China's Outward Direct Investment Likely to Rise Steadily

In 2020,the COVID-19 pandemic brought a sharp drop in global cross-border direct investments. Despite this,the overall scale of China’s outward direct investment (ODI) remained relatively stable,except for some decline in the outward investment in manufacturing. It is expected that China’s ODI scale in 2021 will be basically flat or see a slight increase,and in particular,the investment in countries and regions along the “Belt and Road” will show a steady growing trend.

2020: China stayed robust in the global recession

The outbreak and widespread of COVID-19 in 2020 caused a dramatic fall in the scale of global cross-border investment. According to the Global Investment Trend Monitor report released by the United Nations Conference on Trade and Development (UNCTAD) on January 24,2021,as a result of the pandemic,the global foreign direct investment collapsed in 2020,falling by 42% to an estimated US$859 billion,from US$1.5 trillion in 2019. This was even 30% lower than the trough after the global financial crisis in 2009.

Compared with the global economic situation,China’s ODI was relatively stable. According to the statistics released from the Ministry of Commerce,in 2020,China’s overall ODI was US$132.94 billion (equivalent to 916.97 billion yuan),a year-on-year increase of 3.3%; and the non-financial ODI was US$110.15 billion (equivalent to 759.77 billion yuan),a year-on-year decrease of 0.4%. Specifically,the ODI in manufacturing in the first 11 months of 2020 reached US$15.76 billion,accounting for 16.6% of the total non-financial foreign direct investment. Based on this,it is estimated that the ODI in manufacturing arrived at US$17.20 billion for the whole year,a decrease of 15.1% from 2019. Although it was a significant decline,China’s ODI in manufacturing was still robust compared with the sharply falling global direct investment.

In terms of cross-border mergers and acquisitions (M&A),affected by factors such as COVID-19,economic recession and intensified geopolitical competition,enterprises became lessable and willing to invest abroad,and the market was in a strong wait-and-see sentiment. While under the impacts of COVID-19,trade frictions and technological competition,countries including Japan,the European Union,Russia and India further tightened their controls on the entry of foreign capital,slowing down the overseas M&A activities by Chinese enterprises significantly. According to Dealogic data,in 2020,China completed 260 foreign cross-border M&A investments,with the actual completed transaction amount being US$34 billion,which was about 17.4% lower than US$41.16 billion in 2019,showing a downward trend.

