International Experience of Achieving Carbon Peak and Carbon Neutrality...

Title: International Experience of Achieving Carbon Peak and Carbon Neutrality with Financial Support

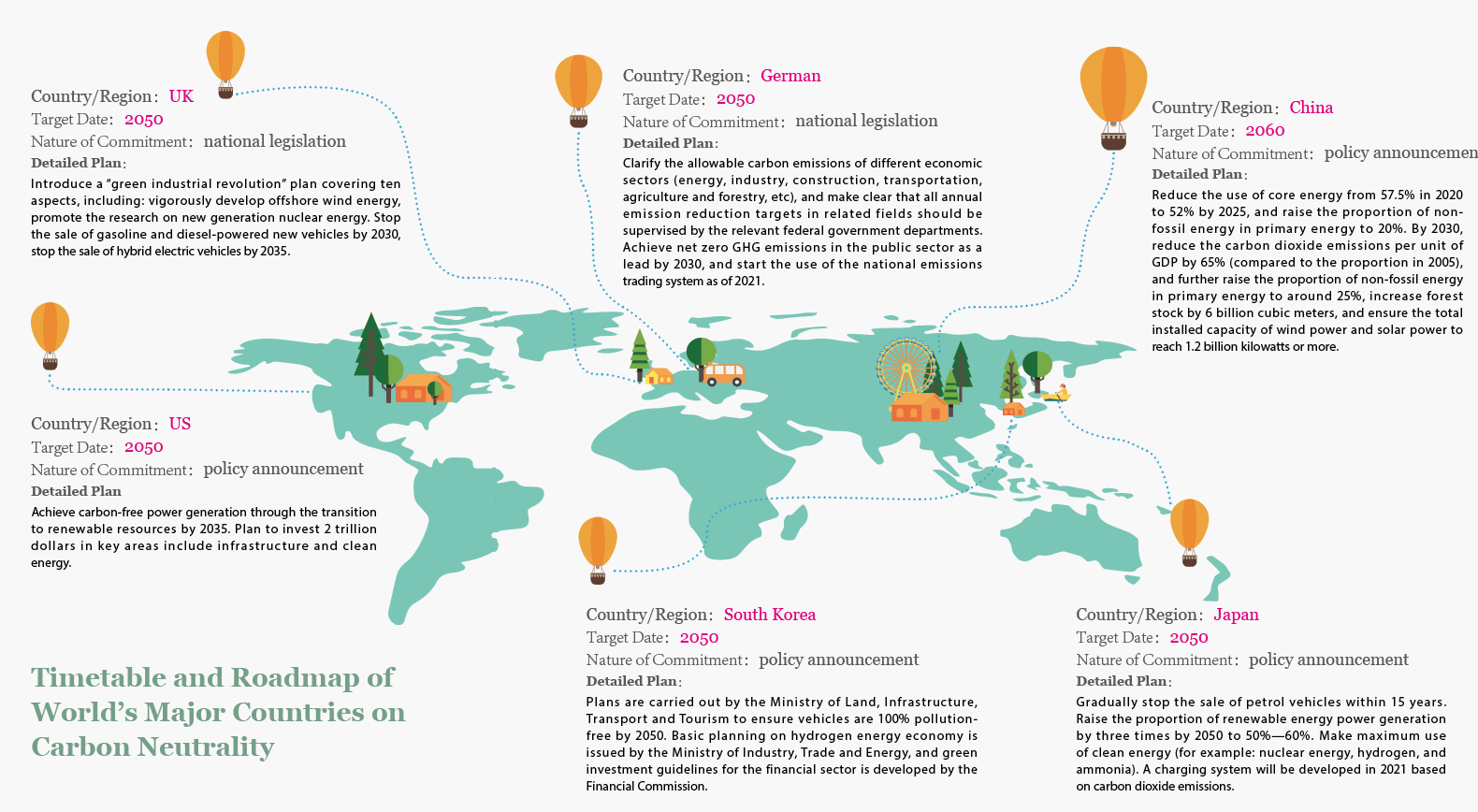

As the climate crisis intensifies,achieving carbon neutrality has become a consensus among the world’s major economies. Major countries around the world have released carbon neutrality timetables and roadmaps (see table below),and worked out countermeasures to cope with global climate changes based on their respective social and economic development status. Financial support is a necessary part in achieving these goals,and developed economies such as the United Kingdom and the United States already have accumulated rich experience in this area. These mature experiences and practices will help us better utilize finance to achieve our goals on carbon peak and carbon neutrality.

UK: Marketization and Government Guidance

The UK is a global advocate and pioneer in tackling climate change. It started to reduce greenhouse gas emissions through financial measures as early as 2001,and has gone through three stages in its exploration. By now,it has accumulated 20 years’ experience in providing financial support for carbon peak and carbon neutrality.

