Our Distance to QE

Author: ZHANG Yu , WEN Ruoyu

Regardless of whether the central bank acquires treasury bonds in the future, China's monetary policy does not require a shift to quantitative easing. This is because China's central bank can expand its balance sheet through refinancing, allowing it to enhance its ability to manage interbank interest rates. At the same time, it is not necessarily the case that China will resort to monetizing fiscal deficits, given that Chinese fiscal policy is under "nominal budget constraint."

What is QE

QE stands for quantitative easing. From an academic perspective, this paper draws on three sets of views from central bank practitioners both domestically and internationally.

Firstly, Alan Greenspan, the former chairman of the Federal Reserve, stated in his speech on bubbles, long-term stagnation, and responses (China Finance, Issue 3, 2015) that quantitative easing by central banks has added trillions of dollars to their balance sheets. By purchasing securities, central banks have reduced interest rates on long-term securities to very low levels.

Secondly, Monetary Policy Committee member HUANG Yiping described quantitative easing in his article, How to Understand Current Monetary Policy (China Finance, Issue 4, 2019), as a policy implemented after short-term interest rates have been reduced to zero. In this situation, the central bank increases the supply of liquidity by purchasing medium- and long-term assets, including risky assets, to lower medium- and long-term market interest rates.

Thirdly, a task force from the People's Bank of China (PBOC) Monetary Policy Department stated in their article Structural Monetary Policy to Help Financing in Five Major Sectors (China Finance, Issue 2, 2024), that when the 2008 international financial crisis broke out, major developed economies saw nominal interest rates reach the lower bound of the effective interest rate, leading to the failure of price-based regulation. Consequently, monetary policy shifted to quantity-based regulation, introducing quantitative easing policies and injecting large amounts of liquidity into the market.

In summary, this paper suggests that QE can be understood from three perspectives:

Contextually: Traditional monetary policy tools have become increasingly constrained.

Methodologically: Quantitative easing involves the purchase of medium- and long-term assets, and in extreme scenarios, even risky assets, to bolster market risk appetite.

Purposefully: The objective of quantitative easing is to boost liquidity supply, thereby lowering medium- and long-term market interest rates.

If the Central Bank Buys Treasury Bonds, Does It Mean that Monetary Policy Turns to QE?

Drawing on the above understanding of the three perspectives of QE, this paper argues that simply purchasing treasury bonds by the central bank in the secondary market throughout the year does not necessarily mean implementing QE as a monetary policy measure.

In terms of background, there is a lack of necessity.

Given the background, China's traditional monetary policy tools still have a considerable role to play, making the early implementation of QE unnecessary. XUAN Changneng, Deputy Governor of the PBOC, explicitly stated during a press conference at the State Council Information Office on March 21, "Foreign central banks' changes in balance sheets, particularly the QE and QT measures of major foreign central banks, are closely monitored. However, due to their statutory reserve requirement ratios being nearly zero, their margin for adjustment is minimal, and they rely more on proactively expanding and contracting to regulate liquidity. Our average required reserve ratio (RRR) remains at 7%, which continues to be a significant tool for managing liquidity."

In terms of methods, the central bank can still manage interbank liquidity efficiently, making QE inefficient.

