RMB Internationalization: Conditions, Strategies and Risk Prevention

The outbreak of the Covid-19 pandemic in 2020 has severely impacted the global economy,and many major developed economies have fallen into recession. China's economic recovery from its initial setback was quick and robust due to the early control of the outbreak,and that contributed to the impressive performance of the renminbi. There is a view that the internationalization of the renminbi has entered a period of historical opportunity,and now is a good time to vigorously promote it. Against this background,some key questions need to be answered: What is the current state of the internationalization of the renminbi? What conditions need to be met for further gains? What are the key points and strategies of renminbi internationalization? How to prevent risks in the process of renminbi internationalization? These are the main issues this paper attempts to discuss.

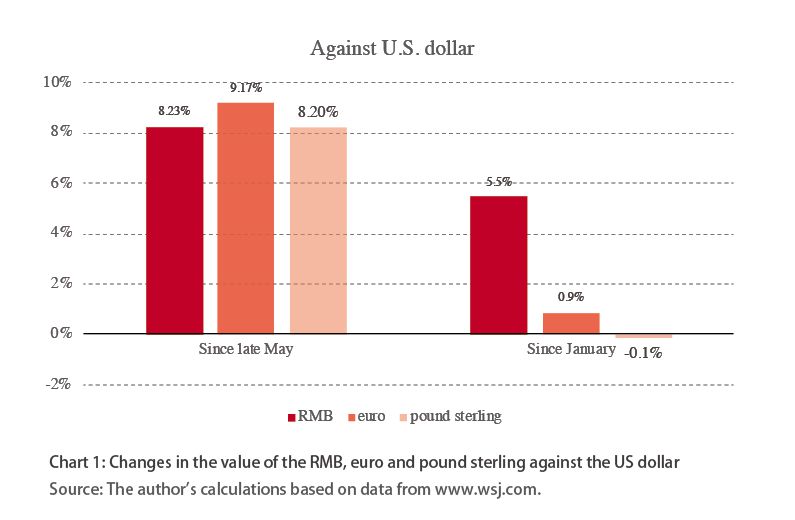

Recently,discussions on the appreciation of the renminbi have been heated. In late May we saw the lowest point of this year's renminbi exchange rate. At that time,1 US dollar was worth 7.17 yuan,but the dollar now fetches only 6.58 yuan. This is incredible: in the very short span of five months,the yuan has appreciated by 8.2% against the US dollar.

But one thing that seems to be overlooked is that it is not just the renminbi that has greatly appreciated against the US dollar. During the same period starting in May,the British pound sterling also rose by 8.2% against the US dollar,while the euro appreciated against the US dollar by as much as 9.2%! (see Chart 1)

People might think that when they are discussing renminbi appreciation,it must the an issue of the renminbi itself. But comparisons such as these have made it very clear that this is not only an issue of the renminbi,but in fact,to a large extent, it is an issue of the dollar.

Moreover,there are other issues at play. If you look at the trend from the beginning of the year,the euro and the pound sterling have been very stable relative to the US dollar: the euro rose by 0.9% and the pound fell by 0.1%,while the renminbi appreciated by 5.5%. (See Chart 1) Therefore,although the US dollar issue has been common since late May,the appreciation of the renminbi was still very prominent throughout the year. The change in the renminbi exchange rate calculated against a basket of currencies also illustrates this point: the renminbi's exchange rate against other currencies in the CFETS and BIS currency baskets both rose 4.4%,and it gained 2.8% against those in the IMF's SDR currency basket.

Therefore,to discuss the issue of renminbi appreciation,it is necessary to take into account both individual and common factors. In my opinion,the main reasons leading to the appreciation of the renminbi are as follows:

First of all,China controlled the epidemic earlier and its economic performance was better than other major economies. As a result,confidence increased.

Secondly,although China's monetary policy is loose,it appears to be very restrained compared to those in major economies such as the United States,the European Union and Japan,with more limited money supply growth and higher interest rates.

