Central Bank Divergence

While the world is getting used to rising interest rates almost everywhere – with noticeable exceptions in China,Japan,and Turkey – there are signs of central bank divergence on the horizon.

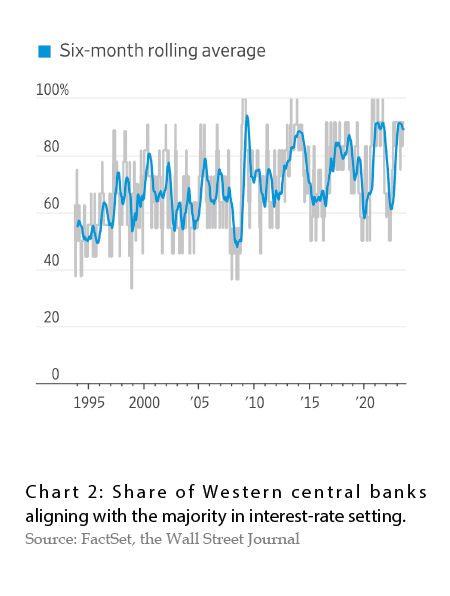

The divergence in central bank policies is not new. Domestic economic conditions differ,calling for different responses. Yet,the past year and a half,amid global inflationary pressure,has seen central banks act in unison – hiking up rates aggressively to quell inflation in fear of a wage-price spiral. More generally,in the past three decades,central bank policies,especially those in the developed counties,have become more synchronized.

The recent central bank actions serve as a reminder that as inflationary pressure recedes in some parts of the world,central banks will find themselves navigating complex challenges,occasionally marked by conflicting domestic imperatives.

Monetary Policies: A Divergent Path After Consensus

Central banks have a complex task ahead to address evolving domestic challenges via monetary policies. The last eighteen months of global inflationary pressures have seen a coordinated response from central banks. However,as these pressures start to ease across regions –– albeit at a different pace –– central banks are granted more flexibility to tackle domestic issues. This suggests a looming divergence in monetary policies is on the horizon.

The US Approach: Treading with Cautious Optimism

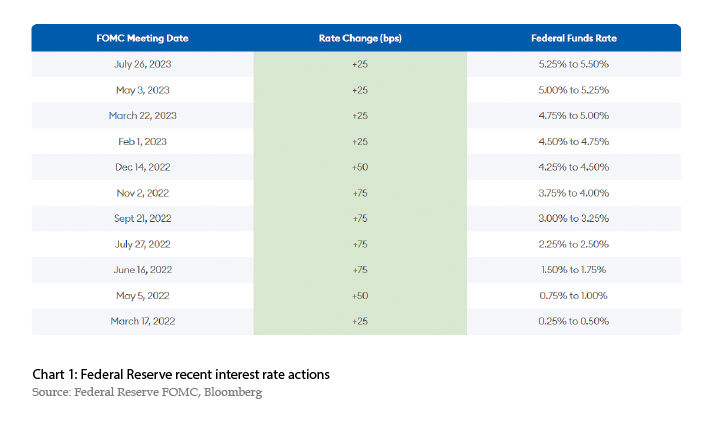

Dampening inflations have made some central bankers cautiously optimistic. The Federal Reserve (FED) has raised interest rates 11 times in the past 17 months (see Chart 2),and inflation appears to be finally budging. The US inflation numbers might be particularly complex to discern due to a “base effect.” In July,the consumer price index – the headline inflation – increased 3.2 percent,way below the peak of 9.1 percent in the same period last year. Excluding food and energy prices,which are typically volatile,the core inflation rose 4.7 percent year-over-year. While both headline and core inflations appear to have gone up from June,this uptick mostly reflects a “base effect”: gasoline prices had peaked in June 2022 and then began to fall. The resulting fall in energy prices contributed to a 0 percent monthly CPI in July 2022,and this unusually-low reading was carried forward in every yearly inflation calculation through June 2023. This helps explain that the annual rate ticks up but the 3-month rate falls in the latest CPI reporting in July 2023. With US interest rates standing at 22-year high,investors already expect that the FED will reverse course in the coming months to avoid a possible recession.

European Vigilance: A Hawkish Stance against Inflation

Central banks in other developed countries,however,remain vigilant: the European Central Bank (ECB),the Bank of England,Sweden’s Riksbank,and Norway’s Norges Bank have become more hawkish fighting escalated level of inflation or remain worried about an inflation rebound. In particular,the Bank of England has remained hawkish,having raised interest rates 14 times in a row to a 15-year high at 5.25%. Its Monetary Policy Committee (MPC) has affirmed its commitment to the 2% target,by keeping rates “sufficiently restrictive for sufficiently long.” And other central banks appear to be in agreement,including the Bank of Canada and the Reserve Bank of Australia.

Asian Powerhouses: Unique Challenges,Distinct Responses

The People’s Bank of China (PBOC),unlike many of its central bank peers,did not face immense inflationary pressure but is now put to test. With manufacturing and housing activities slowing down,PBOC might consider easing monetary policies further,after a pause in July. Most recently,the Caixin/S&P Global manufacturing purchasing managers' index (PMI) fell to 49.2 in July from 50.5 in June,hitting a 6-month low. The Bank of Japan (BOJ),having sustained ultra-loose monetary policy for a decade in hope to lift the inflation expectations. Since the introduction of quantitative and qualitative monetary easing (QQE) in April 2013,the BOJ has relied on two levers lift the inflation expectations,including yield curve control and "inflation-overshooting commitment,in which BOJ controls short- and long-term interest rates through market operations,and commits to continuing to expand the monetary base until inflation stays above the 2 percent target in a stable manner,respectively. With core inflation at 3.3%,the BOJ finally saw signs of success – by June,Japanese inflation had been above target for 15 months in a row.

