Future Trends in China's Financial Development and Prospects for...

Title: Future Trends in China's Financial Development and Prospects for Financial Development Dynamics in 2024

Over the past five years, China's financial reform has made positive progress, laying a solid foundation for building a strong financial country in the future. At the end of October 2023, the China Central Financial Work Conference pointed out the direction and focus of China's financial development for the next stage. As China's economy enters a stage of high-quality development, the financial system also needs to make corresponding adjustments. As the first year after the Central Financial Work Conference, China's financial sector will also make new developments in 2024. This article will examine the evolution of China's finance in 2024, focusing on five major areas: financial support for technological innovation, green finance, financial risk resolution, RMB internationalization, and financial opening-up.

China's financial development has made positive progress in the past five years

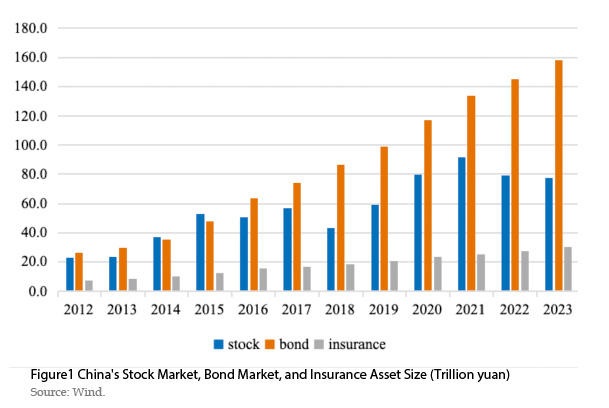

The financial system has continued to improve. Firstly, the scale of the financial institution system has grown rapidly. China's banking industry has the world's largest total assets, and the scale of stocks, bonds, and insurance ranks second in the world. Inclusive finance is at the forefront of the world. Secondly, the organizational system of financial institutions has been continuously improved. China has initially formed an organizational system of financial institutions in which large state-owned financial institutions and small and medium-sized financial institutions develop in a disjointed manner, and commercial financial institutions and policy-oriented financial institutions each perform their own duties. Promote the development of professional pension insurance companies, financial sasset investment companies (AICs), bank’s wealth management subsidiaries and other new financial institutions. Thirdly, the types of products and services provided by financial institutions have been continuously expanded. Pilot infrastructure real estate investment trusts (REITs), personal pension insurance products, green bonds and other new financial products have been introduced.

Support for the real economy has improved significantly. In recent years, financial institutions have continued to increase their support for manufacturing, technological innovation, micro and small enterprises (MSEs), rural revitalization, green development and other fields, and promote the allocation of financial resources to key areas and weak links. To conclude, inclusive small and micro loans have surged to 29.06 trillion yuan by the end of 2023, with an average annual growth rate of about 25% over the past five years. This figure is higher than other loans due to the rapid growth of green loans, medium- and long-term loans in manufacturing, loans for “specialized and new" small and medium-sized enterprises (SMEs), and agricultural loans.

The financial reform progress has shown positive results. Firstly, key aspects of the reform of financial operations have made incremental breakthroughs, and the stock market has made adjustments. From an incremental perspective, the establishment of the Science and Technology Innovation Board and the pilot registration system by the Shanghai Stock Exchange have opened up wider listing channels for high-tech enterprises. The issuance of corporate bonds has implemented a registration system, and the scope of issuers has been extended to all corporate legal persons, reducing the threshold of direct financing. The development of the third pillar of pension insurance, the launch of pilot pension savings and pension wealth management products. From the perspective of stock, the Shenzhen Stock Exchange implemented the reform of the Growth Enterprise Board and piloted the registration system, promoting the reform of the stock market registration system in the pilot of Growth Enterprise Board. The interconnection between the interbank and exchange bond markets has been carried out, and the infrastructure of the bond market has been accelerated to unify. The comprehensive reform of auto insurance has improved consumer experience, promoted "increasing insurance coverage, improving quality and reducing prices", and assisted in the recovery of automobile consumption. The management and application of foreign exchange reserves have been broadened, forming an investment pattern covering equity, debt, funds, joint financing by multilateral development institutions, etc. Secondly, significant adjustments have been made to various aspects of the financial regulatory system, and regulatory coordination has been significantly improved. In 2017, the Financial Stability and Development Committee of the State Council was established. In 2018, the former China Banking Regulatory Commission and China Insurance Regulatory Commission merged to form the China Banking and Insurance Regulatory Commission. Local governments have established financial supervision bureaus to supervise local financial organizations. In 2023, a new round of financial regulatory system reform was launched, with the establishment of a central financial committee, a central financial work committee, and a national financial supervision and management organization to deepen the reform of the local financial regulatory system.

The opening-up of financial institutions has been accelerating. With regard to the introduction of international financial institutions, the restrictions on the proportion of foreign shares in the fields of banking, securities, funds, futures, personal insurance, etc. have been completely abolished, and the requirements for the qualifications of foreign shareholders have been continuously relaxed. In terms of going global, Chinese banking institutions have set up thousands of branches overseas. At the same time, the global influence of financial institutions has been continuously enhanced. Among the 29 systemically global important banks announced by the Financial Stability Board at the end of November 2023, there are 5 Chinese commercial banks.

Future trends for China's financial development

Firstly, adhere to the fundamental purpose of serving the real economy. Strong financial strength should rest on a solid economic foundation. A strong financial system must have the capacity to support the real