The Promotion of Opening-up of the Financial Industry through RMB...

Title:The Promotion of Opening-up of the Financial Industry through RMB Internationalization

Since the launch of the Pilot Scheme of RMB settlement in cross-border trade in 2009,the internationalization of RMB has been enhanced for more than ten years. The RMB business has achieved substantial development from the real demand by corporates to institutional investment,from current account to capital account,from pilot projects in selected areas to global outreach. The 20th National Congress of the Communist Party of China shared the strategic goal of "promoting the RMB internationalization in an orderly way". The increasing use of cross-border and offshore RMB,along with capital accounts becoming increasingly convertible,is expected to usher in a new round of development,which will effectively promote the opening up of our country's financial industry and form a new pattern,and inject stronger impetus into economic recovery and sustainable development after the pandemic.

Improving and upgrading RMB internationalization

RMB has become an important international currency,as it moves from domestic market to international platform,and is widely used in cross-border fields and offshore markets. This is the inevitable outcome of which China’s reform and opening up has reached to a certain stage,and the overall national strength has accumulated to a certain extent,and the foreign economic and trade has increased to a certain level. However,the internationalization of RMB was not widely accepted by the offshore market from the beginning. It has experienced various challenges,especially during the periods of global financial crises in the old days. In recent years,the global RMB business has gradually recovered,and the pace has been accelerated as well,which has brought the internationalization of RMB to a higher level.

The level of RMB internationalization has been improved continuously. In the early days,the use of RMB mainly concentrated in the field of cross-border trade and investment. There were not many participants involved,and the business model was relatively simple. With the acceleration of the RMB internationalization,the openness of the financial market,and the increased number of market players,the RMB business has become more complicated. Supervising cross-border capital flows while ensuring that RMB business is more convenient,which has revealed higher requirements towards the regulatory framework. In recent years,China has optimized the cross-border RMB management system,built consensus among all parties,strengthened policy coordination,and formed policy synergy. The People's Bank of China (PBC) and various ministries and commissions jointly promoted RMB internationalization. For example,in November 2020,the PBC and the State-owned Assets Supervision and Administration Commission jointly held a symposium on RMB internationalization with the focus to facilitate and to promote a better ecosystem of corporate trade and investment,providing a closer environment among enterprises and financial institutions. In January 2023,the Ministry of Commerce and the PBC jointly issued the Notice on Further Supporting Foreign Economic and Trade Enterprises in Expanding the Cross-border Use of Renminbi to Facilitate Trade and Investment.

The policy for RMB internationalization has been incrementally improved. The development of policy framework has become more systematic,with the connotation of policies continuously deepening,the overall feedback generated from the policy has become more positive and encouraging. In the field of cross-border bond investment,the PBC and other regulatory agencies have adapted to the IMF's inclusion of RMB in the SDR and its weight raised,and successively issued policies to relax financial market access restrictions,expand the cross-border investment channels,and facilitated foreign central banks and investors who have increasing interests to add their holdings of RMB assets. In the field of overseas trade and investment,the PBC and other regulatory agencies have focused on facilitation measures related to domestic and foreign currencies settlements,to banks who could simplify the procedures to handle settlement and payment from free trade zone to the whole country,from the promotion of trade in goods to service and to new trade formats,from the development of trade to foreign contracted projects. The PBC and the State Administration of Foreign Exchange (SAFE) continue to promote the integration of domestic and foreign currency policies,unify the management standards for RMB and foreign currency business,implement the macro-prudential management,and provide greater convenience for market players. For example,in April 2016,the PBC replicated the macro-prudential management policy on the overall cross-border financing across the country. In March 2021,it launched pilot projects of the integrated capital pool in domestic and foreign currencies for multinational enterprises in Shenzhen and Beijing.

Participants in RMB internationalization are more diversified. The expansion of the usage of the offshore RMB business and the improvement of offshore RMB market have continuously attracted new users to participate,as a result,the coverage of RMB business has expanded significantly in recent years. In China’s Hong Kong (hereinafter referred to as Hong Kong),in addition to Chinese enterprises,more and more Hong Kong enterprises and regional headquarters of multinational companies in Hong Kong are also adopting RMB settlement in different fields. Some super national institutions and international investors have set up trading platforms in Hong Kong to carry out RMB investment and trading. In Southeast Asia,besides Chinese enterprises which tend to use RMB more,overseas Chinese and their companies have a strong interest in RMB settlement. The local central banks,governments and sovereign funds also pay attention to the internationalization of RMB and start to participate in the RMB market onshore and offshore. The Philippine government,for instance,issued the Panda Bonds in the mainland.