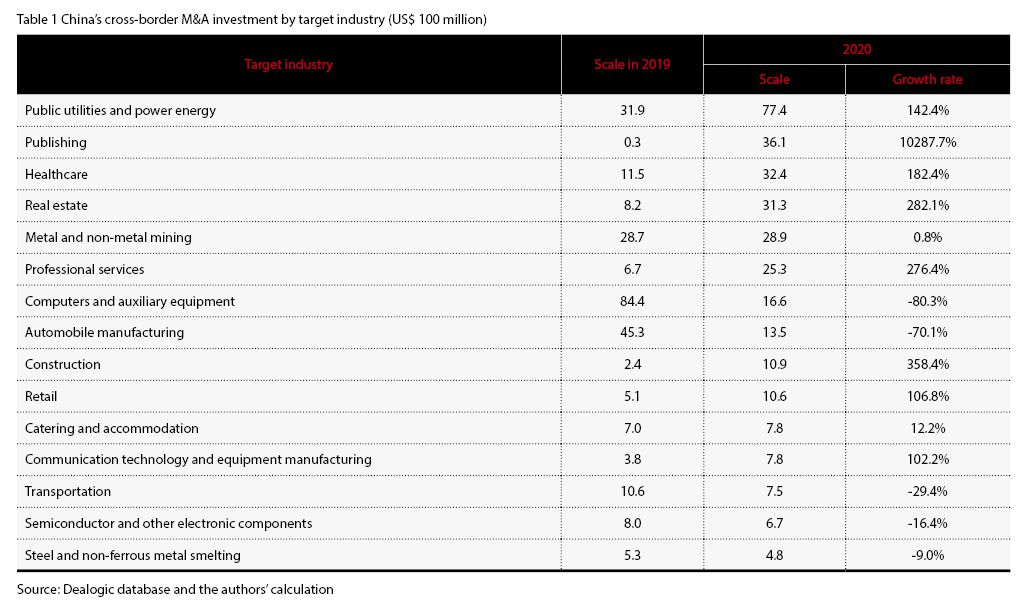

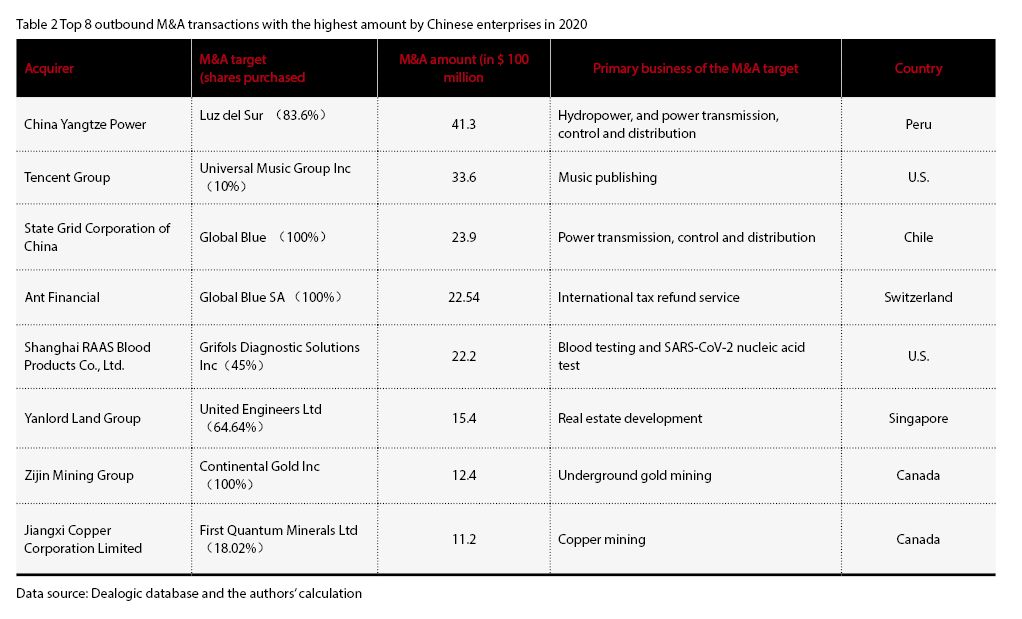

From the perspective of the target industries for M&A,the investment in computers and auxiliary equipment and automobile manufacturing in the manufacturing industry declined significantly,while that in construction,communication technology and equipment manufacturing saw a big increase. In addition,the investment in service industries like publishing,real estate,professional services grew rapidly. In particular,the purchase of Universal Music Group’s shares by Tencent Holdings at US$3.36 billion was the main contributor to the surge in investment in the publishing industry. The investment in public utilities and power energy reached US$7.74 billion,an increase of 142.4%,reflecting China’s growing demand for cross-border M&A in clean energy and the fact that its energy consumption structure is being further transformed from traditional fossil energy to clean energy. The COVID-19 pandemic also stimulated China’s M&A demand in the healthcare industry - the scale of mergers and acquisitions rose to US$3.3 billion,an increase of 72% on a year-on-year basis. In particular,Shanghai RAAS Blood Products Co.,Ltd. acquired a subsidiary of Grifols Group engaged in blood testing for US$2.22 billion,which was the largest outbound M&A transaction in the Chinese healthcare industry in 2020 (see Table 1 and Table 2).

From the perspective of destinations,China’s M&A investment in developing countries in 2020 was US$10.28 billion,a year-on-year increase of 3.1%; and that in developed countries fell from US$29.87 billion to US$22.56 billion,a year-on-year decrease of 24.5% (See Table 3). Affected by the pandemic,the European Union further tightened the controls over foreign direct investment,forcing China’s M&A investment in Europe to drop by 50.4%,from US$18.74 billion to US$9.30 billion,which became an important reason for the decline in China’s total cross-border M&A investment.

2021: the overall scale will stabilize or slightly increase

In 2021,the downward risks in economy caused by COVID-19 will still exist. There has been a lack of engines for global economic recovery,leading to a worrying international investment environment. The Global Economic Outlook Report released by the World Bank in January 2021 pointed out that the economic downside risks caused by the pandemic would exist for a long time,and that the economic growth rate in 2021 will still be much lower than that projected before the outbreak of COVID-19. According to the World Investment Report 2020 published by UNCTAD,the global flows of foreign direct investment in 2021 will likely decrease further by 5%-10%. Due to the slowdown in global economic growth and the adverse impacts of the international investment e