Practice and Reflections on Bilateral Local Currency Cooperation between...

Title: Practice and Reflections on Bilateral Local Currency Cooperation between China and Four ASEAN Countries

Author: ZHANG Manjing and WANG Zichen

In recent years, economic and trade exchanges between China and ASEAN countries have become increasingly close. Market demand for local currency settlement and direct exchange has been steadily growing, highlighting the significance of strengthening bilateral cooperation in local currency. In this study, the authors selected four ASEAN countries, namely Singapore, Malaysia, Thailand, and Indonesia, as case studies. They extensively discussed the current situation of local currency settlement and transactions between China and these countries, providing valuable insights for the further advancement of China-ASEAN bilateral local currency cooperation.

New Opportunities for China-ASEAN Bilateral Local Currency Cooperation

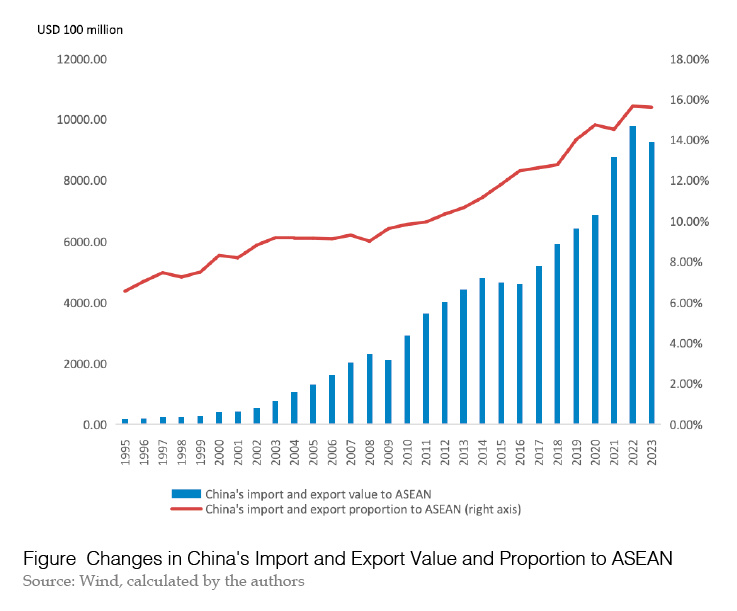

Strengthening of ties in the real economy provides market momentum for China-ASEAN bilateral local currency cooperation. In recent years, economic and trade relations between China and ASEAN have been continuously deepening, which has stimulated the demand for bilateral local currency cooperation. Under trade in goods, Wind data shows that the value of imports and exports between China and ASEAN increased from US$18.438 billion in 1995 to US$926.548 billion in 2023; ASEAN's share in China's value of imports and exports rose from 6.56% in 1995 to 15.61% in 2023 (see Figure), and in 2020, ASEAN surpassed the European Union (EU) to become China's largest trade partner in goods. Among them, the import and export value between China and Singapore, Malaysia, Thailand, and Indonesia has accounted for more than 60% of the import and export value between China and ASEAN in the past decade. Under direct investment, data from the Ministry of Commerce shows that China's direct investment stock in ASEAN has increased from US$1.256 billion in 2005 to US$154.663 billion in 2022. As of the end of July 2023, the cumulative two-way investment between China and ASEAN exceeded US$380 billion. With the strengthening of ties in the real economy, the market has become more inclined to use local currencies for cross-border trade and investment to reduce exchange costs and manage exchange rate risks, thus strengthening the market base for bilateral local currency cooperation.

The diverse forms of cooperation lay the policy foundation for the continuous advancement of China-ASEAN bilateral local currency cooperation. Globally, driven by factors such as geographical proximity and close economic and trade exchanges, ASEAN was the region where China initiated bilateral local currency cooperation (in the 1990s in the early stage, the People's Bank of China (PBOC)and Vietnam signed the Agreement on Settlement and Cooperation), and it is also a key region for bilateral local currency cooperation, with cooperation forms including bilateral local currency swaps, bilateral local currency settlement, and currency listing transactions. According to the 2023 Report on Use of RMB in ASEAN Countries published by the Financial Society of Guangxi, by the end of 2022, China had signed bilateral local currency swap agreements with four ASEAN countries, signed bilateral local currency settlement agreements with four ASEAN countries, established RMB clearing banks in five ASEAN countries, and included 103 financial institutions from ASEAN as participants in the Cross-border Interbank Payment System (CIPS). Within ASEAN, Singapore, Malaysia, Thailand, and Indonesia have relatively higher levels of economic development and well-established financial infrastructure, creating a favorable environment for bilateral local currency cooperation. Currently, the bilateral local currency swaps and currency listing transactions signed between China and ASEAN countries are mainly concentrated in Singapore, Malaysia, Thailand, and Indonesia. Additionally, these four countries do not impose special restrictions on the use of RMB, and RMB follows the unified foreign currency management regulations locally and can achieve cross-border payment and settlement through correspondent banks, RMB clearing banks, CIPS, and other channels. The currencies of these four countries can achieve cross-border local currency payment and settlement through the mutual opening of interbank accounts in each other's currencies by commercial banks of the two countries. The established cooperation foundation provides room for further optimization of the bilateral local currency cooperation system design.

