China's Financial Sector Opening Up and Currency Reform on the New Journey

The 20th National Congress of the Communist Party of China (CPC) was successfully held in October 2022. The Congress emphasized that the central task of the CPC will be to lead the Chinese people of all ethnic groups in a concerted effort to realize the Second Centenary Goal of building China into a great modern socialist country in all respects and to advance the rejuvenation of the Chinese nation on all fronts through a Chinese path to modernization.

Over the past decade,China made significant progress in opening up the financial sector. Major milestones include the launch of Stock and Bond Connect and RMB assets being added to major world indices. Meanwhile,the RMB exchange rate under the managed floating framework has witnessed wider movements in both directions after the reform in March 2014 and August 2015,also breaching the level of 7 yuan per US dollar in August 2019. The market is playing a more decisive role in the formation of the RMB exchange rate.

On China’s new journey to build a modern socialist country in all aspects,it is important to promote high-standard financial sector opening up,deepen the market-oriented currency reform,enhance the flexibility of the RMB exchange rate,and keep the RMB exchange rate basically stable at an adaptive and equilibrium level.

Building a High-Standard Socialist Market Economy

The meeting emphasizes to realize the Second Centenary Goal of building China into a great modern socialist country,we must fully and faithfully apply the people-centered development philosophy,continue reforms to develop the socialist market economy,and promote high-standard opening up.

Before the "8.11" currency reform in 2015,the private sector accumulated huge net external liabilities and currency mismatches due to the one-way appreciation of the RMB exchange rate for more than two decades. As the rigid exchange rate was maintained for a long time,the market lost its vigilance against the gradual reversal of the foreign exchange situation in 2014. It was not until the adjustment in the central parity quotation of the RMB against the US dollar on August 11,2015,the market became aware of it and suddenly fell into panic. In contrast,the RMB exchange rate fluctuated more frequently in both directions after breaching the level of 7 yuan per dollar in August 2019. As a result,it released market pressure promptly,avoided the accumulation of one-way expectations,and ensured the stable and orderly operation of the foreign exchange market.

The market-oriented currency reform is both a reform and an opening up,as the market is playing a more decisive role in the formation of the exchange rate. Meanwhile,the exchange rate with increased flexibility has promoted the concept of risk neutrality to gradually gain popularity,which in turn has motivated market participants to actively hedge against exchange rate risks. In recent rounds of exchange rate adjustments,the market remained orderly and participants behaved rationally.

The next five years will be a critical period for the start of building a modern socialist country in an all-around way. It is crucial to let the market play a more decisive and representative role in the exchange rate formation,and improve the formation mechanism of the central parity rate (or benchmark exchange rate). Also,it is important to expand the scope of foreign exchange market transactions,provide more trading tools,include more market entities,improve market infrastructure and supervision,promote the deepening development of the onshore foreign exchange market,and better adapt to the orderly financial opening-up and RMB internationalization.

That said,every currency policy choice (including exchange rate regime and exchange rate policy operation) has its pros and cons,and the challenges for the flexible exchange rate are that it is more prone to excessive and pro-cyclical fluctuations,deviating from fundamentals (also known as exchange rate overshooting). Therefore,the market-oriented currency reform should still pay attention to the role of the "two hands" of the market and the regulator. The central parity rate quotation mechanism and the counter-cyclical factor are the innovation of the managed floating exchange rate regime with Chinese characteristics. The excessive and disorderly fluctuations in the exchange rate still need to be guided properly under the premise of abiding by the neutrality of currency policy. This not only depends on communications by the authority but also on actions taken to deal with the transparency and credibility issues of the intermediate solution faced by managed floating (fixed and floating exchange rates are corner solutions).

Promoting High-Standard Opening Up

The Party Congress points out that one objective of the next five years is to make new strides in reform and opening up and put in place new systems for a high-standard open economy. This includes leveraging the strengths of China's enormous market and attracting global resources and production factors. Moreover,it also requires steadily expanding institutional opening up regarding rules,regulations,management,and standards.

