Trade Wars and the Future of the Global Trading System

Over the past year,the Trump administration has been escalating its trade confrontations with its important trading partners. It has imposed tariffs on imports from China,as well as Canada,Mexico,the European Union,Japan and South Korea. Though not all of the threatened actions are in effect as of this writing,the impacts could still be huge.

These protectionist measures could have significant repercussions ¡ª reduced trade,redistributing income from domestic consumers to domestic producers,higher prices,benefiting domestic producers of the product but harming consumers who are forced to pay more. The consequences of import restrictions also include a reduction in exports and lower employment in downstream industries.

Most of the anti-import measures taken by the Trump administration fly in the face of widely accepted trade norms and in some cases are illegal. As Robert Z. Lawrence,a Harvard University professor and a senior fellow at the Peterson Institute for International Economics,wrote in his article How the United States Should Confront China Without Threatening the Global Trading System (August 2018),"Many of these steps have been notable for violating rules and regulations embodied by previous agreements with trading partners and by those enforced by the World Trade Organization (WTO),which have nearly always provoked trading partners to retaliate and warn of further actions".

Why does the Trump administration address its concerns this way? In my view,Trump believes that foreign production by US firms must be punished. Companies that maintain offshore operations must be forced to return some manufacturing to the US. Another goal could be to maximize US negotiating leverage with its trading partners and we can see that very clearly from the ongoing North American Free Trade Agreement (NAFTA) renegotiations.

The world trading system is under serious threat,and the risks to the worldwide flow of goods,services,and investments are considerable.

Trade War: Where Do We Stand Now?

The Trump administration has proposed successive rounds of tariffs on US imports from China,including intermediate inputs,capital goods,and consumer products. The total value of these imports in 2017 were US$505 billion. Here's a breakdown of where we stand:

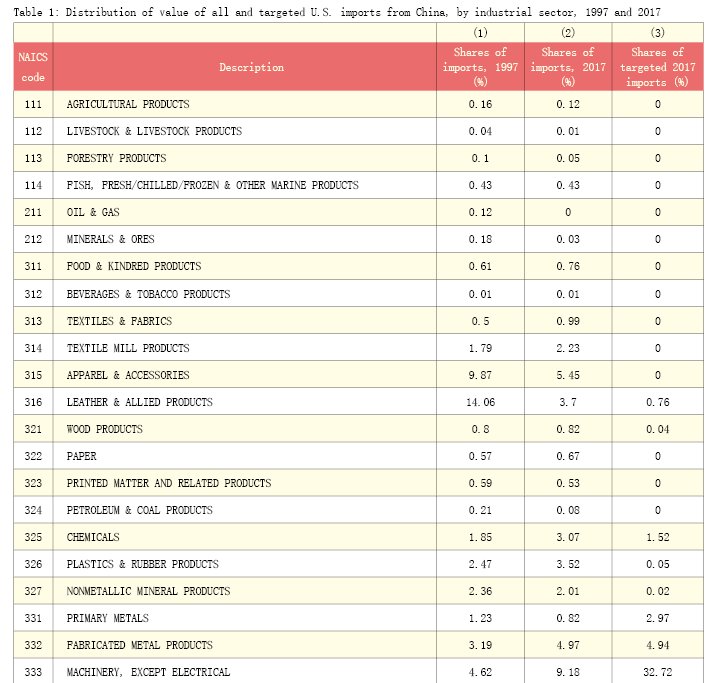

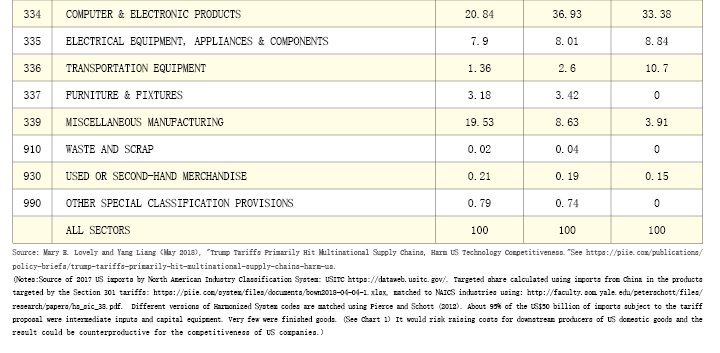

Round One: The Trump administration imposed tariffs on US$50 billion in Chinese imports,splitting the levies into two tranches of US$34 billion and US$16 billion. The US$50 billion list of 1,333 Chinese products under consideration for 25% tariffs was released on April 3,then revised on June 15. The first phase of tariffs on US$34 billion in imports went into effect on July 6,including auto parts,electronic components,jet engine parts,compressors and other machinery. The second phase,which the US followed through on by imposing tariffs on US$16 billion of imports from China,mainly applied to chemicals and electronic parts and went into effect on August 23 (see Table 1). In parallel with each phase of President Trump’s tariffs,China immediately responded "dollar for dollar."