Regulatory Policies: Charting Uncertain Waters

Central banks are increasingly called upon to maintain a prudential stance and pave the way for financial innovation via its regulatory role. Central bank divergence extends beyond interest rate policies. Their supervisory roles in financial regulation highlight this divergence,especially with the rapid advances in financial technology. Central banks are now forced to rethink and expand their traditional regulatory roles to keep pace with the digital age. Central Bank Digital Currency (CBDC) exemplifies this transformation,with significant global interest evident from the sheer number of countries exploring or adopting them.

CBDCs differ from physical currencies besides the digital form. Unlike existing arrangements,CBDCs,as a liability of the central banks,would not require mechanisms like deposit insurance to maintain public confidence,nor would they depend on the underlying asset pool to maintain value. A CBDC would be the safest digital asset available to the general public,with no associated credit or liquidity risk.

The US and Europe: Navigating Uncertainty of a Digital Future

In the US,the Federal Reserve has made no official decisions on whether to pursue or implement a CDBC. It is currently gauging the benefits and risks of CBDCs via a discussion paper and public comments. Notably,the FED has outlined four key features it deems crucial for a potential US CBDC: privacy protection,intermediary involvement,wide transferability,and identity verification. As emphasized by FED Chair Jerome H. Powell,a CBDC,if created,would serve as a complement to,but not a replacement of,the greenback.

Over in Europe,the ECB's approach to a potential digital euro mirrors that of the FED. The ECB’s principles share some commonality with the FED’s desirable features: such as the incentive scheme to compensate intermediaries while preventing overcharges. In addition,the ECB enshrines the notion of the digital euro as a public good,emphasizing its cost-free basic use for individuals and the self-financed nature of the Eurosystem. Launched in October 2021,the ECB's exploration is set to conclude in October 2023.

China: Leading the Charge in CBDC Experimentation

China stands out as a digital currency trailblazer,both in terms of private entrepreneurship as well as government actions. Beyond housing the world's most significant cryptocurrency exchange and busiest trading activities,the PBOC took the lead among central banks in exploring CBDCs. The PBOC’s research effort commenced as early as 2014,culminating in the digital yuan's pilot in 2020. By June 2023,the digital yuan transactions amounted to an impressive 1.8 trillion yuan,equivalent to 250 billion US dollars. This is an incredible achievement when comparing to other CBDC experimenters. Despite this vast sum,the digital yuan is still under 0.2% of PBOC’s M0 money supply,hinting at the digital yuan's vast growth potential and momentum.

The PBOC's methodical approach,from years of groundwork to its phased rollout,offers a blueprint for other central banks keen on CBDCs. PBOC’s digital yuan experimentation in 2020,a pioneering act,was backed by years of research since 2014. PBOC’s rollout of the pilot was cadenced,starting with four cities initially and expanding gradually over time. It also leveraged the 2022 Winter Olympics to elevate the digital yuan’s international visibility. In rolling out CBDC,the PBOC experiences provide a useful roadmap for others.

Small Open Economies: Embracing the CBDC Evolution

Several smaller economies have swiftly incorporated CBDCs into their financial infrastructure. To date,11 countries have officially launched and distributed CBDC to the public,with notable examples such as the Sand Dollar in the Bahamas,DCash by the Eastern Caribbean Central Bank (ECCB) – a central bank governing the eight-member Eastern Caribbean Currency Union,eNaira in Nigeria. The list is almost guaranteed to grow longer,as 53 countries already in development or piloting stages. Notably,a significant portion of the G20 countries have CBDC initiatives in the pipeline,with nine already conducting pilot tests. Given these developments,the global CBDC community is poised for expansion.

The distinct design principles and the different implementation paces of CBDCs attest to the variance in central bank supervisory roles,especially when juxtaposed with the broader context of financial regulation and innovation. This divergence is primarily anchored in two fundamental trade-offs central banks face: balancing innovation with stability and security,and reconciling privacy with legitimacy.

Financial innovation has intensified the indispensability of central banks,contrary to the decentralized finance (DeFi) narrative that casts them as institutions of the past. While cryptocurrencies have captured global attention,their volatile pricing and non-transparent transactions pose significant challenges. In contrast,CBDCs emerge as a beacon of stability and security. This distinction is starkly evident when considering the security resilience of CBDCs — no known successful cyber-attacks have been reported against them. On the other hand,DeFi platforms have been vulnerable,with theft-related losses surpassing a staggering US$10 billion in 2021,as highlighted by the Bank of International Settlement (July 2023).

The evolution of CBDCs brings to the fore the delicate equilibrium central banks must strike between preserving user privacy and ensuring financial legitimacy. To uphold the sanctity of user privacy,central banks are compelled to implement robust safeguards to shield sensitive data,including payment behaviors and account details. Simultaneously,the overarching mandate to curtail illicit financial activities necessitates that cent