China’s trade surplus, ex-Price effects, and RMB Exchange...

Title:China’s trade surplus, ex-Price effects, and RMB exchange rate against trade basket

The RMB exchange rate against trade-partner currencies has had a positive relationship with China¡¯s 12-month rolling trade surplus. As the international commodity prices increased significantly after the pandemic outbreak,creating large price effects on the trade growth rates,it is useful to analyze the evolution of imports and exports excluding the price effects.

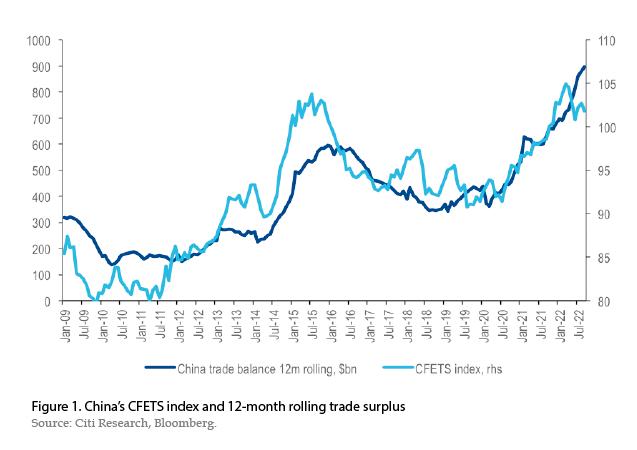

After the Covid-19 shock in 2020,the renminbi has appreciated significantly against its trade-partner currencies. The CFETS Exchange Rate Index,which measures the RMB exchange rate against a trade-weighted basket,has surpassed 100,reaching a new high. One important contributing factor is the significant increase in China’s trade surplus. The CFETS index has historically had a positive relationship with China’s 12-month rolling trade surplus (Figure 1). As the pandemic develops,and the macroeconomic situation continues to change domestically and globally,it is important to assess the outlook of the CFETS index – how the RMB exchange rate will evolve against its trade partners. And in this regard it is crucial to study the evolution of China’s trade surplus after the pandemic outbreak and consider how it will keep evolving in the next phase.

When looking at the trade surplus,a common perspective is to examine the nominal growth of imports and exports. After the pandemic outbreak,the nominal growth of imports and exports has been relatively high for a prolonged period. During the same period,the prices of international commodities have increased significantly. In this context,it is imperative to delve deeper than the appearance of high nominal growth rates in order to better grasp the dynamics of imports and exports,as well as their evolution.

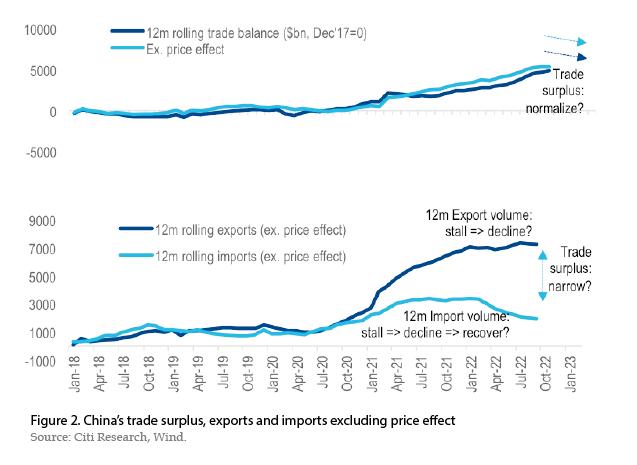

As the nominal growth rate can be split into two components - price growth and volume growth - one approach is to separate the price and volume components of imports and exports. China customs provides a set of indices that records the year-on-year growth of import and export prices,and the volume growth then is the difference between the nominal growth and the price growth. This tool helps to not only analyze and attribute the nominal growth to the individual components,but also helps to estimate imports and exports excluding price effects,arriving at one combined measure of the volumes of imports and exports,even as they include a wide array of individual goods in different quantities. With the estimated import and export volumes,we could also estimate the trade surplus excluding the price effect,and see how these ex-price measures evolve over the years. As the CFETS index is more closely related to the 12-month rolling trade surplus,in Figure 2,we show the 12-month rolling trade surplus,the estimated trade surplus excluding price effects,and the 12-month rolling imports and exports excluding price effects.