The first stage: exploration (2001 - 2005). The UK made its preliminary exploration on supporting carbon emission reduction with finance during this period. For Example,the Carbon Fund and Carbon Trust were established in 2001 to help enterprises and institutions improve energy efficiency through relevant financial support,consulting and certification services. In 2002,a carbon emission trading system was established to cope with the market failure of carbon emission reduction. And the concept of “low-carbon economy” was proposed in 2003.

The second stage: development (2006 - 2017). During this stage,the UK further promoted financial support for carbon emission reduction by means of national legislation and management mechanism. At the legislation level,the Climate Change Act was announced in 2008,making the UK the world’s first country to include CO2 emissions into the law. At the management mechanism level,environmental factors were incorporated into the investment decisions of institutional investments in 2006,and financial institutions were encouraged to join the United Nations Principles of Responsible Investment (UN PRI). In 2009,the Loan Guarantee Scheme was issued to encourage SMEs to invest in green industries. In 2012,the UK Green Investment Bank was founded as the world’s first state-established bank dedicated to financing green and low-carbon projects. In 2015,Taskforce on Climate-Related Financial Disclosures (TCFD) was established,focusing on climate-related financial risks. In 2017,a Green Finance Taskforce was set up to coordinate with institutions including the London Stock Exchange,the Bank of England and HSBC to promote green and low-carbon development through financial means.

The third stage: maturity (2018 to date). The UK further strengthened the top design and international cooperation of financial support for carbon emission reduction. The Sino-UK Green Finance Center was established in 2018 with the purpose to promote green financial cooperation between the two countries. The Climate Change Act was revised in 2019 to formally clarify the goal of achieving “net zero emissions” of greenhouse gas by 2050. The British Green Financial Strategy was published the same year,specifying that financial services will play a greater role than any other industry in tackling climate change.

On the whole,financial institutions and non-governmental organizations are the major forces that drive the UK’s financial sector to actively participate in achieving carbon peak and carbon neutrality,while the government sticks on the principle of marketization,and encourages financial institutions and the private sectors to participate in carbon emission reduction by introducing relevant laws and policies at the legislative and regulatory levels respectively.

US: Explore Regional Green Finance Development

US is a federal country,and state governments have played an important role in providing financial support to carbon emission reduction. Under the institutional framework of the federal government,the states governments have carried out primary level exploration on supporting carbon emission reduction with financial means based on actual situations,and have formed a relatively mature system for regional green finance development.

On institutional design,the state government has carried out a series of laws and regulations on greenhouse gas emission controlling,supporting financial institutions to participate in low-carbon development and emissions reduction. In 2006,for instance,California promulgated the California Global Warming Solutions Act to clarify CO2 emission reduction targets. In 2007,Western Climate Initiative was jointly issued by California,Arizona,New Mexico,Oregon and Washington,according to which agreement was made to reduce greenhouse gas emissions by 15% in 2020 compared to 2015.

In terms of fiscal policy,the state government has been guiding financial institutions to increase support for related fields of carbon emission reduction with fiscal subsidies and finance discounts. For instance,the Pennsylvania government has provided nearly US$15 million of financial support for 41 clean energy projects by means of finance discounts,and leveraged nearly 200 million dollars in bank loans and private investments to support the development of Pennsylvania’s clean energy industry from 2001 to 2011.

On market build-up,the US government has been actively exploring the establishment of regional green banks to ensure the effective supply of carbon emission reduction related financial products and services. One of the examples is the establishment of the New York State Green Bank in 2014. It aimed to enhance cooperation with the private sector to expand the financing for clean energy. Still in 2014,the State of New Jersey established the Energy Resilience Bank to promote clean energy projects in New Jersey by providing financing and technical assistance.

Although the development of financial support for carbon emission reduction by the state governments has much to do with their high autonomy under the federal system,practices such as following the objective laws and local social and economic development ,respecting the exploratory spirit of local governments,and appreciating the incentive and guiding role of the market provide valuable experiences in promoting regional green finance.

Germany: Give Full Play to the Guiding Role of Policy Banks

Germany is one of the fastest growing industrial countries since World War II,but also the EU’s largest CO2 emitter. In recent years,Germany has been actively participating in global response to climate change,and has become a global leader in green and low-carbon development. During this process,policy banks played a significant guiding role in Germany’s carbon neutral action plan.

Kreditanstalt Fuer Wiederaufbau (KFW) is Germany’s most influential policy bank and one of the largest financiers in climate change field across the globe. It has been the main green funds provider in Germany since the 1970s. According to statistics,between 2012 and 2016阅读全部文章,请登录数字版阅读账户。 没有账户? 立即购买数字版杂志