Covid-19: China's Monetary Policy and the Resilience of Its...

Covid-19: China's Monetary Policy and the Resilience of Its Macro-Financial System

With its rapid transmission,severe symptoms,and high death rates,Covid-19 had spread across China by the end of January 2020. It has since proved far more infectious and dangerous than the deadly SARS (Severe Acute Respiratory Syndrome) outbreak of 2002-2003. It has also imposed a huge challenge to the Chinese economy,which was already under significant pressure from prolonged US-China trade friction,an economic slowdown,and painful but necessary structural reforms.

When financial markets reopened on February 3,following the Chinese Spring Festival,investors' deep concerns was obvious. The Shanghai Stock Exchange (SSE) Composite Index dropped 7.7% for the biggest single day loss since August 2015. The median credit spread across AA+ rated industry bonds of different maturities widened by about 18 basis points,the third largest one-day increase since January 2010. In response to mounting concerns regarding the extent of the impact of Covid-19,the People's Bank of China took decisive action,using a wide range of monetary policy tools to restore market liquidity and bolster macro-financial stability.

This article reviews the key steps taken by China's central bank and evaluates the effects of the monetary policy initiatives on the interbank and credit markets as well as the overall stability of the economy.

The PBOC's Response to the Coronavirus Outbreak

In coping with the quick spread of the Covid-19 epidemic,the PBOC took immediate policy actions to contain the direct damage to the financial markets and the critical segments of the manufacturing sector. On February 3 and 4,the PBOC used its open market operations (OMO) to inject a total of 1.7 trillion yuan in short-term liquidity into the interbank market through reverse repurchases or repos. This effectively eased market concerns,bringing down the 7-day and 14-day OMO reverse repo rates by 10 basis points. The PBOC reversed the direction of these liquidity injections by withdrawing lending on maturity,thereby ensuring sufficient liquidity in the markets without creating massive quantitative easing. The PBOC also rolled out a special-purpose lending facility of 300 billion yuan on January 31 to provide immediate discount loans to major national banks and local banks operating in regions that were most affected by the coronavirus. As a result,firms that were producing urgently needed medical equipment and other essential materials were assured they would receive needed liquidity at an effective rate of no more than 1.6%. By March 13,according to PBOC data,more than 5,000 firms deemed essential in combating the outbreak had received discount loans as well as interest rate subsidies. The effective rate of borrowing for these firms was as low as 1.26%.

In addition,apart from stabilizing the financial markets in the short-term,the PBOC utilized a series of tools to strengthen the financial rebound and achieve economic recovery. On February 26,the PBOC arranged a second special-purpose lending facility of 500 billion yuan. These had longer maturities and provided lower cost loans to an expanded group of financial institutions and producers. Importantly,local banks,the agricultural sector,the international trade sector,and small and medium-size enterprises (SMEs),which were more seriously affected throughout the crisis,were given access to such credit windows. The interest rates on loans supporting agricultural production and SMEs were lowered by 25 basis points. By March 13,107.5 billion yuan out of the total had been loaned out and the effective borrowing rate was no greater than 4.55%. On March 31,the Administration of the State Council determined that another round of low-cost loans would soon be provided by the PBOC. The central bank would set up a third lending facility of one trillion yuan aimed at more than two million qualified small- and medium-size enterprises,roughly 7% to 10% of all registered SMEs. In general,these arrangements would provide sufficient credit support to those affected firms at much lower costs and for a longer duration to cover their operating costs,roll over their maturing debts,reactivate long-term investment projects,and allow them to eventually restore revenues and profits.

Accommodative Monetary Policies

The financial markets reacted positively to the PBOC's credit support. First,asset valuations rebounded sharply as a result of renewed confidence. By March 5,the Shanghai Stock Exchange Composite Index had roughly recovered its losses,racking up gains of 11% since the beginning of February. For April,the Shanghai Composite was up 4%. Second,there was a reversal of the market uncertainties and concerns. The median credit spread across AA+ rated industry bonds shrank to 158 basis points,about 30 basis points below the 2019 fourth quarter average. In addition,expectations of a depreciation of the Chinese currency were arrested. The renminbi's central parity exchange rate against the US dollar strengthened to 6.926 on March 6.

In addition,the interbank

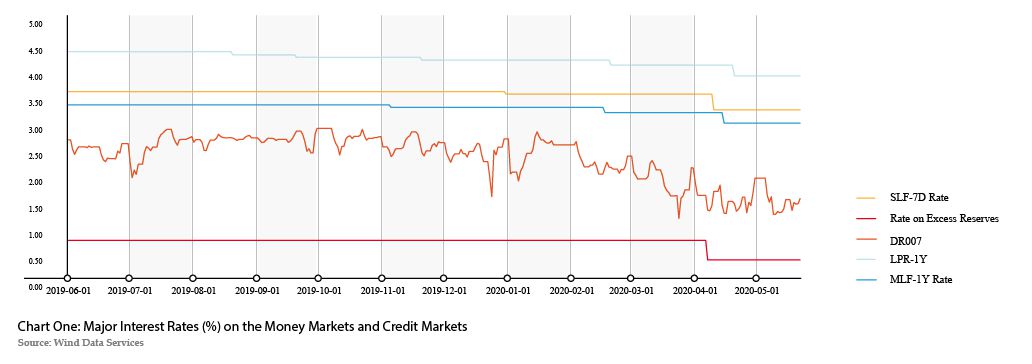

markets and the credit markets,the crucial nexus between the financial markets and the real economy,benefited a great deal from the PBOC's rapid liquidity expansion and reduction in borrowing costs. Chart One plots five major interest rates as recorded between June 1,2019 and May 22,2020. The yellow and red solid lines denote the seven-day interest rates on the Standing Lending Facility (SLF) operations and the PBOC's interest rate paid on banks' excess reserves,which serve as the theoretical ceiling and the floor of the interest rate corridor. It can be seen that the important market-based benchmark interest rate,i.e. DR007,which is regularly affected by the PBOC's short-term open market operations and captured by the line in orange in the chart,is well within the corridor. These three interest rates define the fundamental profile of the interbank market with respect to their roles indicating the sufficiency of short-term market liquidity. In addition,the PBOC also adjusted longer-term market liquidity by means of the Medium-term Lending Facility (MLF) operations. Consequently,the critical interest rates tied to medium and longer term bank lending in the credit markets,the Loan Prime Rate (LPR),are determined by the rate of PBOC-controlled MLF plus some floating rate instruments. For illustrative purposes,Chart One also plots the one-year MLF rates,as denoted by the darker blue line,and the LPR rates of the same duration as captured by a lighter blue line. These two series of interest rates,therefore,demonstrate the liquidity tightness of the credit markets.

<

<