Industrial Chain under Changing Situation

Author: Zhang Jingjing and Luo Dan

Japan had moved into trade deficit in 2021 that continued to widen since then. In 2022,manufacturing economies such as South Korea,Vietnam,and Germany have also fallen into trade deficits. Meanwhile,commodity exporters have shown a substantial expansion in trade surplus. Explicitly,the superficial reasons are commodity prices and exchange rates,but the underlying reason is the supply chain layout. In such a changing situation,a supply chain with imports or exports highly dependent on the external market is extremely unstable. China pursues the“dual circulation”strategy which allows the domestic and overseas markets to reinforce each other with the domestic market as the mainstay,and this helps to strengthen its supply chain. For investment,the stability of the industrial chain needs to evaluate from the following three aspects: integrity,rapid response capability,and continuous upgrading capability. In addition,the joint construction of the Belt and Road will also be a long-term strategy.

Manufacturing countries have shown trade deficits

Several manufacturing economies have fallen into deficits. In May 2022,Germany had the largest trade deficit in years. Although this was the first time that Germany ran up a deficit in recent more than 30 years,it was not completely unexpected if we judging from the timeline of recent years. In fact,Germany had showed a trend of shrinking surplus at the beginning of 2021,which speeded up since September 2021. Similar to Germany,South Korea and Japan are also traditional major producers. As of June 2022,Japan has run a deficit for 11 consecutive months,which was also the fundamental factor behind the depreciation of the yen since 2021. South Korea had a trade deficit in January 2022,a surplus in February and March,and another deficit for four consecutive months since April. In addition to these traditional major producers,Vietnam,as a new processing plant base,has also faced trade deficits in 2022. It had an overall trade deficit in the first half of this year,and a trade deficit in the second quarter despite a year-on-year growth of 21% in the value of exports.

The superficial reasons are commodity prices and exchange rates,but the underlying reason is the supply chain layout

Superficial reasons: the price increase of imports far exceeds that of exports,and the currency depreciation further pushes up the prices of imports

Upstream supply shocks and downstream weak demand have continued to widen the price gap between imports and exports. Manufacturers are facing upstream a rapid rise in the price of energy and raw materials,and downstream the contraction of global aggregate demand due to the successive interest rate hikes by the Federal Reserve and the European Central Bank. This has prevented manufacturers from transferring rising import costs to export commodity prices. Take Germany,for example. After the outbreak of the Russian-Ukrainian conflict,German companies have confronted the dual dilemma of both energy shortage and high prices in import and production. As of May 2022,the import price index has reached 139.5,and the export price index 122.4. The year-on-year growth of import prices are much higher than that of export prices,with a widening gap between the two increases,which has directly led to the shrinking of the trade balance.

Regarding exchange rates,in the abnormal situation where commodity prices and the US dollar index rise in tandem,the depreciation of the local currency has pushed up the import prices,leading to an unusual increase in the value of imports. Since the beginning of 2022,the US dollar index has continued to rise,and so have the energy prices under the supply shock. The euro and the yen,two currencies with higher weights in the US dollar index,have both depreciated. The depreciation of the local currency has further raised the import prices in manufacturing countries,causing an extraordinary growth in the import value.

The underlying reason: a supply chain whose “two ends” being reliant on the external market is extremely unsecure

When the “beginning” and “end” of an industrial chain both depend on the external market,the trade value of imports and exports tend to be unstable under the impact of fluctuations in the international political and economic situation. To illustrate,Germany's foreign trade dependence (value of imports and exports/GDP) is as high as 70%. The main imports include chemicals,oil and gas,machinery and steel products,and the main exports include automobiles,communication technology,machinery and chemical products. It is obvious from the industrial structure that Germany’s cost of imports is closely related to the price of commodities such as energy. In terms of exports,according to the data of 2021,only with the US did Germany’s exports grow faster than imports,while with other trading partners its imports generally expanded faster than exports. Especially with Russia and China,the growth rate of exports has plunged.

China's import and export price increases have not significantly deviated. The core reason is that China has been promoting the localization of the industrial chain to support the production and operation of enterprises. The government has taken measures to secure energy supply and stabilize prices,accelerating the release of domestic energy production capacity. This helps reduce dependence on energy imports while meeting domestic production needs,and offset the import cost pressure caused by rising international commodity prices. Data show that from January to June,the output of industrial raw coal above designated size was 2.19 billion tons,a year-on-year increase of 11.0%,with the growth rate up by 4.6% year-on-year. Imported crude oil reached 252.52 million tons,down by 3.1% year-on-year. Imported natural gas amounted to 53.57 million tons,shrinking by 10.0% year-on-year. Meanwhile,the government,industry and enterprises make joint efforts to eliminate shortcomings of the industrial chain in key areas,improving the security of the industrial chain and the modernization level of the industrial supply chain. By the end of 2021,China has established 21 national manufacturing innovation centers,involving various fields including intelligent manufacturing,5G industry,and core materials.

