Divergent Recovery and Structural Reshaping Remain the Theme of the...

Title:Divergent Recovery and Structural Reshaping Remain the Theme of the Global Economy

The global economy under COVID-19 is clearly showing the tendency of rapid recovery and structural reshaping. With strong support from counter-cyclical macroeconomic policies in various countries,science and technology innovation (especially biomedicine and digital technology) is playing a key role,green and digital recovery are releasing new momentum,and major countries are taking a clearer lead. Looking ahead,what is unfolding is a completely different global economic landscape compared to before the pandemic,one where risks and challenges coexist with opportunities. All parties are required to be more level-headed to grasp the trends and seize the future.

Three Key Features of the Global Economy in the First Half of 2021

The pandemic is a key variable in global economic performance. The situation was particularly severe in the first half of 2020,and since then,as vaccine development,inoculation and virus variants move forward,economic recovery in various places of the world undulated,showing the following three main features.

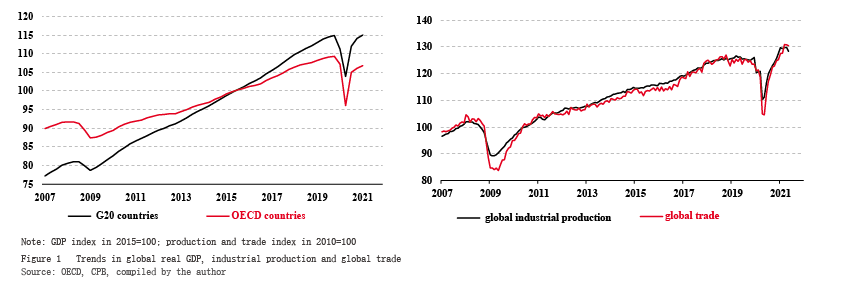

First,global economy has rebounded from a "V-shaped" scenario and entered a critical period of “recovering lost ground”. The impact of 2020 pandemic on the economy is rare in history. The "great lockdown" paused the economy,which quickly triggered a resonance effect across all countries in the context of globalization. As a result,global economy quickly slipped into recession on an unusually steep slope. As China quickly brought the pandemic under control and the U.S. and U.K. unblocked their economies by making breakthroughs in vaccine technology,major economies swiftly adopted unprecedentedly large-scale economic stimulus measures. Against this backdrop,the global economy rebounded rapidly on a very steep slope. As can be observed in the curve,global economy is on a "V-shaped" track from 2020 to the first half of 2021 (see Figure 1). Judging by inflation-adjusted real economic indicators,real economies of the G20 countries,which account for around 80% of the global economy,have recovered their ground lost in the pandemic. In particular,global industrial production and trade volumes have surpassed their pre-pandemic levels,with the output gap narrowed down and the real economy growth approaching its potential level. Compared with the prolonged "L-shaped" recovery following the global crisis in 2008-2009,the global economy is obviously recovering at a fast speed in 2020-2021. The main reason is that the current pandemic crisis is not a financial one,meaning that the recovery is significantly bolstered by the relatively robust financial institutions and dynamic financial markets.

Second,the overall recovery is accompanied by great structural differentiation,while the global economic landscape is being reshaped. As different countries have different stages of development,political and cultural backgrounds,technological conditions and room for macro policies,their pandemic are also contained with different levels of effectiveness. In addition,various industries have unequal capacity to adapt to the pandemic,and various types of demand activities have different response to anti-pandemic measures and resilience to macro policies. The economies therefore showed differentiated trends,hence a "K-shaped" divergent recovery. Consequentially,despite the overall rapid global recovery,structural,regional and sectoral imbalances are still relatively pronounced,accelerating the reconfiguration of the post-crisis world economy.

