A Perspective of Infrastructure Investment on Stabilizing Growth in China

Economic downward pressure since the start of 2022 has seen a notable increase due to disruptions from COVID-19,which causes new difficulties and challenges to achieve the expected growth target set by the government this year. We expect that the macroeconomic counter-cyclical adjustment will be significantly stronger,and infrastructure is one of the most important counter-cyclical adjustment tools. We believe that it is very necessary to further increase infrastructure investment,for which we are well placed. Doing so can serve as an essential support for economic growth this year. The market doesn’t need to be too pessimistic about China’s infrastructure investment growth and economic growth this year.

More Space for Action

A great number of projects have started this year for the 14th Five-Year Plan (2021-2025). In addition,there are plenty more projects waiting to start. In terms of policy arrangements,the first year of the 14th Five-Year Plan (2021) focused on top-down,overall-to-specific government department planning; the second year (2022) is the period of launching numerous projects. This year,each province has plenty more projects to start,hence there is still growth space for infrastructure. As of early April,26 provinces (provincial-level municipalities,and autonomous regions) have released their key project construction plan for 2022. There is a total of 31,467 key projects that involve an annual investment of around 11.7 trillion yuan. On a comparable basis,this is 8% higher than in 2021,indicating a plenty of project choices.

Investment plans for key projects were well achieved in the past,and projects waiting to start will have better implementation conditions when things are getting better about COVID-19. We have gone through the finished actual investment for key projects in 10 provincial administrative regions in 2021. Compared with planned investment amount,the completion rate was 102%-129%. If there is gradual improvement about COVID-19,projects waiting to start will get better implementation conditions,and investment plans this year will be more likely to be realized.

Capable to implement: funding sources are improved

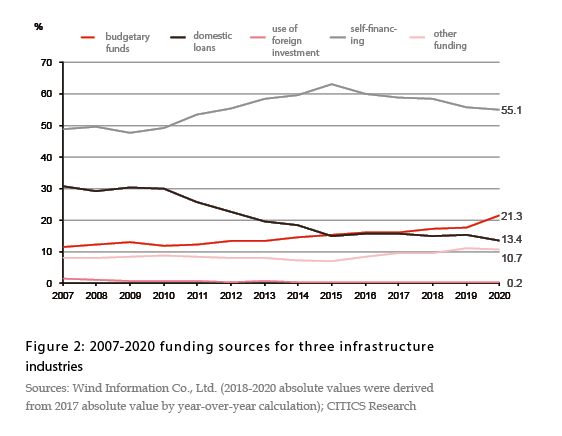

Fiscal funding accounts for an increasingly higher proportion of the project capital sources for infrastructure industries. Infrastructure contains three industries with 12 sub-sectors—production and supply of electricity,heat,gas and water; transportation,storage and post; water conservancy,environment and public facilities. The National Bureau of Statistics of China (NBSC) categorizes infrastructure funding sources into five ones—national budgetary funds,domestic loans,self-financing,use of foreign investment,and other funds. We may calculate infrastructure growth by estimating these five categories. According to the past funding sources of the three infrastructure industries released by the NBSC,self-financing accounts for 40%-60% of the total infrastructure funds,and the proportion went down a bit after 2015; the proportion of budgetary funds continued to rise and surpassed domestic loans in 2017 to become the second biggest funding source with a proportion of 16.1%.

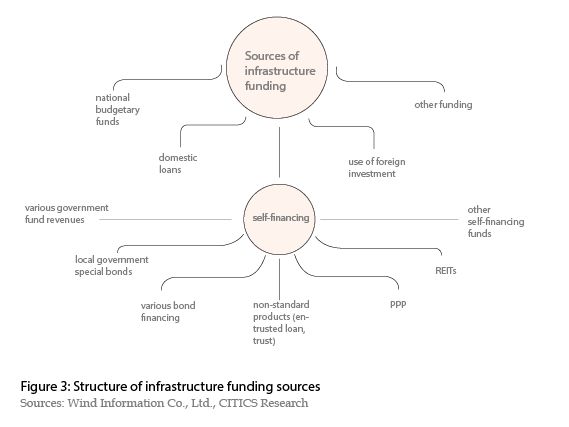

The categorization of funding sources under the NBSC caliber are easy to underestimate the share of fiscal funds in infrastructure projects. Self-financing has a complex mix that covers both fiscal funds and the various funds from enterprises via financing instruments. Therefore,if viewed directly,self-financing has the biggest share,while the share of national budget is low. We think that such categorization largely underestimates the share of fiscal funds from a direct view. NBSC’s categorization caliber for funding sources doesn’t have a clear distinction of the real nature of funds. In reality,fiscal funds and social capital are quite independent. Hence,we believe we should have a direct distinction between fiscal funds (budgetary funds,local government funds,local government special bonds) and social capital (bank loans,corporate self-financing,among others).

