Leveraging the Qianhai Shenzhen-Hong Kong Modern Service Industry Cooperation...

Title: Leveraging the Qianhai Shenzhen-Hong Kong Modern Service Industry Cooperation Zone for the Advancement of Hong Kong as An International Financial Center

To accelerate the construction of a world-class international financial center in China’s Hong Kong(hereinafter referred to as Hong Kong), it is necessary to fully utilize various favorable conditions and mobilize all available resources, including leveraging strong support from key regions in the Chinese mainland and enhancing both internal and external linkages with these areas. The State Council approved the Overall Plan for the Development of Qianhai Shenzhen-Hong Kong Modern Service Industry Cooperation Zone (hereinafter referred to as the Qianhai Overall Plan) in December of 2023. This plan proposes the establishment of a Shenzhen-Hong Kong Deeply Integrated Development Leading Zone, which offers a new approach to support the construction of Hong Kong International Financial Center. That is, by deepening financial integration and collaboration between Hong Kong and Qianhai, solid support will be provided and stronger momentum will be injected into the development of the Hong Kong financial sector.

Important cornerstones and new developments in the construction of Hong Kong International Financial Center

Compared to the long history of development of major international financial centers such as New York and London, the establishment and development of the Hong Kong International Financial Center is relatively short. Nonetheless, it has made significant strides and increasingly exerts its influence not only on the surrounding areas but also on the global market. This success can be attributed to its clear development path, characterized by the formation of a unique service model known as the “one point, two sides” approach, which also acts as a fundamental cornerstone and a key factor contributing to the success of the Hong Kong international financial center.

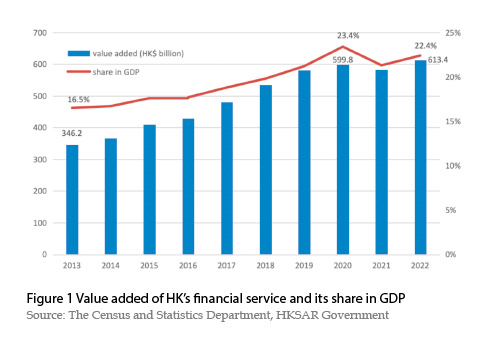

The concept of "one point" in Hong Kong's financial industry is a crucial factor in driving local economic growth by optimizing market mechanisms, enhancing market functionality, and increasing the diversity of financial products. As of 2022, the value added of the financial services amounted to HK$613.4 billion, accounting for a share of 22.4% among Hong Kong's GDP (see figure 1). This sector has been the driving force behind economic growth, providing impetus to the development of other sectors.

The "two sides" stands for the two sectors of the Hong Kong International Financial Center that radiate outward. First, it plays a role of financial bridge and window for the Chinese mainland, and supports the nation's reform and opening up, by providing sufficient funds and high-quality financial services. Secondly, it aims to establish itself as a leading offshore financial market in the Asian time zone, connecting capital markets in Europe and the US, and offering top-notch offshore financial services to the Asia-Pacific region, especially to the surrounding countries and regions.

China's economy has consistently achieved rapid and stable growth, with continuous enhancement of its national strength and deep integration into the global economy and finance, which sets up a robust pillar of support for the development of the Hong Kong international financial center. It is important to bear in mind that Hong Kong's financial industry relies on the motherland, serves the mainland economy and faces the global market. Indeed, Hong Kong has gained a clearer understanding of its positioning and advantages, and its ability to capture various market opportunities has also enhanced. In recent years, the mainland has promoted major national development strategies such as the Belt and Road Initiative, the 14th Five-Year Plan and the Guangdong-Hong Kong-Macao Greater Bay Area Plan, which has laid a solid foundation for Hong Kong's international finance business, and brought new change in the "one point, two sides", showing new characteristic of development in new era.

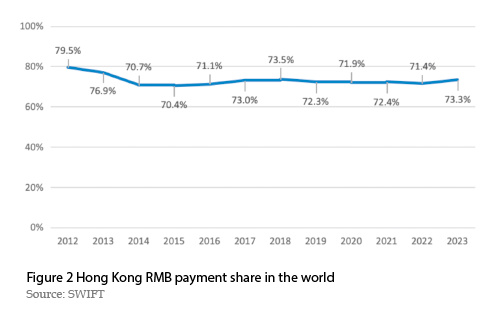

The development of "one point" gets new important connotations

The Hong Kong International Financial Center has evolved into a multi-market, multi-functional offshore financial service platform that encompasses banking, securities, insurance, foreign exchange markets, capital markets, asset management, risk management, equity investment, and more. These sectors have achieved significant development and have reached an internationally renowned, first-class level. In the past 20 years, the mainland has vigorously promoted the international use of RMB and established the first overseas RMB clearing bank in Hong Kong. With the support of the central government and the efforts of the industry, Hong Kong has successfully established itself as the premier overseas offshore RMB center and has gradually upgraded to a global offshore RMB business hub. According to SWIFT statistics, Hong Kong's RMB payment volume has always accounted for more than 70% of the world's total (see figure 2), showing that Hong Kong has become the most important overseas RMB clearing center.

