Challenges Faced by Traditional Monetary Theory and China's Monetary...

Title:Challenges Faced by Traditional Monetary Theory and China's Monetary Policy Choice

Traditional monetary theory believes that too much money will accelerate economic growth and lead to inflation. As the famous monetarist Milton Friedman said: Inflation is and only a monetary phenomenon. It is the inevitable result of the increase in the quantity of money faster than the increase in output. In this theory,the key determinant of the amount of money is the monetary base,the sum of currency in circulation and deposits held by banks and other depository institutions in their accounts at the central bank.

However,this theory is facing serious challenges: since the 2008 U.S. financial crisis and before the outbreak of COVID-19 pandemic in early 2020,the Federal Reserve(the Fed),the U.S. central bank,has increased reserve deposits,the main part of the monetary base,dramatically,but broad money supply M1 and M2 have grown slowly. Not only has it failed to significantly increase consumption and inflation,it has also made people worry about the risk of falling into deflation.

But in China,the transmission of monetary base to the broad money supply is still smooth,and the connection between different measures of money supply and the real economy is still very strong. For this reason,so far,the required reserve ratio (RRR) policy is still one of the main tools of China's monetary policy.

Challenges faced by traditional monetary theory

As mentioned above,in the U.S.,traditional monetary theory is facing challenges. But what went wrong with this once proven theory? In my opinion,there are two main reasons:

First,in the 2008 financial crisis and several years after that,the U.S. has been unable to get out of the crisis quickly. Because of this,the risk appetite of the banking,corporate,and household sectors declined. For banks,due to high investment and lending risks,the opportunity cost of holding reserves is very low,so banks would rather store funds in the Fed rather than lend or invest them. Therefore,around zero interest rate,the elasticity of demand for reserves could be very high. This is also true for the household and business sectors: because of the weak economy and uncertainty,they would rather hold cash than spend it.

Second,after the U.S. came out of the 2008 crisis,banks still kept a large amount of reserves in the Fed without lending or investing. To a large extent,it was the result of the Fed's interest payment on reserves.

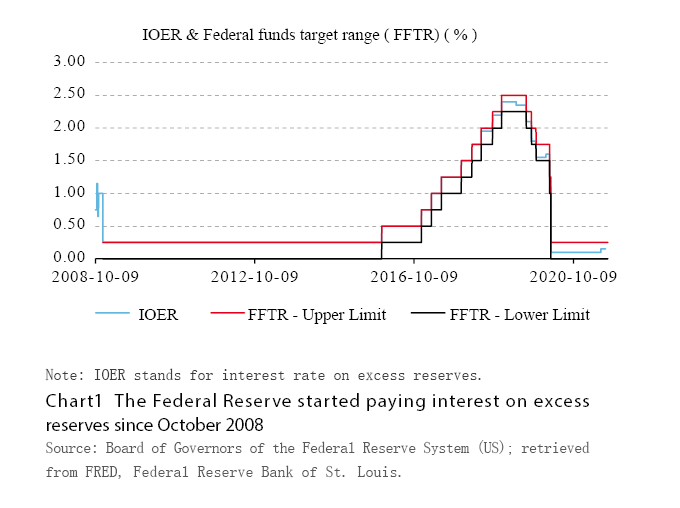

Since October 2008,the U.S. began to pay interest on banks' excess deposit reserves in the Fed (See Chart 1) . The reason for this is that under the excess reserve system,the federal funds rate is under tremendous downward pressure. If interest is not paid on the reserves,it cannot be guaranteed that the federal funds rate is within the policy range. But during the crisis,the Fed had to create more reserves to support its loan projects,on the one hand to rescue financial institutions,on the other hand to improve financial conditions to help economic recovery.

