Crude Oil Futures Start Trading in Shanghai

China rolled out trading of crude oil futures in Shanghai in March. In preparing for this milestone in opening up the domestic market and with the goal of facilitating fund settlements and physical delivery,the State Administration of Foreign Exchange (SAFE) issued its Notice on the Issues of Foreign Exchange Management of Foreign Traders and Overseas Brokerage Institutions Engaged in the Trading of Certain Types of Futures in China (SAFE 2015 document No. 35) and the Reply of State Administration of Foreign Exchange on the Relevant Issues Concerning the Operation of Foreign Exchange Business of Physical Delivery of Crude Oil Futures (SAFE 2018 document No.1). SAFE thereby allowed foreign counterparties to participate in specific types of futures transactions within Chinese territory. In addition,SAFE made clear provisions on issues related to specific varieties of futures for the first time. This was a breakthrough in promoting China’s futures products on the international stage.

Opening Up China's Commodity Futures Trade

The development of the futures market plays an important role in improving China's financial system and accelerating the upgrading of the nation's industrial structure. China’s futures market got its start in the late 1980s and underwent a pilot stage and a period of significant disruptions,followed by a market rectification and finally healthy development. Similar to commodity futures elsewhere,China's futures markets started with agricultural products aimed at individual investors. But for much of this time,only domestic parties were allowed to participate. This created a significant impediment,denying these markets the chance to become truly international and thwarting the ability to exercise pricing power in the global futures market.

China's commodity futures exchanges include the Zhengzhou Commodity Exchange,the Shanghai Futures Exchange and the Dalian Commodity Exchange. Currently,55 futures products are traded,including 47 commodities futures products. China’s futures markets have gradually exerted their influence in domestic pricing of copper,PTA and oils and fats. This has also helped promote fair competition among domestic enterprises in the international market.

At the end of 1992,China launched oil futures trading,but due to significant market shortcomings such as inadequate government supervision,trading was scrapped. A two-step strategy was applied,starting with fuel oil and gradually introducing other products on the Shanghai Futures Exchange from 2004 to 2013. These served as an important part of the eventual re-launch of domestic crude oil futures.

China first proposed the introduction of crude oil futures products priced in yuan in 2012. The framework for a crude oil futures market has since been put in place piece by piece,with the creation of an international platform,the setting of prices in yuan,the use of net price trading and the creation of bonded delivery. Different from other varieties of commodities futures in China,crude oil futures allow the participation of foreign investors,including multinational oil companies,crude oil traders and financial institutions.

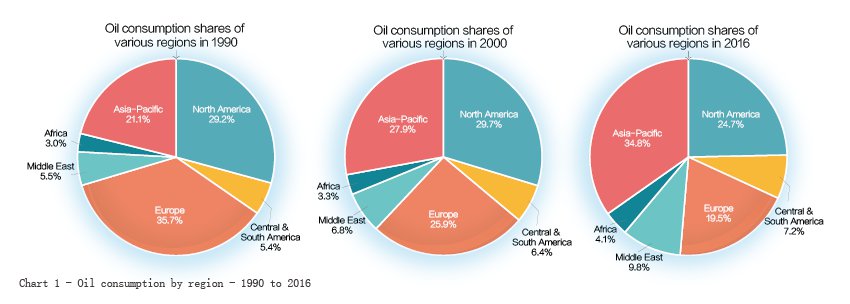

The conditions for the creation of such a market in China had been emerging gradually. From 1990 to 2016,the share of oil consumption in the Asia-Pacific region had gradually expanded,ultimately surpassing that of North America and Europe (see Chart 1). According to the Energy Information Administration of the US Department of Energy,China's average daily crude oil imports in 2017 were 8.4 million barrels per day,exceeding the 7.9 million barrels per day of the US. The introduction of China’s crude oil futures will help form a benchmark pricing system that reflects the supply and demand relationship between China and other oil markets in the Asia-Pacific region. By optimizing the allocation of oil resources,this move can provide enterprises with effective tools for price risk management. In so doing it can also serve the real economy,promote the Belt and Road Initiative ¨C a major trade and infrastructure strategy ¨C and help attain the goal of making Shanghai an international financial center.

Crude oil futures officially began trading on March 26 on the Shanghai International Energy Trading Center,a subsidiary of the Shanghai Futures Exchange. It was China’s first futures product that gave foreign brokers and traders an opportunity to trade directly. The parties involved in the crude oil futures exchange include foreign traders,overseas brokerage institutions,and energy center members,among them futures company and non-futures company members,as well as depository banks,designated delivery warehouses and others. At present,the Shanghai International Energy Trading Center has 156 members,including 149 futures companies,seven non-futures firms,13 depository banks,eight overseas deposit guarantee banks,six designated delivery warehouses,three alternate delivery warehouses,and four designated inspection agencies.

Trading and delivery of crude oil futures involves over-the-counter trading and exchange trading. There are three components to over-the-counter trading¡ªcrude oil storage,crude oil futures delivery,and crude oil delivery. Exchange trading transactions have two components¡ªwarehouse receipt flows and fund settlements. The flow of goods and capital is roughly as follows: foreign oil is brought into the domestic bonded oil tanks,a crude oil futures bonded standard warehouse receipt is written,and the external payment is made concurrently. The futures contract with the standard warehouse receipt is transferred to the exchange,with the transfer of cargo ownership,though at this point there is no import/export cargo flow. Overseas funds may then flow into the futures market through a non-resident alien account (foreign special renminbi/foreign exchange special futures settlement account,which is under the capital account). When the futures contract expires there can be a physical delivery. If an import and export trade occurs,the crude oil will be exported to the purchaser outside the bonded zone in China or out of the country. At that point a domestic payment or cross-border collection of foreign exchange occurs.

Exchange Trading

Crude oil futures traded at the Shanghai International Energy Trading Center use open centralized trading methods or other methods approved by the China Securities Regulatory Commission. Market participants issue trading orders through written trade orders,telephone,Internet and other entrusted methods. Futures company members and overseas special brokers conduct capital and position verification on client trading orders,and pass the customer orders to the energy center for participation in the bidding process. A transaction is established when the trading order has been completed.

Fund Settlements

Crude oil futures trading is denominated and settled in yuan. Foreign traders and overseas brokers can directly use foreign exchange as a deposit,and foreign exchange margins can be used for settlement of domestic crude oil futures funds. Energy centers,members,foreign traders,and overseas brokerage