The China's Foreign Exchange Market Shows Greater Resilience since the Reform

At the start of the "August 11" exchange rate reform in 2015,China experienced intensive cross-border capital flow shocks,witnessing capital outflows,foreign reserve declines,and RMB depreciation. In 2017,the RMB exchange rate rebounded from falling. Since then,the People’s Bank of China (PBC) has mostly withdrawn from normalized intervention in the foreign exchange market,returning to a neutral exchange rate policy. The Chinese foreign exchange market has since become increasingly resilient. This article analyzes the resilience of China's foreign exchange market and the reasons behind its resilience. It also proposes measures to further strengthen the resilience of the exchange market.

Two signs that the Chinese foreign exchange market has grown more resilient

Since 2018,China's foreign exchange market has withstood a number of sharp drops in the renminbi exchange rate and capital flow reversals.

Withstanding sharp RMB exchange rate falls

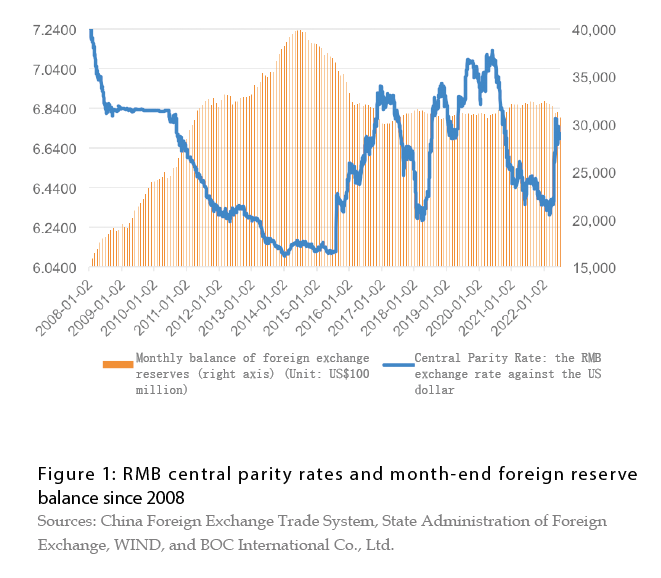

When the “August 11” exchange rate reform started,the unexpected fall of the central parity rate of the RMB triggered a market panic of RMB depreciation. By the end of 2016,the RMB exchange rate against the US dollar was close to 7 while China’s foreign exchange reserves fell to near US$3 trillion. At the time,debates were over whether to maintain the RMB exchange rate or the foreign exchange reserve. In 2017,however,the RMB exchange rate against the US dollar rose by around 7 and China’s foreign exchange reserve increased by US$129.4 billion. Since then,the RMB exchange rate against the US dollar has risen and fallen healthily,with wide fluctuations (see Figure 1). Amid the sharp depreciation of the RMB,the exchange rate played an effective role as leverage,where the currency was bought during appreciation and sold during depreciation. China’s foreign exchange kept balanced supplies and demands at both home and abroad.

