How to Use Announcement Effect to Stabilize the Economy and Prevent Risks

In the process of a country's economic development,how to guard against risks and avoid financial crises is an eternal theme. The history of financial crises over the past eight hundred years shows that while some crises are destined to happen,some potential crises can be avoided if managed properly in a timely manner.

During the rapid growth of the past four decades,China's economy has also encountered tempestuous storms,including the Asian financial crisis in 1997-98,the global recession that started in the United States in 2008,the stock market crash and capital outflow in 2015-16,and the bond market default storm in 2018 and the shock of the Covid-19 epidemic in since early 2020,but China finally managed to survive without a profound negative stock market and economic collapse similar to Japan's circa 1990.

However,it is worth paying close attention to the fact that the Chinese economy is currently facing triple pressures of shrinking demand,supply shocks,and weakening expectations,and we need to find ways to meet the challenges. Be alert to major potential risks and learn how to respond to avoid a crisis. In particular,a deep understanding of the critical importance of well-designed policies to achieve a positive "announcement effect" is needed. At a critical juncture,there must be the determination and guts to implement policies with a powerful "announcement effect" to produce the "Draghi moment" that can turn expectations around completely.

The "Announcement Effect": Theoretical Origin and Practice in Europe

The so-called "announcement effect" of a policy refers to the fact that after a policy is announced,although no specific measures have been implemented,it is enough to change people's thinking,and because people believe it will happen,it can immediately lead to a change in expectations. The term "announcement effect" was first coined by British economist John Richard Hicks,who won the Nobel Prize in Economics in 1972. In his 1977 book,he made a very direct and clear exposition of the meaning of the "announcement effect" and had a profound impact on future policymakers. (Hicks,John,1977. "Economic Perspectives: Further Essays on Money and Growth," OUP Catalogue,Oxford University Press.)

Of course,before Hicks,Ralph George Hawtrey,a famous British economist and a close friend of Keynes,had expressed a similar view,but he regarded it more as a "psychological effect" . Hicks,on the other hand,believed that it was rational behavior beyond psychological influence,and used the term "announcement effect" for the first time.

Not all policies can produce the announcement effect that policymakers hope,that is to say,the announcement effects of various policies are also different in size and strength. Some policies have little response,some only have a certain impact,and some others have far-reaching effects. In the author's opinion,when the impact is extreme,it will produce a special "Draghi moment",in other words,the "Draghi moment" is actually the highest level of the announcement effect produced by a policy.

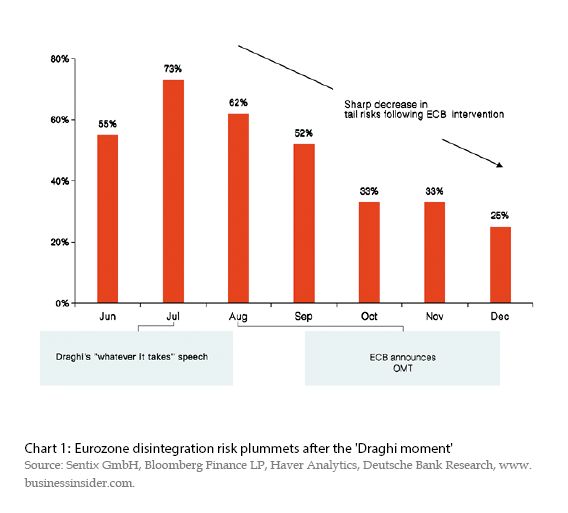

The term "Draghi moment" is named after Mario Draghi,the former president of the European Central Bank(ECB) and the current Prime Minister of Italy. Draghi was once hailed as the greatest central banker of our time by Nobel laureate Krugman. When he was appointed as ECB president in November 2011,the European debt crisis broke out and the euro zone was on the verge of disintegration. On July 26,2012,at a time when the whole world was pessimistic about the survival of the euro,Draghi flatly declared at a global investment conference in London that "…the ECB is ready to do whatever it takes to preserve the euro.” And emphasizing "…believe me,it will be enough.” This had a profound effect on boosting market confidence,which saved the euro,literally. (See Chart 1)

The phrase "whatever it takes" has gone down in history with Draghi himself,and the moment when the Italian uttered the words that instantly changed market confidence is known as the "Draghi moment." In 2014,Draghi was named the eighth most influential person in the world by Forbes magazine for his successful rescue of the euro. In 2015,Fortune magazine named him the second-best leader in the world.

The "Announcement Effect": How Did the Fed Avoid a Financial Crisis?

The Federal Reserve(the Fed,the U.S. central bank) has also had its proud "Draghi moment." In March 2020,the Covid-19 epidemic began to ravage the world,causing violent turbulence in the financial. In the U.S.,capital has been fleeing from stock and bond funds,leveraged loans have suffered huge redemptions,money-market funds have shrunk significantly,and Treasury bond volatility has approached levels seen during the 2008 financial crisis. Investors are like frightened birds whose risk appetite has plummeted,and funds are chasing after liquidity and high-credit assets in search of safe havens. In addition,tight domestic liquidity has forced American companies and financial institutions to withdraw huge amounts of funds from abroad,triggering a global dollar shortage.

The worsening of the epidemic and the economic shutdown combined with financial shocks have made the economic recession a foregone conclusion. In this context,once the liquidity crunch turns into a repayment problem,contagion will easily lead to panic and run,which will lead to the outbreak of financial crisis. At that time,some pessimists predicted that the severity of the potential crisis might exceed that of 2008,and they did not even rule out a depression like the 1930s.

Drawing on the lessons of sluggishness and unfavorable response to the crisis in 2008,this time the Fed acted quickly,boldly and decisively,and a series of emergency policy tools were like a storm.

When the epidemic has only spread in a small area and the economy,financial markets and people's lives have not been disturbed in any way,the Fed held an emergency meeting outside its regular schedule on March 3 and announced a 50 basis points cut in interest rates. The author was visiting Harvard University at the time as a research scholar,and in my impression,many people around me were quite surprised by this,and some even felt that the Fed had overreacted.

In hindsight,the Fed was actually quite forward-looking. Sure enough,with the further spread of the epidemic,financial market turmoil intensified,especially after the U.S. declared a state of emergency on March 13,economic activity also plummeted. On March 15,the Fed held another emergency meeting to cut interest rates by 100 basis points to around zero,while increasing holdings of Treasury securities and agency mortgage-backed securities(MBS),expanding open market operations,encouraging banks to borrow from the discount window,easing capital and liquidity constraints on banks,removing minimum reserve requirements. The Fed also stated that it "is prepared to use its full range of tools to support the flow of credit to households and businesses.” (See Chart 2)