Thoughts on the High-Quality Development of Trade in Services

Foreign exchange administration of trade in services has always adhere to the purpose of promoting the development of trade in services,with the focus on facilitating the foreign exchange receipts and payments of the transaction entities and preventing cross-border capital flow risks. Continuous efforts are being made to optimize policies and processes as well as advance institutional innovations.

In recent years,global technological progress and changes in demand structure have stimulated a thriving growth of trade in services across the globe. Experience of the developed economies shows that the innovative development of trade in service is a key factor to promote the transformation and upgrading of economic structure,foster new drivers of growth,and improve the quality and efficiency of development. As President Xi Jinping marked at the Global Service Trade Summit of the 2021 China International Fair for Trade in Service (CIFTIS) ,trade in services is a key component of international trade and an important area of international economic and trade cooperation,which has a big role to play in fostering a new development paradigm. With the new international economic and trade paradigm,China's service trade has faced new opportunities and challenges. How to balance facilitation and risk prevention to promote the high-quality development of trade in services is an issue that needs to be addressed for the moment.

Main Features of Current Global Trade in Services

As defined by the Organization for Economic Cooperation and Development (OECD),trade in services refers to the input and output of services between residents and non-residents,including services provided through foreign affiliates established abroad. The General Agreement on Trade in Services (GATS) issued by the World Trade Organization (WTO) makes four categories of trade in services according to the mode of service supply: cross-border trade (mode 1,e.g. doctors provide medical services to residents of other countries through the Internet),consumption abroad (mode 2,e.g. residents seeking medical treatment abroad),commercial presence (mode 3,e.g. setting up hospitals or clinics in other countries),and mobilization of natural persons (mode 4,e.g. doctors entering the country of the patient to supply medical service).

Global trade in services developed rapidly during recent years,and has become a new driving force for global economic growth. Its trend mainly reflects the following features:

First,the share of trade in services continues to rise in global trade,approaching 30 percent of the total world trade volume. Except for the decrease caused by subprime crisis and COVID-19 pandemic,the global service industry keeps growing in recent years. The World Bank data shows that the share of value added of service industry in global GDP is constantly high,rising from 61% in 2001 to 65% in 2019. Meanwhile,the share of industrial value added in global GDP drops from 28% in 2001 to 25% in 2019. The rapid growth service industry brings about the vigorous development of trade in services. Since 2000,the annual average increase of total trade in services (except for special instructions,the data on service trade is based on BOP statistical caliber) is 5.5%,0.3 percentage points higher than that of trade in goods. According to statistics of WTO,total trade in services accounts for 28% of total global trade in 2020,and according to the predictions in the World Trade Report 2019 of WTO (here in after WTO report),this share will rise to 1/3 in 2040,with the trade in services being the main momentum of global trade growth.

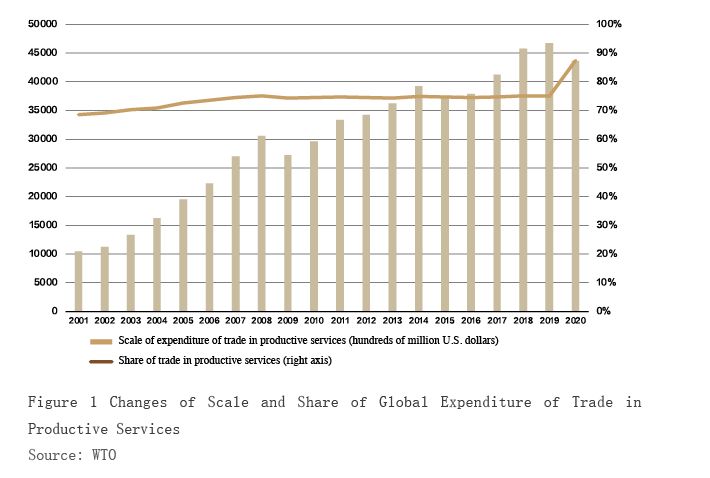

Second,productive service expenditure takes a dominant part in the expenditure of trade in services,making up for over 70 percent. With further refinement of international divisions of work,productive service trade such as transportation,telecommunication,finance,commerce,etc.,which is closed related to manufacturing industry,is applied to value adding of trade as intermediate inputs of trade in goods. The productive service trade promotes commodity production to spread to two-ends of value chain and the integration of service industry and other industries. Data of various countries show that,since the beginning of the 21st century,expenditure of trade in productive services has maintained an overall growing trend owning to the rapid development of high technology and globalization policy dividends,which basically took over 70 percent of the total global trade in services expenditures (see Figure 1),and has become the main engine driving global trade in services and economic growth.