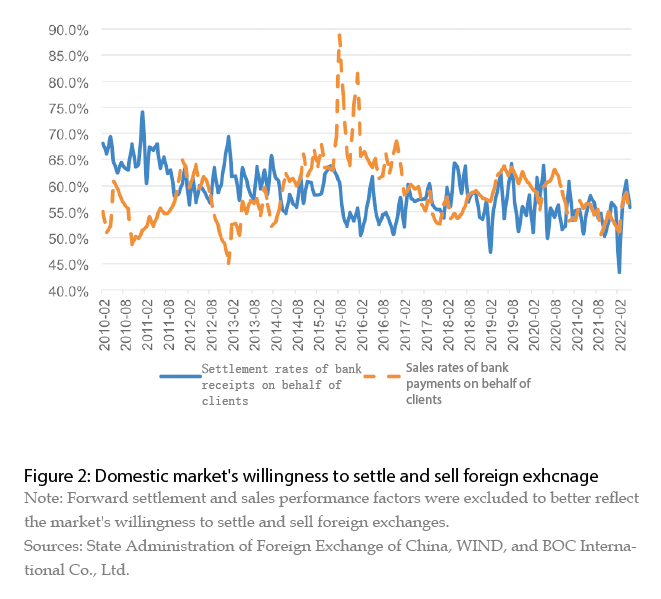

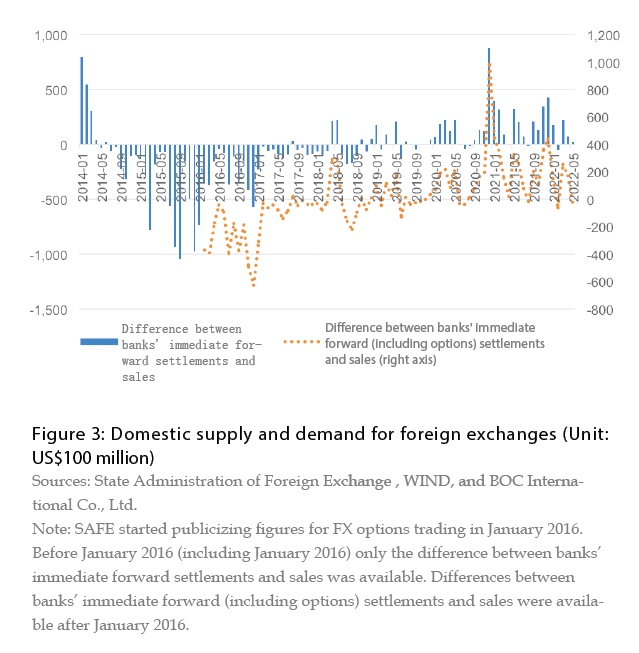

The first challenge was when the RMB exchange rate rapidly retraced between early April and early November 2018. At the beginning of 2018,the RMB extended the previous year's strength,rising to around 6.28 in early April,a new high since the exchange rate reform. In the following eight months since then,the RMB depreciated by around 10%. In early November 2018,the RMB rate against the US dollar depreciated to around 7 twice (see Figure 1) due to the US Dollar Index rebound,trade friction escalations,and domestic economic downturns. However,the market did not panic but showed a stronger willingness to purchase the RMB and a weaker willingness to sell the RMB: from April to October 2018,the average settlement rate of bank receipts on behalf of clients excluding forward performance was 60.6%,3.6 percentage points higher than the average between January 2017 and March 2018; the average sales rate for bank payments on behalf of clients was 56.4%,down by 0.8 percentage points (see Figure 2). During the same period,the average monthly surplus of bank immediate forward (including options) settlements and sales were US$1 billion,compared with a monthly deficit of US$6.5 billion between January 2017 and March 2018 (see Figure 3).

The second challenge was when the RMB exchange rate broke 7 against the US dollar in August 2019,and when the RMB depreciated to a 12-year low in late May 2020. In May 2019,the RMB rate against the US dollar depreciated to around 7 for the third time since the “August 11” reform due to Sino US economic and trade conflicts but did not breach 7. In early August 2019,the RMB exchange rate “broke 7” when the two countries’ trade negotiation stagnated,adding flexibility to the currency’s exchange rate. In early 2020,the RMB turned to depreciate after the outbreak of COVID-19 severely impacted the domestic economy. Coupled with geopolitical factors,the RMB exchange rate fell below 7.10 by the end of May (see Figure 1). However,enterprises continued to "settle foreign exchange at higher rates": from August 2019 to May 2020,the average settlement rate of bank receipts on behalf of clients was 57.5%,1.7 percentage points higher than the average value from November 2018 to July 2019; the average sales rate for bank payments on behalf of clients was 60.4%,up by 0.4 percentage points (see Figure 2). During the same period,the average monthly surplus of bank immediate forward (including options) settlements and sales was US$7.3 billion,and the average monthly surplus from November 2018 to July 2019 was US$2.1 billion (see Figure 3).

The third challenge was the fast RMB depreciation since mid-March 2022. From early June 2020,the RMB appreciated due to multiple factors including successful COVID-19 prevention and control,fast economic recovery,widening US-China spread,and weakening US dollar index. The RMB rate against the US dollar rose to around 6.30 by early March 2022,a four-year high. However,since mid-March,the RMB devalued again due to geopolitical risk spillover,COVID-19 outbreaks,and a strong rebound in the US dollar index. The RMB rate fell to around 6.80 by mid-May,a cumulative decline of over 7% in two months (see Figure 1). However,businesses continued to "settle foreign exchange at higher rates": from March to May 2022,the settlement rate for bank receipts on behalf of clients averaged 57.6%,3.6 percentage points higher than the average from June 2020 to February 2022; the sales rate for bank payments on behalf of clients averaged 56.8%,up by 0.9 percentage points (see Figure 2). The average monthly surplus in banks' immediate forward (including options) settlements and sales was US$12.8 billion during the same period and US$20 billion from June 2020 to February 2022 (see Figure 3).

Withstanding the reversal of international capital flows

In terms of the balance of payments,China suffered from surging capital outflows at the beginning of the "August 11" exchange rate reform. This was due to the combined impacts of the “stockpiling foreign exchange amongst the private sector” policy and “debt repayment”. China found itself in a vicious circle of “capital outflow to foreign exchange reserve declines to RMB depreciation”. In the first quarter of 2022,the RMB exchange rate quickly retraced due to the combined impact of internal and external factors. Short-term foreign capital utilization turned from a net inflow of US$62 billion in the previous quarter to a net outflow of US$61.8 billion. Aggregated with short-term investment net outflow,the net short-term capital outflow was US$109.6 billion,up by 203% quarter-on-