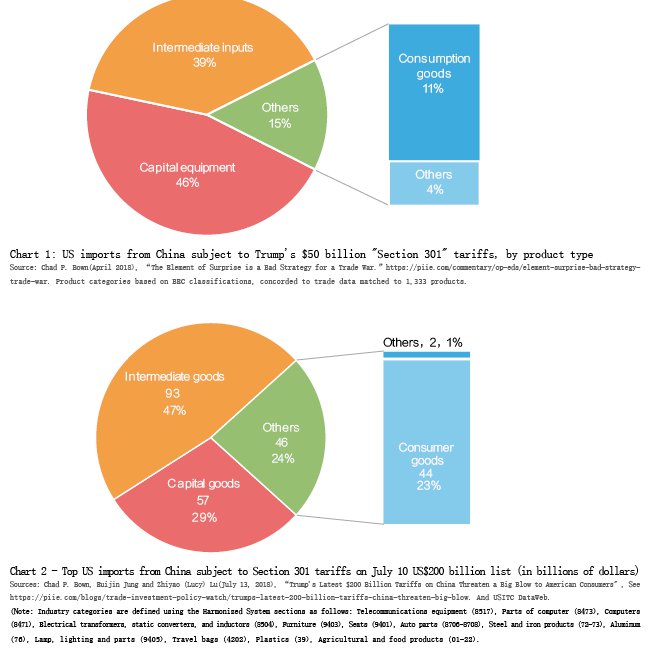

Round Two: The US is finalizing plans for tariffs on US$200 billion in Chinese imports,and 47% of the items on the list are intermediate goods,such as computer and auto parts. A substantial number of consumer goods are also targeted (see Charts 2 and 3). It's unclear whether the new tariffs will be set at 10% or 25%. The public comment period ended on September 6,the last step before a decision. According to the Wall Street Journal,President Trump later signaled that the timing of this US$200 billion move has not yet been finalized. He was quoted as saying it "could take place very soon depending on them — to a certain extent it depends on China." The Office of the US Trade Representative took three weeks after the end of the first comment period to announce tariffs.

Round Three: President Trump in July,and again in September,threatened that he was ready to impose a third round of tariffs on another US$200 billion or more of Chinese goods. At US$267 billion in goods,the figure Mr. Trump gave on September 7,would bring the total amount of goods subject to tariffs to more than the US$505 billion the US imported from China in 2017. That would be on top of the 25% levies on US$50 billion of Chinese exports already in force and tariffs on another US$200 billion of goods the administration is considering.

In this US$267 billion list,about 11% of all US merchandise imports,capital goods and consumer products are the major targets,accounting for 46% and 38% of the value of imports that would be hit. Intermediate inputs account for 14%.

The tensions are escalating. Though we may not encounter the worst case scenario,the impact could still be huge. It was said on September 12 that the US side sent an invitation to Chinese counterparts,proposing another bilateral trade meeting. Let’s wait and see.

The Impact of Trade Conflicts

In its most recent minutes,the US Federal Reserve indicated concerns over trade conflicts: "[M] any District contacts expressed concern about the possible adverse effects of tariffs and other proposed trade restrictions,both domestically and abroad,on future investment activity; contacts in some Districts indicated that plans for capital spending had been scaled back or postponed as a result of uncertainty over trade policy. Contacts in the steel and aluminum industries expected higher prices as a result of the tariffs on these products but had not planned any new investments to increase capacity."

A group of 152 trade associations representing US manufacturers,farmers and agribusinesses,retailers,technology companies,natural gas and oil companies,importers,exporters and other supply chain stakeholders issued a joint letter opposing the potential tariffs on Chinese goods. This was submitted as a public comment on the USTR's investigation into potential tariffs on $200 billion worth of Chinese goods.

The Information Technology Industry Council (ITI),a premier advocacy and policy organization for 67 of the world's leading information and communications technology companies,said "the administration continues to impose more tariffs without a clear objective or end in sight,threatening American jobs,stifling economic investment,and increasing the prices of everyday goods." ITI urged President Trump "to delay this unnecessary escalation before more consumers and workers are harmed".

According to the Wall Street Journal,a handful of tech giants argued that tariffs would stall next-generation technology that promises higher-speed connections needed for self-driving cars,wireless virtual reality and other innovations.

Apple said in a filing that the Trump administration's proposed tariffs "will disproportionately hurt Apple and US consumers." Apple cited its wireless headphones,Apple Watch and Mac mini computers,as products that would be hurt by the proposed tariffs.

