts to write papers on related subtopics,including inflation,labor markets,international trade,economic growth,financial stability,and,of course,monetary policy. Though the discussions are heavily weighted towards academic analysis,central bankers also use this important gathering to indicate major changes in monetary policy.

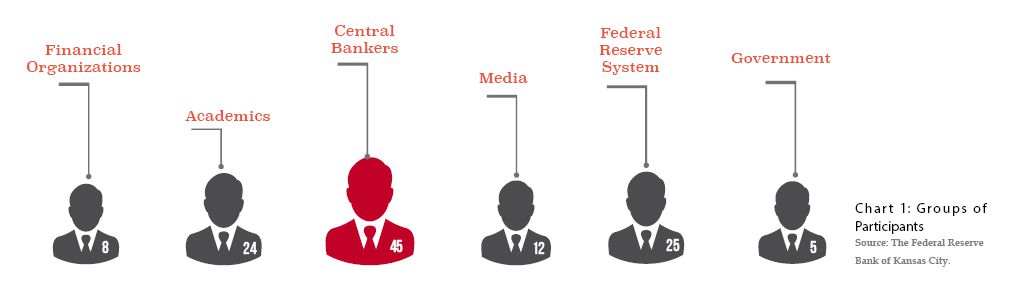

To foster open discussion,attendance at the event is limited and by invitation only. Attendees are selected based on each year’s topic with consideration for diversity in region,background and industry. About 120 people attend in a typical year (See Chart 1). According to Vincent Reinhart,a former Fed official who is now with BNY Mellon Asset Management,market participants have gone from 27% of attendees in 1982 to 3% in 2013. Their spots have been taken by foreign central bankers,who grew from 3% to 31%,and reporters,who went from 6% to 12% (The Economist,Aug 21st,2014). Throughout the event’s history,attendees from 70 countries have gathered to share their diverse perspectives.

The Jackson Lake Lodge is a National Park Service facility that does not have any resort-like amenities such as a spa,exercise room or salon. The author once stayed in a cabin at the resort,and foud it very rustic but comfortable. Throughout the conference,there is no special consideration from the Lodge,which still remains open to the public. All symposium participants pay a fee to attend,and the funds are used to recover event expenses.

The discussions are not only academic but at times they offer important signals on policy shifts. Over the past 42 years at the Jackson Hole Symposium,there have been numerous indications of future policy moves alongside a raft of interesting anecdotes. Below are some highlights.

─The theme for the 2007 symposium “Housing,Housing Finance and Monetary Policy” was viewed by some invitees as unsuitably boring,unimportant,and irrelevant at the time of its announcement. However,by the time the event kicked off in late August,the housing market had collapsed,making it the hottest topic of the financial world.

─In August 2010,then-chairman Ben Bernanke spoke of reasons and objectives for using unconventional monetary policy to provide additional stimulus. Three months later,the Fed announced a second round of quantitative easing,QE2.

─In a speech at the 2012 symposium,Bernanke described high unemployment as a “grave concern” and signaled a readiness to take another round of quantitative easing,which was announced the following month and came to be known as QE3.

─During his appearance in 2014,ECB President Mario Draghi gave a very strong signal of embarking on quantitative easing soon. The following March,QE in the euro area started.

─As then-chairman Greenspan’s retirement loomed,the theme for the 2005 symposium was “The Greenspan Era: Lessons for the Future,” focusing on what could be learned from Greenspan’s central banking tenure,the longest ever. Raghuram Rajan,then Chief Economist and Director of Research at the International Monetary Fund,and later the 23rd Governor of the Reserve Bank of India,warned about the growing risks in the financial system,which seemed to directly counter what Greenspan had believed. At a celebration honoring Greenspan,symposium participants didn’t expect to hear this. Lawrence Summers,former US Treasury Secretary,then-president of Harvard University,called the warnings “largely misguided” and Rajan himself a “luddite” (See Paul Krugman. “How Did Economists Get It So Wrong?” The New York Times, September 2,2009). However,following the 2007–2008 financial crisis,Rajan’s ideas came to be widely seen as prescient. In April 2019,Rajan came to Harvard University as a guest speaker. When moderator Harvard University professor Dani Rodrik referred to the encounter at the 2005 symposium as a debate,Rajan smiled: “it was not really a debate,Summers was just making his points,while I was giving my speech.”