We estimate that the share of fiscal funds could reach half of the total for infrastructure projects,and fiscal funds are the largest funding source. Take a look at the funding sources in 2020. Project funding for the three infrastructure industries totaled 15.7 trillion yuan,among which were 8.7 trillion self-financing,3.3 trillion national budgetary funds,2 trillion domestic loans,1.7 trillion other funds,while using 31.1 billion yuan of foreign capital. From the perspective of fiscal funding,there were three parts,i.e.,national budgetary funds,local government funds,and local government special bonds. In 2020,government fund expenditure nationwide reached 11.8 trillion yuan. This included railway construction funds,port construction funds,among others. It also included funds used for infrastructure-related matters in land sale such as land leveling. A conservative estimate indicates that these funds accounted for at least 20% of the 11.8-trillion-yuan expenditure. That’s 2.4 trillion yuan from government-related infrastructure construction. Thirdly,local government special bonds have become an important source of infrastructure funding in recent years. The issuing scale of such special bonds in 2020 was 3.75 trillion yuan. Due to COVID-19 outbreak that year,the finance department clearly required special bonds to support infrastructure-related fields,but with a trend of being high first and going low later throughout the year in terms of its share in infrastructure construction. By conservative estimates,some 30% of special bonds were used for infrastructure construction in 2020,special bonds contributed 1.13 trillion yuan to infrastructure construction. Overall,in 2020,the three parts of fiscal funding totaled 6.83 trillion yuan,accounting for 44% of the total infrastructure funds.

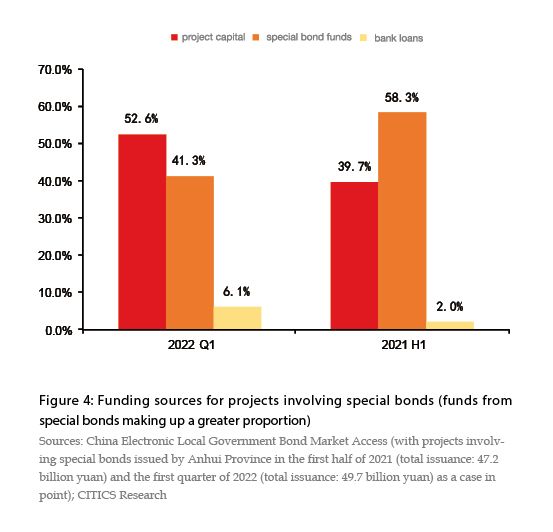

If we take a look at special bond projects,special bond funds account for over 40% of the total used in such projects. Plus,government funding makes up a large share of the total project funding,fiscal funds have a higher percentage of the total. We take special bond projects as an observation target. Considering that the incremental issuances of special bonds are similar in total amount,we did a comparison analysis of the special bond projects newly issued by Anhui Province in the first quarter of 2022 (total issuance: 49.7 billion yuan) and the first half of 2021 (total issuance: 47.2 billion yuan). Firstly,the funding sources vary from project to project,mostly categorized into three types—project capital,special bond funds,and other funding. But to make it clear,project capital contains government funding—either budgetary funds or government funds,among others. Secondly,the proportion of special bond funds in special bond projects is 40%-60%,and this year the proportion has a certain decline. Thirdly,in this year project capital has a higher proportion than last year. But taking into account of the financing pressure at local governmental platforms and feedback from surveys,we believe that the main reason for project capital’s higher proportion was the promotion by budgetary funds.

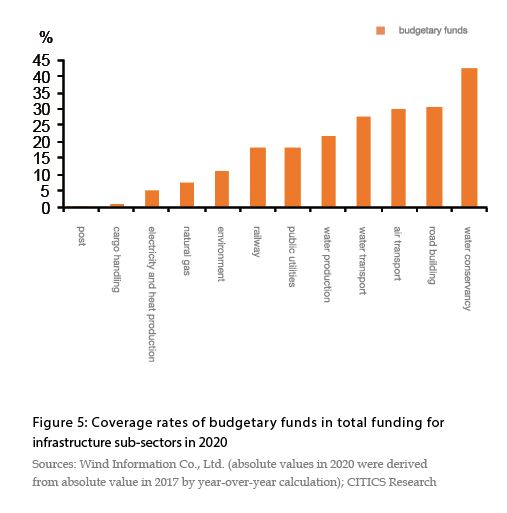

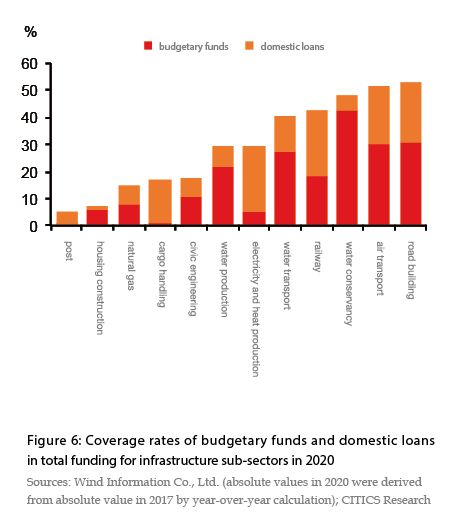

In terms of the sub-sectors