Implications of the Dollar Dominance Paradigm

After the U.S. dollar supplanted the British pound sterling in 1945,it gradually established its core position in the international financial system. Because it was so entrenched in the whole system,even the collapse of the Bretton Woods system in 1973,the challenge of the Deutsche mark and the Japanese yen in the 1980s,and the threat of the euro after 1999 have not shaken its status.

The 2008 U.S. Financial Crisis once caused a lot of worries that the status of the U.S. dollar was about to decline,and the successor was most likely to be the euro or the yuan. Unexpectedly,the European debt crisis a few years later threatened the survival of the euro,so confidence in the dollar regained. Nowadays,many people believe that the dollar will be in a hegemonic position for a long time and it is difficult to be replaced. Of course,there are voices of doubt. But no matter what,judging from various indicators,the current leading role of the dollar in the international financial system is even no less inferior than it was when the Bretton Woods system was established after World War II.

In addition to the financial system,the dominance of the dollar is also reflected in international trade. A large part of global trade is invoiced in dollars,which is nothing new. However,the empirical research carried out in this field in recent years has pushed this to an unprecedented new stage. On one hand,there are a large number of new and important data discoveries. On the other hand,the conclusions drawn from the in-depth analysis based on this are challenging the existing economic theories and policies,which deserve great attention.

The above-mentioned research shows that for countries other than the United States,the depreciation of the domestic currency is not expansionary,and appreciation is not contractionary; for the United States,

exchange rate fluctuations don’t affect inflation,but for other

economies,the opposite is true – this is diametrically opposed

to the Mundell-Fleming paradigm,the current mainstream consensus. The new theory based on this research is called the dominant currency paradigm – because the U.S. dollar is

the dominant currency right now,so I use dollar dominance paradigm interchangeably – and is the frontier of international

economics. For China,it also has strong policy implications.

The dollar dominance in international financial system

The dollar dominance is just at a peak at the moment,even after World War II and all of Europe was destroyed,it’s hard to say that the dollar was actually as dominant as it is today.

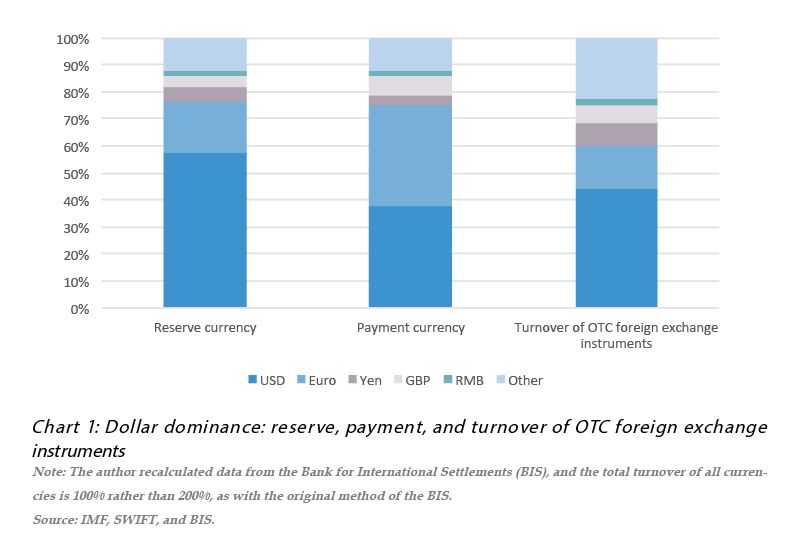

In terms of the share of the U.S. dollar in global foreign exchange reserves,as of the second quarter of 2020,the dollar ranked first with US$6.9 trillion,accounting for 57.5%,while the second-ranked euro was only 19 %. In addition,data from the Bank for International Settlements (BIS) shows that in April 2019,the global average daily transaction volume of various currencies was US$13.2 trillion,of which the U.S. dollar ranked first with US$5.8 trillion,accounting for 44%,far exceeding the 16.1% of the second euro. According to SWIFT data (October 2020),as a payment currency,the U.S. dollar accounts for 37.6% of the world's total,keeping pace with the euro and far ahead of other currencies (See Chart 1).