Third,commercial presence accounts for nearly 60 percent of global supply of trade in services. With the industrial upgradation and the industrial transition from manufacturing to compromised industry,international merger and transition in service industry is accelerated. In addition,since 1990’s,capital controls have been reduced and multinational companies have grown up due to free capital flows. The service trade in the form of commercial presence of multinational companies has achieved rapid development and become the main transaction mode of service trade. According to the WTO reports,commercial presence accounts for nearly 60 percent of global trade in services; cross-border trade ranks the second,accounting for around 30 percent; consumption abroad accounts for around 10 percent,while mobilization of natural persons accounts for less than 5 percent.

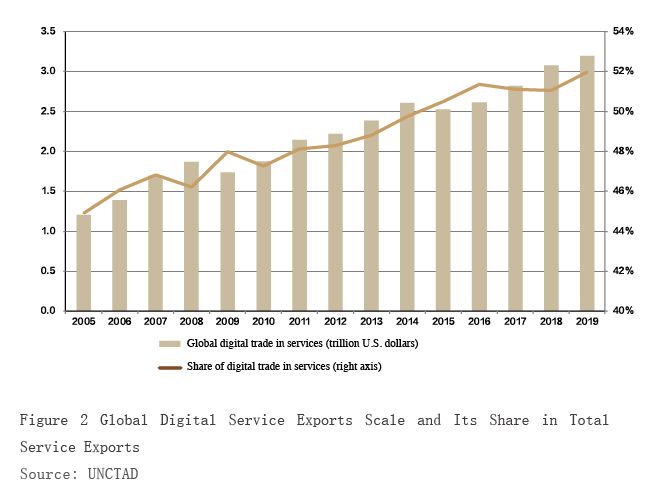

Fourth,digital trade in services accounts for more than a half of the global trade in services. Digital technology digitizes how we trade and who we trade with,and increases the portability and tradeability of services by reducing transaction costs and entry threshold. Digital trade in services converges on high-end field of global value chain,mainly including knowledge-intensive trade in digital technology services,digital content services and other outsourcing services delivered through Internet. By digital embedment and reconstruction,new mode of value creation is established,which promotes the integration of manufacturing industry and service industry and becomes the new engine to boost trade growth. According to the report Adapting to the Digital Trade Era: Challenges and Opportunities published by the WTO in January 2021,technological changes will boost trade growth and increase the share of trade in services in global trade. According to data from the United Nations Conference on Trade and Development (UNCTAD),global digital service exports increased from around 1 trillion U.S. dollars to about 3 trillion U.S. dollars from 2005 to 2019,the average annual growth rate was nearly 7 percent,and its share in global trade in services rose from 45 percent to 52 percent (see Figure 2).

Fifth,the dispute settlement mechanism of trade in services needs to be improved. The barriers of service trade have the characteristics of intangibility,hiddenness,flexibility and strong protectiveness. Countries adopt restrictive regulations for service trade protection. Due to the lack of international norms,disputes of trade in services are more complicated and tougher than that of trade in goods. Countries have different appeals in such service trade fields as digital tax collection,cross-border data flows,privacy protection,market entry and intellectual property protection,which brings about more severe challenges for dispute settlement mechanism of trade in services. Regional agreement has become a way to improve service trade rules in recent years. The Regional Comprehensive Economic Partnership (RCEP),for example,has made certain improvement on the basis of the WTO dispute settlement mechanism,in which the appeal procedure was canceled in an effort to improve the efficiency of dispute settlement.

Status Quo of China's Trade in Services

Since joining the WTO in 2001,China has entered a fast development period in trade in services,which played an important role in boosting industrial development,facilitating residents’ lives and promoting employment. On the whole,we’ve made remarkable achievements in trade in services,yet there is still much room for improvement.

