The Necessity and Feasibility of An Economic Growth Target of Around 5%

The Report on the Work of the Government 2024 (hereinafter referred to as the Report) has set an annual GDP growth target of approximately 5%, aligning with market expectations. Given the economic fundamentals, there exists significant pressure to attain this target in 2024. However, with the implementation of various policies aimed at ensuring stable growth, it is still anticipated that the economic growth rate will meet the target as planned.

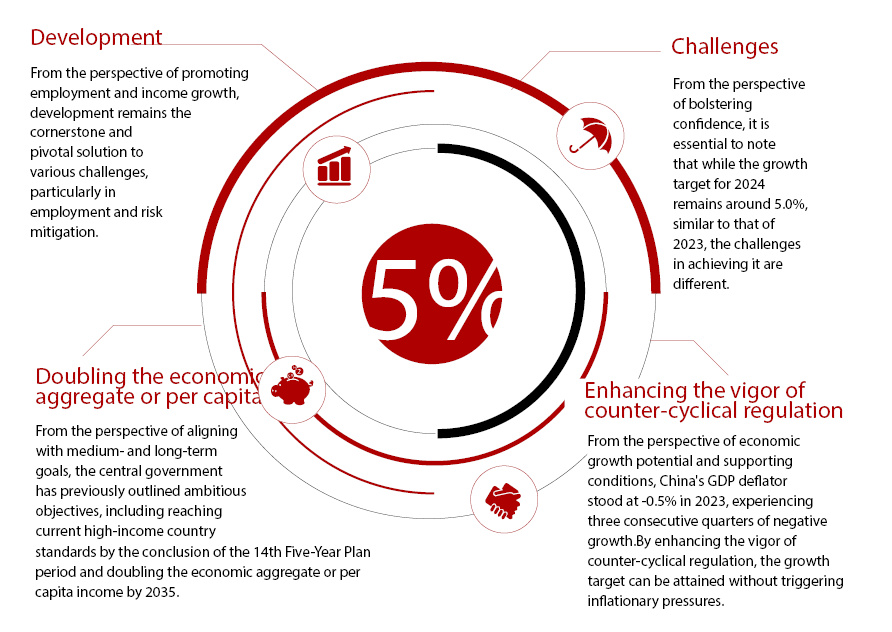

Why Set A Growth Target of Around 5%?

The Report emphasizes a target of approximately 5% economic growth which is carefully calibrated to address several key factors: the imperative of fostering employment and income growth, the necessity of averting and managing risks, alignment with the objectives outlined in the 14th Five-Year Plan, and the overarching goal of achieving modernization. Moreover, it takes into consideration the inherent potential and conducive conditions for economic expansion, thus embodying proactive and dynamic imperatives. The rationale behind this goal can be clarified from four distinct perspectives.

From the perspective of promoting employment and income growth, development remains the cornerstone and pivotal solution to various challenges, particularly in employment and risk mitigation. In 2024, the number of college graduates is expected to soar to 11.79 million, reaching an all-time high. Utilizing the projection that "one percentage point of economic growth drives about 2.20 million jobs", it becomes evident that a growth rate of approximately 5.0% is indispensable to effectively accommodate the influx of new graduates. Additionally, maintaining a certain level of economic growth is imperative to establish a solid foundation for addressing risks in sectors such as real estate, local debt, and small and medium-sized financial institutions.

From the perspective of aligning with medium- and long-term goals, the central government has previously outlined ambitious objectives, including reaching current high-income country standards by the conclusion of the 14th Five-Year Plan period and doubling the economic aggregate or per capita income by 2035. As of the end of 2023, China's per capita GDP is projected to reach US$12,700, approximately 10% lower than the high-income country standard of US$13,800. Hence, maintaining a growth rate of around 5% over the next two years becomes imperative to realize the goals set forth in the 14th Five-Year Plan. Furthermore, to achieve the target of doubling by 2035, estimates provided by the Research Office of the State Council suggest that the economy must sustain a growth rate of around 5% from 2024 to 2035.

From the perspective of economic growth potential and supporting conditions, China's GDP deflator stood at -0.5% in 2023, experiencing three consecutive quarters of negative growth. This suggests a negative output gap in the economy, indicating that it has not yet reached its potential growth level. Various estimates indicate that the potential economic growth rate during the 14th Five-Year Plan period hovers around 5%. Therefore, by enhancing the vigor of counter-cyclical regulation, the growth target can be attained without triggering inflationary pressures.

From the perspective of bolstering confidence, it is essential to note that while the growth target for 2024 remains around 5.0%, similar to that of 2023, the challenges in achieving it are different. Despite leveraging the low base effect in 2022, 2023 witnessed a year-on-year growth rate of 5.2%. However, the average growth rate during the two years stands at approximately 4.1%. Setting a 5% target for 2024, even with the diminishing impact of the low base effect, underscores the necessity for proactive and resolute efforts. It also sends a more optimistic signal to the market, encouraging a forward-looking and enterprising approach.