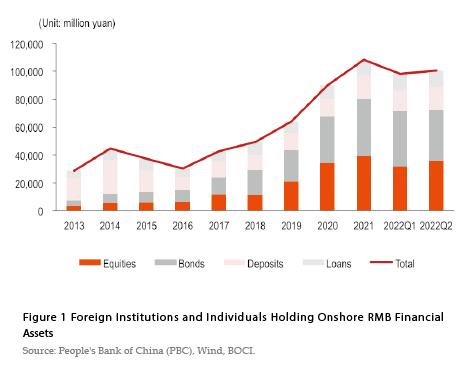

In recent years,China has taken a gradual and manageable approach to opening up the financial sector. Through this approach,China has made great progress in opening up the financial markets. By the end of the second quarter of 2022,the amount of the financial assets held by foreign entities such as domestic RMB stocks,bonds,loans,and deposits reached 10.1 trillion yuan,3.5 times the amount of the end of 2013. Among them,Chinese domestic stocks and bonds have become the prominent options for RMB assets allocated by overseas investors,accounting for 72 percent of total RMB assets held by foreign entities,in contrast with 26 percent as of the end of 2013 (See Figure 1).

The launch of Stock Connect and Bond Connect greatly accelerated the pace of China’s opening up financial markets. In November 2014,the Shanghai and Hong Kong Stock Connect was first launched. Later in December 2016,it was extended to encompass the Shenzhen market and removed the annual investment quota. Then,in June 2019,the Shanghai-London Stock Connect was officially launched in London.

In the bond market,the Northbound Bond Connect was officially launched in July 2017,which effectively complements the QFII,RQFII,and China Interbank Bond Market (CIBM) mechanisms. In September 2021,the southbound Bond Connect was then launched,marking the sailing of the two-way opening of Bond Connect.

In addition,the domestic bond market predates the stock market and takes the lead in the orderly opening of the primary market. Since 2005,foreign institutions have been allowed to issue RMB-denominated in the onshore primary market,also known as panda bonds. In recent years,the panda bonds issuance rules have gradually improved. Overseas issuers have covered various types of entities such as government institutions,international development institutions,financial institutions,and non-financial enterprises. By the end of October 2022,a total of 381 overseas issuers had issued 623.6 billion yuan worth of panda bonds.

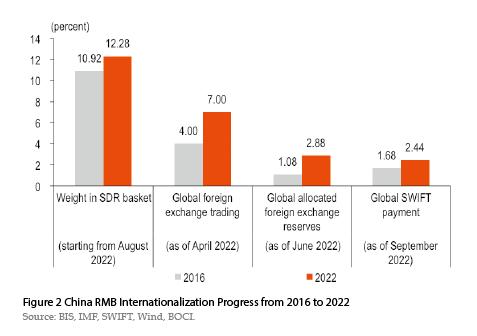

These opening-up efforts have made great progress and gained recognition from the international community. From 2018 to 2021,Chinese stocks and bonds were included in six world major stock and bond indices,demonstrating Chinses financial assets’ growing attraction to foreign investors. Furthermore,the International Monetary Fund (IMF) announced on May 11,2022,to raise the weight of the RMB in the Special Drawing Rights (SDR) currency basket from 10.92 percent to 12.28 percent,up by 1.36 percentage points from 2015. Also,according to the currency composition of official foreign exchange reserves (COFER) data by the IMF,global RMB reserve assets reached 322.4 billion US dollars by the second quarter of 2022,3.55 times that of the end of 2016. The corresponding RMB share in global allocated reserve assets has increased from 1.08 percent to 2.88 percent over the same period. In addition,the 2022 Triennial Central Bank survey from the Bank for International Settlements shows that the global average daily transaction volume of RMB reached 526 billion US dollars as of April 2022,an increase of 85 percent compared with April 2019 (the last survey),the share of RMB in global foreign exchange trading increasing from 4 percent to 7 percent (See Figure 2),and the world ranking rose from the eighth to the fifth.

Deepening the market-oriented exchange rate reform to better adapt to high-standard financial opening

Over recent years,there have been several rounds of quick adjustments in the RMB exchange rate. During these quick adjustments,the Chinese authority has adhered to the principle of currency policy neutrality. It did not introduce new administrative intervention measures,except adjusting macro-prudential measures such as the counter-cyclical factor,the foreign exchange required reserve ratio,etc. But rather,the authority steadily expand