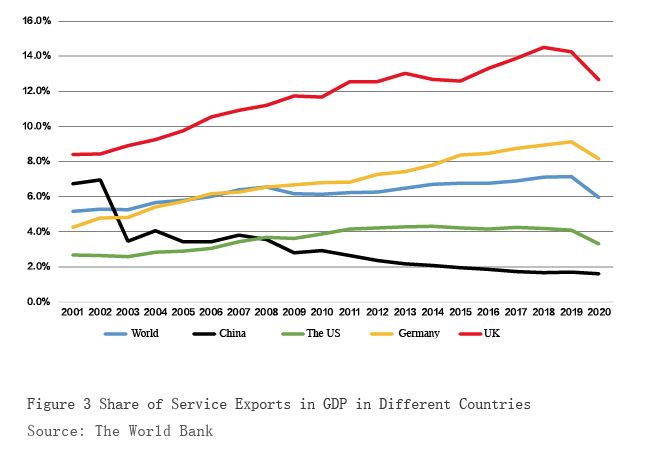

First,cross-border trade in services continues to expand,but service exports contributed not enough to economic growth. According to data collected by the State Administration of Foreign Exchange (SAFE),China's trade in services expanded by about 7 times compared to that at the time China joined the WTO; around 370,000 enterprises engaged in cross-border trade in services,with an increase of nearly 90 percent compared to 2010; in 2020,about 700,000 cross-border trade in service transactions were made with a single value of more than 50,000 U.S. dollars,an increase of around 50 percent over 2010. However,if we look at the proportion of service exports in GDP,its contribution to economic growth is relatively low. Data from the World Bank shows that between 2001 to 2020,China's service exports accounted for an average of around 3 percent in GDP,3.2 percentage points lower than the global average level,and 8.6,3.9 and 0.6 percentage points lower than the average levels of the United Kingdom,Germany and the United States respectively (see Figure 3).

Second,China has maintained its status as the world's second largest service exports country,but the share of trade in services in global trade in services is lower than the share of trade in goods in global trade in goods. The IMF data shows that China's service trade surpassed that of Germany in 2014 and was the second largest only next to that of the US. In 2020,China's service trade was US$40 billion more than that of the third largest country-Germany. Compared to trade in goods,the share of China's trade in services in global trade in services is relatively low. Data from the World Bank indicates that,in 2020,China's trade in services accounted for only 7 percent of global total trade in services,while the share of trade in goods in global total trade in goods was 13 percent.

Third,deficit of trade in services has narrowed since the outbreak of the COVID-19 pandemic,yet the scale of deficit remains at a high level. Since the entry to the WTO,China's expenditure on travelling continued to rise,and trade in services changed from surplus to deficit since 2005. The deficit scale expanded year by year,and reached its peak in 2018. It declined a bit in scale in 2019,but the deficit still exceeded 260 billion U.S. dollars. In 2020,travel deficit nearly halved compared to that of last year as a result of the global pandemic,and deficit of trade in services declined to 145.3 billion U.S. dollars.

Fourth,the emerging trade in productive services develops rapidly,but the industrial structure of trade in services is yet to be further optimized. In 2020,China’s emerging trade in productive services (mainly including telecommunication,computer and information services,intellectual property rights tolls,finance and insurance services,etc.) accounted for 43 percent of the total trade in services,9 percentage points higher compared to 2010,while this proportion in the United States,Japan and the United Kingdom was all around 70%,meaning that the industrial structure of China's trade in services needs further optimization.

Fifth,development of trade in services shows diversified features in different regions in China,but the regional development is not balanced. While the major advantages of the eastern coastal areas are other commercial services (mainly including advertisement,consultation and transfer of research results),transportation,telecommunications,computer and information services,the strength of the central and western regions mainly lies in overseas construction,computer services and processing services. Since the development of service industry is not synchronized in different regions,the development levels of service trade of these regions are quite different. According to the data of 2020,China's trade in services comes mainly from Beijing,Shanghai and Guangdong,whose service industry is advanced. These three regions account for nearly 70% of China's total service trade; the last ten areas are middle and eastern ones,whose total trade in services makes up less than 2%.

Sixth,the competitiveness of Chinese enterprises needs to be improved against the backdrop of gradual opening up of China's service industry. With the continuous opening up of service industry in recent years,the amount and share of foreign investment to service industry rise year by year. The statistics of Ministry of Commerce shows that during the 13th five-year period (2016-2020),the service industry attracted approximately US$540 billion foreign investment,with the share in the total foreign investment rising from 70% to 78%. Compared to foreign-funded enterprises,the competitiveness of Chinese enterprises in service trade needs to be improved. Regarding exports,70% service trade exporting enterprises are Chinese enterprises,but the share of these enterprises’ exports in the total service trade exports is less than 1/2; in addition,the transactions of Chinese enterprises focus mainly on traditional services such as transportation,construction,etc.,while foreign enterprises have obvious advantages in services such as other commerce service and intellectual property rights tolls. Therefore,Chinese enterprises have great potentials in the share of exports and emerging industries.