Almost all pilot projects for RMB internationalization and capital account convertibility of mainland were mainly implemented in Hong Kong, while Hong Kong's financial industry took the initiative to undertake the projects, leading to significant growth opportunities while successfully fulfilling the tasks assigned by the central government. The 14th Five-Year Plan repositions Hong Kong's economy and lists the international financial center as the first of the eight international centers in Hong Kong. It further emphasizes the financial development themes that focus on strengthening the functions of Hong Kong as a global offshore RMB business hub, an international asset management center, and a risk management center, thereby highlighting the distinctive status of its financial industry.

The development of "two-sides" is more focused, with its direction clearer

Internally, Hong Kong is actively seeking a more significant role and position as a prominent international financial center, with the focus on better serving the high-quality development of the mainland economy and high-level openness to the global market, and leveraging "Hong Kong's strengths", meeting "the needs of the country". It also supports and participates in a development paradigm of dual circulation with the domestic market as the mainstay, and domestic and overseas markets reinforcing each other, serving as the connection point which is conductive to the smooth two-way flow of factors and resource between the two markets. In terms of regional distribution, Hong Kong is regarded as leading International Financial Center within the Great Bay Area, guiding the financial industry to actively engage in global competition.

Externally, in response to the country’s opening-up policy and the regional economic cooperation initiatives like the Belt and Road Initiative (BRI), the Regional Comprehensive Economic Partnership(RCEP) and China-ASEAN Community with a Shared Future, Hong Kong is improving offshore investment, financing and risk management platform, and supporting enterprises in leveraging Hong Kong’s various advantages to expand overseas markets. Moreover, it enhances the function of the global offshore RMB business hub, radiate the advantages of RMB products and services to neighboring countries and accelerate the construction of those RMB markets.

The significance of the new positioning of the Qianhai Overall Plan to Hong Kong

In recent years, competition among international financial centers has intensified, with many countries and regions considering the establishment of world-class international financial center as a strategic goal and source of core competitiveness. Some surrounding international financial centers have even taken Hong Kong as a direct competitor and have implemented targeted and relevant measures, therefore increasing competitive pressure faced by Hong Kong. Following Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, the Qianhai Overall Plan further details Qianhai's policies and measures to support the development of Hong Kong, proposing new ideas for promoting financial cooperation between the two regions and responding to international challenges.

Due to its special geographical location and convenient transportation, Shenzhen was the earliest place for Hong Kong's financial industry to enter the mainland market. Up to now, Shenzhen is still the city with the highest density of Hong Kong financial institutions and the strongest cross-border financial services in Chinese mainland. The Qianhai Cooperation Zone has gradually matured, forming a high-level infrastructure, broad spatial layout and high-level innovative mechanisms, which has greatly attracted Hong Kong financial institutions, thus forming a new Shenzhen-Hong Kong cross-border service center.

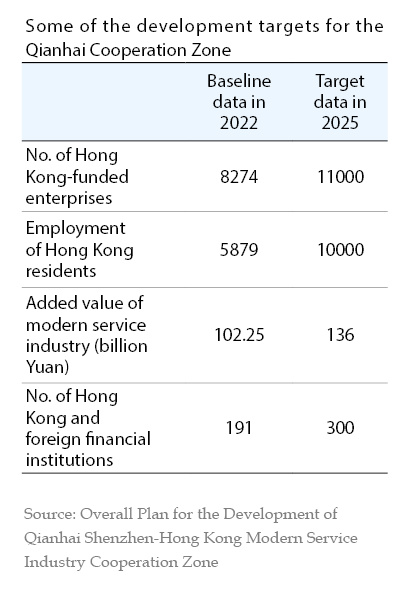

According to the Qianhai Overall Plan, the Qianhai Cooperation Zone is positioned as Shenzhen-Hong Kong Deeply Integrated Development Leading Zone. This special platform is required to adhere to the principle of relying on Hong Kong and serving Hong Kong, promoting the organic connection of rules and mechanisms, the seamless connection of infrastructure, and the common development of people’s livelihood, hence further expanding space for Hong Kong’s economic development (see table 1). In the long run, Qianhai’s support for Hong Kong as an international financial center will continue to increase. The Qianhai Overall Plan outlines the development targets for the Qianhai Cooperation Zone.

It strives to promote the deep integration of the financial industries between Shenzhen and Hong Kong, jointly build the core financial circle in the Great Bay Area and provide stronger support for the construction of Hong Kong as an international financial center.

Qianhai Cooperation Zone makes full use of the institutional innovation advantages granted by the central government, actively enhances connectivity with the Hong