Where Does the Real Estate Demand Go?

Author: WU Ge, YU Tao, CAO Haiwei , GAO Tong

In the current landscape of the real estate market, we can see significant adjustments in pricing and sales figures. In the first quarter of this year, commercial property transactions decreased by 27.6% compared to the corresponding period last year, with total sales plummeting by 44% from the historic peak recorded in the first quarter of 2021. This significant decline in housing demand and the sudden surge in the supply of pre-owned homes could be attributed to enduring factors such as demographic shifts and urbanization. Will the market undergo a process of self-correction and stabilization?

Is Population the Main Cause of Real Estate Overshoot?

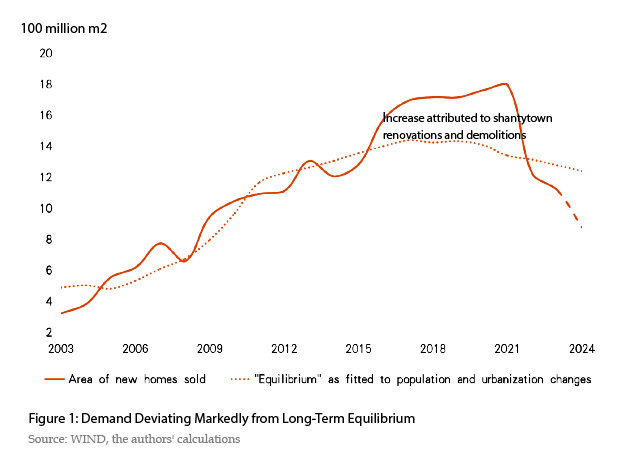

Based on the first quarter data, this year's projected annual sales of new homes are estimated at about 900 million square meters, a figure significantly below the long-term equilibrium value of approximately 1.2 billion square meters, reflecting population and urbanization trends. This indicates that population dynamics alone may not enough to explain the current downturn in the housing market. Even after factoring in the previous surge in demand resulting from shantytown renovations and demolitions in third- and fourth-tier cities, it remains challenging to justify the ongoing decline in demand.

Internationally, if micro-entrepreneurs’ expectations continue to wane, the homeownership rate is likely to decline substantially. This would prompt residents to postpone their home purchase decisions and opt for rental options instead. As the traditional concept of "rigid demand" evolves, the real-world demand equilibrium for housing is also expected to decrease dynamically.

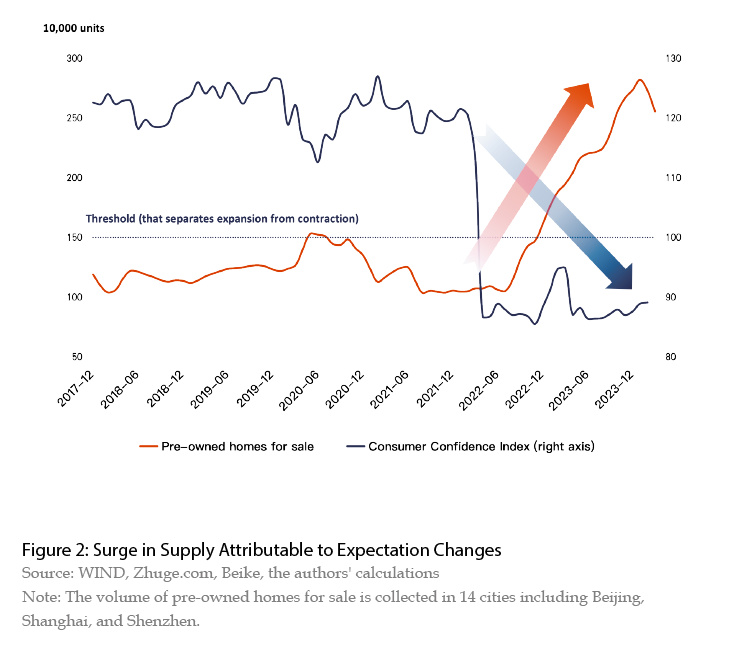

In contrast to the past, there has been a significant shift in the supply side, with pre-owned homes increasingly becoming the primary driver of changes in commercial housing supply. The surge in pre-owned homes for sale reflects a shift in residents’ behavior, possibly linked to the "weak social expectations" highlighted by the central government. This raises the possibility of a pro-cyclical relationship. International experience indicates that when the consumer confidence index falls, the volume of pre-owned homes for sale tends to rise. In 2022, China's consumer confidence index remained low following a sharp decline, which was accompanied by a continuous increase in pre-owned homes for sale.

Moreover, global trends indicate that the market for newly built homes often experiences a downturn during the sale-off phase of pre-owned home supply, persisting until the inventories of pre-owned homes return to normal levels and the market for newly built homes sees sustainable improvement. Presently, pressure from pre-owned homes for sale in China remains significant. For instance, in 14 major cities, initial calculations suggest that it would take approximately 17 months to absorb the pre-owned homes for sale over the past two years. Even if the sales of newly built homes were redirected to pre-owned homes, it would still take around 9 months to absorb this supply.

It is worth noting that estimating the size of the potential supply remains challenging, as it depends on further changes in expectations. According to a central bank survey, the average urban household in China owned 1.5 housing units in 2019, surpassing the average of about 1.1 housing units per household in Japan and the US.

Can the Market Stabilize Itself through Price Cuts?

International experience suggests that relying solely on price cuts to achieve spontaneous stabilization in the real estate market during a unilateral adjustment is often ineffective and can even worsen the situation once certain thresholds are reached. For instance, during periods of declining house prices in the US and Japan, residents' net worth also decreased significantly. When home prices decline by a larger ratio than down payment ratios, some residents may find themselves with negative net home values. This could further dampen their home ownership expectations and accelerate the downward adjustment in home prices. Given the high leverage of China's real estate enterprises, significant price adjustments may pose formidable challenges to their ability to deliver sold homes.

Following a unilateral adjustment in the real estate market, achieving spontaneous stabilization through price cuts alone is challenging. Housing is the most important asset for many Chinese residents, so a substantial decline in housing prices would inevitably lead to a reduction in wealth, thereby suppressing home buying behavior. Similar trends have been observed during periods of falling home prices in countries such as the US and Japan, where residents' net worth has also declined. When price cuts exceed payment ratios, some homeowners may experience negative net home values, further weakening their intentions to buy homes and accelerating the decline in home prices.

It is worth noting that in countries where real estate accounts for a larger share of the total assets of residents, downward adjustments in housing prices tend to be more prolonged. In China, real estate accounts for a significantly higher proportion of residents' net assets compared to countries such as Japan and certain European and American nations. At the onset of Japan's real estate adjustment in the early 1990s, housing assets accounted for approximately 50% of residents' total assets. In 2005, housing assets comprised about 33% of the total assets of the US residents. According to calculations by the C