Evaluation of Renminbi Internationalization...

Title: Evaluation of Renminbi Internationalization in the Past Five Years Since It Joined the SDR Currency Basket

It has been five years since the renminbi officially joined the currency basket of Special Drawing Rights (SDR) created by the International Monetary Fund (IMF) on October 1,2016. How has the renminbi internationalization progressed during this period? It is evaluated according to the review criteria of SDR currency weights in this paper.

The method for determining the currency weights of the SDR basket in 2015

The method for determining the currency weights of the SDR basket before 2015 was passed in 1978. The weight of each currency was decided by the exports of the currency issuing country and the holdings of the currency in the reserves of other countries in the five years before the SDR weight review. The weights of exports and reserve holdings were constantly changing. Take 2010 for example,their weights were 2/3 and 1/3,respectively. However,with the increasing importance of international capital flows and the rapid growth of capital flows of private sector,this method for determining the weights was no longer applicable.

In 2015,the IMF revised the method for determining the currency weights of the SDR basket. Based on the previous formula,it reduced the weight of exports and added supplementary financial variables,including foreign exchange transactions,international bank liabilities (IBL) and international debt securities (IDS). Thereby,the formula for calculating the SDR basket currency weights became as follows: the share of exports accounted for 1/2 and the share of comprehensive financial indices accounted for another 1/2. The weights of financial indices were as follows: 1/3 for official sector index (reserves),1/3 for foreign exchange transactions,and 1/3 for the index of currency use of private sector in international financial activities (the sum of IBL and IDS) (See Table 1). The international payment shares of major currencies published monthly by the well-known Society for Worldwide Interbank Financial Telecommunication (SWIFT) was not included.

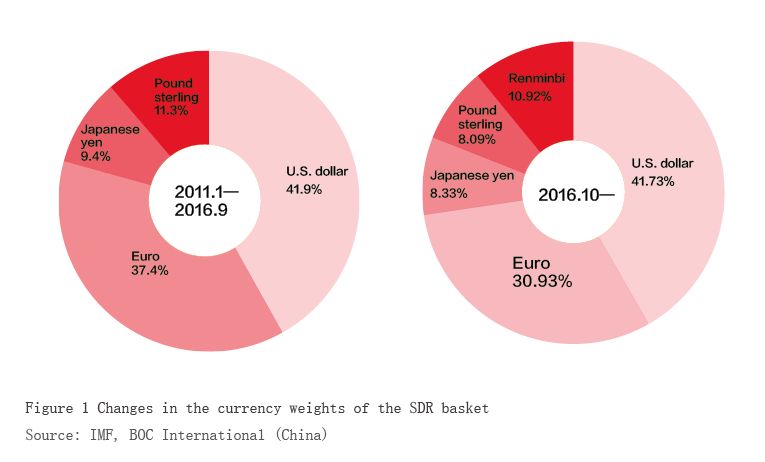

According to the new formula,the weights of U.S. dollar,euro,renminbi,yen and pound in the SDR currency basket that came into effect on October 1,2016 were 41.73%,30.93%,10.92%,8.33%,and 8.09% respectively. Compared with the results of the 2010 review,the weight of the U.S. dollar was reduced by only 0.17 percentage points; the weights of the yen and the pound were reduced by 1.07 and 3.21 percentage points respectively; the weight of the euro was reduced the most by 6.47 percentage points (see Figure 1). In this sense,the weight of the renminbi mainly came from the transfer of the weights of the euro and the pound.

The upward trend of China's share of exports since the SDR review in 2015

In order to reflect the role of currencies in global trade,the IMF has always used exports as a key index when determining the currency composition and weights for the SDR basket. In the formula for calculating the currency weights in the SDR basket,the share of exports refers to the share of the annual average value of goods and services exported by a basket currency issuing country (or currency union) in the total annual average exports of all basket currency issuing countries (including currency union) in the five years before the review.