ASEAN's "de-dollarization" and the cross-border use of RMB inject new momentum into the deep implementation of China-ASEAN bilateral local currency cooperation. In recent years, to reduce the spillover effects of the Federal Reserve's monetary policy and prevent the risks of the weaponization of the US dollar, Southeast Asian countries have gradually reduced the use of the US dollar in cross-border transactions and have signed local currency settlement agreements with each other to foster more efficient local currency markets. Meanwhile, with the steady advancement of RMB internationalization, the scale of cross-border receipts and payments in RMB with ASEAN countries has been continuously growing. According to the 2023 Report on Use of RMB in ASEAN Countries, total cross-border RMB receipts and payments with ASEAN countries increased from 2.4 trillion yuan in 2019 to 4.9 trillion yuan in 2022. The enhanced consensus on local currency settlement between China and ASEAN provides positive support for continuously optimizing bilateral local currency cooperation arrangements.

At the same time, it should be noted that the US dollar remains the primary "vehicle currency" for cross-border transactions in ASEAN countries, and is widely used as a third-party currency in trade and investment exchanges between ASEAN and countries and regions outside the United States. Regarding the choice of vehicle currency, the academic community generally considers three influencing factors. Firstly, transaction cost. The lower the transaction cost and the better the liquidity of a currency, the more likely it is to become a vehicle currency. Secondly, industry characteristics. Once a currency establishes a dominant position in a particular industry sector, enterprises within that industry are more willing to use that currency as a vehicle currency. Lastly, economic fundamentals. The issuing country of a vehicle currency should have stable macroeconomic fundamentals to avoid significant exchange rate fluctuations. Given that industry characteristics and economic fundamentals are difficult to change in the short term, it is essential for bilateral local currency cooperation to build consensus through cooperation, eliminate barriers to cross-border use of local currencies, and reduce local currency transaction costs .

China-ASEAN Bilateral Local Currency Settlement Cooperation: From "One-Way Drive" to "Dual-Engine Drive"

From a micro perspective, cross-border payment and settlement of local currency is the primary step for enterprises and individuals to engage in cross-border economic activities. Ensuring smooth cross-border payment and settlement channels for local currencies across different countries (regions) and reducing market settlement costs are essential for the practical promotion and use of local currencies. This has been confirmed by the history of the internationalization of the US dollar. Along with the widespread use of the US dollar in global economic activities, the cross-border payment and clearing mode for the US dollar has also been continuously improved. As the economic and trade relations between China and ASEAN countries become increasingly close, their cooperation in local currency settlement is gradually deepening, mainly in the following three modes.

Mode 1: Market-driven formation, supporting bilateral local currency settlement

The correspondent bank is a typical representative of this mode. As a mature mode of cross-border currency payment and settlement, the essence of the correspondent bank mode is that a foreign bank (relative to the currency-issuing country/region) opens an inter-bank account with a bank within the currency-issuing country/region (i.e., the correspondent bank), indirectly participates in the central bank's payment system of the currency-issuing country/region, thereby achieving cross-border payment and settlement in the currency issued by that country/region. Currently, China's local currency settlements with Singapore, Thailand, and Malaysia can all be conducted through the corresponding bank mode. However, due to Indonesia's policy of non-internationalization of the Indonesian rupiah, foreign banks are not allowed to hold Indonesian rupiah positions, making it difficult to establish an Indonesian rupiah correspondent bank mode. Indonesian commercial banks can manage RMB positions by opening RMB interbank accounts with commercial banks in China and meet the needs of RMB cross-border payment and settlement between China and Indonesia.

Mode 2: One-way policy-driven formation, supporting one-sided local currency settlement

Typical examples of this mode are the RMB clearing bank mode and CIPS mode launched by China, and the Appointed Overseas Office (AOO) mode launched by Malaysia. Among them, the essence of the clearing bank and AOO modes is that commercial banks authorized by the monetary authority of the currency issuing country/region provide offshore settlement and clearing services for the local currency of the country. Overseas institutions do not need to open accounts domestically; they only need to open accounts with these offshore institutions to achieve cross-border payment and settlement in the currency, representing a "single-point advancement". The essence of the CIPS mode is to build a dedicated cross-border payment infrastructure and attract relevant institutions as participants in this infrastructure to achieve cross-border currency payment settlement, representing a "networked expansion". Specifically, under the RMB clearing bank mode, commercial banks in ASEAN countries open accounts with the RMB clearing bank to handle RMB fund transfers. The RMB clearing bank then connects to China's high-value payment system through its head office to complete cross-border and offshore RMB settlement and clearing services based on the high value payment system. Under the AOO mode, non-residents do not need to open accounts with local banks in Malaysia; they only need to open accounts with an AOO to use the Malaysian ringgit for cross-border trade settlement and foreign exchange transactions (including spot and forward transactions) and to obtain ringgit quotes outside of Malaysia's foreign exchange market hours. As of the end of June 2024, Malaysia has established 21 AOOs in mainland China, including China Construction Bank and 20 other foreign banks in China. Under the CIPS mode, direct participants open accounts with CIPS, and indirect participants gain CIPS services through direct participants. CIPS opens a clearing account with China's domestic high-value payment system, and direct participants complete their own capital injection, increase, decrease, and zero through their accounts in the high-value payment system. Currently, cross-border RMB payments between China and Singapore, Malaysia, and Thailand can be achieved through the RMB clearing bank mode and CIPS, while cross-border RMB payments between China and Indonesia can be achieved through CIPS.

Mode 3: Two-way policy-driven formation, supporting bi