Thirdly,due to strong fiscal support in addition to extremely loose monetary policies of major economies such as the United States,incomes have not been reduced for many people. Wealth is generally increasing and consumer demand is strong. However,because of the lack of production caused by the economic shutdown,businesses urgently need to replenish inventory. In response they have increased imports,and China is one of the most important suppliers. For example,in October,China's exports increased by 11.4% in US dollar terms.

It is worth noting that the logic of this export growth of China is quite special and completely different from the past. Once the pandemic is under control and production is back on track in the United States,China's export growth may slow down quite a bit.

In addition,the pace of China's financial opening has been accelerating even amid the pandemic. This has promoted an influx of investment funds under the capital account.

Finally,there is another special reason for the appreciation of the renminbi; that is,the strong monetary and fiscal policy support of major economies has greatly reduced global economic and financial risks. As a result of the decline in demand for hedging,the US dollar is no longer favored. Of course,the depreciation of the US dollar reflects other factors. The extremely loose US monetary policy and fiscal stimulus have widened the trade deficit and led to a huge increase in debt. Additionally,the out-of-control Covid-19 pandemic has hindered the economic recovery.

To a certain extent,the recent rapid appreciation of the renminbi is event-driven. Therefore,if the event ends,the surge will terminate accordingly. At present,the global pandemic is very severe. Although research and development is progressing rapidly,it is still unknown whether vaccines can be deployed in sufficient volumes by the middle of next year. During this period,the monetary easing policies of major economies will continue. The new and more expansive monetary policy framework adopted by the Federal Reserve in September will also have a profound impact on the value of the US dollar.

It is very likely that the strengthening of the renminbi will continue for some time,perhaps until the second or third quarter of 2021. The momentum for the appreciation of the renminbi will probably diminish or even reverse its direction at that point.

Currently,the increase in demand for Chinese goods is not very closely related to the competitiveness of the renminbi. The currency's appreciation will improve the terms of trade,so it is unnecessary to worry about a stronger renminbi for the time being. But maintaining the renminbi at its current level appears to be the most favorable scenario.

The more important consideration is how to proceed with the next step. If the currency appreciates excessively in the future,how much could it affect export companies? Although foreign countries need Chinese goods now,will they be unhappy seeing trade deficits jump dramatically after the pandemic is over? This factor should not be ignored when the new US administration is reconsidering its trade policies. In addition,when the currency value is high,is it also a good time to increase imports of important commodities? This may lead to a win-win result: on the one hand,you can buy much-needed commodities while benefiting from a better price,and on the other hand,you can achieve more balanced trade with key trading partners. That could be a good starting point for future trade negotiations.

Regarding China's monetary policy,some observers contend it is time to think about stepping back from easing in an orderly manner. However,when the momentum for appreciation of the renminbi has not diminished,I am afraid we need to be more cautious when assessing this issue.

There is also a view that,given that the renminbi has reversed its previous decline and has been sought after by international capital again,it is now a good time to promote the currency's internationalization. It is of course reasonable to take some targeted measures to adapt to the changes in the global environment. But at the same time,we must clearly recognize that the internationalization of the renminbi cannot be accomplished overnight. Summarizing historical experience and comparing reality,it is undoubtedly a fairly long-term process,and it will take 20 years or even more to reach a higher level. Therefore,strategies are very important. Haste should be avoided and good judgment should not be abandoned.

RMB Internationalization ¨C Too Much Optimism?

Roughly speaking,the process of renminbi internationalization only began after 2008. It quickly attracted great attention and controversy. Some people thought that it would not succeed,while others were perhaps overoptimistic. For example,in 2011 Barry Eichengreen,a renowned economist at the University of California,Berkeley,suggested that the US dollar,euro,and renminbi would probably share the world stage in the international monetary system sooner than people thought. Arvind Subramanian (2011) even predicted that the renminbi might overtake the dollar around 2022.

Unfortunately,the actual situation is not so optimistic. From some major indicators,including the share of foreign exchange reserves held by various central banks,the proportion of renminbi in global payments and renminbi transaction volume,it is obvious that the renminbi is still far from being a truly international currency.