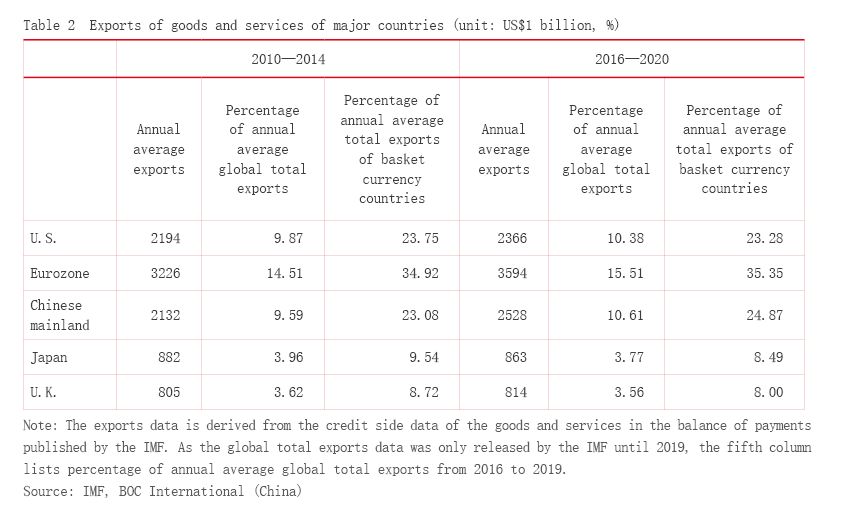

In 2015,the IMF collected data from 2010 to 2014 when determining the currency weights for the SDR basket. During this five-year period,China was the third largest exporter next to the Eurozone and the United States,with its exports accounting for 9.6% of the global total exports,only 0.3 percentage points lower than that of the United States and significantly higher than that of Japan and the United Kingdom. It was by virtue of its large exports that the weight of renminbi ranked the third in the 2015 SDR review.

Compared with the last review period,the Eurozone exports still rank first at present,but China has replaced the United States as the second largest exporter. From 2016 to 2019,the Eurozone and China's exports of goods and services accounted for 15.51% and 10.61% of the global total exports respectively,up by approximately 1 percentage point from that of the annual average exports during 2010 to 2014. Meanwhile,the share of exports of the United States only increased by 0.5%,while that of Japan and the United Kingdom even declined,which suggested that the share of China's exports in the total exports of SDR basket currency issuing countries increased. According to the balance of payments data published by the IMF,from 2016 to 2020,China’s exports constituted 24.87% of the total exports of basket currency issuing countries,an increase of 1.80 percentage points from the period of 2010 to 2014 (see Table 2). According to the formula,the 1.80 percentage point increase will raise the weight of renminbi by about 0.90 percentage points.

The upward and downward trend of renminbi financial indices since the SDR review in 2015

