The Trump Trade Doctrine 2.0: Global Stakes

The Trump Trade Doctrine 2.0: Global Stakes

By Marcello Estevão and Jonathan Fortun

The re-election of Donald Trump has led to immediate yet cautious reactions across global markets, as investors brace for potential shifts toward tax cuts, deregulation, and aggressive trade policies. U.S. equities initially surged by 2 -3% following the election results, while the U.S. dollar appreciated by 3% against a basket of currencies, reflecting expectations of tighter Fed stance owing to the inflationary impacts of higher tariffs, lower immigration flows to the United States, and loose fiscal policies. Long- term Treasury yields, however, have risen only modestly, signaling (i) some concern about inflationary impact of Trump’s policies, while (ii) somewhat paradoxically, apparently some skepticism about the feasibility and full enactment of Trump’s proposed tariffs. In the end, tariffs are one tool in the broader economic policies that the Trump Administration appears to want, and it appears that investors are anticipating that tariffs will serve as a strategic tool in trade negotiations rather than as fixed policy.

Although Trump’s policies could have notable implications for the U.S. economy, this paper focuses specifically on the impact of his proposed tariffs on trade partners, which provides a detailed assessment of how tariffs could shape global economic conditions. Through a scenario analysis, we explore the economic ramifications across these regions, focusing on growth, inflation, and currency stability, using recent market data to highlight potential shifts.

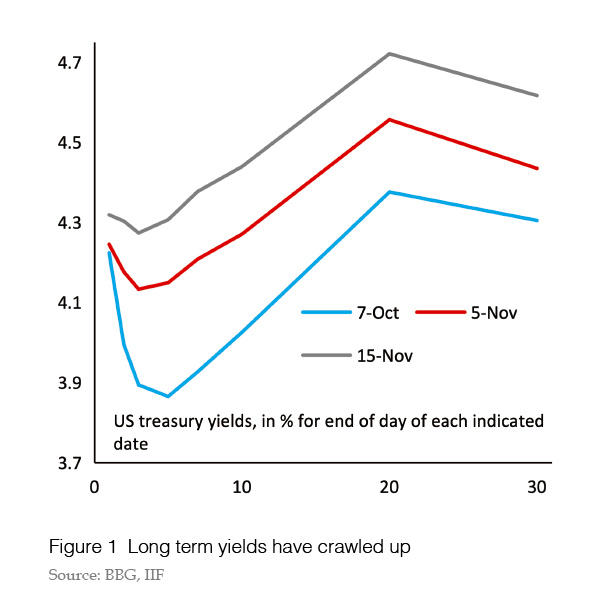

Trump’s re-election has sparked a mixed reaction in financial markets. U.S. equities saw a robust increase, as major indices such as the S&P 500 and DJ rose approximately 2% immediately following his victory. This initial optimism was driven by confidence in Trump’s business-friendly agenda, which includes an extension of the 2017 Tax Cuts and Jobs Act and further corporate tax reductions to stimulate business investment and domestic production. Despite this enthusiasm, bond markets responded more cautiously,with 10-yearTreasury yields rising around10 basis points to4.4%, reflecting lingering market concernsover fiscal sustainability and inflation risks tied to the President-elect's fiscal, immigration and trade policies (Figure 1).

