China to Boost Cross-Border Trade and Investment

China's State Administration of Foreign Exchange (SAFE) issued a policy document (SAFE Document No. 8 [2020]) aimed at improving foreign exchange regulation,easing regulatory controls over businesses and streamlining administrative measures. The SAFE Circular on Optimizing Foreign Exchange Administration to Support Foreign-related Business Growth,which was formally announced on April 10,sets out eight measures to attain these goals.

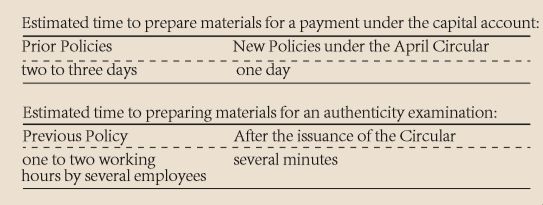

01 Making domestic payments from foreign exchange revenue under the capital account and renminbi funds from related foreign exchange settlements

For companies included in the reform program

There was no need for examination of transaction documents by banks in advance on a case-by-case basis; Formalities could be completed directly with payment instructions.

For companies not included in the reform program

They needed to provide banks with related documents for authenticity and compliance examinations on a case-by-case basis.

Note: Foreign exchange revenue under the capital account mainly includes capital funds,foreign debt and revenue from overseas listings.

Case-by-case examination of transaction documents is no longer required for companies nationwide. This can be handled directly with payment instructions.

Note: Banks should manage risks under the pilot program as they develop their business. Foreign exchange regulators should supervise banks through spot inspections or post-transaction evaluations.

02 Foreign exchange refunds for companies receiving or paying foreign exchange related to the trade in goods when the interval between the refund date and the foreign exchange receipt or payment date is more than 180 days during a calendar year or the foreign exchange cannot be refunded via the original route due to special circumstances:

Companies needed to register with the local foreign exchange authority before undergoing refund procedures with banks.

Companies no longer need to register with authorities for refunds and will be able to obtain a refund directly from a bank if the amount is no more than US$50,000 (NOTE: US$50,000 is permitted)

03 Companies needed to register with their local foreign exchange bureau.

Formalities can be completed at banks.

Which companies are eligible for simplified formalities? Non-financial companies which have been discharged of their responsibilities under a contract related to an overseas loan with a domestic guarantee Non-financial companies whose overseas lending matures and have collected principal and interest on that lending

Note: In cases where principal or interest cannot be paid on time under valid contracts for offshore loans with a domestic guarantee,follow-up procedures should be undertaken at the local SAFE branch.

There are nearly 2,800 valid overseas loans with a domestic guarantee and these involve more than 1,200 non-financial enterprises.Nearly 940 cases of offshore lending were discharged in 2019.

04 In principle,domestic foreign exchange loans related to exports and settled in renminbi needed to be repaid with foreign exchange received as export income. It is generally not permissible to make repayments with purchased foreign exchange.

Note: Domestic foreign exchange loans related to exports usually involve borrowings from banks using the future collection of foreign exchange from exports as collateral. Therefore,banks generally prefer to use foreign exchange receipts from exports as the first source of repayment for the sake of risk management.

For loans made under a guarantee of export documents and other domestic foreign exchange loans that are settled in a foreign exchange settlement account under the current account as required by relevant provisions,companies should,in principle,repay the loans with their own foreign exchange holdings or from foreign exchange receipts from exports on the trade in goods. However,if companies cannot obtain foreign exchange from exports on schedule and have no other foreign exchange on hand to repay domestic foreign exchange loans,the lending bank can handle the formalities of foreign exchange purchases to repay the loan in accordance with prudential business principles. The bank should report such cases to local foreign exchange authorities within five working days from the beginning of each month.

05

05.1 Expanding the use of electronic documents

For a domestic company