Economic Policy Response to the Pandemic: A Global Perspective

We are in the midst of a worldwide public health crisis. More than 6 million people have been infected by Covid-19 and more than 360,000 have died. The crisis has also brought much of the world economy to a halt. Businesses have shuttered,workers are staying home,people have temporarily withdrawn from many kinds of economic and social activity in a bid to slow the spread of the virus. The result has been substantial economic harm.

According to the International Monetary Fund's World Economic Outlook,released in April,the global economy is projected to contract by a sharp 3% in 2020,much worse than during the 2008–09 financial crisis. But there are severe risks of a worse outcome,"depending on the pathway of the pandemic and the severity of the associated economic and financial consequences."

Federal Reserve Chairman Jerome Powell gave his forceful warning about the risks to the economy,echoed IMF's views. "The scope and speed of this downturn are without modern precedent and are significantly worse than any recession since World War II." He testified before the US Senate on May 19.

Tracking Global Fiscal and Monetary Support to Fight the Pandemic

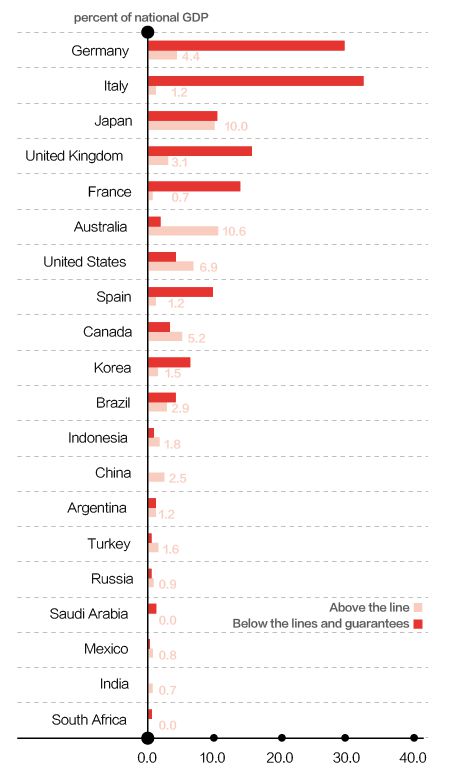

Most countries have taken monetary and fiscal measures to mitigate their difficulties. According to the IMF Fiscal Monitor report in April,the global fiscal package is about $8 trillion,including $3.3 trillion direct budget support,and another $4.5 trillion additional public sector loans and equity injections($1.8 trillion) and guarantees($2.7 trillion),and other quasi-fiscal operations. The Group of Twenty(G20) economies are at the forefront with a total of $7 trillion. (See Chart 1).

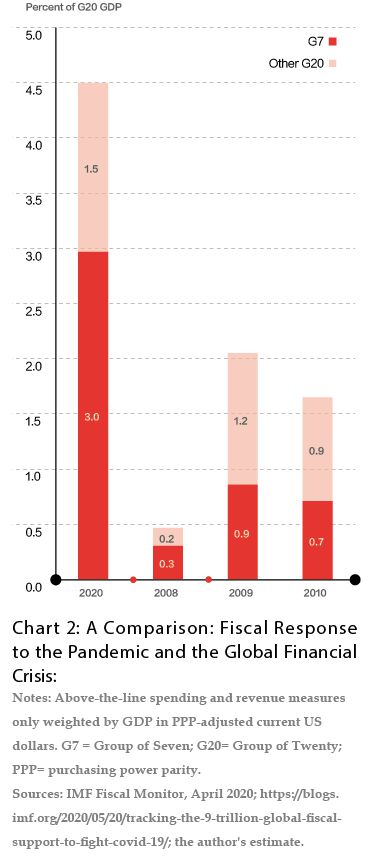

On May 20,the IMF updated the above numbers upward to $4.4 trillion and $4.6 trillion,respectively,totaling $9 trillion compared to $8 trillion as of April 8,because of a second wave of measures by governments. The total revenue and spending package for G20 countries accounts for 4.5% of GDP on average,larger than during the global financial crisis (See Chart 2).

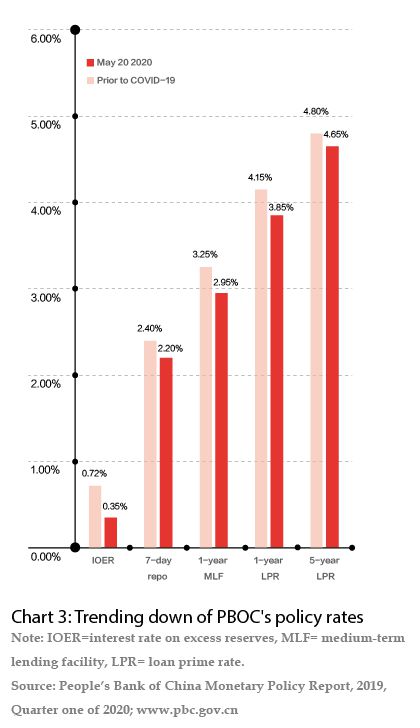

For China,an estimated 3.6 trillion yuan (or 3.5 percent of GDP) of above-the-line fiscal measures have been announced,on top of which is the issuance of 1 trillion yuan of special central government bonds. The People’s Bank of China,the central bank,provided monetary policy support as well and acted to safeguard financial market stability,including lowering reserve requirement ratio three times and cutting IOER,MLF and LPR rates (See Chart 3) .

