China's Balance of Payments in 2022: Fundamentals Remain Stable ...

Title:China’s Balance of Payments in 2022: Fundamentals Remain Stable

In 2022,under the unexpected impact of a series of internal and external factors,China’s balance of payments continued to maintain an independent equilibrium. The trade surplus in goods boosted the current account surplus to the second largest in history,while the basic balance of payments maintained a relatively large surplus,effectively hedging short-term capital account fluctuations.

According to the preliminary balance of payments data,China’s current account surplus increased in 2022. The basic balance of payments was strong despite unexpected effects from the spillover risk of the conflict between Russia and Ukraine,the Federal Reserve’s (Fed) aggressive tightening,and sporadic domestic resurgence of COVID-19 cases. In addition,capital outflows increased but tended to moderate. China’s foreign exchange reserves declined in nominal terms but increased in real terms. Generally speaking,the foreign economic sector has stood the test of shocks to capital flow and wide fluctuations in exchange rates.

The current account surplus reached its second-highest level in history,while the trade surplus in goods,as well as the volume of imports and exports,reached record highs.

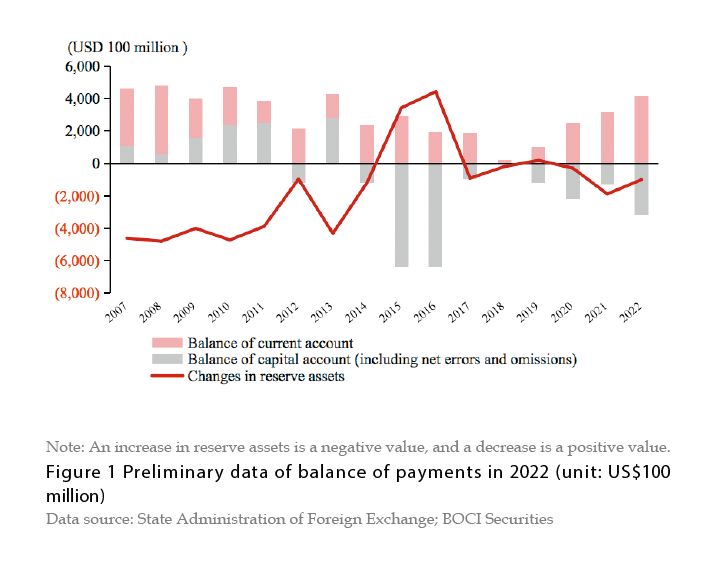

In 2022,China’s balance of payments continued to maintain an independent equilibrium under various unfavorable factors. Specifically,the current account surplus reached US$417.5 billion,up by 32% year on year. The non-reserve capital account deficit (including net errors and omissions) reached US$317.6 billion,a year-on-year increase of 1.46 times. Reserve assets rose by US$100 billion,down by 47% year-on-year (see Figure 1).

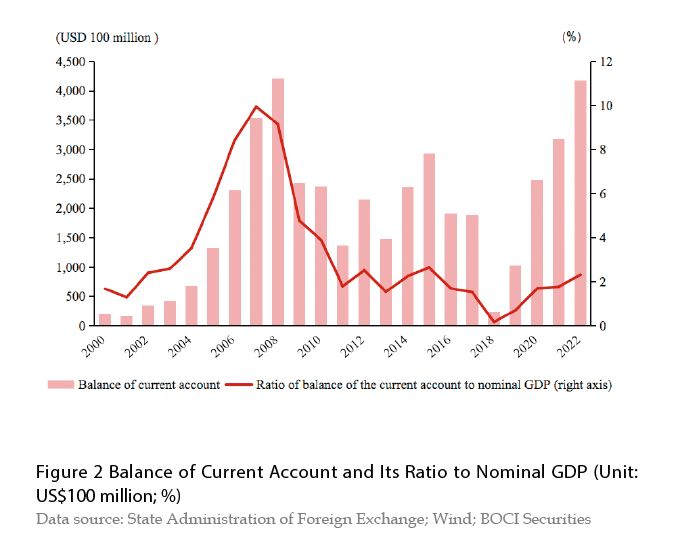

By total volume,China’s current account surplus in 2022 hit the second highest in history,second only to 2008,which recorded US$420.6 billion. Its ratio to nominal gross domestic product (GDP) reached 2.3%,up by 0.5 percentage points year on year,remaining within the international warning line of ±4% (see Figure 2). China’s current account surplus has grown in absolute scale in recent years,but its ratio to GDP still fell within a reasonable range,showing that China’s foreign economy was in equilibrium.

By item,the expansion of the current account surplus was due to the increasing trade surplus in goods,the rising surplus in secondary income,and the narrowing trade deficit in services,which contributed 123%,6%,and 4%,respectively. In addition,the widening primary income deficit contributed 32% to the increase in the current account surplus.