The upward trend of share of official foreign exchange reserves

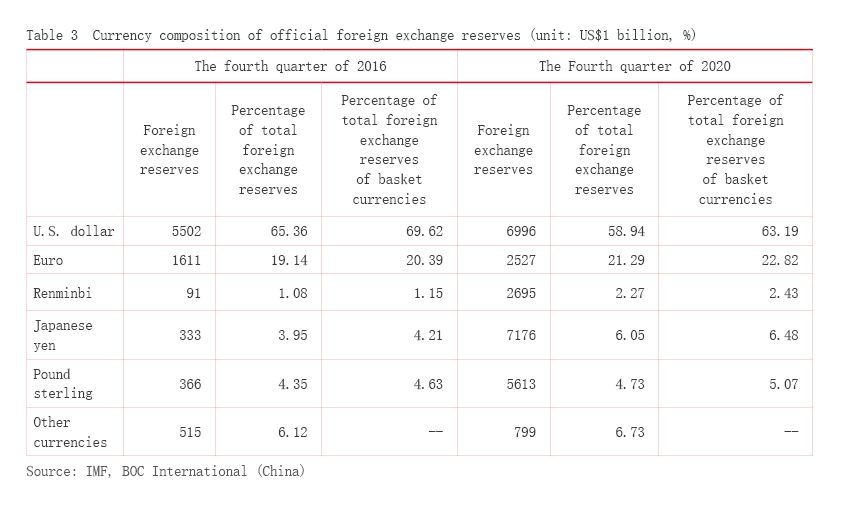

One of the purposes of creating SDR is to supplement international reserve assets. In order to enhance the attractiveness of SDR as an international reserve asset,the global reserve scale of a certain currency figures prominently when the IMF determines the weights of the basket currencies. The share of reserves in the formula for calculating the currency weights refers to share of reserve holdings of a certain currency in the basket in total reserve holdings of all basket currencies at the end of the five-year period before the review. As the renminbi officially joined the SDR basket on October 1,2016,the IMF has separately released data on renminbi reserves held by countries participating in the Currency Composition of Official Foreign Exchange Reserves (COFER) survey since the fourth quarter of 2016. The COFER data shows that in the fourth quarter of 2020,the reserve holdings of SDR basket currencies still accounted for more than 90% of the total official foreign exchange reserves. Among the five basket currencies,with the exception of the U.S. dollar,the share of reserves denominated in the other four currencies increased compared to the fourth quarter of 2016,but the sum of the increase did not offset the decrease of the U.S. dollar. The share of reserve holdings of the four currencies other than the U.S. dollar in the total reserve holdings of the SDR basket currencies also increased. Among them,the share of reserves denominated in the renminbi rose from 1.15% in the fourth quarter of 2016,close to the share (1.1%) of the total renminbi assets held by the IMF members to official foreign currency assets in 2014,to 2.43% in the fourth quarter of 2020 (see Table 3). According to the formula for calculating the SDR currency weights,a rise in the share of renminbi reserves by 1.29 percentage points will raise the weight of the renminbi in the SDR basket by approximately 0.21 percentage points.

The upward trend of share of foreign exchange transactions

Whether a country's currency is widely traded in the major foreign exchange markets is one of the indices used by the IMF to judge whether the currency meets the free use standard. In the formula for calculating the currency weights of the SDR basket,the share of foreign exchange transactions refers to share of transactions of a certain currency in the total transactions of all basket currencies in the five years before the review. The triennial central bank survey conducted by the Bank for International Settlements (BIS) counts foreign exchange transactions of major currencies. We suppose that the average daily trading volume during 2010 and 2013,and that during 2016 and 2019 represent the data collected in the 2015 SDR review and this SDR review (according to the latest timetable released by the IMF,the next review of SDR currency weights is supposed to carry out in 2022,when more recent data on global foreign exchange trading volume counted by 2022 BIS sample survey is likely to be available). Data shows that the trading volume of SDR basket currencies makes up the vast majority of total trading volume in the global foreign exchange markets. Among them,the share of the renminbi trading volume in the global total trading volume rose by 2.5 percentage points,the share of the U.S. dollar and the pound sterling increased less than that of the renminbi,and the share of the euro and the Japanese yen declined. In the total trading volume of SDR basket currencies,the share of renminbi accounts for 2.68%,up by 1.63 percentage points from the annual average in 2010 and 2013 (see Table 4). According to the formula for calculating the SDR currency weights,a rise of 1.63 percentage points in the share of foreign exchange trading volume will raise the weight of the renminbi in the SDR basket by about 0.27 percentage points.