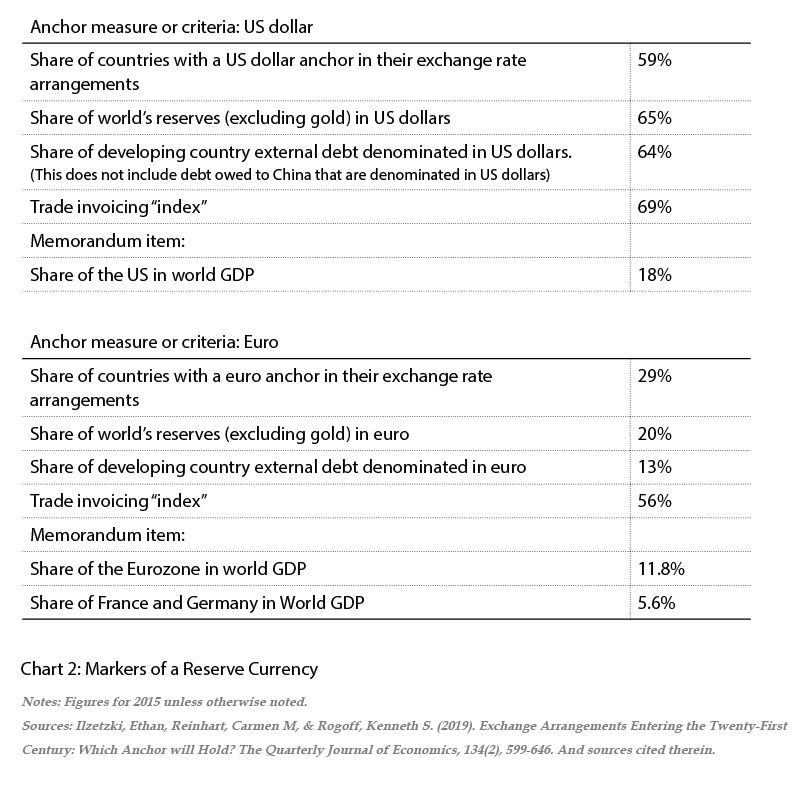

Another key indicator is the U.S. dollar as the reference currency,or currency anchor. In 1990,42% of the countries/regions in the world used the U.S. dollar as their currency anchor,which increased to 57% in 2016. In terms of economic size,the U.S. dollar-anchored countries/regions accounted for 45% of the global GDP in 1990,but now it has soared to 70% (See Chart 2).

Dominance of dollar invoicing in world trade

In addition to the financial system,another area that reflects the dominance of the U.S. dollar is international trade. A large part of global trade is invoiced in dollars,which is nothing new. However,the empirical research carried out in this field in recent years has advanced this to an unprecedented new stage: not only new important data discoveries,but also conclusions drawn from in-depth analysis based on this are challenging the existing mainstream economic theory and policies.