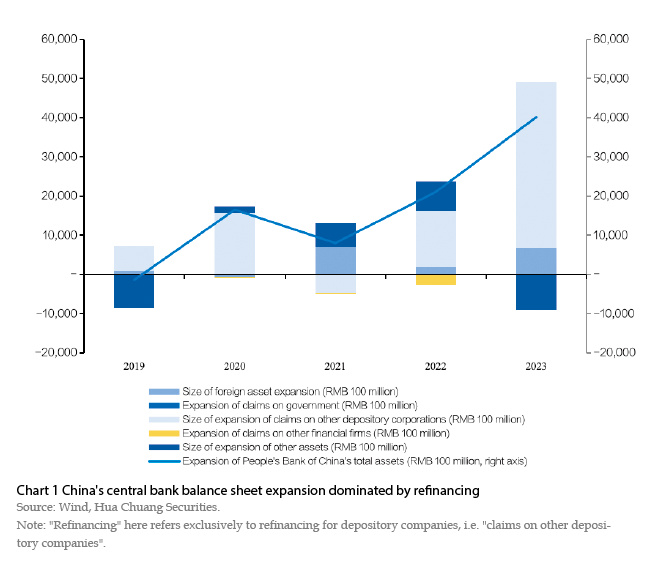

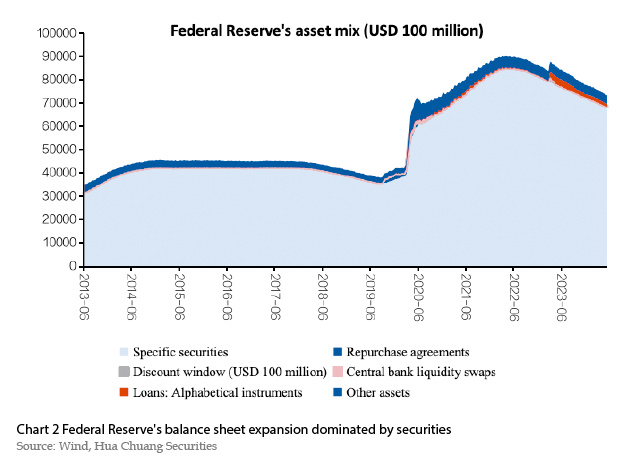

From a methodological perspective, China's central bank primarily relies on refinancing as the main method of expanding its balance sheet. Even if it initiates treasury bond purchases, it remains an auxiliary measure. Data from 2023 indicates that China's central bank expanded its balance sheet by approximately 4 trillion yuan, while various forms of refinancing provided funds amounting to about 4.2 trillion yuan. In contrast, the Federal Reserve's balance sheet expansion relies primarily on the purchase of medium- and long-term assets. As of March 2024, the Fed's total assets stood at US$7.5 trillion, with securities holdings accounting for 93%, approximately US$7 trillion.

The disparities in the impact on interbank liquidity between the expansion of the balance sheet through refinancing and the purchase of long-term assets stems primarily from two factors.

Liquidity "Tightness": Expanding the balance sheet through refinancing does not necessarily result in short-term liquidity loosening, whereas expanding it via purchasing long-term assets inevitably leads to short-term liquidity relaxation. This difference arises because the two methods provide different term structures for the base currency. Refinancing allows for the injection of ultra-short-term liquidity (e.g., 7-day repos), while purchasing long-term assets can be considered equivalent to lowering reserve requirement ratios, resulting in the injection of longer-term liquidity.

Duration of Liquidity Easing: Relying on refinancing as the primary method for expanding the balance sheet allows the central bank to tighten liquidity whenever necessary. However, it is less feasible to tighten liquidity in the short term when expanding the balance sheet based on the purchase of long-term assets. This difference arises because refinancing allows for the injection of short-term liquidity, enabling the central bank to scale back refinancing if it perceives short-term liquidity as excessively loose. Conversely, if the central bank purchases long-term assets, unless other institutions take over these assets or they naturally mature, it is challenging for the central bank to actively retract the injection of base money.

From the Perspective of Purpose: The Central Bank's Purchase of Treasury Bonds as a Synergy between Monetary and Fiscal Policies

Legal Boundaries: The central bank's behavior in buying and selling treasury bonds is delineated in the Law of the People's Republic of China on the People's Bank of China. This practice is not a new policy. According to Article 29 of Chapter 4 of the Law, "The People's Bank of China must not allow the government to overdraw from its account in the central bank, and must not directly subscribe to or underwrite on a firm commitment basis central government bonds or other government securities." This indicates that China's central bank is prohibited from buying or selling treasury bonds in the primary market. However, it is permitted to purchase treasury bonds in the secondary market. Article 23 of Chapter 4 of the Law states that to implement monetary policy, the PBOC may purchase and sell central government bonds and other government securities, financial bonds, and foreign exchange on the open market.

Purpose: The primary aim of the central bank's purchase of treasury bonds is to enhance synergy between monetary and fiscal policies. This perspective is supported by Column 3 of the Monetary Policy Implementation Report for the third quarter of 2023, titled Proactively Strengthening the Synergy between Monetary and Fiscal Policies. The article explicitly states, "The report to the 20th National Congress of the Communist Party of China (CPC) emphasized the need to 'enhance the coordination of fiscal and monetary policies.' Fiscal policy and monetary policy are two important pillars in the macroeconomic governance system, as well as two important means to support the expansion of domestic demand and promote high-quality economic development."

Acquisition of Risky Assets: There is no inherent correlation between QE and the central bank's inclination to acquire risky assets. For instance, during the Asian financial crisis