Three Misreadings and Possibilities of RMB Exchange Rate

In 2022,the RMB exchange rate (bilateral exchange rate against the US dollar,unless otherwise specified) shows two-way and wide fluctuations due to the divergence of the US and China monetary policy and the interest rate spread turning negative. From last March to November,the RMB depreciated from 6.30 to around 7.30 within eight months,which was the fastest and deepest adjustment since the currency reform in early 1994. Since November 2022,the RMB has rebounded rapidly with the optimization of domestic pandemic control and regulatory policies,recovering below 7.0 again in early December within less than three months.

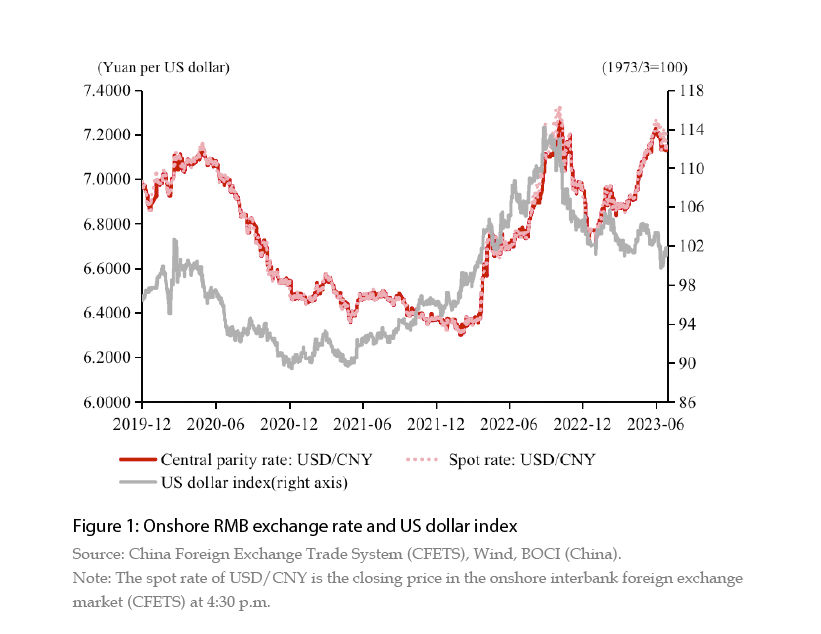

Followed by the rebound,the market consensus was that as the pandemic eased and the Chinese economy reopened,the RMB exchange rate would strengthen in 2023. However,unexpectedly after a lapse of five months,the RMB exchange rate dropped through 7.0 again in mid-May 2023,and further fell to 7.20 by the end of June,approaching last year’s low (see Figure 1). Should we be worried about the adjustment? And how will the RMB perform in the second half of 2023?

Three Common Misreadings of RMB Exchange Rate Fluctuations

The first misreading would be to equate the actual appreciation or depreciation of the yuan with people's expectations of such changes.

The market-oriented exchange rate reform is about allowing the market to play a decisive role in exchange rate formation. Under normal circumstances,it should be buying foreign exchange (FX) during appreciation and selling FX during depreciation. If the exchange rate falls and market entities rush to buy and hoard foreign exchange,it suggests that the foreign exchange market is malfunctioning. When the exchange rate lacks flexibility,it is prone to accumulate large imbalances in foreign exchange supply and demand,as well as strong one-sided exchange rate expectations.

Since the beginning of 2023,the RMB exchange rate has fluctuated in both directions and the domestic foreign exchange market has remained in balance. In the first half of 2023,the surplus of banks' foreign exchange settlement and sales (including forward and options) was 79 billion US dollars,with a year-on-year increase of 63.3 percent. Although the RMB exchange rate adjustment has accelerated since mid-May,the leverage of buying when the RMB appreciates and selling when the RMB depreciates has worked well in the FX market. From May to June,the average ratio of FX settlement to foreign receipts (excluding forward execution) and FX purchase to foreign expenditures both increased from November 2022 to April 2023 average. The former increased by 5.2 percentage points,slightly larger than the latter's increase of 5.0 percentage points (see Figure 2). This suggests that the market’s willingness to sell FX has increased while the motivation to purchase FX has weakened.

Also,expectations of RMB depreciation increased but remained manageable after breaching several major thresholds. As depreciation pressures were released in a timely manner,the expectation of RMB depreciation implied by the one-year non-delivery forward (NDF) increased from May 17 (breaching the 7.0 threshold) to end-June. But the strongest depreciation expectation is just 1.2 percent,well below the 3 percent level in October 2022. Over the same period,the daily maximum deviation of CNH (offshore RMB) from CNY (onshore RMB) was 374 basis points,which was smaller than the 504 basis points from the beginning of November 2022 to May 17,2023.

The well-functioning FX market has given the authority the confidence to communicate but not take substantive actions. On May 19,the People’s Bank of China (PBOC) issued a press release through China Foreign Exchange Committee (CFXC),warning to curb speculation and resolutely prevent excessive exchange rate volatility. It also noted that the breadth and depth of the domestic foreign exchange market have been extended,and the market could strike a balance autonomously. The RMB exchange rate also has its own strength and self-correcting mechanism and thus can remain basically stable at an adaptive and balanced level.

It was not until July 20 that the PBOC raised the macro-prudential adjustment parameters for cross-border financing to release stabilizing signals. Besides,LIU Guoqiang,the Vice Governor,said in a press briefing on July 14 that China’s foreign exchange market was operating smoothly. The settlement and sale of foreign exchange by financial institutions,enterprises,and residents are rational and orderly. And expectations are basically stable. To quote a popular saying,currently,there are neither “aunties” (actions like the aunties’ buying spree) nor “crocodiles” (predators in the market) in the foreign exchange market.

The second misunderstanding lies in viewing appreciation as a positive factor and depreciation as a negative one.

This inertia thinking is the continuation of the old period of lenient entry and strict exit on cross-border capital flows and the environment of foreign exchange shortages. In theory,the exchange rate fluctuation is a double-edged sword. In practice,whether currency appreciation or depreciation is good or bad requires a case-by-case analysis.

If depreciation is simply regarded as negative for the equity market,it is hard to understand that when the Japanese Yen against the US dollar fell by nearly 10 percent in the first half of this year,the Nikkei 225 index rose by 27 percent,hitting a 33-year high.

Moreover,exchange rate appreciation is not necessarily a good thing for the Chinese economy. During the second half of 2020,the RMB appreciated rapidly,which was counted as one of the triple pressures on Chinese exports along with rising raw material prices and soaring freight rates. The Central Economic Work Conference held in late 2020 mentioned maintaining the RMB exchange rate basically stable at an adaptive and balanced level for the first time since 2018. In 2021,the authority issued two press releases through CFXC and introduced several macro-prudential measures to curb the excessive appreciation of the RMB.

Besides,when the private sector in a country with a large trade surplus has less net external debt and a lower currency mismatch,currency depreciation would help enhance the profitability of export-oriented enterprises. In 2022,the RMB depreciated by more than 8 percent,but non-bank A-share companies (excluding financial anomalies) realized a net foreign exchange gain of 27.9 billion yuan. On the contrary,when the RMB appreciated in 2020 and 2021,non-bank A-share companies realized net foreign exchange losses of 28.9 billion yuan and 16 billion yuan respectively.

In terms of the co-movements between the FX market and the stock market,historical experience suggests that prices in both markets have some correlations when the same factors are at play,but