What is Steering the Direction of Capital Flows?

Author: Wu Ge Cao Haiwei Yu Tao Gao Tong

As a basic element of economic life,capital flow has its own running rules. Cross-border capital flows are affected by both external and internal factors. The external factors include policies and economic fundamentals of major overseas economies,global risk preference,etc.,while internal factors include domestic policies and economic fundamentals,institutional changes,etc.

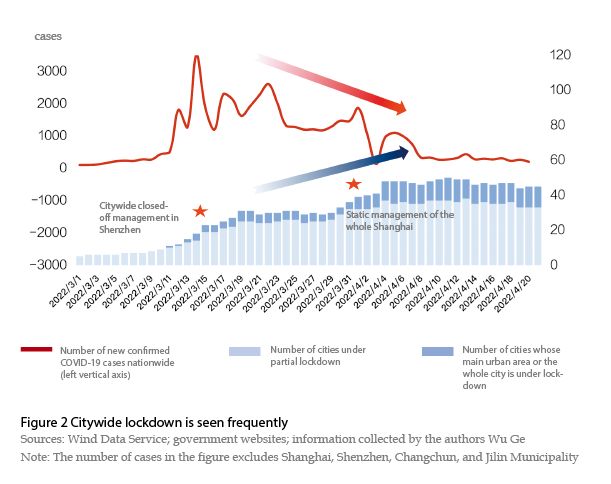

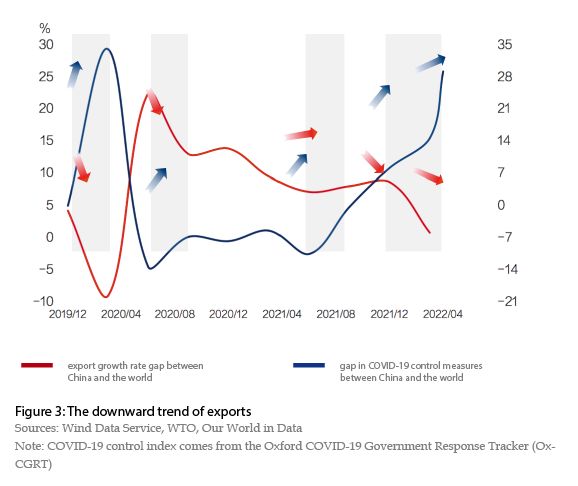

Recently,there are evident signs of short-term capital outflows. Since March,net outflows through the northbound Stock Connect program with China’s Hong Kong nearly reach the level of that during the Wuhan lockdown in 2020. According to IIF statistics,in March,China has capital outflows of US$11.2 billion in bonds and US$6.6 billion in stocks,the highest among emerging market countries in the same period. In a situation where the Fed is widely expected by the market to aggressively raise rates and downsize the balance sheet while China’s COVID-19 waves increase short-term volatility of economic fundamentals,both the external and internal factors exist to influence capital flows. What is steering the direction of capital flows? Is it a short-term perturbation or a long-term trend?

External Factors are Certainly Important

When it comes to cross-border capital flows,external factors are indeed important. According to Interest Rate Parity,international short-term capital pursues higher yields,hence it flows to countries with higher interest rates. But due to notable misalignment on economic cycles between China and developed countries like the U.S. since the start of this year,China’s monetary policy cycles are also apparently misaligned with these countries. This has led to a narrowing China-U.S. interest rate gap,even the yield on China’s 10-year government bond fell below that of the U.S. for the first time in the recent 12 years on April 11. In the U.S.,thanks to the large-scale fiscal stimulus and quantitative easing since the pandemic outbreak,the US resident income went up instead of down during the pandemic,making a quick recovery on the demand side that stays high; but supply chain disruptions caused by the pandemic and labor shortage resulted in ongoing supply side shortages. Due to persistent supply-demand contradiction,U.S. inflation rate has reached a 40-year high. The consumer price index rose 8.3% in April year-on-year,far higher than the Fed’s 2% inflation target. But its unemployment rate has fallen to pre-pandemic levels. Hence,the Fed has to move faster in downsizing the balance sheet. At the FOMC Meeting in May,the Fed raised interest rates by 50 basis points,the first 50bp hike since 2000. In the meantime,the Fed will begin to reduce the size of its balance sheet in June,which will be reduced by US$47.5 billion per month starting in June and then by US$95 billion starting in September. In this way,the downsizing this year would probably get close to the total downsizing scale in the last round. That’s equivalent to a 75 bp hike,which might go beyond market expectation. Against this backdrop of rapid quantitative tightening by the Fed,the China-U.S. interest rate gap will be sure to have notable narrowing or even inversion,indicating a short-term pressure of capital outflow.

In a situation where the Fed and the central banks in most developed countries all start a tightening cycle,the global financing cost gradually increases along with a notable tightening of liquidity. The Chicago Fed’s National Financial Conditions Index (NFCI) indicates that U.S. financial conditions have reached the tightest level since May 2020. As central banks across the world step up tightening,global liquidity will tighten further,which makes emerging markets face pressures of financial asset price adjustment and exchange rate depreciation. Such trends are also reflected in China’s recent “dual weaknesses” in both stocks and bonds as well as the rapid renminbi depreciation.

Another factor affecting cross-border capital flows is global risk preference. Recently,the Russia-Ukraine conflict has escalated geopolitical risks. Since the conflict started,western countries have imposed all-out sanctions against Russia,including freezing Russian central bank foreign currency reserves,kicking some Russian banks out of SWIFT. Affected by this,international investors have begun to control the risk exposure of their assets in emerging markets,which also aggravates China’s short-term capital outflow pressure.

Internal Factors are Even More Critical

Internal factors are decisive while external factors are conditions. Dialectic is also a