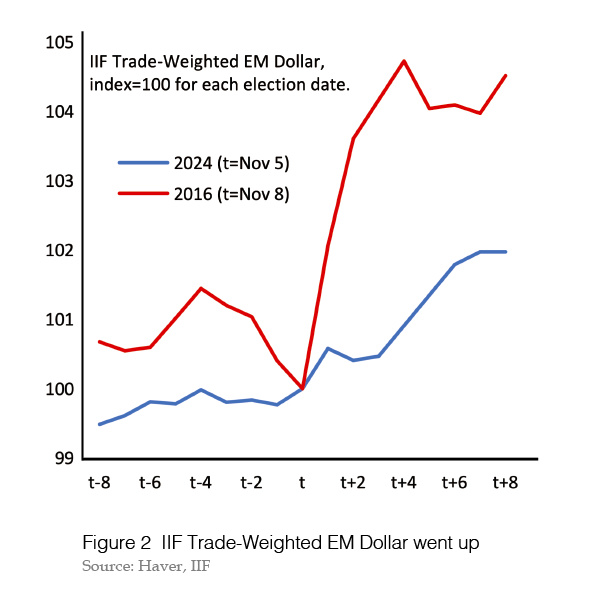

Currency markets also reflected this ambivalence. The U.S. dollar strengthened by nearly 3% against major currencies, as a result of the same policies and their indication of a more hawkish Fed than previously priced by the market. Indeed, expectations for the fed funds rate in June 2025 have gone up by almost a full percentage point to near 4%. Several EM currencies, particularly in Latin America, have depreciated. However, the scale of EM currency depreciation has been notably smaller compared to the days followingTrump’s 2016 election,when heightened uncertainty drove sharper declines across the EM complex(Figure 2). This more muted reaction suggests a market sentiment that Trump’s tariff agenda might not fully materialize or that tariffs could be deployed strategically, depending on trade negotiations with key partners.

Scenario Analysis of Potential Tariff Policies

The true extent of the impact from Trump’s tariffs will depend largely on their scope and application. With that in mind, we explore three scenarios that reflect different levels of tariff implementation and assess their potential economic consequences for America’s key trading partners. These are not exhaustive scenarios but give the flavor of the different factors at play here.

Full Tariff Implementation: In the most aggressive scenario, the Trump administration could impose tariffs as high as 60% on Chinese goods, along with a 10-20% universal tariff on U.S. imports. Such a move would create widespread disruption across global supply chains, particularly for industries like electronics, machinery, and consumer goods, where the European Union, Japan, and China play a dominant role. Global GDP could contract significantly over two years under full retaliation scenarios, with individual regions facing varying degrees of impact.

China would face reduced export volumes due to decreased U.S. demand, especially in high-value sectors like electronics, machinery, and telecommunications equipment, which together account for approximately 40% of China’s exports to the United States. In comparison, the euro area’s GDP could decline by approximately 0.3-0.4%, with Germany seeing the sharpest contraction given its reliance on manufacturing exports, particularly in machinery and automotive sectors. Japan could experience a GDP reduction of 0.2%-0.3%1, largely concentrated in its technology and automotive exports.

Globally, the 60% tariff on Chinese goods would disrupt supply chains and elevate costs for importers reliant on China, particularly in sectors where Chinese production cannot be easily substituted. For instance, products such as semiconductors and electronics, where China has a dominant market position, could experience price increases further straining inflationary pressures in importing countries.

Selective Tariffs with Negotiation Flexibility: In this scenario, the United States adopts a targeted approach, applying tariffs selectively to specific industries where it seeks to exert negotiation leverage. For the European Union, this could mean tariffs on high-profile sectors like automotive and luxury goods, while Japan might see tariffs on technology and machinery. This approach would reduce the risk of broader economic disruption, containing GDP contractions to around 0.1 -0.2 of a percentage point for both the euro area and Japan.2 This strategy would a llow the United States to pursue trade concessions without destabilizing entire supply chains. However, companies in directly affected sectors, particularly German automotive and Japanese technology firms, would likely experience significant margin pressures as passing these increased costs onto consumers proves difficult.

For China, selective tariffs would focus on a handful of key goods, likely in technology, electronics, and industrial machinery sectors, echoing the structure of the first U.S.-China trade war. While these tariffs would cover fewer categories, their levels could remain high—potentially in the range of 30-45%—to maintain negotiation power. This focused tariff strategy would still affect China’s export profile, particularly for high-value-added goods, and could lead to a reduction in GDP growth by approximately ½ of a percentage point.

Moderate Tariffs with Exemptions: The moderate approach would see tariffs imposed but with exemptions for allied nations or critical industries within U.S. supply chains, such as raw materials and high-tech components. This limited scope could maintain strategic pressure on certain trade partners while minimizing cost impacts for U.S. manufacturers. Under this scenario, overall economic impacts on DMs would be modest, with little to no effect on GDP or inflation, although specific sectors might still encounter competitive challenges. Still, Japan’s technology sector and Germany’s manufacturing industry would be vulnerable, requiring companies to reevalu