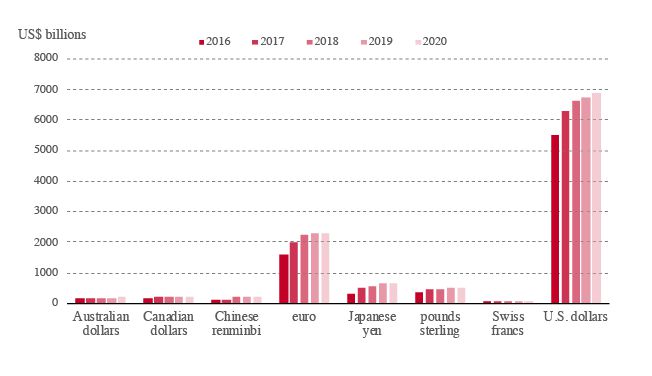

First look at the renminbi's proportion of global foreign exchange reserves. As of the second quarter of 2020,the world's total foreign exchange reserves totaled US$12 trillion. Among them,the US dollar ranked first with US$6.9 trillion,accounting for 57.5%,while the euro accounted for US$2.28 trillion,ranking second with a 19% share. The Japanese yen,the British pound and the renminbi ranked third,fourth,and fifth,respectively,with shares of US$648 billion or 5.4% of the total,US$502 billion or 4.2%,and US$230 billion or 1.9%. Since the renminbi joined the International Monetary Fund's Special Drawing Rights (SDR) in 2016,it improved significantly in 2017 and 2018,but then stagnated in the following years. Although it still ranks in the top five,its share remains very small. (See Chart 2)

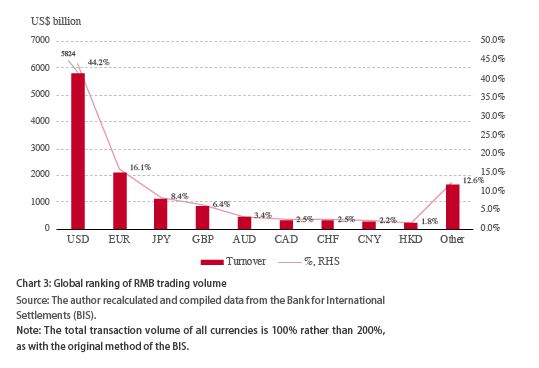

Second,look at the proportion of renminbi transaction volume. According to data from the Bank for International Settlements (BIS),in April 2019,the global average daily transaction volume of various currencies was US$13.2 trillion,of which the US dollar ranked first with US$5.8 trillion,accounting for 44%. The euro,yen and the British pound ranked second,third,and fourth,accounting for 16.1%,8.4%,and 6.4%,respectively. Renminbi trading volume was US$285 billion,accounting for only 2.2%,which is only slightly higher than the ninth-ranked Hong Kong dollar. (See Chart 3)

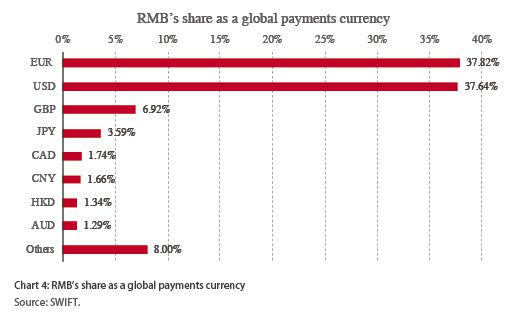

Let's look at the renminbi's share of payments. According to SWIFT data,in October 2020,renminbi payments fell by 17.6% from September of the previous year,accounting for 1.66% of the total. The renminbi's ranking also dropped from fifth to sixth. The top three were the euro,the US dollar and the British pound,accounting for 37.8%,37.6% and 6.9% respectively. The Japanese yen ranked fourth,accounting for 3.6%. Payments in various currencies fell by 2.33% over the same period,but China's decline far exceeded this average. (See Chart 4)

Therefore,according to the above-mentioned main indicators as a whole,the renminbi not only accounts for a low proportion,but has even stagnated in recent years. It is far from being regarded as a truly international currency.

Why is the RMB Still So Far from Its Goal?

It is generally believed that there are three conditions for the internationalization of a country's currency: First,is the size of the economy,mainly the scale of the GDP but also the amount of trade. Second,the holder must have confidence in the currency's value. This is af