A Closer Look at the Offshore RMB FX Market and CNH Interbank Liquidity

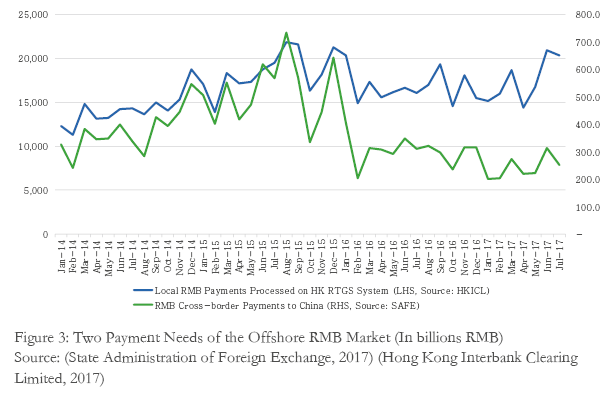

Two years have passed after the August 11 FX reforms in China. The offshore RMB foreign exchange market (the CNH FX Market) has seen some new phenomena,including the large swing of interbank short term interest rates,an indicator of interbank liquidity. It is worthwhile to have a closer look at this market to better understand how it functions,as we look forward to the next phase of market development.

The CNH FX market has a comprehensive set of FX instruments including spot,forward,swaps,cross-currency swaps and options. It is participated by not only banks and corporates,but also a wide range of other users including institutional investors,individuals,public sector and others. It is a decentralized,over the counter market that is open around the clock in multiple financial centers. It is not a real-need-based market,so that the market participants could manage their risks with flexibility and operational efficiency. The CNH FX market has become larger than the onshore FX market. The BIS triennial FX survey in 2016 indicated that RMB FX done inside Mainland China accounted for some 22% of global total (Bank for International Settlements,2016). The rest is now mainly CNH (instead of non-deliverable forwards).

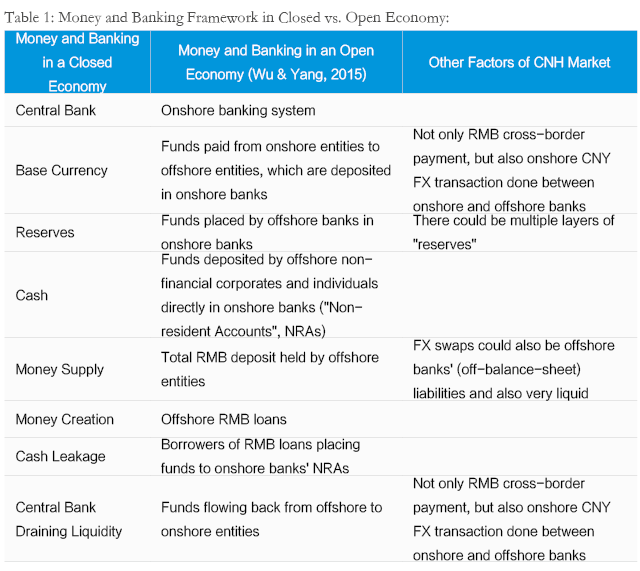

Given the experience in the past two years,one may wonder,why the CNH market exhibits the tendency to have extreme interest rate movements ¨C as reflected by the USDCNH swap points (which shows the relative interest rate between the USD and the CNH,Figure 1). Why could a large,actively traded,open and efficient market be so illiquid at times,yet so flushed in others?

Unlike the onshore market where there is a monetary system with the central bank,in the CNH market,there is no central bank managing the system¡¯s liquidity. As (Wu & Yang,2015) has pointed out,the "central bank" role of the offshore market is in fact played by the onshore banking system. The funds of offshore banks placed in the onshore banking system are the "reserves",and the non-resident account (NRA) balance in the onshore banking system is the "cash". Together they form the "base money" of the offshore monetary system. In this article,we try to expand on this discussion and take a closer look at some factors that play an important role in the CNH market,and discuss how these factors affect CNH interbank liquidity.

Factors Impacting CNH Interbank Liquidity

CNH interbank liquidity,or the "reserves",is used for processing of customer and interbank payments. CNH payment between two offshore parties is essentially a reallocation of "reserves" between different banks. The cross-border payment with China is the transfer of "reserves" out of the offshore banking system into the onshore banking system,and vice versa. So the factors affecting CNH interbank liquidity includes the "supply" of aggregate "reserves" within the offshore banking system vs. the total payment needs (i.e. The "demand"),and the structural distribution of "reserves" among the different offshore banks.

The clearing and settlement setup of the CNH market also sets important background for this topic. There are primarily two different models of RMB clearing in offshore markets: the "Clearing Bank" model,and the "Correspondent Bank" model. In the "Clearing Bank" model,payments are handled by the "Clearing Bank" designated by PBOC. It supports cross-border payments and also offshore payments. To use Hong Kong as an example,the Clearing Bank is also the Clearing Bank for Hong Kong RMB RTGS system that handles offshore payments. In the "Correspondent Bank" model,cross-border payments are handled by the commercial banks onshore .

We should note that the "reserves" has multiple layers due to the setting above. The most liquid layer is the clearing funds at the Clearing Bank,because it can support the needs of both offshore payments and cross-border payments. The next liquid layer is the clearing funds in the correspondent banks in China. This usually can only be used for cross-border payments,but can be transferred to the Clearing Bank to support the offshore payments needs in the RTGS system. The most illiquid layer is the funds placed with either the Clearing Bank or the correspondent bank at a tenor,because the funds could not be readily used by the offshore banks for payments. Therefore,how offshore banks manage their liquidity by allocating their "reserves" across the multiple layers also has an impact on overall CNH liquidity.

