Innovative Efforts and Policy Reforms Drive Stable Growth in Consumption

By WANG Wei and WANG Nian

In 2024, the consumer market is set to transition to stable growth. With both consumption and policy innovations simultaneously driving positive change, the consumer market is expected to maintain steady growth, solidifying the pivotal role of final consumption in driving economic growth.

Consumption Growth Tends to be Stabilized with Stronger Innovation-Driven Momentum

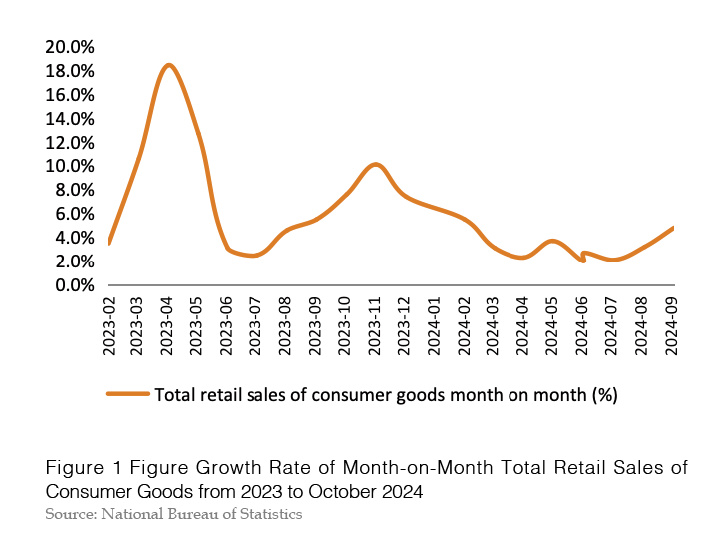

Since the beginning of 2024, consumption growth has tended to stabilize gradually in China. According to economic data from January to October, total retail sales of consumer goods increased by 3.5% year-on-year. In September and October, the year-on-year growth rate continued to rise, reaching 3.2% and 4.9%, respectively, an increase of 1.1 and 2.8 percentage points over August’s 2.1%, reversing the downward trend in growth(see Figure 1). In the first three quarters, final consumption contributed 49.9% to GDP growth, driving GDP growth by 2.4 percentage points, 1.1 and 1.3 percentage points higher than gross capital formation and net exports, respectively, continue to play a fundamental role in supporting economic growth.

In the area of consumption, five new impetuses have been supporting growth since 2024, which include the continuous strengthening of consumption innovation, the implementation of targeted innovative policies such as trade-ins for consumer goods, accelerated opening-up, and a raft of incremental policies.

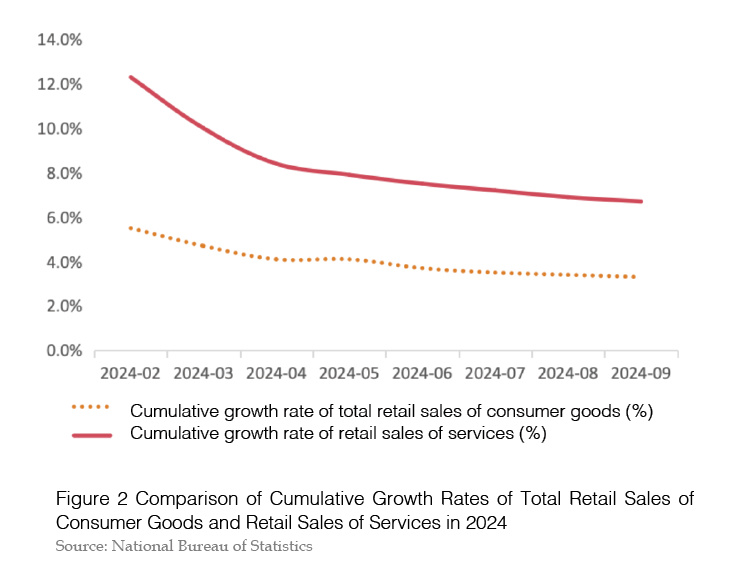

Firstly, the consumption structure continues to upgrade, with service consumption becoming a new driving force for growth. In recent years, service consumption has become the main trend in upgrading the household consumption structure of China, and its contribution to consumption growth and even economic growth has been continuously increasing. From January to October, the retail sales of services grew by 6.5% year on year, surpassing the growth rate of total retail sales of consumer goods by 3 percentage points (see Figure 2). In the first three quarters, the proportion of household consumption expenditure reached 47%, an increase of nearly 1 percentage point compared to the same period last year, basically restored to pre-epidemic levels. The shift from consumption of goods to consumption of service has further accelerated.