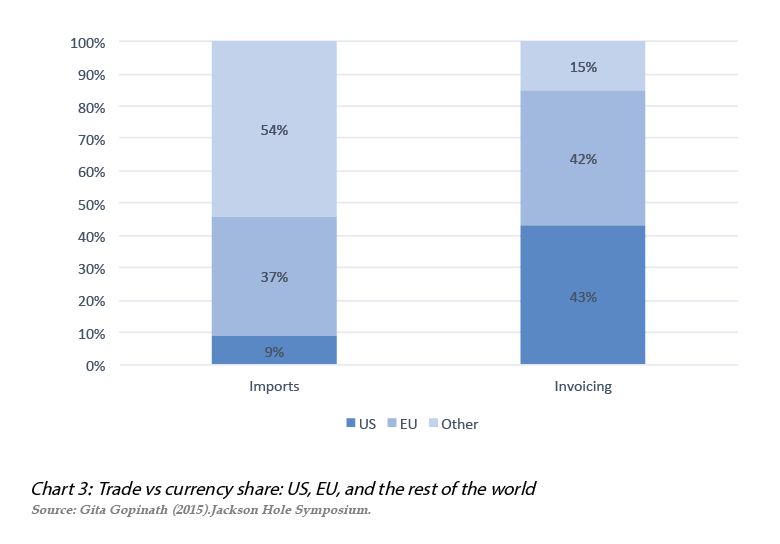

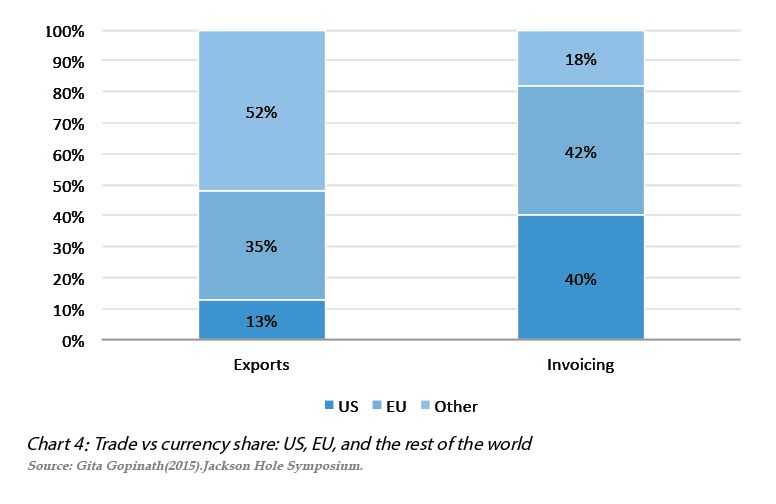

IMF chief economist and Harvard University professor Gita Gopinath (2015) analyzed 43 countries’ imports (55% of global imports) and 44 countries’ exports (57% of global exports). Among all the imports,the part invoiced in dollars is 4.7 times the value of U.S. imports,and among all exports,those invoiced in dollars is equivalent to 3.1 times the U.S. export value. This shows that global trade invoicing is dominated by the dollar,and a large number of them which have nothing to do with the U.S. are also invoiced in dollars. In contrast,the share of trade invoiced in euros is equivalent to the share of the trade of the European Union,and the former is 1.2 times the latter,and most of them are trade between countries in the European Union. For most other countries,their imports and exports are rarely invoiced in their own currencies (See Chart 3 and Chart 4).