The function of RMB as an international currency gets stronger. RMB has demonstrated its function of being the international settlement and payment currency in cross-border trade,and gradually has extended its function to trade financing and currency transactions. With wider usage of RMB,the proportion of RMB assets and liabilities in the balance sheet of enterprises raised. When exchange rate and interest rate fluctuations of major international currencies increased,enterprises have to control settlement costs and effectively manage exchange rate risks,thus put forward the demand for RMB risk hedging. The trading of OTC RMB interest rate swaps,currency swaps,Cross Currency Swap (CCS),options,and exchange derivatives in Hong Kong has become more active,so the RMB risk hedging function has emerged. In 2016,the IMF included the RMB in the SDR currency basket,global central banks increased their holdings of RMB in their foreign exchange reserves,followed by institutional investors to add more allocation to RMB assets,and thus it enhances the functions of RMB as reserves and investment currency.

Interconnection presents systematic development. The interconnection of financial markets represents the significant innovation of the mechanism,connecting domestic and foreign financial infrastructure together,enabling investors to trade financial assets in another market using the trading methods that they are familiar with. During the process,the local regulatory agencies can supervise markets,respectively. In November 2014,the Shanghai-Hong Kong Stock Connect has been launched. Afterwards,many Connect Programs have been arranged for investment under capital account,such as Shenzhen-Hong Kong Stock Connect,the Northbound trading under the Bond Connect,the Southbound trading under the Bond Connect,the Cross-boundary Wealth Management Connect Scheme in the Guangdong-Hong Kong-Macao Greater Bay Area,ETF Connect,and the Shanghai-Hong Kong Gold Connect etc. Thus,it has undergone a systematic development,enhanced the interconnection between the mainland and other international financial centers. Interconnection mechanism has become more and more important and widely welcomed by both domestic and foreign investors due to its convenience. More channels for cross-border investment have been created,such as Qualified Foreign Institutional Investors(QFII),Qualified Domestic Institutional Investor (QDII),China Interbank Bond Market (CIBM),Qualified Foreign Limited Partner (QFLP) and Qualified Domestic Limited Partner (QDLP),to facilitate the internationalization use of RMB over the past few years.

Main offshore RMB business indicators continue to improve

RMB becomes more integrated with the rest of the world. The level of RMB internationalization can be demonstrated by the main indicators listed below.

RMB settlement and clearing grows steadily. According to SWIFT,the amount of global RMB payments has maintained growth for five consecutive years from 2017 to 2022. In 2022,RMB payments accounted for 2.31% of all currency payments,ranking as the fifth largest international payment currency. Hong Kong is the global hub for renminbi,where a wide range of renminbi products and services is available to meet the needs of businesses,financial institutions,and investors. In 2022,Hong Kong accounted for 71.4% of the global RMB payment,becoming the most important RMB clearing and settlement hub overseas. In 2022,the transaction volume of the RMB RTGS system operated by the Hong Kong RMB clearing bank amounted to 384.3 trillion yuan,a year-on-year increase of 7.5%,and the average daily transaction volume was about 1.65 trillion yuan,which had maintained the growth for six consecutive years. According to data from the Hong Kong Monetary Authority,the total amount of RMB remittances related to cross-border trade in Hong Kong in 2022 stood at 9.34 trillion yuan,with a YoY increase of 31.9%,a growth maintained for five consecutive years,and a cumulative increase of 1.4 times in five years.

