Sovereign Wealth Funds Scrambling for the High Ground in Green Investment

The large-scale sovereign wealth funds (SWFs) are important mid- and long-term investors in the international financial market. In recent years,with the increasing impacts of environmental and climatic factors on the financial market and the acceleration of the low-carbon and green transformation of the global economy,the SWFs of various countries have been actively exploring and implementing the idea of green investment,and in this process,their experience and practices are truly worth learning. Green finance is an important measure to promote carbon emission reduction. Therefore,the investment institutions in China should give full play to the leading role of funds and accelerate their greening so as to help China achieve the goal of “carbon emission peak by 2030 and carbon neutrality by 2060”.

SWFs’ Risks and Returns of Green Investment

Environmental and climatic factors have profound impacts on the stability of the financial market and the judgments on investment risks. Mark Carney,Former Governor of Bank of England,once summarized the systemic impacts of environmental and climate factors on economic and financial activities into three major risks. The first is physical risks. Amid extreme natural disasters such as droughts and floods and long-term chronic evolutions such as global warming and sea level rise,no player in the real economy and global supply chains can truly manage alone . The second is debt risks. Risks related to climate change have not been fully and quantitatively reflected in the pricing and rights and obligations of financial products,so the losses rising from such risks will be off-budget,which will damage the financial stability of creditors and debtors. The third is the transformation risks. The economic transition towards low carbon and environmental protection now has been a broad consensus all over the world. Factors such as policy environment and technological changes will have substantial impacts on the commodity pricing and the valuation of financial products. Facing the above uncertainties,the SWFs featured by large scale,wide range of investments and long investment maturities have to be more prepared in advance and proactively carry out environmental risk assessment and management to avoid long-term losses.

The transition towards a low-carbon and green economy has brought huge investment opportunities. The United Nations Framework Convention on Climate Change (UNFCCC) forecasts that during the global low-carbon transition from 2016 to 2050,the financing gap will be about US$1.6-3.8 trillion per year; and according to the forecast of the International Finance Corporation (IFC),a subsidiary of the World Bank,from 2016 to 2030,the potential size of climate-smart investments in emerging markets will be about approximately US$23 trillion,of which the size in China will be approximately US$15 trillion. Climate change and the low-carbon transition of the economy will lead to another reshuffle across and within industries: the new leading companies will stand out,and outdated production facilities will be closed down. In order to obtain the potential long-term returns brought about by the economic transformation,many investment institutions,including SWFs,have incorporated environmental and climate factors into their asset allocation and investment decisions. According to the data of Bloomberg New Energy Finance,the scale of global energy transition investment in 2020 exceeded US$500 billion for the first time,an increase of 9% from 2019. Having the long-term mission and strategic goals of enhancing national competitiveness and improving national well-being,SWFs have been playing an important role in the process of economic transformation. The strategic positioning of SWFs as medium- and long-term investors matches the long-term planning for low-carbon economic transformation,and the nature of medium- and long-term funds matches the long-term risk returns generally associated with green investment projects,which will help SWFs gain unique competitive advantages over other investors..

¡°Overall Plan¡± and Typical Practices of SWFs in the Green Transformation

Jointly establishing the “One Planet —— Sovereign Wealth Funds Framework”

At the joint initiative of France,the UN and the World Bank ,“One Planet Summit” was convened in 2017. In order to have SWFs expand their low-carbon green investment and resist the risks of climate change,on the basis of related initiatives,six sovereign investment institutions,including Abu Dhabi Investment Authority,New Zealand Super Fund and Government Pension Fund Norway,jointly established the “One Planet Sovereign Wealth Fund Working Group”,and published the “One Planet —— Sovereign Wealth Funds Framework” (hereinafter referred to as the “Framework”) in 2018. The Framework mainly includes three major principles and 14 detailed rules (see Table 1). First,Alignment. It is emphasized that the investment features of SWFs should be aligned with the long-term elements of climate change,and the climate change elements should be built into the overall decision-making framework of investment. Second, Ownership. It is emphasized that SWFs should be active investors,and encourage invested companies to consider climate issues in their governance,business strategy and planning,risk management and public reporting to promote value creation. In particular,the adequate environmental information disclosure at the corporate level is the basis for risk pricing in the financial market,and SWFs are required to encourage companies to disclose environmental information in accordance with standard systems such as the Greenhouse Gas Protocol and climate-related financial information disclosure recommendations. Third, Integration. It is emphasized that SWFs should integrate the consideration of climate change-related risks and opportunities into investment management to improve long-term investment portfolios. The Framework is self-disciplined,aiming to accelerate the integration of climate change analysis into the management of large,long-term and diversified asset pools. So far,15 sovereign investment institutions have voluntarily joined the Framework and followed the proposed principles.