Secondly, digital consumption is vibrant, injecting new momentum into sustained consumption growth. From January to October, China’s online retail sales of physical commodities reached 10.333 trillion yuan, a year-on-year increase of 8.3%, which is 4.8 percentage points higher than the total retail sales of consumer goods, accounting for 25.94% of the total retail sales of consumer goods. New consumption models such as live-streaming e-commerce and instant retail continue to grow, injecting innovative momentum into consumption growth.

Thirdly, innovative consumption is emerging at an accelerated pace, driving rapid growth in new routes and industries. In recent years, China’s consumer innovation has been extremely active, with new products, new brands, new scenarios, new services, and new models emerging rapidly, driving the rapid growth of many new tracks and new industries. In the first three quarters, China witnessed 15.185 million kinds of new consumer goods. The five international consumption center cities have increasingly more first stores, indicating that the launching economy remains active. Green consumption drives the rapid development of industries related to new energy, high efficiency, and smart products. From January to September, the production and sales of new energy vehicles reached 1.31 million and 1.12 million units respectively, representing year-on-year growth of 49% and 51%, and accounting for 46% and 39% of the total production and sales of vehicles, respectively. New energy vehicles are gradually becoming a leading force in the growth of the automotive industry.

Fourth, new measures to open up to the outside world, including visa-free policies, are accelerating the recovery in international consumption. Since the beginning of 2024, China has continued to promote visa-free policies and optimize measures to facilitate foreigners' payment, accelerating the recovery of international consumption. From January to September, the number of foreign visitors entering China through various ports reached 22.821 million, a year-on-year increase of 102.1%; among them, 13.427 million entered visa-free, accounting for 59%, with a year-on-year growth of 136.4%. With an average consumption of 3,500 yuan per person, it can drive nearly 80 billion yuan in consumption, and the annual consumption can be driven to 100 billion yuan. With the continuous introduction of payment facilitation measures such as "swiping cards for large amounts, scanning codes for small amounts, and cash payment", foreigners' consumption experience has improved. Data from Alipay shows that in the first half of this year, the number of transactions for the foreign bank card binding service on the UnionPay platform reached 37.3818 million, with a transaction amount of 5.417 billion yuan, representing a year-on-year increase of 6.7 times and 8 times, respectively.

Fifth, incremental policies such as trade-ins for consumer goods are beginning to show results. The potential for bulk consumption is being released faster. Since the beginning of this year, multiple consumption-promoting policies have been intensively introduced, especially after the meetings of the Political Bureau of the CPC Central Committee held in July and September; a raft of incremental policies was launched. This has accelerated the implementation of policies such as trade-ins for consumer goods and the reduction of mortgage rates on existing home loans, playing an important role in boosting consumer confidence and willingness, as well as unleashing consumption potential. For example, the new round of mortgage rate cuts on existing home loans is expected to benefit 50 million households or 150 million people. After a 70 basis point reduction last year, this year's interest rate has been cut by another 30 basis points, which will reduce borrowers' interest expenses by 150 billion yuan annually, providing support to improve consumption capacity and unleash consumption potential. On July 25, the National Development and Reform Commission and the Ministry of Finance of the People's Republic of China issued Several Measures to Enhance Support for Large-Scale Equipment Renewal and Trade-In of Consumer Goods, significantly enhancing the intensity, scope, and standards of financial subsidies. Among them, the central government has allocated 150 billion yuan in financial subsidies for the trade-in of consumer goods using ultra-long special treasury bonds. As of November 20, applications for automobile scrappage and renewal subsidies and trade in consumer goods have exceeded 2 million; as of November 8, 21.608 million consumers have applied for subsidies and purchased 32.719 million units of household appliances in eight major categories. In October, the retail sales of auto businesses above the designated size increased by 3.7% year on year, with the growth rate accelerating by 3.3 percentage points compared to September, among which the retail sales of new energy vehicles grew rapidly; the retail sales of household appliances and audio-visual equipment, cultural and office supplies, and furniture respectively increased by 39.2%, 18.0%, and 7.4%, with the growth rate reaching a record high in the past three years.

Expansion of Continuous Consumption is Faced with Several Challenges

Currently, with the increasing complexity, severity, and uncertainty of the external environment, residents are experiencing slow income growth, leading to weak consumer confidence and insufficient effective demand. Meanwhile enterprises are under significant operational pressure, and domestic circulation is not smooth enough, resulting in various difficulties and challenges in the continuous expansion of consumption.