As shown in Figure 2,while the 12-month rolling trade surplus has been rising after the pandemic outbreak,imports and exports excluding price effects have experienced a few phases with different characteristics. Before mid-2021,both exports and imports increased; as exports were growing faster,trade surplus expanded. From mid-2021 to late-2021,exports continued to gain pace whereas imports started to stall. Trade surplus continued to expand. In 2022,12-month rolling exports also stalled,but as imports started to decline the trade surplus expanded further. This angle shows that the expansion in trade surplus is more complicated than just summarizing it as “strong exports”. On the one hand,exports were certainly strong and growing for more than a year,driven by a few factors: global demand for final products accelerated after the pandemic; and other parts of the global supply chain were more negatively impacted whereas China’s greater resilience allowed it to play a greater role as supplier of manufactured goods after the pandemic. But after 2022,the 12-month rolling export volume appears to have stalled (albeit at a high level). On the other hand,imports did not move in sync with exports and weakened earlier than exports. Imports are related not only to exports but also domestic demand. As domestic demand experienced more challenges in late 2021,the 12-month rolling import volume seems to have stalled (even as exports kept increasing),and in 2022 it began to decline.

Looking ahead,as imports recover and exports decelerate,China’s trade surplus could gradually normalize from very high levels. On the import side,the 12-month rolling import volume has declined significantly due to weakening domestic demand,including during the COVID-19 shock in 2022. In the next phase,import volumes may gradually pick up from low levels. This could narrow the trade surplus. On the export side,the factors so far supporting strong exports have been fading in strength. The 12-month rolling export volume has already stalled,and the next phase may see weakening due to a slowdown in global demand for final goods amid growing recession fears,recovery in other parts of the global supply chain from the pandemic shock,and some lingering effects of the 2022 COVID-19 shock on China’s export sector. This could narrow the trade surplus. These two forces combined could gradually lower China’s 12-month rolling trade surplus from a very high base to a more normalized level,even if in the short term there might be some compensatory growth to make up for logistical delays during the COVID-19 shock earlier this year.

With the 12-month rolling trade surplus gradually normalizing from a high level,there is a possibility of the CFETS index falling from a high level given the positive historical relationship between the CFETS index and the 12-month rolling trade surplus. The process is likely to be relatively gradual,unless there is a sharp decline in the trade surplus over a very short period,driven by an outsized drop in exports or increase in imports. The other elements of the balance of payments also seem less likely to serve as a strong offset to the normalization of trade surplus,or potentially could be an additional source of outflow. Portfolio investments are still less likely to turn into large inflows at this stage,given the less attractive interest rate differential. The services trade still has the potential of recovery in cross-border travel in the future,which would result in incremental outflows. In this process of gradual normalization,should there be a short-term speculative move driven by herd-behavior,it would be a scenario where more macro-prudential measures could become more likely. But if fundamental factors drive gradual normalization of the CFETS index,it should be seen as an acceptable outcome,as the exchange rate could play its role as an auto-stabilizer of the balance of payments.

In conclusion,the RMB exchange rate against trade-partner currencies (the CFETS index) has had a positive relationship with China’s 12-month rolling trade surplus. As the international commodity prices increased significantly after the pandemic outbreak,creating large price effects on the trade growth rates,it is useful to analyze the evolution of imports and exports excluding the price effects. While the 12-month rolling exports volumes strengthened first and later stalled,12-month rolling import volumes stalled earlier and declined later. In the next phase,there may be forces that could cause exports to come off from a high level and let imports recover from a low level,as global demand slows and domestic demand recovers. This may gradually normalize China’s 12-month rolling trade surplus to a lower level. And in this process,the CFETS index may also gradually move lower.

The author is Vice President,Emerging Markets Strategy,Citi Research