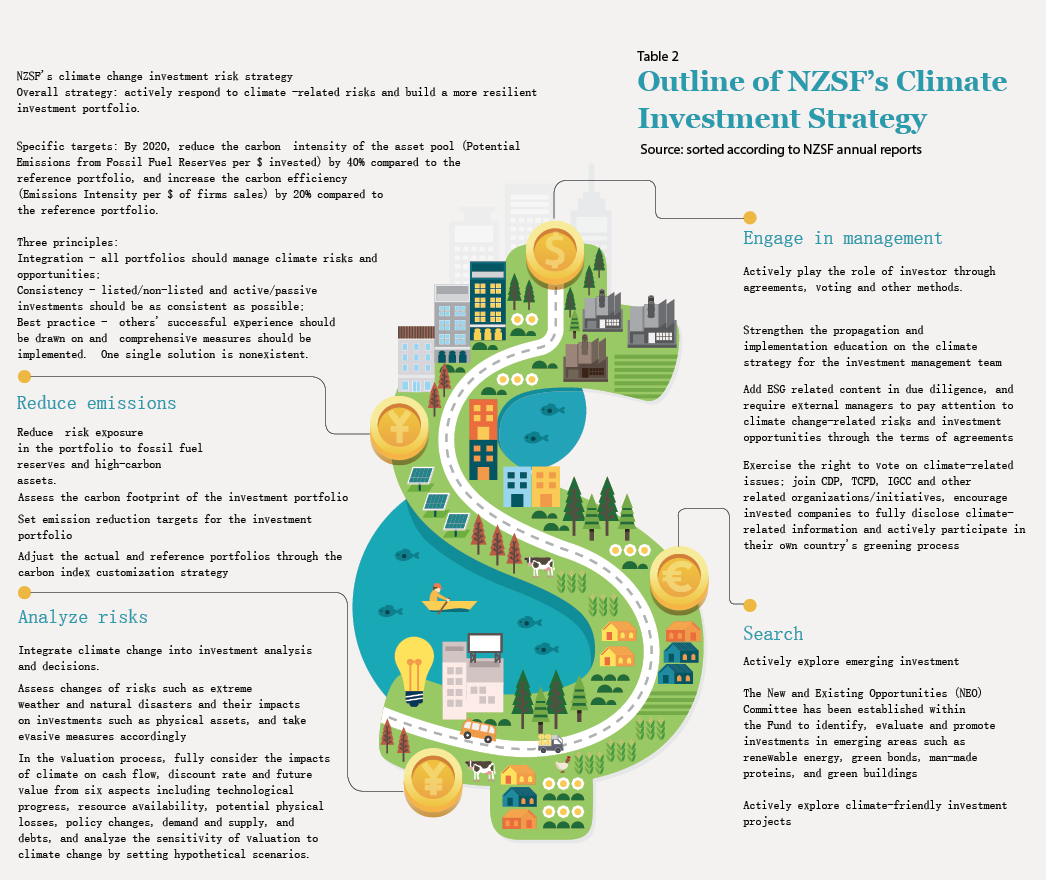

Strengthening climate risk management and customizing carbon emission reduction indexes

For a long time,SWFs of various countries represented by the New Zealand Super Fund (NZSF) have been actively exploring and implementing the idea of green investment,during which,relevant experience and practices gained are worth learning. NZSF believes that in the long run,the carbon transition risks are currently under-priced in the financial market. Based on this basic judgment,NZSF comprehensively assessed its existing investment portfolio,formulated a climate change investment strategy and specific emission reduction targets,and established a green investment practice system with four work dimensions “Reduce emissions,Analyze risks,Engage in management and Search for opportunities” (See Table 2).

