New Trends in FDI Flows in China

Foreign direct investment (FDI) is an important driver of global industrial and supply chains. Affected by the COVID-19,the total global FDI fluctuated greatly from 2020 to 2021. In 2021,China's FDI has grown rapidly,showing that China's position in the global economic structure and global influence has been constantly improving. In the future,with the policy change of the Federal Reserve,the adjustment of the global industrial chain layout and the continuous escalation of the competition between major powers,the global FDI flow pattern will be further adjusted in depth. It is expected that the long-term positive trend of China's use of FDI will not change.

New Characters on China's FDI in Recent Years

China's FDI has maintained steady and independent growth,compared with the large fluctuations of FDI in major economies. Since the reform and opening-up policy in the 1980s,China's FDI flow has maintained an overall growth trend except for a few years when it showed point-like fluctuations influenced by internal and external economic conditions ,but the year-on-year growth rate has gradually decreased. For example,the average annual growth rate from 1980 to 1989 was 38.9%,the average annual growth rate from 1990 to 1999 was 9.6%,the average annual growth rate from 2000 to 2009 was 2.9%,and the average annual growth rate from 2011 to 2019 was 0.5%. Since the beginning of the new century,except for the decline in 2000 (-13%) and 2010 (-17%),which were affected by the global economic downturn,the rest years were dominated by small increases,which were free from cyclical fluctuations compared with advanced economies. Affected by the rise of trade protectionism and the shrinking global trade since 2016,China's FDI flow has maintained a slight increase in the range of 1%-2%.

Since 2020,China's FDI has entered a stage of accelerated inflow. With the impact of COVID-19,the global FDI flow in 2020 dropped sharply by 44% year-on-year to US$859 billion,which was less than US$1 trillion for the first time since 2005,and was more than 30% lower than the trough. Due to China's early control of the spread of the epidemic,China's FDI flow in 2020 reached US$163 billion,a 4% increase compared with the reverse change of developed economies,the highest value in this century,overtaking the United States to become the largest foreign capital inflow country. In 2021,FDI in China maintained a high-speed growth of 20%,continuing the trend of accelerated inflow of FDI.

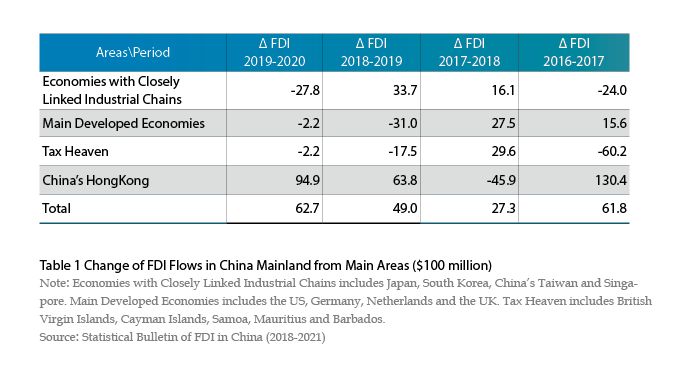

In recent years,the capital decoupling policy implemented by the United States has not had a significant impact on FDI flows in China. As of the end of 2020,the utilization of FDI in China has generally maintained a stable but increasing situation. First,Japan,South Korea,China's Taiwan,and other economies closely linked with our industrial and supply chains are still important sources of FDI for us. Except for a slight decline in 2017,they have maintained steady growth in the rest of the year. Second,the developed economies of the United States and Europe are generally stable but fluctuated slightly. China’s actual use of FDI from the United States and Europe continued to grow from 2016 to 2018,after that,there was a slight drop of 3.1 billion dollars in 2019. The third is that the “tax havens”,including China’s Hong Kong Free Port and the Cayman Islands have relatively large short-term fluctuations. Except for 2018,the complementary relationship between the two has played a role in promoting my use of FDI.

Long-Term Trend Factors Support China's FDI

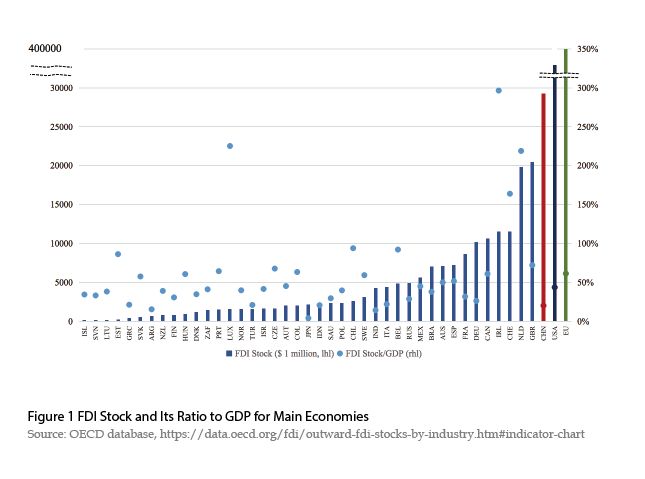

In the long run,the growth of global FDI has been sluggish since 2015. Developing and developed economies have changed the trend of "sharing half and half" since the new century,showing an inverse relationship. The proportion of China's FDI stock is much lower than that of developed countries. With the continuous improvement of China's position in the global industrial chain and the expansion of the economic and trade cycle in the Asia-Pacific region with China as the core,China's FDI has an endogenous driving force for continuous growth.

Even though China's FDI stock is relatively low,there is much potential for improvement. China maintains a high level of FDI flow utilization,but there is still a big gap with the developed countries in terms of the stock volume. At the end of 2019,China’s FDI stock (2.9 trillion US dollars) ranked the third,after the EU and the US,and the absolute size is only equivalent to 31% of the US and 7.8% of the EU. At present,the ratio of China's FDI stock to GDP is 20%,far lower than the US (44%) and the EU (61%),and even lower than the global aver