The Supply of CNH Liquidity

The supply of CNH interbank "reserves" almost entirely depends on cross-border RMB settlement,because there is no central bank for the offshore market,and there is virtually no credit extension from the onshore banking system to the offshore system. The offshore central banks like the HKMA and offshore Clearing Banks provide some liquidity facilities,but the capacity is very limited. The cross-border RMB settlement remains the dominant channel of CNH interbank liquidity supply. It needs to be emphasized that cross-border RMB programs are real-need based,i.e. there must be a genuine transaction background,and thus two-way interest will always exist and the direction of payment will not be only (passively) responding to market pricing signals.

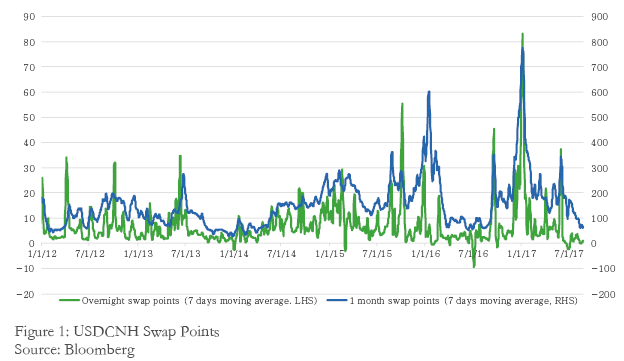

Net payments of RMB from onshore entity to offshore entity form the "base money" of the CNH system. As previously discussed,the "base money" is onshore banks' liabilities to offshore entities. When studying the relevant statistics from SAFE (cross-border RMB customer payments) and PBOC (RMB deposits owned by offshore entities),it is found that the cumulative RMB net paid into the offshore market did not fully translate into the "base money" lodged in the onshore banking system: there is a gap that is filled by some other channels (Figure 2).

As some offshore banks (Clearing Banks and some Participating Banks) can directly access the onshore CNY FX market to square FX positions related to eligible cross-border RMB goods trade,services trade,direct investment (and more recently Bond Connect),some RMB might have been "bought back" into the onshore banking system via FX - e.g. when the offshore party did not want to hold RMB received from RMB cross-border payment programs,and they requested to have the RMB converted to foreign currencies via the onshore FX market. This might have added to the FX outflow pressure on China. But most recently,this direction might have been reversed: RMB seems to be net paid from onshore to offshore via this channel in most recent months - the offshore importers are buying RMB via this channel,so they can use the RMB to pay into China.

The Demand for CNH Liquidity

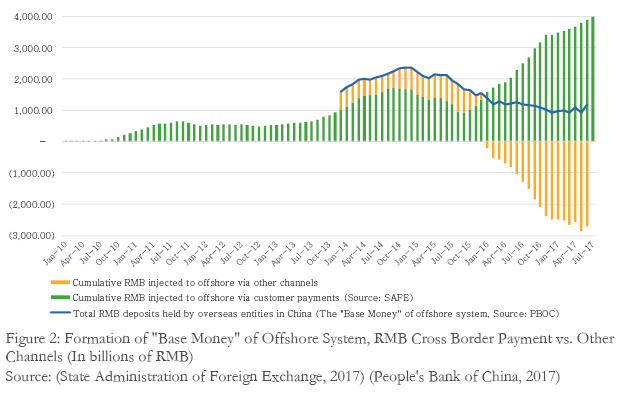

The "demand" offshore RMB liquidity includes the needs from cross-border and offshore payments. The first is relatively small in scale (notice the scale difference in Figure 3),but as real "reserves" must be paid into onshore,this could put pressures on the offshore liquidity. When cross-border flow tilts towards the inflow direction heavily,it is more likely to see offshore liquidity tightness.

The second need does not impact the total amount of "reserves" in the system. Since there is no central bank in the offshore market that could temporarily expand the total amount of "reserves" (except for the limited amount of liquidity facilities provided by the HKMA etc.),the offshore banks could only depend on the available reserves in the market,and the bilateral credit between different banks to reallocate the reserves from the "surplus banks" to the "deficit banks". The offshore payment is very active,partly driven by the active FX market,and it would demand a large scale of "reserves" to accommodate the liquidity needs. Figure 3 takes the local RMB payments processed in local RMB RTGS system in Hong Kong as a proxy of all CNH offshore payments.

The scale of money creation is also an indicator of the demand for the CNH liquidity. To study the money creation in the CNH market,one needs to consider not only the traditional loans-deposits mechanism,but also the role of FX,especially the FX swap market to facilitate money creation. FX swap is the instrument that involves two exchanges of currencies in different time. It has two key features that enable itself as a facilitator in the CNH market. First,the foreign currencies could be seen as collateral in the transactions,which helps to reduce the credit exposure for transaction parties. Second,holding FX swap contracts enables parties to achieve the same economic impacts as RMB deposits/loans without having the FX exposure. Instead of placing CNH as a bank deposit,an offshore investor could enter an FX swap to sell-buy CNH to achieve the same result. The two features made the CNH FX swap market very significant in size compared with other instruments. A result is that the interest rate of CNH is first and foremost represented by the CNH FX swap market,and this rate is also the most sensitive to change in market conditions.

Figure 4 shows how Hong Kong banks create CNH via the on-balance-sheet loans-deposits mechanism,as well as the volumes of CNH FX swaps market. It takes positions of other foreign currencies (i.e. excluding HKD,USD,GBP,JPY,EUR,CAD and CHF) as a proxy of CNH act