The Intractable Post-Pandemic Inflation Puzzle

Burgeoning demand effect,cost-driven scenario and supply chain bottlenecks are the main factors leading to higher-than-expected U.S. price increases. The Fed’s efforts to re-inflate,coupled with the strong fiscal stimulus,make the inflation outlook unpredictable. This will inevitably have spillover effects on other economies including China.

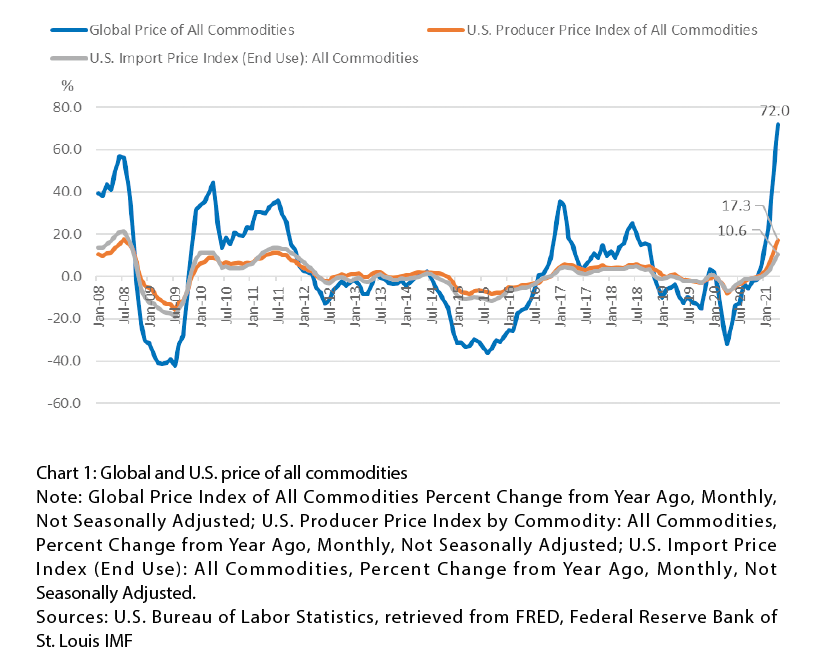

Affected by multiple factors such as extremely loose monetary and fiscal policies,brighter economic reopening prospects,and supply chain bottlenecks,there has been a surge in inflation around the world in recent months. In April,the Global Commodity Price Index rose 72% from a year ago,much higher than January’s 14.9%; U.S. PPI and CPI rose 6.2% and 4.2% respectively,the highest level since 2008,while core CPI rose 3% and set a new high since 1996; in China,although the CPI only rose 0.9%,the PPI rose to 6.8%. (see Chart 1) With the gradual economic reopening of various countries but the uneven control of the pandemic,especially the global supply chain severely impacted,where the inflation will be trending up,and how the extremely loose monetary and fiscal policies will be adjusted accordingly have become the focus of attention.

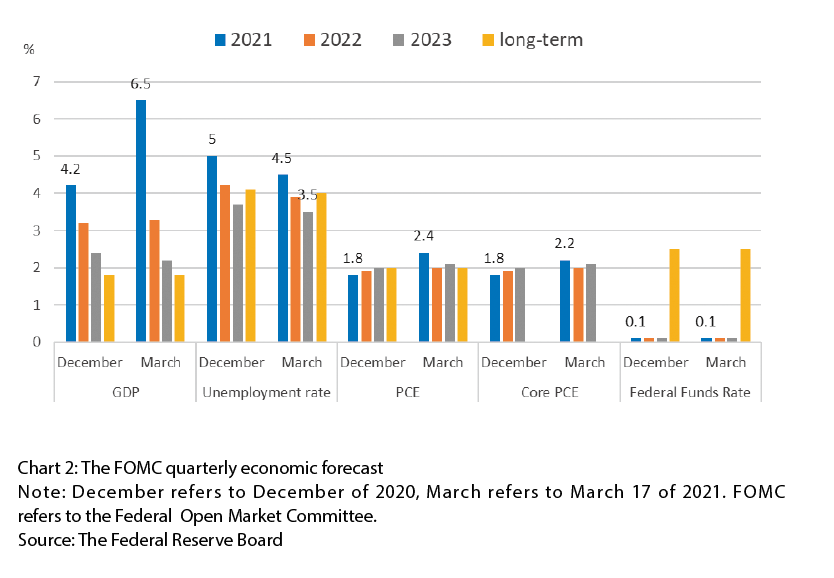

The situation in the United States is very representative. With the smooth progress of the vaccination,the Covid-19 pandemic has gradually been brought under control,and the economy has quickly reopened because of this. Although there are still concerns caused by the mutation of the virus,optimistic sentiments and expectations have risen to a high point over the past year. The latest quarterly economic forecast released by the Federal Reserve – or the Fed,the U.S. central bank - on March 17 shows that the U.S. GDP growth rate may reach 6.5% in 2021,which will be the highest level since 7.9% in 1983,while the unemployment rate and inflation will be 4.5% and 2.4% respectively. Compared with the forecast made in December by the Fed last year,the above-mentioned data are all significantly improved. (See Chart 2)

In terms of inflation,most economists seem to agree with the Fed’s forecast. According to a survey conducted by the Wall Street Journal with more than 60 economists in early April,this year's CPI in the United States will reach a high of about 3% in June,and then gradually fall back to 2.6% in December. Bloomberg surveyed 71 economists at roughly the same time,and the results were similar to those of the Wall Street Journal,that is,the CPI peak will appear in June at 3.1%,and then drop to 2.6% in December.

So what is the actual situation? On May 12,the monthly data released by the U.S. Bureau of Labor Statistics (BLS) showed that the CPI rose 4.2% from a year ago in April. (See Chart 3) Although people's optimism about economic recovery is high,the data still far exceeds expectations,shocking all parties. The economists who took the questionnaire probably need to go home to reflect on their economic models again.

After the release of the data,the stock market plummeted and bond yields rose on the same day. The debate among policymakers and economists on the outlook for inflation and its controllability has become more intense.

The debate on inflation: will the economy overheat?

As early as the beginning of this year,the debate on whether the economy will overheat and whether inflation can be controlled has been sparked,at a time when fiscal relief efforts are still increasing even under the conditions of extremely loose monetary policy. The US$1.9 trillion American Rescue Plan Act passed in March even pushed this controversy to a climax.

The scale of this round of fiscal package is so controversial that not only Republican lawmakers collectively resisted it,but some economists who usually stand with the Democratic Party also strongly opposed it,among them is Harvard University professor of economics,Larry Summers. He believes that the scale of the fiscal relief program is too large,which may cause the economy to overheat and trigger inflation. Some other economists disagree,for example,Nobel Laureate in economics Paul Krugman concludes that this round of fiscal easing will not trigger inflation,because people will not rush to consume after getting money,but will save and spend it slowly.

Burgeoning demand effect

I wonder if Krugman is still so confident after seeing the April CPI data. Rather,the seasonally adjusted annual personal disposable income in March was US$22 trillion,an increase of US$5.4 trillion from a year ago,rose 32.3%. With the gradual reopening of the economy,personal spending has also risen sharply,increasing by 10% on a year-on-year basis in March,achieving positive growth for the first time over the past year. At the same time,the personal savings rate in March was still as high as 27.6%,indicating that consumption potential was strong. (See Chart 4) Therefore,the acceleration of the CPI rise in April,and probably for the next several months as we