In the coming days,the PBOC may have to consider lowering the benchmark deposit rate given the following conditions: the spread of a second wave of coronavirus that closely resembles the first one,a continued drop in expected inflation rate (for example,to below 1.5%),and the exhaustion of other fiscal and monetary policy space. Ideally the aforementioned conditions will remain hypothetical,but the road ahead is still very much uncertain.

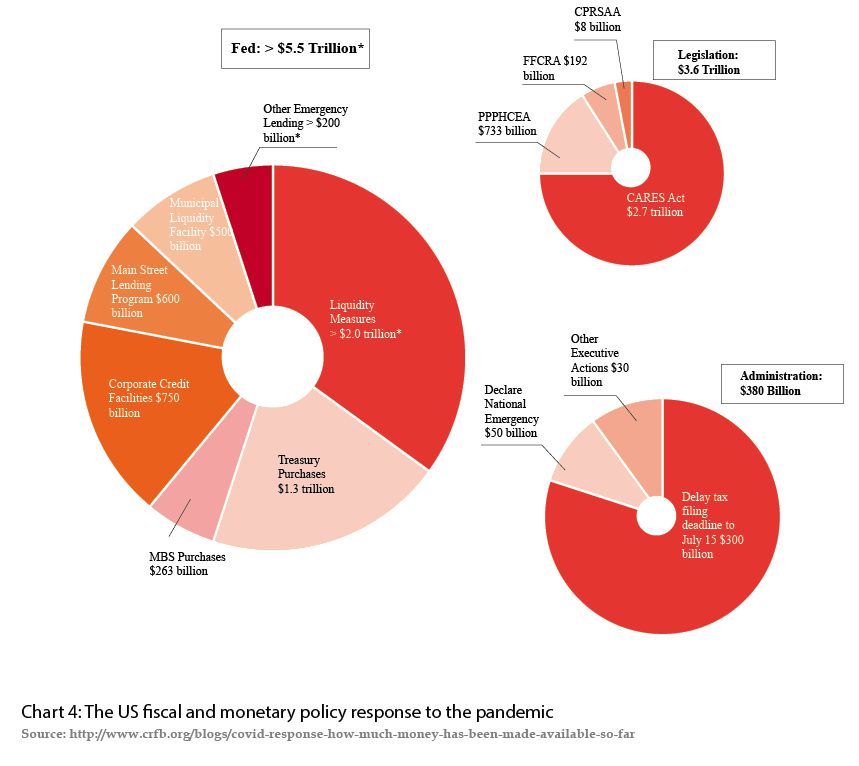

In the US,Congress has authorized roughly $3.6 trillion in fiscal support—about 17 percent of GDP,which will ultimately add around $2.4 trillion to the deficit. In addition,the Federal Reserve has already disbursed around $2 trillion of loans,asset purchases,and other actions and has announced nearly $6 trillion in economic support. (Speech by Jerome Powell on "Current Economic Issues",May 13,at the Peterson Institute for International Economics; and Committee for a Responsible Federal Budget,http://www.crfb.org/project/covid-money-tracker) (See Chart 4) .

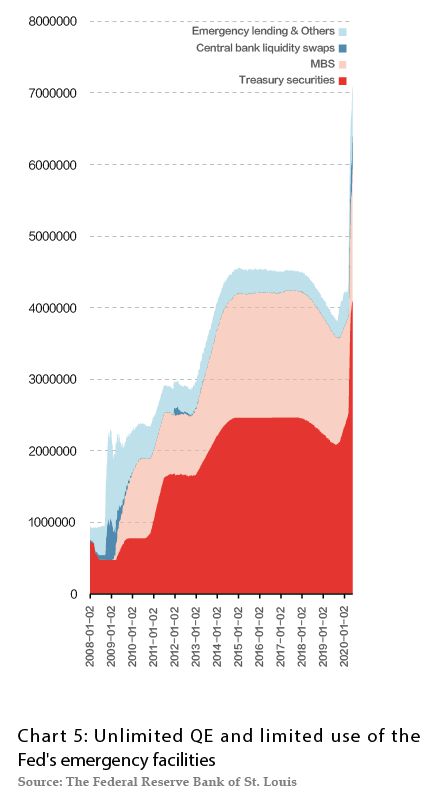

In terms of monetary policy,the Fed has been committed to using its full range of tools to support the economy in this challenging time. It lowered policy interest rates to near zero,purchased Treasury and agency securities were made in amounts needed,expanded overnight and term repos,and lowered the cost of discount window lending. The Fed also introduced nine emergency facilities to support the flow of credit,in some cases backed by the Treasury using funds appropriated under the CARES Act.