The slight decline of the share of the international debt securities

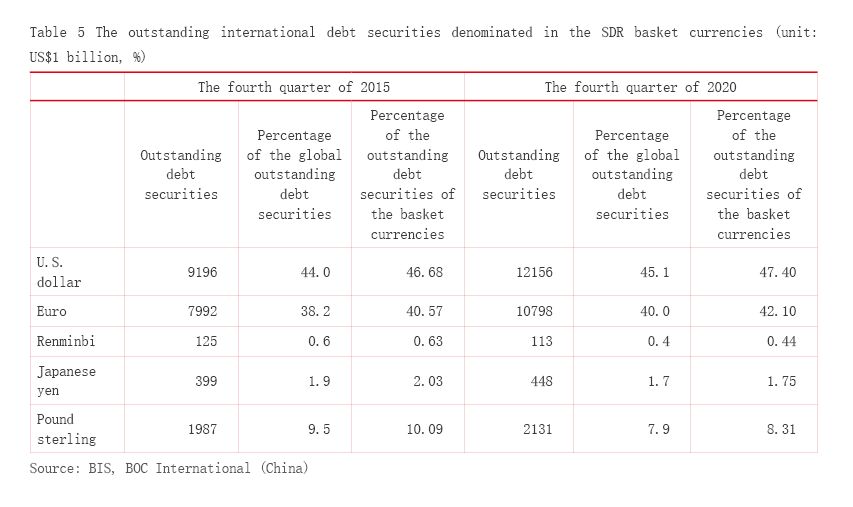

The data on international debt securities is a mirror of the currency usage in the international debt market. The share of international debt securities in the formula for calculating the SDR currency weights refers to share of the international debt securities of a certain basket currency in the total international debt securities of all basket currencies at the end of the five-year period before the review. The BIS data shows that in the fourth quarter of 2020,the SDR basket currencies constituted 95.1% of the outstanding international debt securities,up by 0.9 percentage points from the fourth quarter of 2015. Among them,the share of international debt securities denominated in U.S. dollar and euro increased,while that of the pound sterling,Japanese yen and renminbi decreased. The share of renminbi international debt securities in the total international debt securities of basket currencies fell from 0.63% in the fourth quarter of 2015 to 0.44% in the fourth quarter of 2020 (see Table 5). It is worth noting that the BIS regards that when the direct issuer's residence,issuance registration place,governing law and listing place all point to the same country the debt securities are domestic,otherwise are international. Therefore,the BIS data does not include cross-border investments caused by non-residents investing in locally issued securities,that is,it can not fully reflect the use of currencies in the international debt market. In addition,as the BIS does not separately list the data of international bank liabilities denominated in the renminbi,this paper assumes that the share of international bank liabilities at the end of 2020 is the same as that at the end of 2015. Under this condition,according to the formula for calculating SDR currency weights,the share of renminbi-denominated international debt securities declined by 0.19 percentage points,which will reduce the weight of the renminbi in the SDR basket by 0.03 percentage points.

Conclusion

In accordance with the review criteria of SDR currency weights,the renminbi internationalization has made further progress in recent years. From the perspective of absolute level of various indices,China’s exports in goods and services account for a relatively high proportion of the total of all basket currency issuing economies,averaging 24.87% from 2016 to 2020,second only to the Eurozone,but the shares of renminbi concerning financial indices are relatively low. At the end of 2020,the share of official foreign exchange reserves was 2.43%; during 2016 and 2019,the share of average foreign exchange trading volume amounted at 2.68%; at the end of 2020,the share of international debt securities was 0.44%,all significantly lower than those of the other four currencies. In terms of the changes in various indices,the share of exports,the share of official foreign exchange reserves,and the share of foreign exchange transactions rose by 1.80,1.29,and 1.63 percentage points respectively,and the share of international debt securities fell by 0.19 percentage points. With the weights of indices known in the formula for calculating the SDR currency weights,assuming that the share of renminbi-denominated international bank liabilities remains unchanged,it can be estimated that the weight of renminbi in the SDR basket may have increased by 1.57 percentage points,that is,the weight has risen from 10.92% to nearly 12.49%,with renminbi continuing to rank the third in weight in the SDR basket.

However,it should be emphasized that this is only a rough estimate based on the available data. Since different indices have different time ranges and publication frequencies,and the data collected for 2022 IMF SDR review will come from 2017 to 2021 (the latest five calendar years) with some indices adjusted or supplemented,the author's estimates will differ from the weights given by the IMF in 2022. Nevertheless,considering the relatively small room for adjustment of the data on the share of exports which weighs the largest in the formula for calculating the SDR currency weights, it is expected that the renminbi weight will increase in the new round of SDR review if the formula remains unchanged.

The author is the global chief economist of BOC International (China)