The RMB Should Regain A Solid Footing in 2024

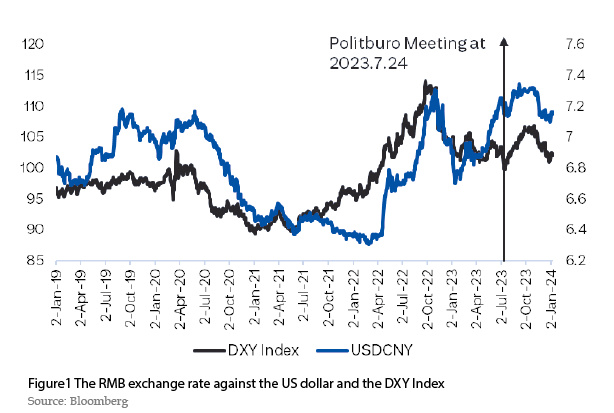

After a volatile year in which the RMB was under considerable depreciation pressures, the RMB exchange rate has regained its footing and has since moved below 7.3, an upper bound the People’s Bank of China (PBOC) may view consistent with China’s macroeconomic fundamentals. Two factors contributed to the stability of the RMB. Internally, China’s economy achieved an impressive 5.2% yoy GDP growth in 2023, and the growth momentum for 2024 remains stable, with a consensus forecast of China’s GDP growth at around 4.6% published by Bloomberg. Externally, the US inflation has been falling to 3.4%, and the US core CPI without the shelter component has already reached 2.5% by the end of 2023. The Fed has since signaled that a first interest rate cut could be in the 2nd half of 2024 at its December FOMC meeting. The DXY index has since weakened, although still volatile, and external pressure for the renminbi to depreciate has largely weakened. Pending China’s economic targets to be announced at the National People’s Congress in early March, it is highly likely that the RMB exchange rate will regain a solid footing in 2024.

The US Interest Rate Cycle Won’t Support a Strong Dollar

While the US January nonfarm payroll data again surprised due to seasonality, the US monthly job generation has been slowing visibly. Some labor market statistics are worth noting. The rebound in service employment job has approached its historical trend; female labor participation in age group between 25 to 54 has reached a new high of 75%; and the financial sector has been shedding labor, joining the technology sector in the first half of 2023. Meanwhile, consumption is likely to slow in 2024 due to slower wage growth and rising unemployment rate. Indeed, the US consumers have already been hit by high default rates in the auto loan and credit card sectors. As the repayment of college loans has resumed, it is estimated that around 20% of household income will need to be allocated for this purpose alone, thus reducing the power of consumption. While a soft landing may be in sight, the US economy will continue to slow to 2.1% from the IMF forecast of 2.5% in 2023. With CPI inflation likely to reach 2.5% by the end of 2024 and unemployment rising to over 4%, the Fed has no reason to keep hiking or can afford to stay higher for longer. Once the expectation is about to enter an interest rate cut cycle with a possible rate cut to about 150bps in 2024, the dollar index has no basis to remain strong, either.

While the Fed may be the first to cut rates among the world’s key central banks, the Bank of Japan will likely normalize monetary policy and move away from its negative interest rate (-0.1%) and yield curve control policy this year. The yen will thus reverse from the high (152 JPY/USD) reached in 2023 and has the potential to 130. Meanwhile, the ECB will likely remain vigilant about inflation in the euro area and could move slower than the Fed in cutting its own policy rate. Against this backdrop, the dollar is not expected to be a strong currency this year, short of major geopolitical shocks.

PBOC’s Interest Rate Cut Won’t Mean a Weak Renminbi

The PBOC surprised the market with a 50bps reduction in reserve requirement ratio (RRR) and a 25bps rollover and rebates for rural financing effective on February 5. The move attempts to address the rising deflation risk, as both CPI and PPI were softer than expected in December and the January PMI remains in contraction territory. Looking ahead, the PBOC is expected to ease monetary policy further on high real interest rates and ongoing property market woes. However, China’s monetary policy outlook does not mean a weak renminbi ahead.

Firstly, China’s monetary policy will finally synchronize with the US monetary policy this year. Given that the expected Fed policy rate cut will be much bigger than the expected PBOC policy rate cut, the current distorted interest rate overhang will narrow substantially, making the RMB yields increasingly attractive, which acts to stem the incentive for capital outflow.

Secondly, China’s exports and imports improved in December. Export growth was above expectations, increased by 2.3% yoy in USD terms from 0.5% in November. Imports also returned to growth at 0.2% YoY, although for the year as a whole export and import growth declines by -4.6% and -5.5%, respectively. Despite negative annual trade growth, the overall trade surplus remains large, at US$823.2 billion for the whole year. Even with an initial FDI outflow in 2023, China’s current account surplus is still much larger than the size of the capital outflow. The 2024 January-February trade data reaffirmed the recovering trend, exports and imports in USD term increased by 7.1% and 3.5% yoy, respectively. This means th