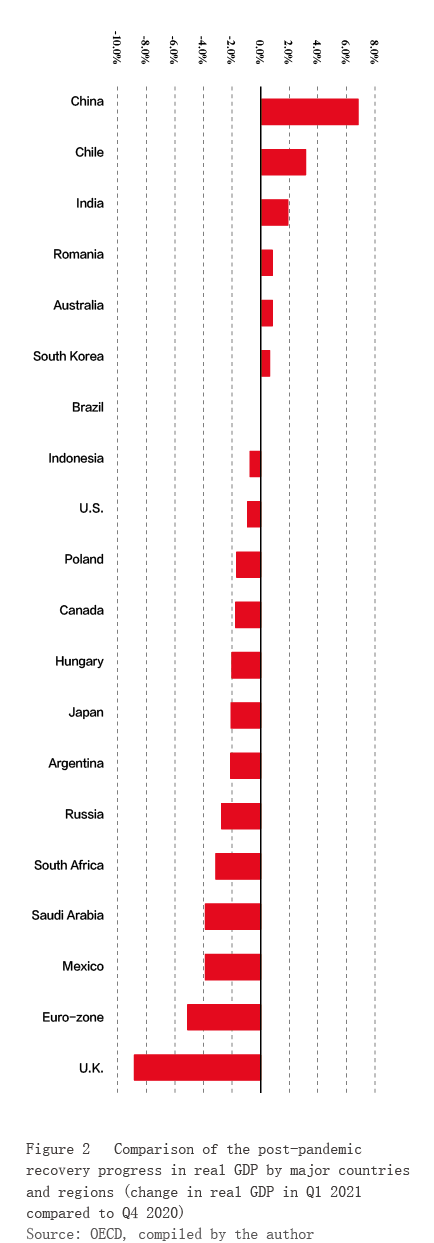

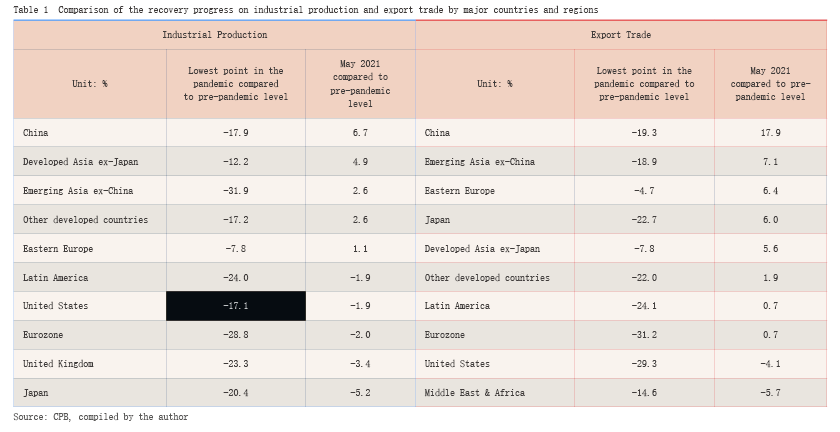

With regards to regions and countries,China and the U.S. are leading the recovery of emerging and developed markets respectively,with the Asia-Pacific region significantly ahead of other regions in speed and progress. In the first quarter of 2021,China's real GDP was 6.8% higher than before the pandemic,returning to the line of the long-term growth trend and staging the best performance among the world's major economies (see Figure 2). The U.K.,however,saw its GDP still 8.8% lower than pre-pandemic level in the first quarter,further departing from the long-term growth tendency and becoming the most lagging one among major economies. Looking at the industrial production and international trade data with higher frequency,similar trends emerge (see Table 1).

In terms of sectors,the manufacturing and mining sectors recover significantly faster than the service sector. In April 2021,the global airline load factor was only 63.3%,still far below the pre-pandemic level of over 80%. In May,the number of restaurant dinners worldwide were still 18.9% lower than the same period in 2019. The trends of various industry sectors in the global equity markets basically reflected the differentiated recovery,with energy,finance and technology sectors standing out.

Third,the divergent economic recovery is accompanied by significant risks,already quietly changing investor behavior and market expectations. The impact of the pandemic is all-encompassing and highly intense. The responding policies are unprecedented in scales and methods,which in turn bring new risks mainly represented by risks of inflation,asset bubble,sovereign debt and geopolitics.

Regarding the risk of asset bubbles,the ultra-low benchmark interest rates and massive easing policies by global central banks have significantly improved global liquidity. However,that liquidity has not fully flowed to the real economy. On the contrary it has significantly increased investors' risk appetite. Consequentially,more of global capital has been allocated to high-risk assets such as those in emerging markets,real estate,equities,high-yield bonds and commodities,intensifying the inflation of asset bubbles. Once global policies adjust under inflationary pressures and market expectations shift along with,the risk of asset bubbles bursting will emerge. The financial instability factors caused by overvalued assets have already been highlighted by the Financial Stability Report by the Federal Reserve in May 2021.

In terms of the so