The Reform and Development Path of Major Commercial Banks in A Low Interest...

Title: The Reform and Development Path of Major Commercial Banks in A Low Interest Rate Environment

Author: ZHOU Aimin and ZHUANG Yuan

The Third Plenary Session of the 20th CPC Central Committee clearly outlined the need to improve the positioning and governance of financial institutions and to establish a sound incentive and constraint mechanism for serving the real economy. Currently, the net interest margin (NIM) of China's major commercial banks continues to narrow, necessitating active adaptation to the low interest rate environment of the Renminbi. This requires comprehensively deepening reforms to promote operational transformation and achieve high-quality development, continuously solidifying the foundation for sustained service to the real economy.

Net interest margin situation of large commercial banks in China The NIM of major banks narrowing

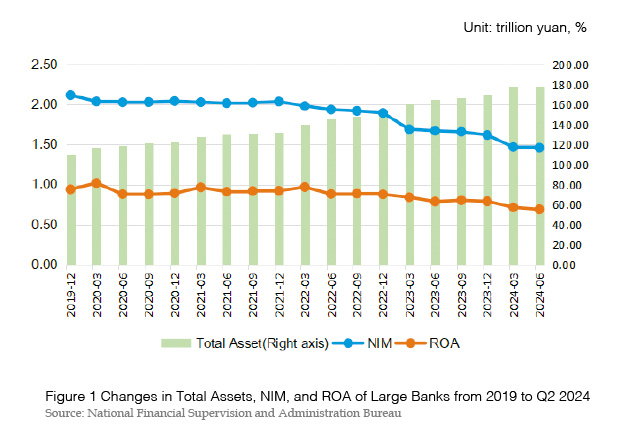

In recent years, to stimulate economic growth, China's major banks (Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, China Construction Bank, Bank of Communications and Postal Savings Bank, hereinafter referred to as major banks) have consistently implemented interest concessions and accelerated fee cuts to the real economy, thereby steadily lowering social financing costs. As the size of their asset grew, the overall profitability and efficiency of major banks declined. By the end of June 2024, the total assets of six large banks reached 178.6 trillion yuan[ Monthly Domestic Data of Large Commercial Banks Released by the Financial Regulatory Administration], with an average annual growth rate of about 13% over the past five years, and a net interest margin (NIM) of 1.46%, down 0.21 percentage points year-on-year, down 0.66 percentage points from 2019. Since net interest income is the main source of income for commercial banks, the narrowing of NIM directly affects the profitability of banks. In the first half of 2024, the net profit of large banks was 626.8 billion yuan, down 2.9% year-on-year compared to the same period last year, which saw an increase of 0.9% year-on-year, with an asset return rate (ROA) of 0.69%, a year-on-year decrease of 0.09 percentage points.

A dynamic analysis reveals that major banks NIM has shown a narrowing trend over the past 3 years. In 2021, the NIM decline was basically within 10BP; in 2022, there was differentiation, with Bank of China (BOC) experiencing an increase of 1BP due to a high proportion of foreign currency business and the impact of interest rate hikes in major economies, while Industrial and Commercial Bank of China (ICBC) and Agricultural Bank of China (ABC) declined by about 20BP; in 2023, the decline in NIM for the six banks has expanded, ranging from 19BP to 32BP; in the first quarter of 2024, the decline in NIM for the six banks compared to the same period last year is in the range of 6BP to 29BP, and no signs of stabilization and recovery have yet been observed.

Analysis of the reasons for the narrowing of the NIM of large banks

On the asset side, interest-earning assets continue to grow, while the asset yields are declining rapidly. Major banks are actively implementing policies to support the real economy, intensifying their investment financing efforts and continuously increasing market share. According to data from the People's Bank of China (PBOC), by the end of June 2024, the domestic RMB loan balance of the seven major banks, i.e. ICBC, ABC, BOC, CCB, BOCOM, PSBC, CDB, reached 122.5 trillion yuan, accounting for 49.2% of the domestic RMB loan balance of financial institutions, the highest level since April 2021. At the same time, this effectively benefits the real economy, with loan yields declining rapidly. Between 2021 and 2023, the 1-year and 5-year Loan Prime Rates (LPRs) decreased by 40BP and 45BP, respectively. In August 2023, major banks cut the interest rates on more than 23 trillion yuan of existing home loans by about 73BP. With the exception of BOC benefiting from overseas interest rate hikes, the loan yield decline of the other five major banks over the past three years has been in the range of 45BP to 62BP, higher than the LPR decline, resulting in an overall asset yield decline of 18BP to 41BP.