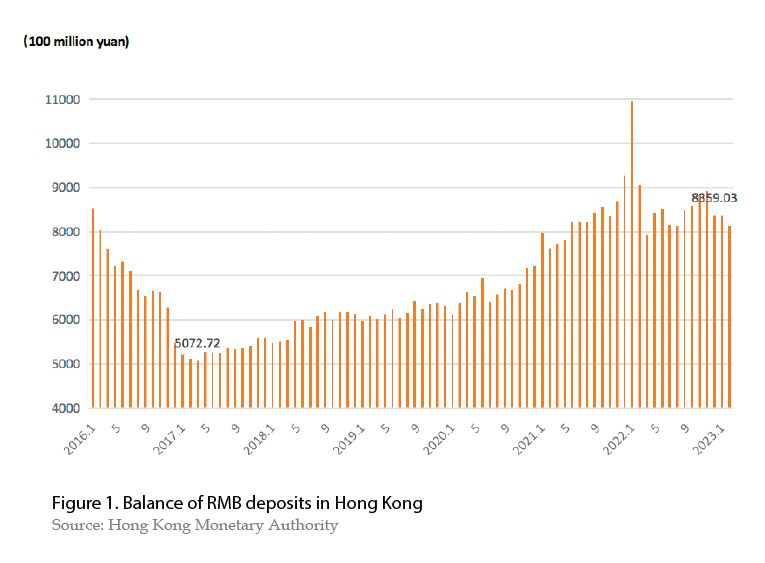

The RMB capital pool continues to expand. Although there are certain scales of RMB funds in London,Singapore,China's Macau and China's Taiwan,Hong Kong has the largest RMB capital pool overseas. At the end of 2022,RMB deposits in Hong Kong stood at 835.9 billion yuan,a rebound of 62% from the trough in March 2017 (see Figure 1). At the end of 2022,the outstanding balance of RMB certificates of deposit (CDs) issued by the Hong Kong banking industry was 145.8 billion yuan with a substantial YoY increase. If we combine the RMB deposits and RMB CDs,the offshore RMB capital pool in Hong Kong reaches 981.7 billion yuan by the end of 2022. At the same time,the balance of RMB deposits in Singapore is 176 billion yuan,an increase of 15.8% over the end of 2017.And RMB deposits in Macau experienced a relatively large increase,while RMB deposits in Taiwan fell back.

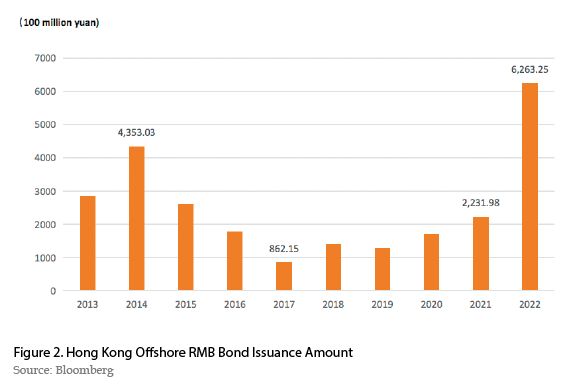

RMB investment and financing rebounded. Since last year,the Federal Reserve has continued to raise interest rates. The USD and RMB interest rates have inverted. As such,Hong Kong’s RMB financing broke through stagnation,both RMB bond issuance and RMB loans have rebounded sharply. Driven by the regular issuance of RMB central bank bills and treasury bonds,the offshore RMB bond market is booming in both issuance and trading. In 2022,the issuance amount of offshore RMB bonds (including dim sum bonds and CDs) reached 626.3 billion yuan,a YoY increase of 1.8 times (see Figure 2) . In the first quarter of this year,91.8 billion yuan dim sum bonds were issued,a YoY increase of 1.2 times. According to data from the Hong Kong Monetary Authority,in 2022,the transaction amount of RMB dim sum bonds hosted by Hong Kong's Central Bond Settlement System (CMU) increased by 2.3 times YoY. By March this year,the outstanding balance of RMB loans in Hong Kong was 245.4 billion yuan,a YoY increase of 38%.

RMB vs. foreign exchange transactions has become more active. According to the triennial statistics of the Bank for International Settlements (BIS),in April 2022,the daily average volume of RMB foreign exchange transactions is 526.4 billion US dollars,accounting for 7% of the total global foreign exchange transactions. At the same time,its ranking among major currencies has risen from the 8th place to the 5th place. Among all,the average daily volume of RMB foreign exchange transactions in Hong Kong reached US$191.2 billion,an increase of 77.7% from the level in the previous survey (April 2019),accounting for 28.2% of global RMB foreign exchange transactions,followed by London and Singapore. According to the TMA survey of the Hong Kong Treasury Market Association,the amount of foreign exchange transactions between HKD and RMB in October 2022 increases by 9.7% compared with October 2021.

The RMB wealth management market is becoming more mature. According to the annual survey conducted by the Hong Kong Securities and Futures Commission,as of March 2022,the China Securities Regulatory Commission(CSRC) has recognized 38 Hong Kong funds under the mutual recognition arrangement of funds,with AUM of 11.886 billion yuan,and the Hong Kong Securities Regulatory Commission has recognized 47 mainland funds with AUM of 1.24 billion yuan. In 2022,there are 692 Hong Kong RMB investment products approved by the Hong Kong Securities Regulatory Commission,with an investment scale of 21.7 billion yuan,an increase of 19.9% and 6.4%,respectively. In addition,in 2022,the market value of RMB-denominated ETFs that have invested in the mainland securities mark