Determinants of Reserve Currency Share and Prospects for the International Status of the RMB

The share of a currency in global reserve holdings is related not only to its share in international trade but also to its proportion in global foreign exchange transactions. Currently, China's share in global trade is slightly lower than that of the Eurozone and comparable to that of the US, making a significant increase unlikely in the short term. However, the share of the RMB in global foreign exchange transactions lags far behind that of the US dollar and euro, and is even lower than the British pound and Japanese yen, indicating considerable potential for growth. According to the author's calculations, if the RMB's share of foreign exchange transactions were to double by 2035, reaching a level comparable to that of the pound or yen today, the RMB's share in global reserves could increase from the current 2.4% to about 4.6%. If the RMB's share in foreign exchange transactions were to quadruple by 2035, reaching the current level of the euro, the RMB's share in global reserves could exceed 8%.

Current Global Reserve Currency Landscape

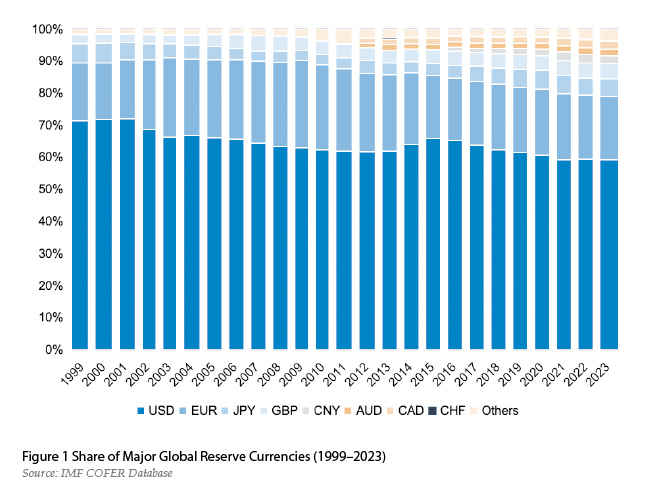

Since the end of World War II, a US dollar-centered international monetary system has emerged, with the dollar becoming the world's primary reserve currency, accounting for up to 80% of global reserve assets at its peak. Following the establishment of the Eurozone in 1999, the dollar's dominance faced a potential challenge, with the euro's share of global reserves peaking at almost 30% (see Figure 1). However, disparities in economic development, fiscal health, and government debt levels among Eurozone member states, as well as the absence of a unified and robust fiscal policy, exposed the limitations of a single currency's monetary and exchange rate policy during the European debt crisis. Nevertheless, with recent progress in joint issuance of government bonds within the Eurozone, the euro is expected to maintain an important position in global reserves, although it is unlikely to displace the dollar in the short term.

After the 2008 global financial crisis, as China rapidly emerged as the world's second-largest economy and advanced renminbi (RMB) internationalization, expectations for the RMB's potential in the global reserve currency system grew significantly. In October 2016, the RMB officially became one of the currencies in the Special Drawing Rights (SDR) basket of the International Monetary Fund (IMF), gaining recognition as an international reserve currency. In the years that followed, as China steadily advanced the opening of its financial industry and markets, the RMB's share of global reserve currencies increased from 1.08% in the fourth quarter of 2016 to 2.84% in the first quarter of 2022[1]. Although the RMB's current share in global currency reserves remains small, it undoubtedly holds substantial room and potential for future growth.

Determinants of Changes in Reserve Currency Share

At the beginning of the 21st century, with the advent of the euro, quantitative research emerged within academia on the determinants of reserve currency shares. A notable example is the research by Chinn and Frankel (2005), the authors originally intended to investigate under which the euro could surpass the US dollar as the dominant reserve currency. Using econometric models, they attributed the global share of reserve currencies to factors such as the issuing country's economy (measured by GDP or trade share), currency stability (e.g., inflation rate, exchange rate volatility), and the size of foreign exchange market transactions. Their predictions suggested that if the UK and other EU members join the Eurozone or if the dollar continues to depreciate, the euro could potentially surpass the dollar as the world's primary reserve currency around 2022. However, the euro's trajectory did not match these expectations.

Following the 2008 global financial crisis and China's rapid rise as the world's second-largest economy, along with the push for RMB internationalization, a new wave of research has begun to examine the path and implications of the RMB becoming a reserve currency. Chen et al. (2009) found that the size of the economy and the openness of capital account play decisive roles in the international status of a currency. China's economic scale and rapid growth provide strong support for RMB internationalization, suggesting that if the RMB becomes fully convertible, it could potentially hold a reserve currency status comparable to that of the yen and pound.

Huang et al. (2014) identified that a nation's GDP and share in global trade are critical determinants of its currency's share as a reserve currency, with currency appreciation, capital account openness, and economic freedom also having an impact. However, variables representing currency stability, such as inflation and exchange rate volatility, were not significant in the medium term. Based on China's 2011 GDP and trade share, their regression model predicted a potential reserve share of about 10% for the RMB. Yet, when accounting for institutional factors such as capital account openness and economic freedom, the potential share was estimated to be around 2%. They recommended that China accelerate trade and investment liberalization, deepen financial market reforms, and enhance policy transparency and the independence of its legal system to gradually increase the RMB's share of global reserves.

Lee's (2014) quantitative research further identified significant impacts of GDP share and currency share in global forex trading on reserve currency share. Assuming that China's capital account openness reached a level comparable to that of the US and Europe from 2011 to 2020, Lee's study suggested that RMB's position in global reserves would then depend primarily on GDP growth rates. Under this scenario, the RMB's share could potentially increase from 0.8% in 2010 to a range of 3% to 12% by 2035.

The above studies were conducted prior to 2015, focusing only on the US dollar (USD), euro (EUR), British pound (GBP), Japanese yen (JPY), and Swiss franc (CHF). However, since 2013, the IMF has expanded the sample in the Composition of Official Foreign Exchange Reserves (COFER) database, adding the Australian dollar (AUD), Canadian dollar (CAD), and renminbi (CNY), each of which currently holds a share of about 2%. This paper utilizes data from all eight currencies currently included in the COFER database. Given that the euro was only introduced in 1999, the analysis here is based on annual data from 1999 to 2023.

This study employs the model similar to those employed in studies by Chinn and Frankel (2005) and Huang et al. (2014). The independent variables selected in this paper are divided into four categories.

Economic Scale Variables: These include the global share of GDP and trade in the currency's issuing economy.

Currency Stability Factors: These include inflation, currency appreciation, and exchange rate volatility.

Global Forex Market Share: This is the share of the currency's daily trading volume in the global foreign exchange market.

Capital account openness and Institutional Variables: For capital account openness, both de facto and de jure openness indicators are used[2]. For institutional variables, this paper al