On the liability side, the trend of converting deposits to fixed terms has intensified, and the cost of liabilities remains rigid. Due to a lack of high-yield investment channels, customers' willingness to save has increased in recent years, leading to significant changes in deposit behavior, with deposits showing characteristics of being more fixed-term and long-term. By the end of 2023, fixed time deposits accounted for 58% of customer deposits in the six major banks, an increase of nearly 10 percentage points compared to the end of 2020. In the past three years, 85% of the increase in deposits has come from time deposits, while this ratio was 54% from 2018 to 2020. To reduce the rising cost of deposits, major commercial banks have successively lowered the deposit interest rates four times from 2022 to 2023, with the interest rates for 3-year and 5-year time deposits reduced by 80BP and 75BP, respectively, which has somewhat alleviated the impact of the trend towards fixed time deposits. However, the adjustment of interest rates on time deposits has been relatively passive and lagging behind the adjustments in the LPR, and the effect of cost reduction will only gradually manifest after the deposits mature and are rolled over, resulting in deposit repayments being slower than loans. Over the past three years, with the exception of Postal Savings Bank (PSB), which maintained stable liability costs, the interest rates on liabilities of the other five major banks have actually increased by 16BP to 52BP.

The Impact of Narrowing NIM on Commercial Banks' Operations Impact on the supplement of Core Tier 1 capital

The current price-to-book ratio (PB) of major banks is generally around 0.6, presenting significant difficulties in replenishing core Tier 1 capital through methods such as secondary public offerings and equity offerings, relying primarily on retained earnings to replenish core Tier 1 capital. Approximately 30% of large banks' net profits are used for shareholder dividends, while 70% is retained. In recent years, large banks have increased their support for the real economy, accelerating the issuance of loans, bonds, and other assets, leading to an increase in rigid capital occupation; however, NIM continues to narrow, profitability declines, and the growth rate of profits is significantly lower than that of risk-weighted assets (RWA). Supplementing capital through methods such as issuing preferred shares, perpetual bonds, and subordinated debt instruments faces scale constraints, and the cost of interest payments will further erode profits. The balance of capital supply and demand has been disrupted, and large banks will enter a state of net capital consumption in the coming years.

Impact on risk compensation ability

As special enterprises manage risks, commercial banks require a certain profit margin to ensure safety. In our country, interest income accounts for more than 80% of the banking industry's operating income, and about 70% of the interest income of the six major banks comes from loans. If the NIM level is too low, even below the non-performing loan rate, it will lead to a decline in the bank's ability to withstand future risks. In addition, large banks must also actively and prudently cooperate in preventing and resolving real estate risks, local government debt risks, and risks from small and medium-sized financial institutions, and they need stable operating returns to bear the responsibility of maintaining financial security.

Impact on the sustainability of the service entity economy

Serving the real economy is the primary responsibility of financial institutions. If bank profit levels are too high or too low, it is detrimental to the sustainability of the real economy. According to market estimates, to support a future GDP growth rate of 5%, the growth rate of the banking industry's RWA should be maintained at more than 7%. If the capital adequacy ratio remains unchanged, the return on equity (ROE) needs to exceed 10%, with a minimum NIM of 1.6% to 1.8%. If large banks' ROE and NIM remain below reasonable levels for an extended period, this will limit capital accumulation, limiting the issuance of loans and bonds.