As the trade tension has escalated,asset prices have become significantly more volatile and divergent,whether in stocks,bonds,currencies or commodities. The Wall Street Journal,which tracks the markets winners and losers regularly,compared the sharply differing performances of global stock indexes,bond ETFs,currencies and commodities. In the global stock market arena,the United States has had a stronger performance,while stock indexes in Europe and Asia have lost ground. A divergence has also been evident within different segments of the US stock market. As of September 14 this year,the Dow Jones Industrial Average had gained 5.8%,the S&P 500 had added 8.7% and the Nasdaq Composite was up 16%. The track record in more recent months has been significantly better than over the first few months this year. Sectors were mixed,with the biggest decliners including the S&P 500 consumer staples (-4.6%),telecoms (-4.5%),materials (-1.9%),financials (+0.7%),and real estate (+1.2%),while the biggest gainers were the S&P 500 technology (+18.6%),consumer discretionaries (+18.3%),health care (+12.8%),industrials (+3.8%),and energy (+2.3%).

Most bond markets ¨C except for China ¨C have lost ground. Emerging markets and US treasuries have been among the worst performers. On the foreign exchange market,the biggest losses against the dollar were chalked up by the Argentine peso (-53.4%) and the Turkish lira (-38.5%).

Commodities have also been affected. The top five gainers included cocoa (up 17.3%),crude oil (14.2%),orange juice (12.9%),wheat (12.4%),and gasoline (9.5%). The five biggest losers were sugar (down 26.4%),coffee (24.4%),lean hogs (21.7%),copper (19.9%) and silver (17.7%).

In the third quarter of this year,almost all commodities ¡ª except cattle ¡ª were lower,with lean hogs,coffee,silver,copper,and cocoa falling more than 10%,while sugar,gasoline,crude oil,platinum,natural gas,soybeans,cotton,orange juice,and corn also were down sharply. This was largely tied to the escalation of the trade war,showing growing market fears of uncertainty about the future direction of the global economy.

Strikingly,gold has lost its safe-haven status amid increasing uncertainty. Gold's fall of 4.9% this year has been driven by rising US interest rates and a strengthening dollar alongside falling demand in China and India. Gold pays no interest,and Fed rate hikes make it less attractive. The dollar has risen and gold is priced in dollars. That has made it more expensive to buy gold using other currencies. The US consumer price index (CPI) rose 2.9% year on year in July on a 12-month basis before easing to 2.7% in August. The core CPI ¨C which excludes food and energy ¡ª rose 2.3% year on year,the highest level since January 2017,before dipping to 2.2% in August. Meanwhile,the strong labor market increases the probability of two more Fed rate hikes this year,suggesting that the dollar will remain strong for some time.

Each trade conflict provoked by the Trump administration has employed a particular legal rationale,including the invocation of national security (Section 232) and "acts,policies or practices that are unreasonable or discriminatory and that burden or restrict US Commerce" (Section 301). As Harvard's Lawrence rightly put it,"Many of these steps have been notable for violating rules and regulations embodied by previous agreements with trading partners and by those enforced by the World Trade Organization (WTO)."

How Trump Tariffs Violate Rules and Regulations

Citing Section 232 of the Trade Expansion Act of 1962,the Trump administration invoked national security as the reason for imposing tariffs on US steel and aluminum imports. "This US law places almost no constraints on the president's ability to apply this law and Article XXI of the General Agreement on Tariffs and Trade...gives countries great scope in deciding for themselves whether such measures are warranted," Professor Lawrence said. He also said: "In principle,the Trump measures are legal,but in practice,it has always been understood that members will rarely undertake such measures,and only for narrowly defined reasons relating to strictly military needs and extreme circumstances."

There is no need for the Trump administration to impose tariffs on Chinese imports for any of its Section 301 complaints. "The use of tariffs,which are illegal because they violate US commitments to grant China permanent normal trade relations and because they exceed the maximum rates the US is allowed to impose under WTO rules,is unnecessary," Lawrence said.

According to the USTR,Section 301 of the Trade Act of 1974 is designed to address unfair foreign practices affecting US exports of goods or services. Section 301 may be used to enforce US rights under bilateral and multilateral trade agreements and also may be used to respond to unreasonable,unjustifiable,or discriminatory foreign government practices that burden or restrict US commerce.

But if the USTR determines that the Section 301 investigation "involves a trade agreement," and if that trade agreement includes formal dispute settlement procedures,"USTR may pursue the investigation through consultations and dispute settlement under the trade agreement," according to a USTR report. This means that in the case of Sino-US trade disputes,the USTR should not conduct an investigation without recourse to formal dispute resolution.

The Information Technology Industry Council called the prospective tariffs "possibly illegal," because no clear connection existed between the action and alleged Chinese infringement of US intellectual property.

In ITI Comments Submission for USTR-2018-0026 Response to "List 3" Tariffs on Chinese Goods Imports (August 20,2018),the US International Trade Commission expressed very strong concerns about this issue,saying: "While ITI addresses several product lines in our comments,we do not support the imposition of tariffs on any of the proposed products,particularly as a method of resolving the issues identified through the Section 301 investigation." It stated further that "¡the proposed tariffs disadvantage US companies that already engage in best practices to protect their intellectual property in China. Raising costs for US companies to do business runs counter to US objectives,especially give