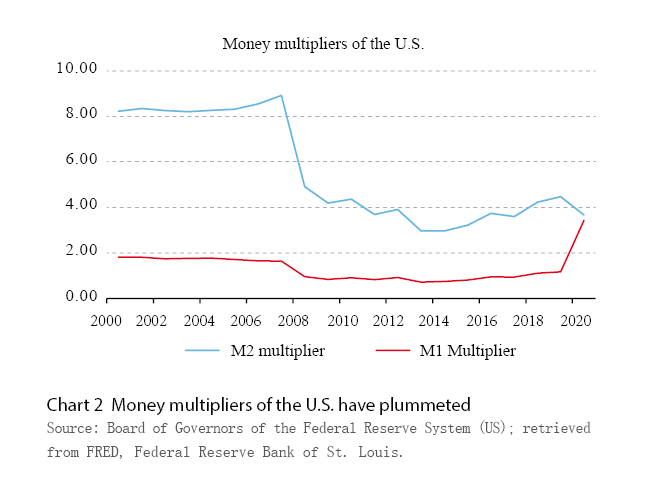

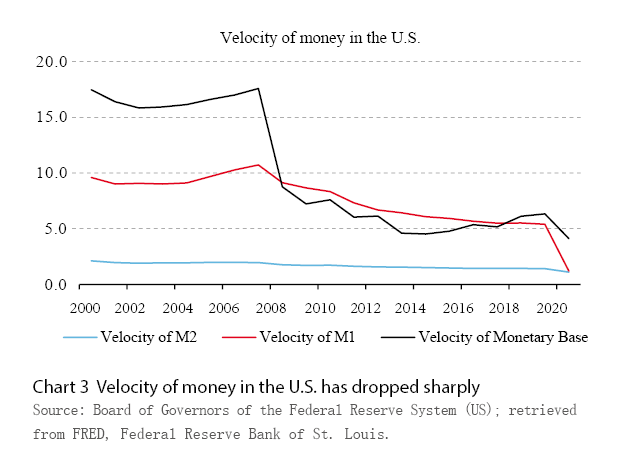

It is precisely because of the aforementioned two reasons that the increase in the monetary base did not cause a proportional increase in the M1 and M2 money stock,and the classic monetary theory of multiple deposit creation and money multipliers failed. (John Williams,2011) What highlights this is that both the money multiplier and the velocity of money have continued to plummet and are difficult to recover. Therefore,the view in traditional monetary theory that the chain of an increase in the monetary base leads to an increase in the money stock and thus higher economic growth and inflation has been broken.

Let's look at the money multiplier first. Data shows that from 2008 to the very beginning of 2020,although the monetary base of the U.S. has increased substantially,the money stock represented by M1 and M2 has only slightly increased,so the money multiplier has not recovered since the sharp drop at the end of 2008 (See Chart 2).

Now,let's take a look at the velocity of money (See Chart 3) . Since 2000,the amount of money per unit has played a much smaller role in the real economy,which is reflected in the sharp decline in the velocity of money,that is,the ratio of nominal GDP to money.

The interruption of the transmission of monetary base to broad money supply,and the significant weakening of the connection between money supply and real economy,fully demonstrates that the understanding of the relationship between monetary policy,money and inflation in traditional textbooks is outdated and needs to be revised.(John Williams,2011)

China is still implementing conventional monetary policy

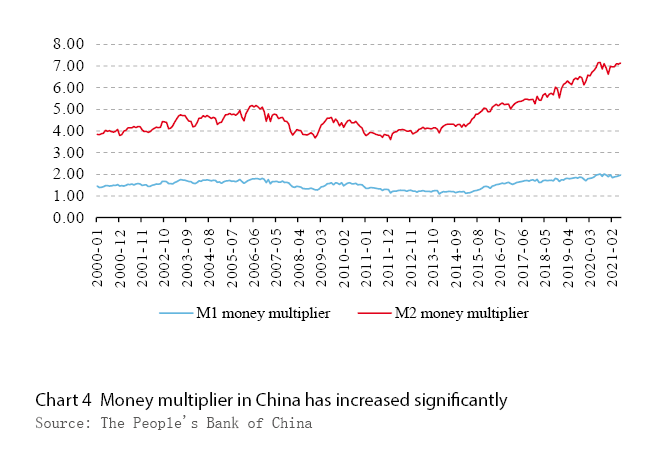

After the 2008 financial crisis,the U.S. has gone further and further along the road of unconventional monetary policy. In contrast,China is still implementing conventional monetary policy,so traditional monetary theory continues to be effective in China. In this regard,there are two important indicators that can illustrate this point: both the money multiplier and velocity of money in China are normal and even on the upward trend over the years.

Let's look at the money multiplier first. The M1 money multiplier,the ratio of M1 to the monetary base,has increased from 1.1 times in January of 2014 to about 2 times now. The growth of the M2 money multiplier,the ratio of M2 to monetary base,is much higher than that of the M1 money multiplier (See Chart 4) .

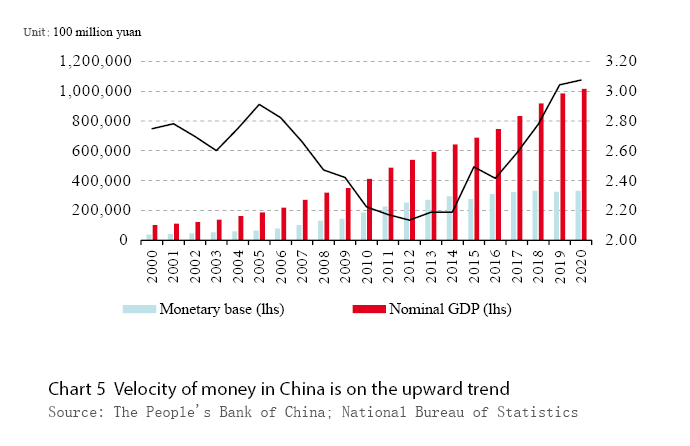

The velocity of money in China shows an obvious V-shaped trend over the past 16 years,that is,a decline from 2005 to 2012,and then an increase from 2013 to 2021. In 2005,the velocity of monetary base dropped from 2.92 times to a low of 2.13 times in 2012. The reason was that although nominal GDP grew rapidly during this period,the monetary base grew faster. After 2012,the nominal GDP still maintained a certain growth rate,but the monetary base experienced a stagnated,and sometimes even negative growth rate which caused the velocity of money to rise all the way,setting a new high of 3.07 times in 2020(See Chart 5).

In short,in China,