The Evolution and Outlook of the Global Monetary Pattern after...

Title: The Evolution and Outlook of the Global Monetary Pattern after the COVID-19 Pandemic

The COVID-19 pandemic in 2020 combined with the global easing of liquidity has a significant "two stage" impact on the global monetary structure. From March 2020 to the end of 2020,the status of the U.S. dollar and yen decreased significantly,while the status of the euro,renminbi and pound increased significantly. The trend of U.S. dollar and euro has been corrected since the beginning of 2021,but they were stabilized on the whole. The status of renminbi and pound has continued to improve,while the status of yen has continued to weaken. In the future,the shift of the Federal Reserve's monetary policy,the reconstruction of the global industrial chain and the remodeling of the international political and economic pattern will become the main factors affecting the evolution of the international monetary system.

The impact of the pandemic on the international use of currencies shows the feature of being "strong first then weak"

Since March 2020,the COVID-19 pandemic combined with the easing of liquidity in major economies has had a high-intensity impact on the real economy and the financial markets of the world. This round of shocks has a significant marginal impact on global monetary pattern and presents a feature of "two-stages" with the end of 2020 as the boundary.

Share of international payments. From March 2020 to November 2020,the proportion of U.S. dollar in international payments decreased by 6.47 percentage points,the proportion of euro increased by 6.6 percentage points,the proportion of renminbi and pound increased slightly,and the proportion of yen decreased by 0.54 percentage points. From December 2020 to July 2021,the proportion of U.S. dollar began to rise slowly by 1.75 percentage points. The proportion of euro and renminbi was relatively stable and increased slightly,while the proportion of pound and yen continued to decline. So far,the impact of the pandemic on the international payment share of major currencies has gradually stabilized. The euro and renminbi form a marginal substitution for U.S. dollar and yen.

Share of reserve currency. From March 2020 to the end of 2020,the proportion of U.S. dollar in official reserves continued to decline by 2.86 percentage points. The euro,renminbi and pound increased by 1.23,0.26 and 0.29 percentage points respectively. The proportion of yen decreased first,then increased,and finally increased slightly by 0.09 percentage points. From the beginning of 2021 to the end of March of 2021,the proportion of renminbi and U.S. dollar increased by 0.18 and 0.6 percentage points respectively,while the proportion of euro,yen and pound decreased by 0.71,0.15 and 0.02 percentage points respectively.

International debt market. From March 2020 to the end of 2020,the proportion of renminbi in outstanding international bonds remained basically unchanged. The proportion of U.S. dollar decreased by 1.3 percentage points,while euro increased by 1.0 percentage point. The proportion of yen and pound "increased then decreased" respectively,but the range was very small. From the beginning of 2021 to the end of March of 2021,the proportion of U.S. dollar increased significantly by 2.44 percentage points,while the proportion of euro decreased significantly by 2.25 percentage points.

The exchange rate trend of major currencies diverge

Effective exchange rate. In terms of nominal effective exchange rate ,from March 2020 to the end of 2020,U.S. dollar and yen weakened,falling by 9.5 percentage points and 2.46 percentage points respectively,while euro,renminbi and pound rose by 4.4 percentage points,1.8 percentage points and 1.3 percentage points respectively. From the beginning of 2021 to the end of July of 2021,U.S. dollar rose slightly by 1.2 percentage points after stabilizing. The nominal effective exchange rate of euro stopped rising and decreased slightly by 1.8 percentage points. The nominal effective exchange rate of pound and renminbi continued to rise and increased by 4.9 percentage points and 4.0 percentage points respectively. The nominal effective exchange rate of yen continued its downward trend and fell by 4.5 percentage points.

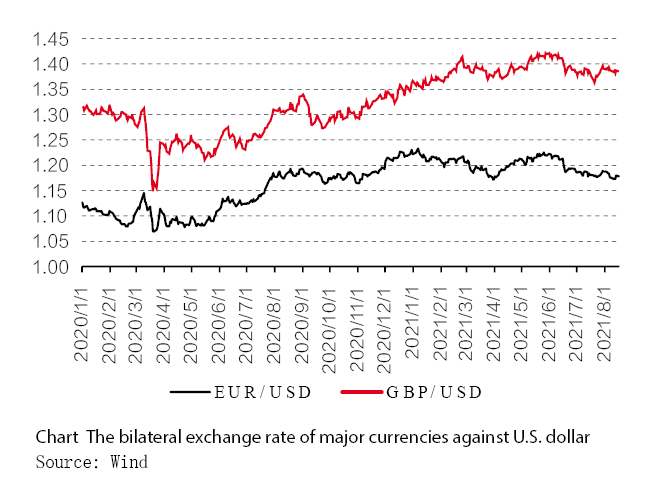

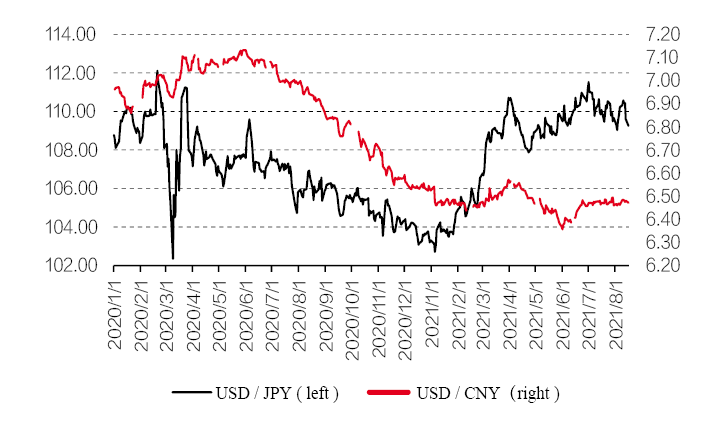

U.S. dollar bilateral exchange rate. From March 2020 to the end of 2020,the exchange rates of euro,pound,renminbi and yen against the U.S. dollar all appreciated significantly,with the rate of 10.7%,10.1%,8.6% and 4.1% respectively. Since the beginning of 2021,the exchange rate of euro and yen took the lead. Among them,the exchange rate of euro has depreciated against U.S. dollar,but in fluctuations,and yen has depreciated constantly. As of mid-August,the exchange rate of euro and yen against U.S. dollar depreciated by 3.9% and