Macroeconomic policies need to exert considerable efforts to achieve this goal.

At the beginning of 2024, there exists notable pressure to meet this target, with various institutions and companies adopting a generally cautious stance when forecasting the Chinese economy. Most of their projected targets fall below 5%. Therefore, to reverse this widespread expectation and ensure the realization of the annual target, it is imperative for policies to intensify efforts and offer ample support.

The policy direction outlined in the Report closely aligns with that of the Central Economic Work Conference held at the end of 2023, emphasizing the principles of "pursuing progress while ensuring stability, promoting stability through progress, establishing the new before abolishing the old." Notably, there has been an increase in the vigor of fiscal policies. The fiscal policy keynote for 2024 emphasizes "appropriately enhancing the intensity of China's proactive fiscal policy and improving its quality and effectiveness."

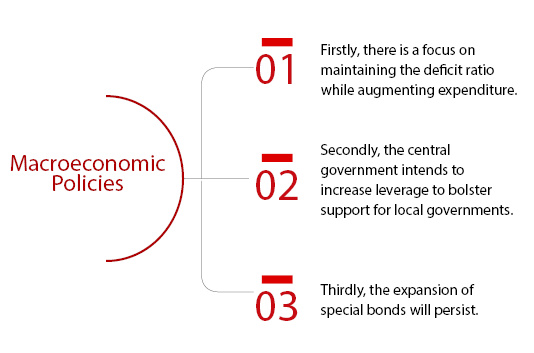

The enhancement of China's proactive fiscal policy manifests primarily in three aspects. Firstly, there is a focus on maintaining the deficit ratio while augmenting expenditure. The Report proposes a deficit-to-GDP ratio of around 3.0% for 2024, consistent with the target set at the beginning of 2023. The projected deficit is expected to reach 4.06 trillion yuan, an increase of 180 billion yuan compared to the initial budget of 2023. Additionally, 500 billion yuan of national debt carried over from 2023 will also be utilized, indicating a robust expenditure effort.

Secondly, the central government intends to increase leverage to bolster support for local governments. In 2024, an additional 1 trillion yuan of ultra-long-term special government bonds will be issued to local governments, with continued issuance planned in subsequent years. These funds will be allocated towards major projects essential to China's prosperity and rejuvenation.

Thirdly, the expansion of special bonds will persist. Recognizing the strain of local government debt and the reduction in land transfer income resulting from adjustments in the real estate market, alongside the sluggish growth in local available financial resources, plans entail allocating 3.9 trillion yuan of special bonds for local governments in 2024. This represents a slight increase of 100 billion yuan compared to 2023. Such measures aim to furnish funding support for pivotal project construction while facilitating improved prevention and resolution of local government debt risks.

Overall, the total amount of deficit, special bonds, and ultra-long-term special national bonds in 2024 is 8.96 trillion yuan, surpassing the sum of deficit, special bonds, and special national bonds in 2023, which amounted to 8.68 trillion yuan. Notably, considering that the 1 trillion yuan special national bonds issued in the fourth quarter of 2023 for disaster prevention and mitigation will be mainly used in 2024, the actual fiscal strength in 2024 will experience a significant strengthening.

The guiding principle of monetary policy in 2024 is to be "flexible, approximate, targeted, and effective." Since the commencement of 2024, various measures have been implemented to reflect this principle. These include a comprehensive 50 basis point reduction in the required reserve ratio, targeted interest rate cuts in the agriculture and small business sectors, and a substantial reduction in the loan prime rate (LPR) for loans with a term of over 5 years. These measures underscore the adaptability and efficacy of monetary policy.

Moreover, with the Federal Reserve's interest rate cut on the agenda, the constraints of the external environment on China's monetary policy have significantly diminished. Consequently, monetary policy will persist in maintaining a prudent and moderately loose tone, with the aim of promoting a steady decline in overall social financing costs. It seeks to strike a balance between the scale of social financing, the money supply, and the expected targets for economic growth and price levels.

Guided by the "targeted" principle, monetary policy will increasingly prioritize effective countercyclical and cross-cyclical regulation. This requires striking a delicate balance between short-term economic growth imperatives and long-term structural optimization challenges. Moreover, it involves making more effective use of structural monetary policy tools. Efforts will be made to strengthen support for five major areas, including technology finance, green finance, inclusive finance, pension finance, and digital finance, alongside "three major projects."

This approach is geared towards fostering the transformation of economic development momentum, facilitating the advancement of new quality productive forces, and actively collaborating on mitigating real estate risks and reducing local government debt. Throughout these endeavors, the guiding principle of "establishing the new before abolishing the old" will be adhered to, ensuring a systematic and sustainable approach to economic development.