The Jackson Hole Consensus

“Jackson Hole consensus,” a term coined by late Harvard University professor and President Emeritus of the National Bureau of Economic Research Martin Feldstein at 2005 Jackson Hole Symposium,has dominated central banking for decades. Feldstein had attended the symposium many times and contributed much to the program. Kansas City Fed president Esther George highly praised his contributions to this longest-standing central banking event. In a tribute she said: “Marty and Kate Feldstein attended many symposiums here,and Marty was on the program some 18 times. His influential contributions to the economics profession and to public service will long be remembered. He was a wonderful mentor and we are grateful for his advice and input over the years as we considered topics and speakers for this program.”

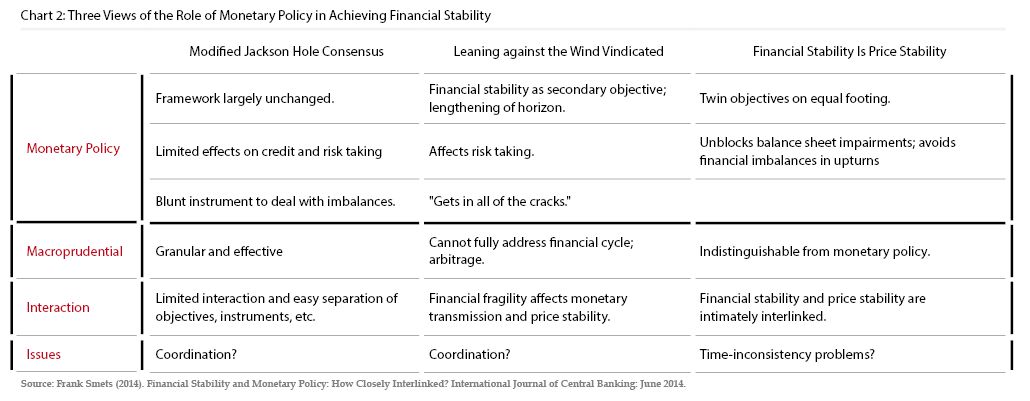

The Jackson Hole Consensus holds that monetary policy is the best means to achieve economic stabilization. When insulated from politics,central bankers are at their best. The prime goal of central banks is to keep inflation low and stable. Markets work. Financial crises are history in advanced economies,because skilled central bankers know how to prevent them (See Irwin,N. (2013). The Alchemists: Three central bankers and a world on fire. New York: The Penguin Press) It favors a single inflation target to anchor expectations,and puts a lot of weight on the transparency and predictability of monetary policy. Since 2012,the Fed has adopted an explicit inflation target of 2%. Generally speaking,central bankers seldom focused much attention on their responsibility for broader financial stability,though there were some views,mainly from Europe and Japan,that monetary policy should “lean against” financial risks (See Chart 2).

But in the wake of the 2008 financial crisis,“The main tenet of the Jackson Hole consensus—that central banks earn their credibility by having a simple target which the public understands and to which they are held accountable—will be much harder to maintain” (The Economist. Jackson’s Holes. August 27,2009). Previously,especially in the Greenspan era,the Fed ignored financial stability,focusing almost solely on price stability. And after the crisis,the Fed has tried to make a balance between price stability and financial stability. But it also depends more on the preference of the Fed chief; former chair Janet Yellen,for example,was very enthusiastic about financial regulation,but Powell is quite the opposite. There are still national preferences; in the US,there have been few macroprudential measures taken,though many have been introduced in the UK.

Fed officials are concerned more about financial stability these days. Eric Rosengren of the Boston Fed and Esther George of the Kansas Fed dissented from the Fed decision to cut rates on July 31,airing their worries about financial risks. As George put it,easing policy is not a free choice. It pulls forward demand,can make leverage more attractive and creates more risk.

Assessing the Fed’s Policy Moves

Last year,the Fed raised rates four times because the unemployment rate was falling,and inflation ran close to the Fed’s symmetric 2% objective. But after inflation unexpectedly softened and market volatility soared at the end of 2018,the Fed shelved plans to keep raising rates later on.