Promoting the High-quality Development of Trade in Services

Foreign exchange administration of trade in services has always adhere to the purpose of promoting the development of trade in services,with the focus on facilitating the foreign exchange receipts and payments of the transaction entities and preventing cross-border capital flow risks. Continuous efforts are being made to optimize policies and processes and advance institutional innovations. Since 2013,foreign exchange administration of trade in services has been focusing on deepening the reform on streamlining administration and delegating power,improving regulation,and upgrading services. Prior approval has been completely abolished,and most of the foreign exchange receipts and payments of trade in services can be handled directly in banks. The facilitation on receipts and payments of foreign exchange of trade in services has been constantly improved.

Strengthening Power Delegation and Releasing Vitality of Market Entities

First,the SAFE launched a pilot program to facilitate foreign exchange receipts and payments of trade in services in October 2019,further optimizing document review process and expanding pilot areas and business scope in an orderly manner. By the end of August 2021,the pilot program has been expanded to cover two thirds of the whole country.

Second,the SAFE opened "green channel” of foreign exchange policies the first time after the outbreak of the COVID-19 pandemic,simplifying the procedures of foreign exchange acceptance and sales of pandemic-related donations. 961 donations,worth about 200 million U.S. dollars,were exempted from opening donation accounts.

Third,the SAFE issued the Guidelines for the Foreign Exchange Business under Current Account (2020 version) in August 2020,which fully integrated the regulations of foreign exchange administration of trade in services,further optimized the business process of trade in services,and realized "one copy presenting all,one document handling all,being clear at a glance" of the foreign exchange administration policy of trade in services. Banks can independently review documents in accordance with the principle of "substance of transaction outweighs form of document",thus establishing the policy environment of "more compliant,more autonomous".

Fourth,the SAFE supported contracted engineering companies to go global. The US$5.8 billion funds for 45 overseas engineering projects are currently managed centrally,which has effectively reduced the cost of fund use and improved the efficiency of fund use.

Transforming Ideas of Regulation and Leading Market Entities to Self-regulate

First,the SAFE established contact mechanism for key enterprises of trade in services,strengthening the structural and linked analysis of "macro + micro",persisted in deep investigation and constantly enhanced the effectiveness and scientificalness of regulatory systems.

Second,the SAFE launched the enhancement of off-site monitoring,effectively used the monitoring indices to dig out anomalous clues,raised the accuracy of on-site inspections,reduced disturbance to banks and enterprises,and promoted the bonding mechanism of "not able to violate".

Third,the SAFE strengthened inspections of anomalous clues and disposal of high-risk businesses,increased the punishment to violations,raised the violation cost,fully played the warning role of typical cases,and established punishment mechanism of "not dare to violate".

Fourth,the SAFE guided banks to change from solely checking documents to evaluating entities' credit risks,from surface compliance to substance compliance,gradually established the credit constraint and positive motivation mechanism of "more integrity in entities,more convenience in procedures",and constructed the self-regulation mechanism of "not want to violate".

Improving the Effectiveness of Serving and Facilitating Foreign Exchange Use of Market Entities

First,the SAFE continued to improve the online verification function for tax filing of foreign payments of trade in services. Territory verification function for electronic tax filing information of trade in services was launched at the beginning of 2020; centralized tax filing information verification function was launched in November 2020,realizing cross-regional and cross-bank verification of tax filing information. In July 2021,a supplementary announcement on tax filing verification was jointly issued by the SAFE and the State Taxation Administration,which stipulated that multiple payments of foreign exchange under the same contract require only one filing,and added new types of business exempted from filing. Some enterprises realized "remaining within doors and online processing" for foreign payments through online banking,which not only saved the foot cost,but also effectively reduced the time needed for foreign exchange payments. As of the end of August 2021,over 200,000 verifications of tax filing for foreign payments of trade in services were handled online through the cross-border financial block-chain service platform of the SAFE,benefiting more than 50,000 enterprises.

Second,in July 2021,the pilot policy on collecting foreign currency rents for operating leasing changed from facilitating specific regions and industries to supporting creditable enterprises with actual needs,making it more efficient and convenient for qualified enterprises to pay domestic operating foreign currency rents with their own foreign exchange income.

Third,since 2021,post-verification of tax filings and special prepayment and apportionment business have been incorporated into the pilot facilitation program of trade in services,and pilot enterprises can enjoy these facilitation policies directly.

The author is the Director-General of SAFE's Current Account Management Department