To strengthen the effectiveness of policies, proactive measures will be implemented to mobilize underutilized and ineffective financial resources. It aims to optimize both credit and financing structures, enhance capital utilization, and infuse fresh impetus into high-quality economic development. Simultaneously, multi-dimensional coordination will persist in strengthening monetary policy alongside fiscal, industrial, regional, real estate, employment, consumption, reform, and opening-up policies. This concerted effort seeks to cultivate a favorable financial environment conducive to fiscal reinforcement and the issuance of ultra-long-term special treasury bonds. Furthermore, it aims to expedite the development of direct financing, concentrate on supporting domestic demand expansion, facilitate supply and demand alignment, and foster a virtuous economic cycle.

Moreover, the Report underscores the importance of policies conducive to maintaining stable expectations, economic growth, and employment. It stresses the necessity of exercising caution in formulating measures that could potentially be contractionary or inhibitive in nature. Additionally, it highlights the imperative of enhancing the consistency of the macroeconomic policy keynote to establish a stable, transparent, and predictable policy environment. This strategic approach undoubtedly draws lessons from the inconsistent policy directions experienced in recent years, which disrupted both macroeconomy and expectations. Overall, the 2024 policy keynote presents a more positive outlook compared to 2023.

Strengthening the Foundation of Consumption

To achieve the 5% growth target, it is imperative to make full use of the fundamental role of consumption, the key role of investment, and the supportive role of exports. Particularly, consumption and investment play pivotal roles in expanding domestic demand. Therefore, the 2024 Report identifies "expanding domestic demand" as the third key focus area, emphasizing the need for better coordination between consumption and investment to augment their contribution to economic growth.

Regarding consumption, final consumption expenditure accounted for 82.5% of GDP in 2023, the highest level since 2000. However, this was mainly due to weak investment and exports. Retail sales of consumer goods experienced modest year-on-year growth of 7.2% in 2023, significantly lower than the double-digit average annual growth rate observed before the pandemic. Furthermore, apart from robust demand for services, consumption of durable goods and housing-related products remained relatively subdued, indicating a need to improve in both consumer purchasing power and willingness.

Therefore, the Report proposes a comprehensive range of measures to unlock potential demand by increasing revenues, improving supply, and reducing restrictions. These initiatives aim to stimulate consumer spending and foster a more robust consumption landscape conducive to sustained economic growth.

The cornerstone of consumer purchasing power lies in stabilizing employment. The Report outlines a proactive target of "over 12 million" jobs for 2024, surpassing the target of "around 12 million" in 2023. This necessitates a concentrated effort on prioritizing employment, bolstering support for stable employment through fiscal, tax, and financial policies, and intensifying special policies aimed at promoting employment. With the implementation of these measures to stabilize employment, it is anticipated that pressure on employment will be alleviated, laying a solid foundation for expanding consumption.

To enhance consumer willingness, it is essential to alleviate concerns about the future. The Report proposes optimizing the consumption environment by launching a year-long program to stimulate consumption and introducing a "worry-free consumption" initiative. Additionally, it underscores the importance of strengthening the protection of consumer rights and interests, fully implementing paid leave, and advancing reforms in areas crucial to people's lives, such as income distribution, social security, health care, and elderly care. These reforms aim to instill confidence in residents to consume and cultivate a willingness to engage in consumption.

The effects of relevant policies have begun to manifest. As of the end of March 2024, the consumer confidence index rebounded to 89.4%, marking the highest level since April 2023. Furthermore, by the end of April, the disparity in growth rates between household deposits and loan balances narrowed to 6.6 percentage points, lower than the 7.0 recorded at the end of 2023. During the New Year's Day and Spring Festival period, the recovery rate of domestic travel and tourism income for residents continued to rise. Additionally, from January to April, the year-on-year growth rates of consumption in communication equipment, and real estate-related sectors accelerated compared to December 2023, setting a promising precedent for unleashing the potential of consumption.

The pivotal role of investment is poised to be revitalized

In 2023, the contribution of gross capital formation to GDP growth stood at approximately 28.9%, roughly around the 30th percentile of historical levels. Notably, the year-on-year growth of fixed-asset investment for the entire year reached 3.0%, only marginally higher than the 2.9% recorded in 2020. This marks the second lowest level since statistics began in 1992.

In light of these figures, the Report advocates intensifying efforts to "increase effective investment" and fully harness the stimulating and multiplier effects of government investment. A special emphasis is placed on supporting major scientific and technological innovation programs, new types of infrastructure, and initiatives for energy conservation, pollution reduction, and carbon mitigation. Additionally, endeavors should target bolstering weak links in economic and social development, such as projects aimed at enhancing people's well-being. It is deemed imperative to build infrastructure for flood prevention, drainage, and disaster response, encourage upgrades and technological transformations of production and service equipment, and expedite the implementation of major projects outlined in the 14th Five-Year Plan.