First, the policy of trade-in for consumer goods has been introduced recently, but it faces low awareness and little impetus. After the allocation of ultra-long special treasury bonds to various regions, local governments gradually introduced implementation plans about one month later, and related application policies are generally only promoted in sales scenarios. In addition, there are significant differences in the application methods and channels for subsidies across regions. Lastly, besides the eight major categories of subsidized products, there are many differentiated products, but residents do not know, leading to unsatisfactory convenience of use, and thus the consumption potential has not yet been fully released. Currently, automobile scrappage and renewal programs have driven car sales to 4 million units, accounting for a quarter of new car sales during the same period, while the sales volume driven by more than 37 million home appliance trade-ins is approximately one-eighth of last year's total home appliance sales.

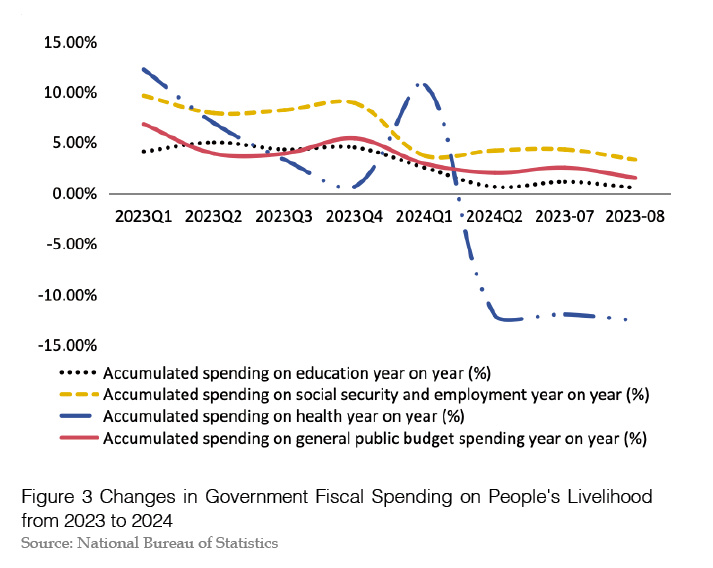

Moreover, government public spending has declined, and the crowding-in effect of livelihood spending has weakened. Since 2024, the growth rate of group consumption has slowed notably, including a decline in the growth rate of government spending on livelihood issues. The growth rate of spending on education and health is lower than that of expenditure on the general public budget at the nationwide level. The year-on-year growth rate of spending on education shows an overall downward trend, and the year-on-year growth rate of spending on health has turned negative, with a substantial decline of 12.6 percentage points from January to August. Only the growth rate of fiscal spending on social security and employment is higher than that of expenditure on the general public budget, but the increase has also declined significantly compared to last year (see Figure 3). The slowdown in the growth rate of fiscal spending is also partly reflected in the decline of the growth rate of residents' net income from transfer. In the first three quarters, net per capita income from remittances reached 5,721 yuan, an increase of 4.9%, 0.9 percentage points lower than the growth rate in the same period last year.

Furthermore, consumption of goods in first-tier cities has slowed significantly, and the accelerating outflow of consumption is worth noting. Since the beginning of this year, the growth rate of consumption among residents in first-tier cities has widened compared to the average growth rate of consumption among urban residents nationwide. From January to August, the average monthly growth rates of retail sales of consumer goods in first-tier cities such as Beijing, Guangzhou, and Shanghai were -1.2%, -1.5%, and -4%, all lagging behind the national average of 2.9% over the same period (see Figure 4). The main reason is that the growth of service consumption in first-tier cities has accelerated. In particular, the service consumption amount in Beijing increased by 7.1% in the first three quarters, which is 8.7 percentage points higher than the retail sales of consumer goods in Beijing, and nearly 1 percentage point higher than the national retail sales of services. In the first three quarters, the transaction volume of online shopping in Shanghai increased by 11.5% year on year, with the transaction volume of service-related online shopping increasing by 15.8%, nearly 7 percentage points higher than the growth rate of online retail sales (7.9%)[1]. Second, the outflow of consumption from first-tier cities after the pandemic are faster than the inflow of consumption. In terms of consumption outflow, taking luxury goods consumption as an example, in May and June, Chinese consumers' overseas luxury goods consumption was 32% and 22% higher compared to the same period