China's industrial strength

Three elements of the industrial chain: integrity,rapid response capability,and continuous upgrading capability

The export commodity structure of countries such as Germany,Japan,and South Korea relies heavily on the recovery of the global economy and demand. In contrast,China's export commodity structure since 2022 is mainly connected to daily life and travel necessities after the global epidemic prevention and control policy is loosened,the food crisis caused by the Russian-Ukrainian conflicts,and the demand for new energy vehicles generated by rising oil prices.

In the first half of 2022,the share of mechanical and electrical products in the total export value decreased,while that of agricultural products,luggage,clothing and toys in the total export value increased. Especially in June,the export value of agricultural products went up by 24.0% year-on-year,and that of luggage,toys and clothing rose by 47.1%,35.3% and 19.1% respectively. This suggests China's export commodity structure can quickly adapt to the global demand changes. Given that the rise in global energy prices since 2021 has pushed up the cost of oil-fueled automotive,more consumers have gravitated towards new energy vehicles. Since 2021,China's automobile cumulative export value and export volume have soared year-on-year. Especially those of new energy vehicles have rocketed 350% and 200% year-on-year respectively. In addition to the change in global consumer preferences,this has also benefited from the advantages of China's industrial chain. The industrial chain of China's new energy vehicles has become increasingly complete and continued to upgrade especially after the introduction of Tesla.

As China's core exports,the share of mechanical and electrical products in the total export value has plummeted since the beginning of 2022. Nevertheless,China's complete production chain and high production efficiency enables China's export commodity structure quickly adapt to the global demand changes. Therefore,despite the average performance of mechanical and electrical products,the structural highlights of exports can still support China's export growth,with no trend of a sharp reduction in the trade balance.

Deploy the Belt and Road Initiative and diversify export destinations

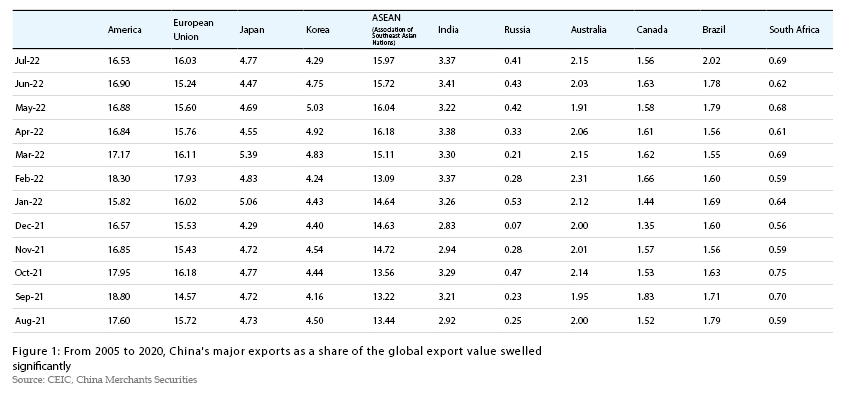

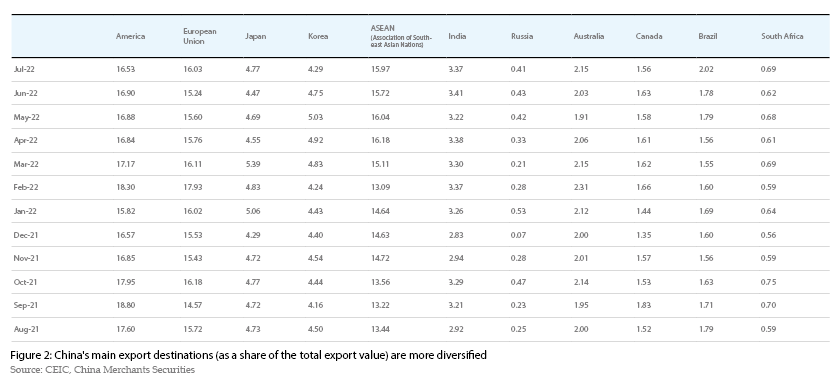

The Germany's export value to the EU comprises more than a half of its total export value,and South Korea's export value to China as a share of its total export value reaches around a quarter. Compared with Germany and South Korea,China has more diversified export destinations with lower dependence on specific ones. In recent years,China's export to the US as a share of the total export has generally shown a downward trend,accompanied by the upsurge in China's export to ASEAN and to South Korea. China is a major supplier of both upstream materials required by South Korea's new energy batteries,semiconductors,automobiles and other pillar industries. China is also ASEAN’s major supplier in machinery equipment and intermediate products. It means that the structural highlights of export destinations have become another main driving force for the increase of China's trade balance. It also shows that deploying the Belt and Road Initiative and diversifying export destinations are essential in expanding the advantages of China's industrial chain.

ZHANG Jingjing is the Chief Macro Analyst in China Merchants Securities

LUO Dan is a Ph.D in Economics,Nankai University