The Fed's balance sheet has been greatly expanded,but only four of its nine emergency policy tools have been put to use since March. Not only is this number small,but the amount of money deployed through these four tools is limited (See Chart 5). Why is this case? Is the situation not as urgent as thought? Is it a design problem of the mechanisms? Is there an operational obstacle or are there other concerns? In short,what is the Fed waiting for?

It’s clear the problem is complicated but how do we account for the Fed's response? This article puts forward the following points for discussion.

One Possibility: The Fed’s Not in a Hurry

One possibility is there was no immediate need for funds,so the Fed did not activate several other emergency monetary policy instruments or expand the size of the funds it put to use.

The logic of this assumption is as follows.

First,since March,the Fed has taken almost all possible policy options. The announcement effect was significant and that substantially stabilized market expectations.

Second,although the funds invested through emergency monetary policy instruments were limited,the balance sheet had been expanded by $2.4 trillion -- a huge number.

Third,in terms of specific strategies,several key links in the financial system have been stabilized through the operation of existing instruments.

Fourth,Congress has passed four bailouts worth nearly $3 trillion,which are being implemented and are beginning to take effect.

The logic seems persuasive. But once compared with the practical difficulties faced by the economy,there are still many outstanding problems. For one,the cumulative number of people filing for unemployment benefits in the last several weeks has reached an unprecedented 36.5 million and the existing bail-out and rescue plan has failed to protect these jobs. Moreover,the situation is likely to continue to deteriorate. The launch of PPP for small businesses also shows that the demand for assistance is far from satisfied. Additionally,state and local governments are facing severe budgetary pressures. Will the federal government come to their aid or force them to take draconian cost-cutting measures? And the strains can be seen on the debt market. The current 30-year AAA-rated local government bond yield is 2.13%,compared with 1.5% at the beginning of March,for example. That is a considerable gap.

As can be seen from the above analysis,financial support from the Fed is needed urgently. So,there must be other reasons.

Possibility Two: Worries about Losses

From the above information,it seemed that the current funding needs might not be urgent,so perhaps the Fed felt it did not need to activate other emergency monetary policy tools or increase the amount of money it has already deployed. There seems to be some truth in this,partly confirmed on April 29 by Fed Chairman Powell. He argued that the monetary policy package has had a strong announcement effect,which restored confidence. Although the Fed only made some short-term money market loans,it did not conduct any business loans. But its actions already had a positive effect on the financial system,and enterprises and other participants could return to the market for financing. It was also unclear how much more money the economy needed.

While some time has been bought,Powell does not think this is the time to wait. He said the announced policies would still have to follow through to make the announcement tangible. The Fed fully recognizes the importance of implementing the emergency tools as soon as possible and the urgency of the need was apparent,he said.

So why is the rollout of these policies so slow?

This involves the second possibility -- worrying about possible losses.

As for the use of emergency policy tools,although Powell has repeatedly stressed that loans should be made only to solvent borrowers to encourage private financial institutions to lend,the Fed is also willing to take risks. As the Fed chief said on April 29,the risks from the Fed lending to the rest of the world have increased markedly this time. Whether or not the loan will lose money is a major concern for the Treasury,whose capital is the first to bear the risk. If the Treasury sees fit,or if the Treasury is not worried about damaging the loans,the Fed has no problem.

This was an unusual thing for Powell to say. As far as I know,during the 2008 financial crisis,the Fed was worried that it would lose money on its loans and asset purchases,and that failing to turn over the profits to the Treasury would create political risk. After the crisis,then-Fed chairman Ben Bernanke proudly wrote in his memoirs that the crisis relief policy made big money.

So,what is the Treasury's position on this? There are signs that the Treasury is clearly risk-averse this time. Also,on April 29,Treasury Secretary Steven Mnuchin said on a conference call with reporters that he wanted to get at least the principal back on the Treasury's emergency lending facility,a baseline assumption. If Congress wants the Treasury to lose all its money,it's not going to be designed as a loan,Mnuchin said. It's going to be in the form of subsidies and grants.

On April 30 the Fed at last produced an updated version of its Main Street Lending Facility (MSLF) design,aimed at lenders to small and medium sized business. There are several important changes to the new terms from the initial announcement: the minimum loan size was reduced from $1 million to $500,000. The Fed will increase the pool of eligible borrowers,raise the annual revenue ceiling from $2.5 billion to $5 billion,and increase the number of employees from a maximum of 10,000 to 15,000. Moreover,whereas banks could sell 95% of their loans to the Fed and keep 5% for themselves originally,the new terms are split according to the type of loan. In some cases,banks can sell no more than 85% and must keep 15%.

In my opinion,the three new changes above all help to reduce the loan risk. The first one diversifies the risk,the second improves the qualification of the borrowing enterprises,and the third,which requires banks to retain 15% rather than 5% in some cases,is designed to make lenders more cautious so as to lend more to better-qualified firms. In this scenario,both Fed and Treasury funds are more protected. That made it harder to put together,so it took three weeks for the details of the tool to be partly designed and implemented after it was announced on Apr