Governance of Macroeconomic Leverage and Its Potential Impact on Economic...

Title:Governance of Macroeconomic Leverage and Its Potential Impact on Economic Development

The Central Financial Work Conference,held in Beijing this October,called for the establishment of a long-term mechanism to prevent and defuse local debt risks,the creation of the government debt management compatible with high-quality development,and the optimization of the debt structure of both central and local governments. Currently,China's overall leverage ratio stands at 297.2%,the highest among global emerging markets and continues to show a rising trend. The accommodative financing conditions of the past two decades have stimulated the expansion of infrastructure and logistics construction. This has contributed to the remarkable growth of China's economy,raised the living standards of domestic households,and led to the inevitable escalation of the macro-leverage ratio. Debt leverage is a double-edged sword. On the positive side,debt is the accelerator of the booming economy. However,rising debt too high or too fast will make future economic operation vulnerability and pose potential risks to financial stability. Debt governance needs to be adapted to the rhythm of domestic economy. In times of economic downturn,the continuation of unlimited debt expansion is both ill-advised and risky. During periods of economic downturn,sectors with high debt leverage are susceptible to liquidity risk. Policymakers should remain cognizant of the heightened risks posed by escalating debt and leverage ratios.

China's Macro Leverage Ratio Continues to Rise

The Chinese government has demonstrated remarkable success in promoting economic growth over the past 20 years,beginning in 2002. Key strategies used in this impressive achievement were strong and effective governance,effective countercyclical policy adjustments and proper debt management. As the economy shift from a high-speed mode to the "new normal",the unproductive and unviable zombie firms would exit the market,allowing healthy firms to operate more efficiently,while promoting the entry of new productive firms. But the debt of the zombie firms that should have exited still exists,especially for the zombie ones,due to the improper intervention of local governments. These debt-driven challenges are closely linked to a major finance-intensive industry. That is,the real estate development industry was characterized by high turnover,high debt and high leverage. The resulting debt risks in this sector have become a giant obstacle for the ambitious de-risk arrangement.