In terms of trade in goods,in 2022,the export of goods from China’s balance of payments reached US$3,364.6 billion,up by 5% year on year. Imports of goods reached US$2,679 billion,a year-on-year increase of 1%. In terms of trade in services,in 2022,China’s trade deficit in services reached US$94.3 billion,further narrowing by 6% from the previous year.

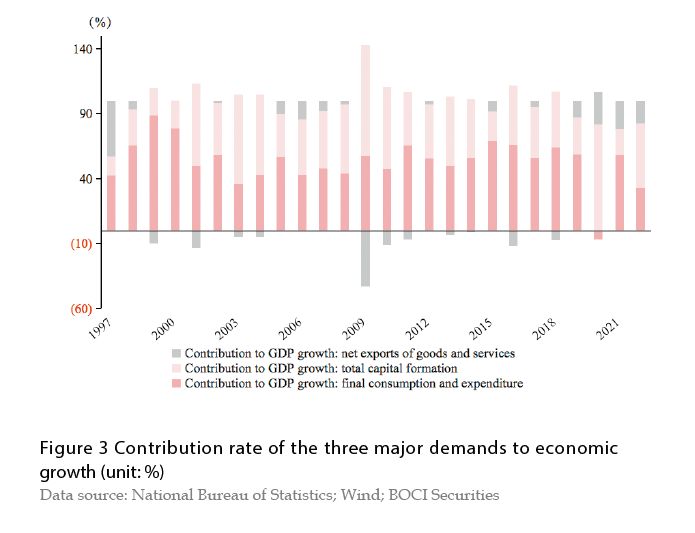

Regarding contributions to economic growth,in 2022,China’s trade surplus in goods and services totaled US$591.3 billion,an increase of of 28% year-on-year ,hitting a record high. The trade surplus in goods and services accounted for 3.3% of GDP,up by 0.7 percentage points year on year. China’s economic recovery since the COVID-19 outbreak has been uneven and its foundation has yet to be solidified,which is primarily demonstrated by the fact that external demand rebounded faster than domestic demand. From 2020 to 2022,the contribution of external demands to economic growth hit the highest for three consecutive years since 1998,with an average of 21.4%,about 20.1 percentage points higher than the average from 2015-2019. On average,investment contributed 50.5% to the economic growth,12.5 percentage points higher; consumption contributed 28.1% to the economic growth,a decrease of 34.6 percentage points (see Figure 3).

In 2023,the effect of sustained monetary tightening overseas will become more evident,and international demand will continue to cool down. And beyond that,given the high base of exports in 2022,it is expected that the role of exports in driving economic growth in 2023 will tend to weaken or even reverse,further highlighting the necessity of expanding domestic demand.

The capital account deficit increased but tended to narrow,and the basic balance of payments surplus effectively hedged short-term capital outflows.

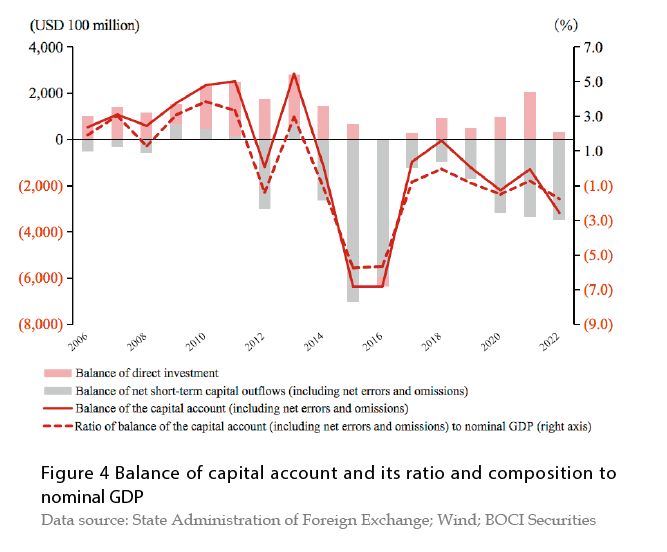

In 2022,China’s non-reserve capital account deficit (including net errors and omissions) was US$317.6 billion,the third highest after 2015 and 2016,accounting for -1.8% of nominal GDP. Despite a decrease of 1.04 percentage points,it was still significantly better than the average ratio of -5.7% in 2015 and 2016. (see Figure 4).

By item,in terms of direct investment,the surplus of direct investment for the whole year was US$32.3 billion,a decrease of US$173.7 billion compared to 2021. More specifically,China’s outward direct investment and inward direct investment fell by US$30 billion and US$143.7 billion,respectively. This mainly reflected the impact of the sporadic domestic resurgence of COVID-19 cases and the slowness of China’s economic recovery since the second quarter of 2022.

In terms of short-term capital flows,the deficit of short-term capital (namely,total portfolio investments,financial derivatives,other investments and net errors and omissions) was