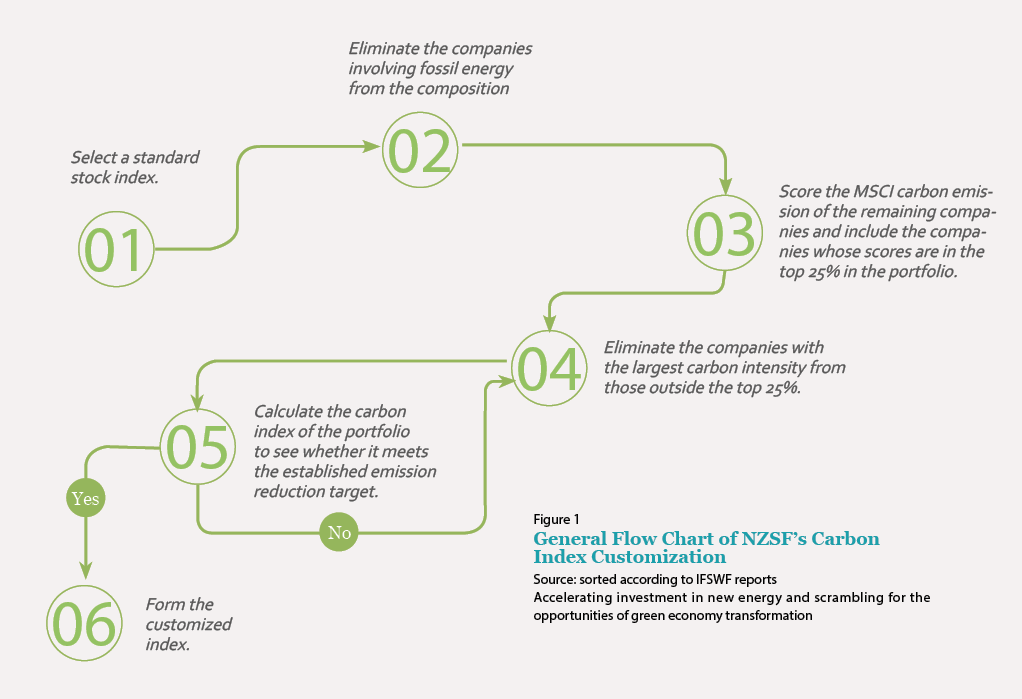

Since 2015,NZSF has compiled the Carbon Footprint report every year,which statistically discloses the carbon emissions of the investment portfolio and is assured by the external auditors. Since 2017,for the stock replicable portfolio,NZSF has eliminated as many as 427 individual stocks by customizing the strategy benchmark index of carbon emission reduction (see Figure 1),leading to a significant drop in the share of high-carbon industries like energy,utilities and raw materials in the portfolio. In addition,NZSF has also incorporated climate factors into its due diligence and achieved “emission reduction” of its investment portfolio in an all-round way by key investment decision-making processes such as the selection of external managers,adding climate-related clauses into the investment agreements,and fully considering the implications of climate change on the long-term stability of cash flow in the valuation. It has also taken the carbon emissions generated per unit of investment and required per unit of sales as the quantitative indexes to measure the carbon intensity and carbon efficiency of the portfolio. As of the end of June 2020,the carbon intensity of NZSF’s asset pool has been reduced by 90% and its carbon efficiency increased by 40% compared with the reference portfolio,significantly exceeding the established targets.

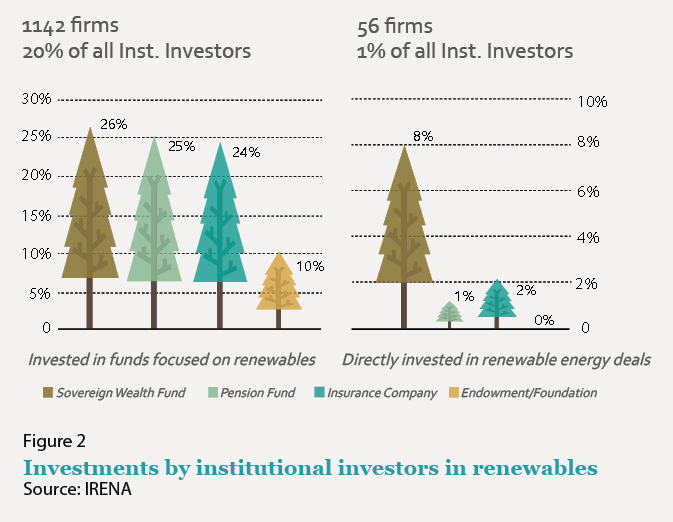

According to a research report by the International Renewable Energy Agency (IRENA),26% of the global sovereign wealth funds have participated in renewable energy investment in the form of funds and 8% through direct investment,significantly higher than the percentages of global institutional investors (which are 20% and 1%,respectively,see Figure 2),making SWFs the main institutional investors in renewable energy. From 2015 to 2020,the average investment made by SWFs in renewable energy fields such as solar and wind energy was approximately US$1.7 billion per year,and in particular,the investment in 2019 was nearly US$3 billion.

In recent years,SWFs of various countries have invested in renewable energy forcefully. In April 2019,the Ministry of Finance of Norway authorized the Government Pension Fund of Norway to make non-public investment in renewable energy,and raised the upper limit of its environmental-related investment from 60 billion Norwegian kroner to 120 billion Norwegian kroner; in 2020,the NZSF and the Commonwealth Superannuation Corporation of Australian government established the “Galileo Green Energy” investment platform jointly with industrial investors to expand the investment in pan-European renewable energy projects; from 2018 to 2020,the Public Investment Fund of Saudi Arabia increased its shareholding in the new energy power company ACWA from 15% to 50%,who develops and operates new energy power generation projects with a total capacity of nearly 30 GW in 12 countries around the world; COFIDES joined the renewAfrica initiative launched by RES4Africa Foundation in 2019,and invested in renewable energy projects with a capacity of more than 832 MW in just one year,exceeding its total investment in the past 7 years. In addition,SWFs like the Public Investment Fund in Saudi Arabia,Temasek in Singapore and Qatar Investment Authority are also found in the list of investors in the new energy vehicle “star” companies such as Tesla,NIO and Xpeng.

The author is from Performance Evaluation Team,Operations Department,Investment Center,State Administration of Foreign Exchange