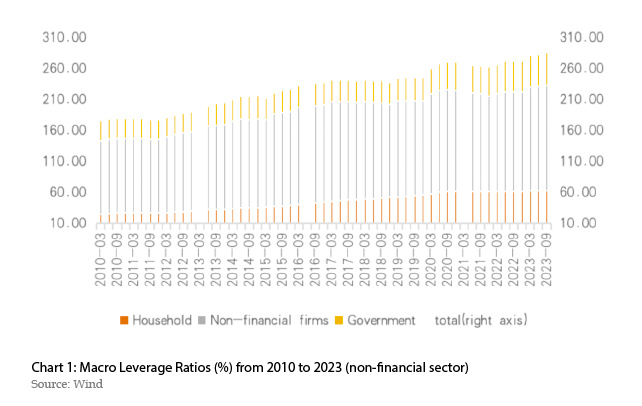

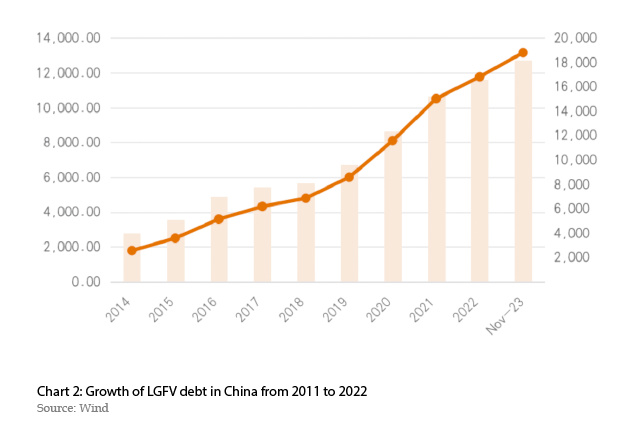

From the initiation of the reform and opening-up strategy to the global financial crisis,population growth has brought more domestic and foreign demand. During this period,economic growth was highly dependent on investments in fixed assets,including the above mentioned real estate development,manufacturing and infrastructure,which together lead to a large number of capital requirements. Given the lagged development in direct financing,a majority of the projects were financed by banking debts through sophisticated channels. This is how real estate developers,private firms and local governments quickly expand large-scale investments in such a time. Following the outbreak of the global financial crisis,the central government launched a broad stimulus to hedge the risk of external demand shrinking. The main stimulus projects were railroads and highways,carried out by local governments. The stimulation of macro debt has continued to rise since 2010,with total leverage rising from 180% to 287% (see Chart 1),much faster than the world average. Among them,local government-funded vehicles (LGFVs) have developed rapidly. LGFVs are distinct entities owned by local governments,typically established for public infrastructure,and have served as the most convenient financing tool for local governments. Since 2011,LGFVs’ debt has grown rapidly,with an annual growth rate of more than 10%. By the end of 2022,LGFVs’ interest-bearing bonds were 12.75 trillion yuan (see Chart 2),an increase of 4.6 times over 2.77 trillion yuan in 2011. These vehicles have become the mainstream type of finance pool with poor governance. When the LGFVs carried out borrowing and repayments following similar patterns,a huge potential risk arose when market liquidity dried up.

China has been facing challenge of weak demand and unstable confidence,and this indicates that a macroeconomic leverage in a sustained upward trend is not the priority from the top-down governance system. According to the National Finance and Development Laboratory,the macro leverage ratio in the second quarter of 2023 rose by 2.1%,from 281.8% at the end of the first quarter to 283.9%,and rose by 10.8% in the first half of the year. Meanwhile,total debt grew to just 9.3% year on year,the lowest level since 2000. Divided into subsectors,the leverage ratios of different subsectors have unique characteristics. The government leverage ratio is 77%,higher than the emerging economies average,and still lower compared with developed economies (109.1%). In the first quarter of 2023,government debt leverage or the ratio of debt to GDP in India,the Eurozone,developed countries,the US and Japan were 83.2%,91.8%,110.1% and 229.0% respectively,significantly higher than that in China. In addition,in China,the leverage ratio of the central government is 21.4%,and that of local governments is 30.1%. This is an attempt to suggest that the central government still has budgetary room to increase its borrowing leverage,but the hidden information should be clarified. The outstanding balance of central government bonds is about 28 trillion yuan,while the balance of local government bonds is about 40 trillion yuan. However,given the large amount of hidden debt held by LGFVs and sponsored by local governments,the debt ratio in some provinces has exceeded regulatory guidelines. With the risk of more LGFV debt becoming more frequent,the scope for both central and local governments to borrow is relatively limited.

The good news is that China's foreign currency debt is limited. The total amount of China's total foreign debt (by the end of 2022) is 17.08 trillion yuan,including 7 trillion yuan in the medium and long term and short term. In the short-term foreign debt of 91 trillion yuan,trade-related payments accounts for 38%,and it means that China's short-term foreign debt that needs to pay attention to is only 829.5 billion yuan. These debts are much smaller than China's overall debt.

It should be noted that the high leverage ratio also reflects the momentum and resilience of China economy,as well as its more policy tools and regulatory capacity. First,part of the high leverage debt was used to mitigate external shocks such as the 2008 global financial crisis and COVID-19 in 2020. Expanding investment and consumption through additional government debt can boost economic growth and bring more jobs. Second,the high leverage ratio also demonstrates the great market demand of China economy in promoting supply-side structural reform and high-quality development. By increasing the fiscal budget for science and technology,education,infrastructure and other productive industries,the economy will enhance its core competitiveness and productivity. Third,the high leverage ratio shows the flexibility of the government in implementing policy adjustments and financial regulation. Through the adoption of appropriate fiscal deficits,monetary easing and debt restructuring measures,a steady economic recovery and a stable financial sector were achieved.

High Leverage Ratio Hurdles Economic Development

Debt is closely linked to economic recovery at this stage,but the debt risk of poor systematic governance may be more pronounced. Policy makers need to balance the debt burden and development. Since the Chinese economy is less likely to experience another rapid development,debt management needs to be treated more seriously,as lower growth produces less cash flow,and requires more time to repay debt. It is important to keep the following in mind before engaging in de-levering or de-risking.

When the leverage ratio decreases and the financial situation tighten,economic growth will be affected. Since 2020,the growth rate of the total social financing stock,reflecting the total amount of funds received by economic agents from the financial system,continues to decline. In 2022,economic growth was 3.0% and the total social financing growth was 9.6% (see Chart 3). In 2023,the economic growth rate recovered to 5.0%,while the growth rate of total social financing is expected to decline to 9.0%. This decline does not simply indicate the phenomenon of "spending less money to for more outcomes",but rather the tightening of the entire social funds.