Major actions taken by major international banks to address the narrowing of NIM

In response to the economic downturn, deflation, and financial stability issues, Japan, Europe, and others have successively implemented low interest rates and even negative interest rate monetary policies, leading to a significant reduction in NIMs for major local banks. Faced with low interest rates and insufficient real financing demand, the main strategies of major local banks are to strengthen overseas expansion, diversify services, optimize asset-liability structures, and reduce costs.

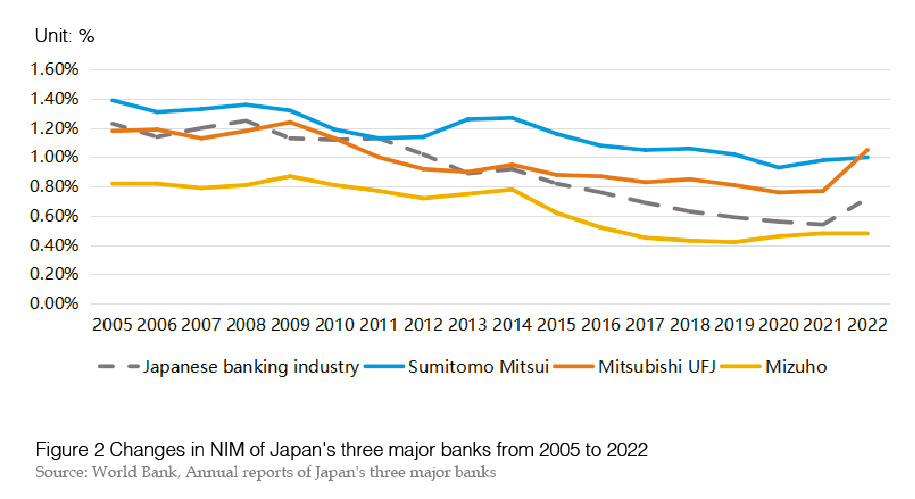

Japan: Mitsubishi UFJ, Sumitomo Mitsui, Mizuho

Japan began its zero interest rate policy in 1999 and entered a negative interest rate period in 2016, continuously increasing the intensity of monetary easing. Over the past 20 years, the average annual compound growth rate of total assets in the Japanese banking industry has been around 2%, while the NIM decreased from 1.49% in 2000 to 0.54% in 2021.The three major banks, Mitsubishi UFJ, Sumitomo Mitsui, and Mizuho, experienced an asset growth rate of around 4% during the low interest rate period, with the PB ratio remaining below 1 for a long time, dropping to as low as 0.3 during the pandemic in 2020.

From the perspective of the asset-liability structure: First, the proportion of overseas loans has increased. From 2005 to 2022, the three major banks experienced weak domestic loan growth, with average domestic loan growth rates for Mitsubishi UFJ, Sumitomo Mitsui, and Mizuho at 1.6%, 3.3%, and 1.9%, respectively, overall lower than the average growth rate of the Japanese banking industry over the same period. However, the growth rate of overseas loans was about 6 percentage points higher than the growth rate of all loans during the same period, and the proportion of overseas loans in total loans continued to rise to about 40%. Second, deposits have steadily increased. The average deposit growth rates for Mitsubishi UFJ, Sumitomo Mitsui, and Mizuho were 3.6%, 5.2%, and 4.2%, respectively, overall higher than the average growth rate of the Japanese banking industry over the same period. In a low interest rate environment, the interest rate spread between time deposits and demand deposits is narrowing, and the ratio of time deposits to demand deposits is decreasing, with the proportion of demand deposits in total deposits increasing by nearly 10 percentage points.

From the main business strategy: First, optimize the global allocation of assets and liabilities. Japanese large banks place great importance on the role of overseas markets in ‘filling gaps’ for the domestic market, breaking through local resource constraints with a global layout. Due to the high degree of yen internationalization, Japanese large banks absorb low-cost domestic yen deposits and invest in high-yield foreign currency assets, enhancing the overall return on interest-earning assets. After 2013, they mainly focused on the United States and emerging markets in Asia. In the past decade, the loan scale of Japan's three major banks in Asia has nearly