At the FOMC meeting that concluded on May 1 this year,the Fed maintained the federal funds rate in a target range of 2.25 to 2.5% and set the interest rate paid on required and excess reserve balances at 2.35%. On the day the Fed decided to hold rates steady,US stocks fell,bond yields rose and the dollar strengthened. That suggested the markets thought the Fed was more tolerant of weak inflation and was not ready to cut rates.

Foreshadowing a Rate Cut

The Fed’s two-day monetary policy meeting ended June 19 with the decision to keep the target fed funds rate unchanged at a range of 2.25 to 2.5%. But there are significant changes in the statement on expectations for the future. The Fed will “take necessary action to maintain economic expansion due to increased uncertainty” depending on future data. The word “patience” disappeared from the previous statement,foreshadowing a rate cut.

When the dust settles,it is still necessary to calm down and carefully collect available data. First of all,it is crucial to figure out reasons for the change in the announcement – the added uncertainty,or “crosscurrents” as Powell stated at the post-meeting press conference. This is the basis for an in-depth understanding of the decision and for tracking and judging the next step.

The announcement of the resolution was made at 2 p.m. and a press conference followed exactly half an hour later,in keeping with tradition. At the press conference,Powell made five points about uncertainty. First,global economic growth was disappointing. Second,trade friction has increased. Third,business confidence has declined and may be further reflected in future data. Fourth,the financial market risk preference has diminished. Fifth,inflation remained weak. All of this could have an impact on the economic outlook.

The Fed is paying more and more attention to uncertainty in monetary policy decisions,which is in line with the speech of Powell’s monetary policy seminar held in Chicago on June 4. He pointed out that everyone generally pays more attention to monetary policy operations under normal circumstances,but it is more important to know how to deal with sudden changes in the economic and financial environment.

Despite the increased uncertainty,the Fed’s benchmark judgment on the current US economic situation was still positive. Consumption was weak in the first quarter but stabilized after rebounding in the second quarter. Inflation was subdued in the first quarter and picked up slightly in the second. Corporate revenue growth slowed in the second quarter,affecting business investment. Despite weakness in manufacturing,investment and trade,the services sector was strong,and this had a fundamental impact on the job market.

Powell still believes that weak inflation is temporary and expects it to creep back toward the 2% target as the job market tightens and wages rise. But the recovery will come more slowly than predicted at the last meeting. Wages are rising,but the magnitude is not enough to provide sufficient momentum for price recovery. And all indications show that inflation expectations are still falling. It should be noted that financial markets are far more pessimistic than the Fed when it comes to inflation. Time will tell who is right and who is wrong. At present,the Fed is quietly moving closer to the market.

In his opening remarks at the June press conference,Powell also mentioned the specific discussion of the interest rate cut by members of the FOMC. He pointed out that many members believe that interest rate cuts would be appropriate. The dot plot pointed to interest rate cuts for the first time. Of course,Powell also stressed that the dot plot is only a personal judgment and does not represent the Fed’s official forecast.

As to a reporter’s question about why there was no interest rate cut at that time,Powell replied that the current evidence was insufficient to support a cut. More time was needed to observe the economy. In response to the strong expectations of cuts in market interest rates,he stressed that the Fed cannot make decisions based on a certain set of data or market sentiment,because individual data and sentiment are highly volatile. Decisions based on these factors may increase uncertainties.

For this meeting,10 members of the Fed’s Open Market Committee voted,9 in agreement on holding rates steady and 1 opposed. The opponent was James Bullard,the president of the St. Louis Federal Reserve Bank,who proposed cutting the Fed funds rate by 25 basis points.

First Rate Cut in a Decade

Finally,after a long wind-up,the Fed acted at the FOMC meeting which ended on July 31. It cut interest rates for the first time in a decade,lowering the federal funds target by 25 basis points and ending the shrinking of its balance sheet ahead of schedule.

From the author’s observation,it is hard to say this was the best time to cut interest rates. The economic data released shortly before the meeting were better than expected. Consumption was strong and inflation also showed a rebound. In the statement,the Fed acknowledged that the economy was doing well,but noted concerns about a global economic downturn,rising uncertainties such as trade friction and weak inflation.

Powell told the press conference that the