In terms of the three pillars of investment, manufacturing investment is anticipated to accelerate. On the one hand, a gradual recovery in external demand is expected to propel the rebound in exports, particularly in high-tech exports. On the other hand, the Report prioritizes "striving to modernize the industrial system and develop new quality productive forces at a faster pace" as the first key task. This initiative is poised to create a vast market space for the transformation and upgrading of the manufacturing industry, as well as the renewal and transformation of equipment. Additionally, the anticipated rebound in the growth rate of industrial enterprise profits in 2024, coupled with the gradual restoration of business confidence, is expected to further contribute to the acceleration of investment growth in the manufacturing sector. Growth is forecast to increase to around 9.0%, up from 6.4% in 2023.

Infrastructure investment, on the other hand, is anticipated to remain generally stable. Fiscal policy in 2024 is expected to be stronger than in 2023, continuing to provide funding support for key project construction. In 2024, efforts will be directed towards appropriately expanding the range of areas and uses to which funds from the sale of special-purpose bonds can be allocated, aiming to leverage more effective investment. While major projects are anticipated to continue progressing, infrastructure investment may encounter pressure from land finance and the acceleration of local government debt. Consequently, the growth rate is expected to decline from 5.6% in 2023 to 7.0%.

The decline in investment in real estate development is expected to narrow. Since 2023, regulators have introduced the "three not less than" credit requirements to large banks, and the real estate financing coordination mechanism continues to play a pivotal role, expected to enhance the funding sources of real estate enterprises. Furthermore, the central government has urged the acceleration of construction for the "three major projects," including government-subsidized housing, while the central bank has reinstated the pledged supplementary lending (PSL) program, and decreased the cost of purchasing houses, which is poised to stimulate growth in development investment. Based on a low base in 2023, the decline in real estate development investment is expected to shrink from -9.4% in 2023 to -7.0%.

As of the end of April 2024, fixed asset investment has surged by 4.2% year-on-year, surpassing the 3.0% recorded in 2023 and surpassing market expectations. Notably, investment growth rates in the manufacturing sector and infrastructure are 9.7% and 6.0%, showing improvements compared to 2023. Only real estate developmentgrows at -9.8%, slower than 2023.

The supporting role of exports is anticipated to be revitalized

In 2023, the contribution of net exports of goods and services to China's economic growth was -11.4%, marking the first time it has become a drag since 2019. Additionally, the annual growth rate of goods exports in US dollars was -4.6%, representing the first negative growth since 2017. This uncommon scenario is expected to reverse in 2024. Annual export growth rate is expected to rebound to around 5.0%, potentially transitioning from a drag on the economy to a growth driver.

The Report underscores "pursuing high-standard opening-up and promoting mutual benefits" as the fourth key task, advocating efforts to steadily enhance the volume and quality of foreign trade. This includes intensifying support for import and export credit insurance, refining cross-border settlements, and enhancing risk management for foreign exchange and other services. Moreover, it calls for supporting businesses in diversifying overseas markets, fostering the sound development of cross-border e-commerce and other innovative business models, optimizing the layout of overseas warehouses, facilitating the upgrading of the processing trade, and nurturing new growth drivers for foreign trade, such as trade in intermediate goods and green trade. These initiatives aim to invigorate the role of exports and bolster their contribution to economic growth.

In addition to the relevant policy support, the authors anticipate an improvement in the external environment facing exports in 2024. In April 2024, the global manufacturing Purchasing Managers' Index (PMI) rebounded to 50.3%, reaching the second highest level since September 2022. This suggests that the global economy still possesses resilience. In the coming period, as developed countries pivot towards interest rate cuts, industries sensitive to interest rates will stabilize and rebound, while the inventory cycle will restart, all of which bodes well for the recovery of China's export growth rate. Despite the promotion of "decoupling" by developed countries, China's export market share has not significantly declined compared to the peak observed during the pandemic. Additionally, with the anticipation of export product price increases in 2024, a rebound in export growth rate appears highly probable.

In fact, these trends have already begun to materialize since the outset of 2024. From January to April, exports surged by 1.5% year-on-year in US dollars, surpassing the -4.6% rate recorded in the Year of 2023. The export delivery value of industrial products above designated size increased by 2.5% year-on-year,surpassing the -3.9% rate recorded in the Year of 2023. The improvement in exports has exerted a positive impact on both manufacturing production and investment, laying a sturdy foundation for achieving the annual target.

In summary, the economic growth target of around 5.0% has been established with careful consideration for both rationality and feasibility. It is aligned with potential economic growth and represents an objective achievable through determined efforts.

WEN Bin is the Chief Economist of China Minsheng Bank

WANG Jingwen is the Director of Macro Research Center of China Minsheng Bank Research Institute