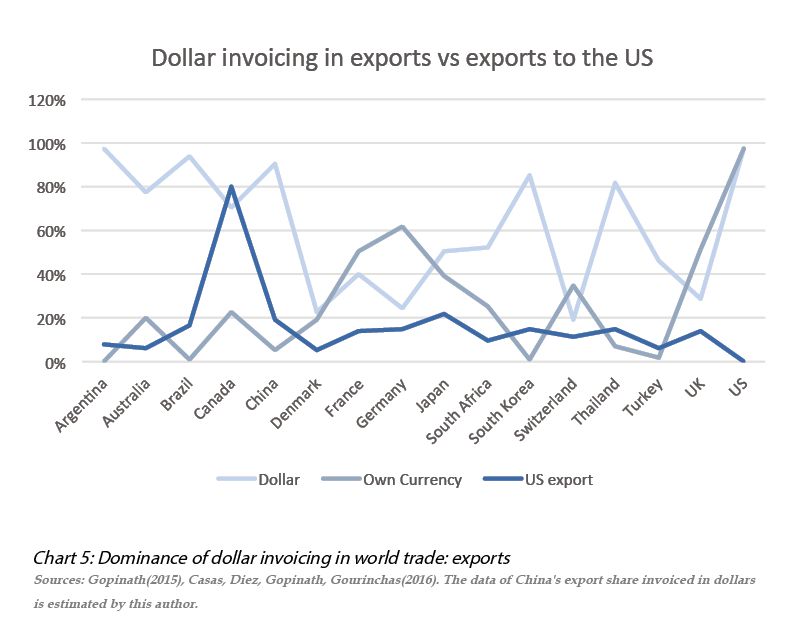

Although the proportion of trade invoiced in dollars varies among the economies of the world,the overall proportion is very high. Specifically,97% of Argentina's exports are invoiced in dollars,but its exports to the United States only account for 8% of its total exports; 77% of Australia's exports are invoiced in U.S. dollars,and its exports to the United States account for only 6%; 82% of Thailand exports are invoiced in dollars,and its exports to the United States account for only 15%. Of course,there are some advanced economies that have a smaller share of their exports invoiced in dollars,but they still don’t match their share of exports to the U.S.: 50% of Japan’sexports are invoiced in dollars,and its exports to the U.S. account for 22% of all of its exports; 40% of France’s exports are invoiced in dollars,and its exports to the United States account for only 14% (See Chart 5).

Challenging the mainstream consensus: the dollar dominance paradigm

In addition to providing new evidence that the international trade invoicing is dominated by U.S. dollars,the above research also conducted a thorough and detailed empirical analysis based on the data on the pass-through of exchange rate fluctuations to inflation and impact of exchange rate changes on trade. These two issues are the core of the international economic theory and policy. The results of this empirical study are completely different from the current mainstream understanding,and are directly challenging the famous Friedman-Mundell-Fleming paradigm.

1. The Friedman-Mundell-Fleming paradigm

In the area of international economics,there is a famous Friedman-Mundell-Fleming consensus which has long been the foundation for analyzing issues about exchange rate,inflation pass-through and balance of payments. (Friedman,1953; Fleming,1962; Mundell,1963) This theory assumes that a country’s exports are invoiced in its own currency,which is the so-called producer currency pricing(PCP),but the PCP is sticky and not subject to change easily. In this case,the way of making exports more competitive is to depreciate its own currency. So the exchange rate depreciation is expansionary,while appreciation is contractionary. Further,the exchange rate changes can be fully reflected in export prices,that is,if the bilateral exchange rate depreciates by 1%,the impact on the terms of trade is also 1%. At the same time,the theory believes that the impact is symmetrical,that is,different countries follow the same logic. This consensus is also the theoretical basis of currency wars: through exchange rate manipulation,exports can be stimulated to achieve the goal of beggar-thy-neighbors.

In addition,the theory also believes that although the depreciation of the domestic

currency can make exports more competitive,it also makes imported goods more expensive in terms of its own currency,thereby importing inflation. The depreciation of the exchange rate will be 100% pass-through to domestic prices. If the currency appreciates,the effect will be the completely opposite.

2. Challenging the Friedman-Mundell-Fleming paradigm

As mentioned above,the Friedman-Mundell-Fleming paradigm has an important hypothesis which assumes that all international trade are invoiced in their own currencies: U.S. exports are invoiced in U.S. dollars,Japanese exports are invoiced in yen,Chinese exports are invoiced in yuan,and so on.

However,a large amount of evidence shows that not only is international trade mainly invoiced in U.S. dollars,but the U.S. dollar invoiced prices are not sensitive to exchange rate changes and are extremely sticky. As a result,for countries other than the United States,the depreciation of the domestic currency is not expansionary,and appreciation is not contractionary; for the United States,exchange rate fluctuations don’t affect inflation,but for other economies,the opposite is true – this is diametrically opposed to the Mundell-Fleming paradigm. The new theory based on this research is called the dominant currency paradigm and is the frontier of international economics.(Gopinath,Gita,Emine Boz,Camila Casas,Federico J. Díez,Pierre-Olivier Gourinchas,and M